Market brief 29/10/2025

VIETNAM STOCK MARKET

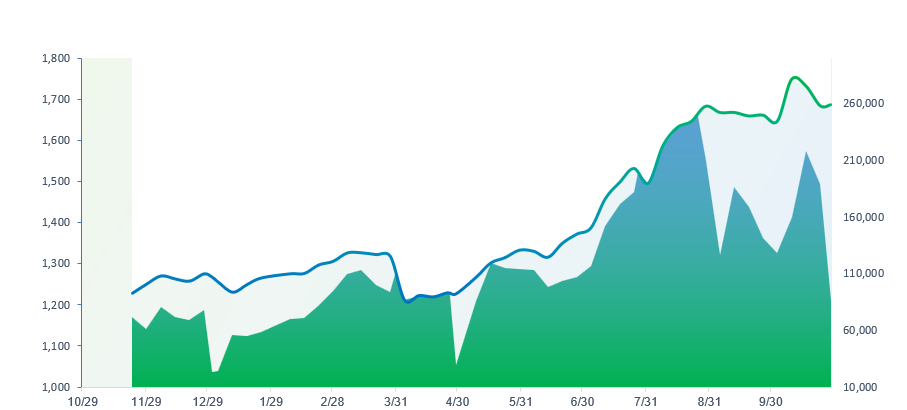

1,685.83

1D 0.32%

YTD 33.08%

268.04

1D 0.47%

YTD 17.86%

1,949.76

1D 0.02%

YTD 44.99%

112.64

1D 1.51%

YTD 18.49%

-1,559.98

1D 0.00%

YTD 0.00%

28,297.00

1D -13.40%

YTD 56.07%

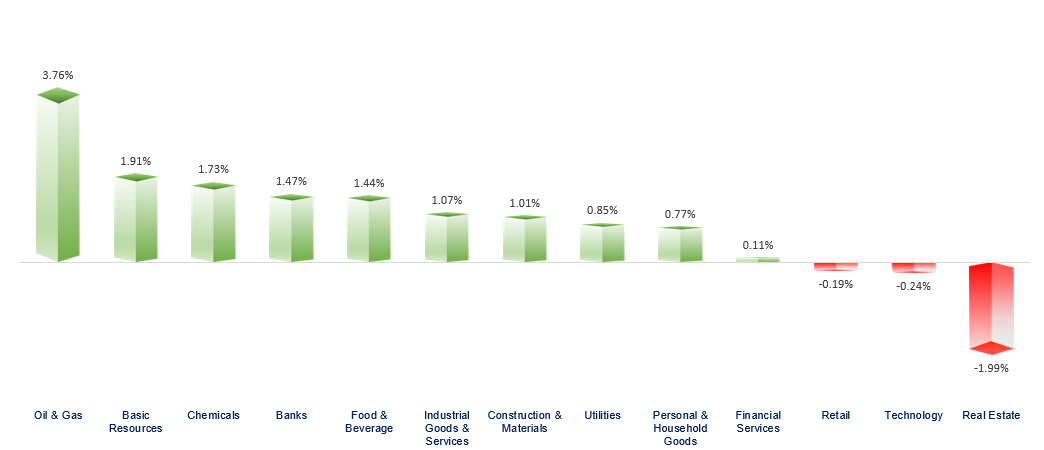

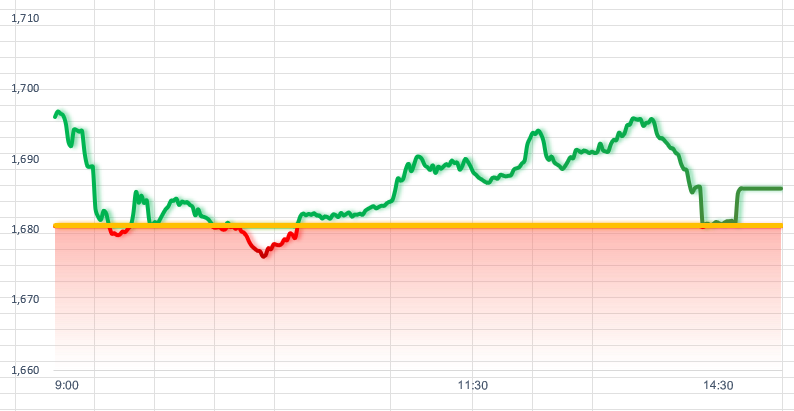

VN-Index pared losses to close 10 points higher after the ATC session, having fallen more than 20 points in the final 30 minutes of trading. The Oil & Gas, Resources, and Chemicals sectors were the most positive performers today. In contrast, Real Estate, Technology, and Retail were relatively sluggish.

ETF & DERIVATIVES

34,550

1D 0.44%

YTD 47.15%

23,600

1D 0.00%

YTD 44.96%

24,230

1D 0.00%

YTD 45.09%

29,200

1D -1.02%

YTD 45.27%

31,640

1D 1.09%

YTD 43.17%

39,000

1D 1.30%

YTD 16.35%

25,390

1D 0.36%

YTD 41.69%

1,947

1D 0.31%

YTD 0.00%

1,945

1D 0.77%

YTD 0.00%

1,929

1D -0.27%

YTD 0.00%

1,934

1D -0.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

51,307.65

1D 2.17%

YTD 28.61%

4,016.33

1D 0.70%

YTD 19.83%

26,346.14

1D 0.00%

YTD 31.34%

4,081.15

1D 1.76%

YTD 70.08%

85,007.26

1D 0.44%

YTD 8.19%

4,440.21

1D -0.23%

YTD 17.23%

1,315.64

1D 0.10%

YTD -6.04%

63.71

1D -0.19%

YTD -15.11%

4,017.00

1D 1.63%

YTD 52.44%

