Market brief 06/11/2025

VIETNAM STOCK MARKET

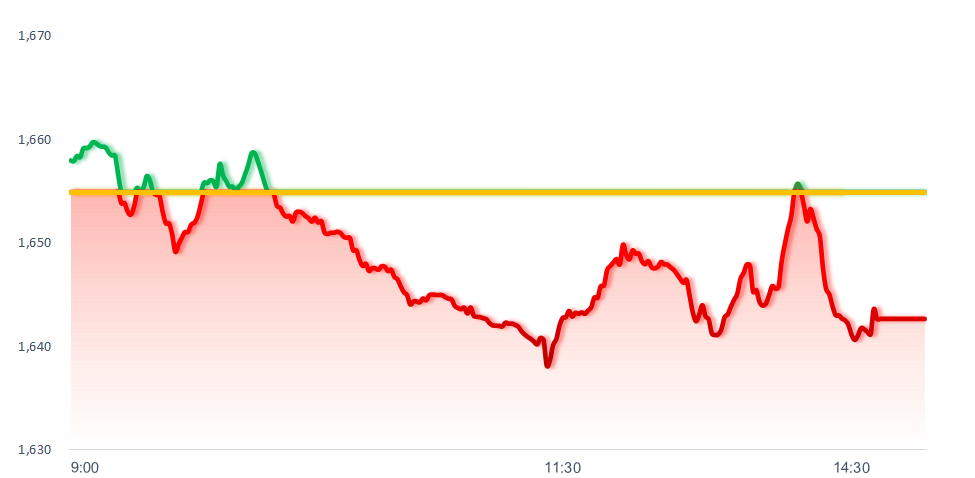

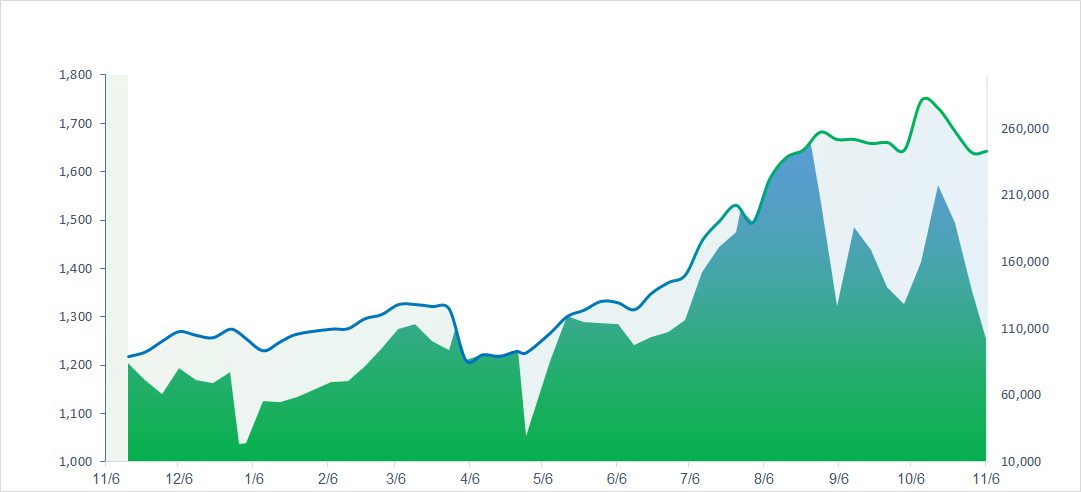

1,642.64

1D -0.74%

YTD 29.67%

266.15

1D -0.21%

YTD 17.03%

1,869.60

1D -0.89%

YTD 39.03%

116.22

1D -0.24%

YTD 22.26%

-1,229.78

1D 0.00%

YTD 0.00%

20,294.00

1D -10.96%

YTD 11.93%

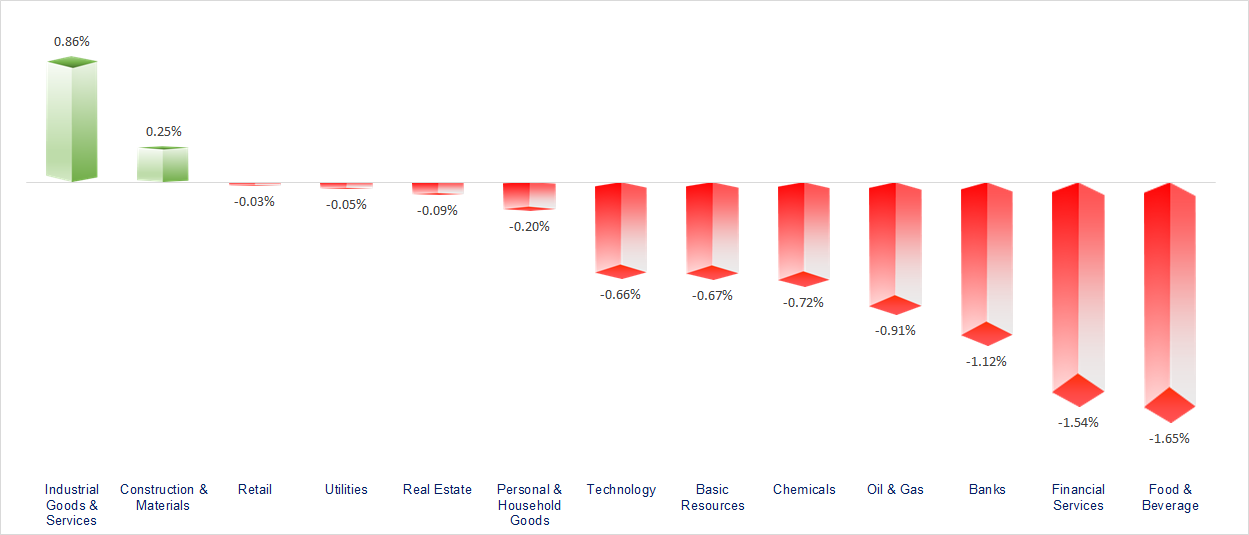

VN-Index experienced strong volatility in the last 30 minutes of the afternoon session as the Banking sector corrected, while market liquidity fell to a five-month low. Most sectors declined today, with the most negative performances coming from F&B, Securities, and Banking, while Industrial Services and Construction showed relatively positive momentum.

ETF & DERIVATIVES

33,180

1D -0.36%

YTD 41.31%

23,010

1D 0.13%

YTD 41.34%

23,700

1D -0.29%

YTD 41.92%

29,350

1D -0.51%

YTD 46.02%

30,220

1D 0.07%

YTD 36.74%

38,680

1D -0.72%

YTD 15.39%

25,750

1D -0.58%

YTD 43.69%

1,867

1D -1.03%

YTD 0.00%

1,866

1D -0.89%

YTD 0.00%

1,865

1D -1.01%

YTD 0.00%

1,884

1D 0.15%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,883.68

1D 1.34%

YTD 27.55%

4,007.76

1D 0.97%

YTD 19.57%

26,485.90

1D 2.12%

YTD 32.04%

4,026.45

1D 0.55%

YTD 67.80%

83,311.01

1D -0.18%

YTD 6.03%

4,484.99

1D 1.54%

YTD 18.41%

1,313.31

1D 1.39%

YTD -6.21%

63.88

1D 0.57%

YTD -14.88%

4,005.38

1D 0.66%

YTD 52.00%

Following Wall Street’s rally overnight, Asian markets mostly gained on Wednesday, recovering part of the previous session’s steep losses. The Hang Seng Index (Hong Kong) led the region with a more than 2% rise, closing at 26,485.9 points, followed by Japan’s Nikkei 225, which advanced over 1% to reach 50,883.68 points.