Asian stock markets mostly advanced today as investors expected the U.S. Federal Reserve to cut interest rates tonight. Notably, Japan’s Nikkei 225 and South Korea’s Kospi both hit new record highs, rising over 2% and 1.7%, respectively, while Hong Kong’s market was closed for a holiday. U.S. President Donald Trump also commented that he saw opportunities to reach trade deals with both South Korea and China.

VIETNAM ECONOMY

4.22%

1D (bps) -123

YTD (bps) 25

4.60%

3.22%

1D (bps) -7

YTD (bps) 75

3.75%

1D (bps) 10

YTD (bps) 90

26,345

1D (%) -0.02%

YTD (%) 3.11%

31,473

1D (%) 0.01%

YTD (%) 15.43%

3,768

1D (%) 0.04%

YTD (%) 5.80%

Meanwhile, global gold prices rebounded 1.6% to 4,018 USD/oz. In contrast, domestic gold prices showed mixed movements among major brands: SJC gold bars continued to fall on the buying side but rose on the selling side, maintaining a premium of more than 20 million VND/tael over global prices. Plain gold rings and 24K jewelry edged up slightly after the sharp decline in the previous session.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- A proposal to raise the basic salary starting January 1, 2026;

- More than 500,000 people unemployed in the first nine months;

- The proposal to soon define job positions, adjust salaries and allowances for officials at the commune level;

- President Donald Trump may reduce tariffs on fentanyl from China;

- The U.S. government remains shut down after a failed Senate vote;

- At the Federal Reserve meeting today, interest rates are not the only concern.