VIETNAM ECONOMY

6.00%

YTD (bps) 203

4.60%

3.31%

1D (bps) 8

YTD (bps) 83

3.69%

1D (bps) -12

YTD (bps) 84

26,355

1D (%) 0.02%

YTD (%) 3.15%

31,074

1D (%) 0.27%

YTD (%) 13.97%

3,754

1D (%) 0.09%

YTD (%) 5.41%

On the commodities front, global gold prices (November 6) rebounded above 4,000 USD/oz, supported by renewed safe-haven demand and a weaker U.S. dollar. Domestically, SJC gold bars and SJC plain rings both climbed, quoted at 147.8 million VND/tael and 145.2 million VND/tael, respectively.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Central Committee has reached a consensus on personnel nominations for the Politburo and the Secretariat of the 14th tenure;

- Vietnam attracted more than USD 31.5 billion in FDI during the first 10 months of 2025;

- In the same period, the CPI rose by 3.27%, core inflation increased by 3.20% year-on-year;

- Nvidia’s CEO warned that China will surpass the U.S. in the AI race;

- Major U.S. retailers have raised prices to cope with President Trump’s tariffs;

- President Trump revealed information provided by President Putin regarding Ukraine.

VN30

BANK

60,300

1D -0.82%

5D -0.50%

Buy Vol. 4,712,027

Sell Vol. 7,195,187

38,500

1D -0.39%

5D 1.58%

Buy Vol. 3,513,118

Sell Vol. 5,489,466

51,100

1D -0.39%

5D 3.86%

Buy Vol. 10,942,967

Sell Vol. 13,470,109

33,600

1D -1.47%

5D -5.88%

Buy Vol. 23,961,500

Sell Vol. 19,537,191

28,500

1D -2.56%

5D -2.40%

Buy Vol. 22,286,787

Sell Vol. 22,626,577

23,700

1D -0.84%

5D -1.04%

Buy Vol. 24,908,299

Sell Vol. 22,850,299

30,100

1D -3.06%

5D -9.88%

Buy Vol. 19,043,695

Sell Vol. 19,111,637

16,900

1D 0.00%

5D -1.46%

Buy Vol. 14,388,354

Sell Vol. 9,017,992

51,900

1D -2.99%

5D -8.79%

Buy Vol. 11,965,104

Sell Vol. 11,832,613

18,550

1D -1.07%

5D -1.07%

Buy Vol. 5,751,388

Sell Vol. 6,963,690

25,300

1D -1.17%

5D 0.80%

Buy Vol. 13,270,506

Sell Vol. 10,853,659

15,850

1D -2.16%

5D -6.21%

Buy Vol. 84,900,509

Sell Vol. 90,867,608

17,450

1D -0.29%

5D -2.51%

Buy Vol. 14,725,136

Sell Vol. 15,732,819

51,500

1D 0.00%

5D -0.96%

Buy Vol. 3,925,283

Sell Vol. 3,044,691

VPB: After a long period of low rates, the “interest rate race” has unexpectedly heated up as several banks announced deposit rate increases, with VPBank being the latest to join. Specifically, in-branch savings rates for terms of 1–5 months are set at 4.2% per year for deposits under VND 10 billion, and rise to 4.3%–4.4% per year for deposits from VND 10 billion and above. Longer terms over 12 months range from 5.3%–5.6% per year, while online deposits receive 0.1–0.2 percentage points higher, with the maximum rate reaching 5.8% per year.

OIL & GAS

62,100

1D -1.43%

5D 4.02%

Buy Vol. 1,387,699

Sell Vol. 2,292,952

34,750

1D -1.28%

5D 0.58%

Buy Vol. 2,857,594

Sell Vol. 4,624,304

Today, Gasoline prices decreased slightly, while diesel prices increased by more than VND 100 per liter.