VN30

BANK

60,700

1D 1.17%

5D 1.85%

Buy Vol. 7,616,921

Sell Vol. 6,535,126

37,800

1D 1.89%

5D 1.61%

Buy Vol. 6,181,307

Sell Vol. 5,321,757

49,650

1D 1.33%

5D -1.68%

Buy Vol. 12,910,445

Sell Vol. 10,745,365

36,400

1D 1.11%

5D -4.21%

Buy Vol. 20,790,703

Sell Vol. 20,143,602

29,850

1D 1.36%

5D -1.97%

Buy Vol. 36,383,061

Sell Vol. 43,161,108

24,350

1D 1.46%

5D -4.32%

Buy Vol. 45,640,005

Sell Vol. 41,616,778

33,400

1D 3.73%

5D 2.77%

Buy Vol. 42,153,927

Sell Vol. 52,695,803

18,150

1D 1.11%

5D 0.00%

Buy Vol. 18,424,768

Sell Vol. 21,933,329

57,200

1D 0.70%

5D 3.25%

Buy Vol. 8,748,072

Sell Vol. 12,194,326

19,000

1D -1.04%

5D 1.88%

Buy Vol. 8,175,519

Sell Vol. 10,719,362

25,400

1D 0.00%

5D 1.20%

Buy Vol. 41,180,993

Sell Vol. 56,578,689

16,800

1D 2.75%

5D 0.90%

Buy Vol. 197,368,036

Sell Vol. 168,886,433

17,950

1D 1.13%

5D -1.64%

Buy Vol. 5,003,840

Sell Vol. 3,943,372

53,900

1D 2.08%

5D 8.02%

Buy Vol. 5,003,040

Sell Vol. 3,490,862

VIB: Vietnam International Bank (VIB) announced its business results for the first nine months of 2025 with pre-tax profit exceeding VND 7,040 billion, up 7% year-on-year. Credit and deposit growth reached 15% and 11%, respectively. Asset quality continued to improve, maintaining a safe and optimal management level.

OIL & GAS

60,200

1D 0.33%

5D 2.03%

Buy Vol. 1,181,546

Sell Vol. 1,268,892

34,500

1D 1.32%

5D 0.73%

Buy Vol. 2,691,164

Sell Vol. 2,305,691

Brent crude oil has declined more than 2% over the past two sessions as OPEC+ is likely to increase production in December.

VINGROUP

212,000

1D -3.68%

5D 4.43%

Buy Vol. 4,375,253

Sell Vol. 4,309,558

103,800

1D -2.99%

5D -8.14%

Buy Vol. 6,061,274

Sell Vol. 5,848,105

35,950

1D -2.31%

5D -7.82%

Buy Vol. 12,649,249

Sell Vol. 17,598,449

VRE: In Q3/2025, consolidated net revenue reached VND 2,251 billion, up 8.3% year-on-year, driven by rental and related services, which continued to grow strongly with revenue of VND 2,124 billion, up 7.1% YoY.

FOOD & BEVERAGE

57,500

1D 0.17%

5D 2.13%

Buy Vol. 3,416,073

Sell Vol. 4,243,024

79,200

1D 0.25%

5D 0.25%

Buy Vol. 11,210,549

Sell Vol. 14,387,692

45,750

1D 0.66%

5D 2.12%

Buy Vol. 1,300,293

Sell Vol. 1,506,571

MSN: Masan was net sold by foreign investors for more than VND 47 billion in today’s session after three consecutive sessions of net buying.

OTHERS

66,700

1D 0.30%

5D 2.62%

Buy Vol. 497,239

Sell Vol. 689,376

94,400

1D 0.43%

5D 3.74%

Buy Vol. 2,200,010

Sell Vol. 2,771,131

195,100

1D 4.05%

5D 8.27%

Buy Vol. 3,896,755

Sell Vol. 4,934,042

101,700

1D -0.49%

5D 4.85%

Buy Vol. 13,794,306

Sell Vol. 20,946,544

84,100

1D -0.12%

5D -0.47%

Buy Vol. 7,902,143

Sell Vol. 10,723,741

28,100

1D 2.00%

5D 6.04%

Buy Vol. 5,739,640

Sell Vol. 7,481,164

35,600

1D -0.70%

5D -7.41%

Buy Vol. 33,002,865

Sell Vol. 42,275,175

27,250

1D 1.68%

5D 2.06%

Buy Vol. 69,298,973

Sell Vol. 70,982,232

HPG: In Q3/2025, Hoa Phat Group recorded revenue of VND 36,794 billion and after-tax profit of VND 4,012 billion, up 7% and 33% year-on-year, respectively. For the first nine months, the group achieved revenue of VND 111,031 billion (up 5%) and after-tax profit of VND 11,626 billion (up 26%) compared to the same period last year.

Market by numbers

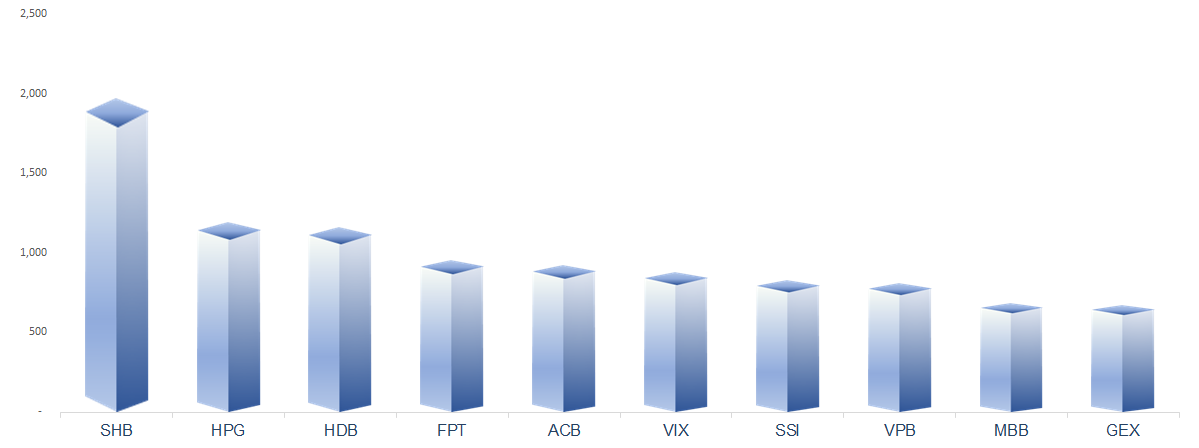

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

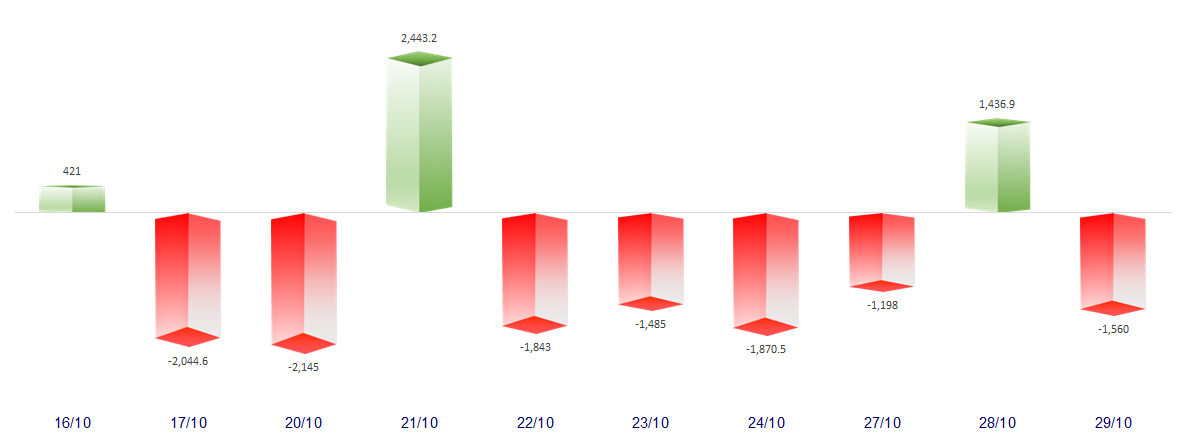

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

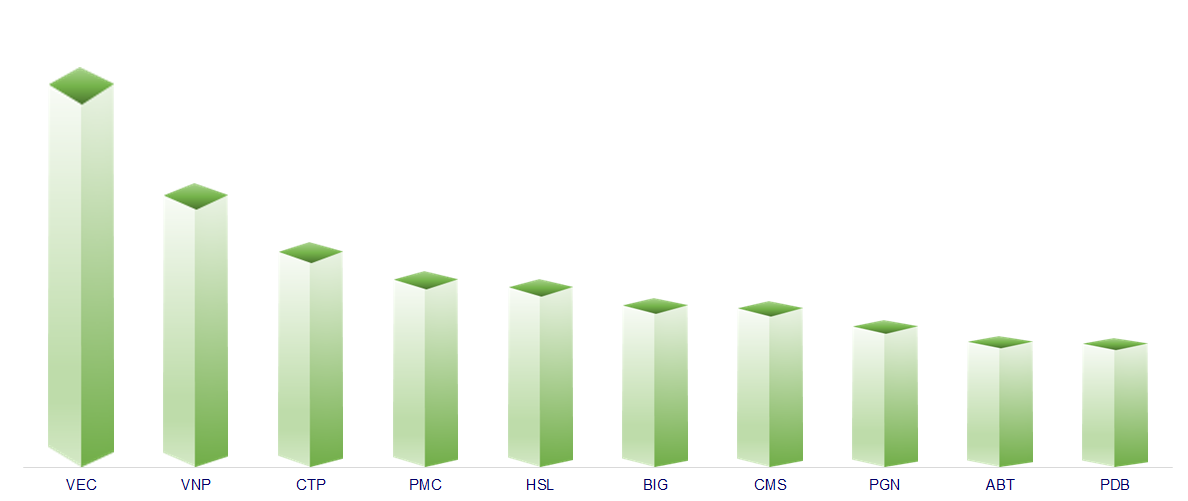

TOP INCREASES 3 CONSECUTIVE SESSIONS

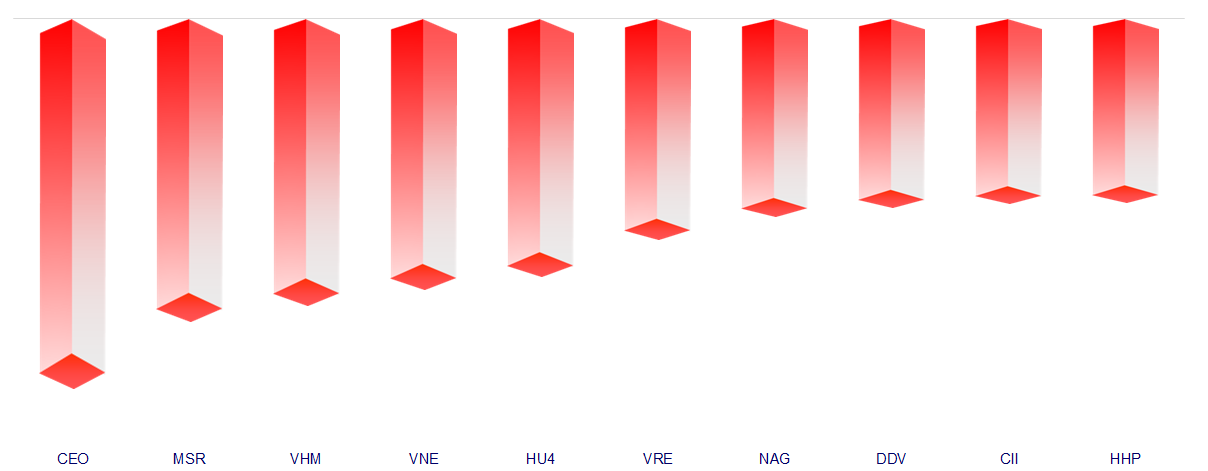

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.