VINGROUP

207,800

1D 0.63%

5D 1.81%

Buy Vol. 5,738,041

Sell Vol. 7,122,422

98,900

1D -0.70%

5D -4.90%

Buy Vol. 6,554,289

Sell Vol. 7,207,061

32,000

1D -1.54%

5D -7.51%

Buy Vol. 13,641,323

Sell Vol. 12,372,344

VIC: Vingroup plans to seek shareholder approval to issue 3.85 billion shares, equivalent to a 1:1 ratio. At the same time, VIC intends to establish Vinspace, a new company related to the aerospace and aviation industries.

FOOD & BEVERAGE

58,000

1D 0.00%

5D 1.58%

Buy Vol. 4,816,552

Sell Vol. 5,253,005

78,800

1D -1.75%

5D -0.63%

Buy Vol. 6,867,223

Sell Vol. 8,514,955

46,150

1D -0.11%

5D 0.98%

Buy Vol. 1,209,667

Sell Vol. 1,335,009

MSN: MCH shares rose sharply, pushing Masan Consumer’s market capitalization above VND 200 trillion.

OTHERS

68,700

1D 2.23%

5D 2.69%

Buy Vol. 921,993

Sell Vol. 1,444,823

95,000

1D 0.00%

5D 1.50%

Buy Vol. 1,841,553

Sell Vol. 3,041,659

180,900

1D -1.95%

5D -7.47%

Buy Vol. 2,364,342

Sell Vol. 2,808,613

100,200

1D -0.69%

5D -2.43%

Buy Vol. 11,734,376

Sell Vol. 11,310,359

80,300

1D 0.12%

5D -4.29%

Buy Vol. 10,217,117

Sell Vol. 10,090,331

28,700

1D -1.20%

5D 1.23%

Buy Vol. 5,317,248

Sell Vol. 9,320,049

34,300

1D -1.72%

5D -1.58%

Buy Vol. 44,055,434

Sell Vol. 39,287,249

26,100

1D -0.76%

5D -2.97%

Buy Vol. 37,362,009

Sell Vol. 43,647,073

MWG: Despite foreign investors net selling over VND 1,000 billion in today’s session, MWG was unexpectedly the most net-bought stock, with a value of over VND 177 billion.

Market by numbers

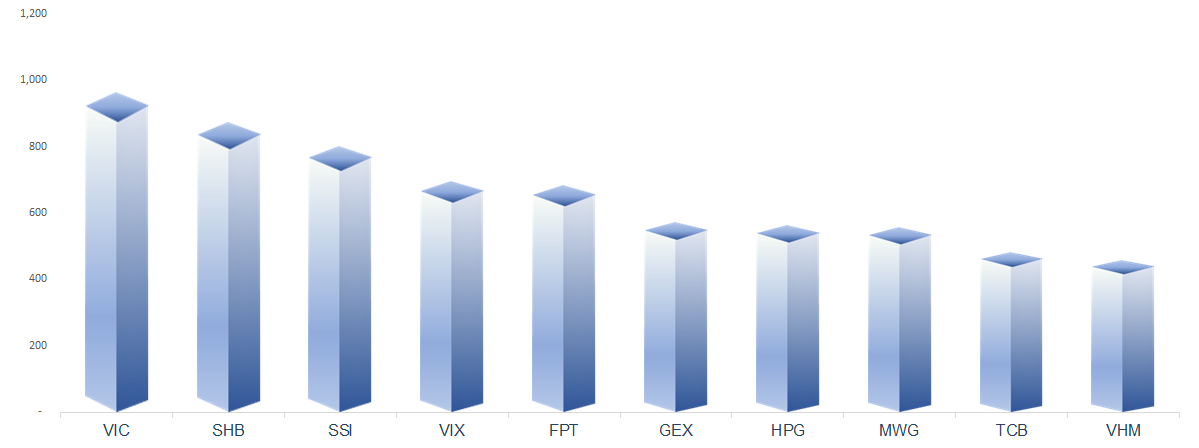

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

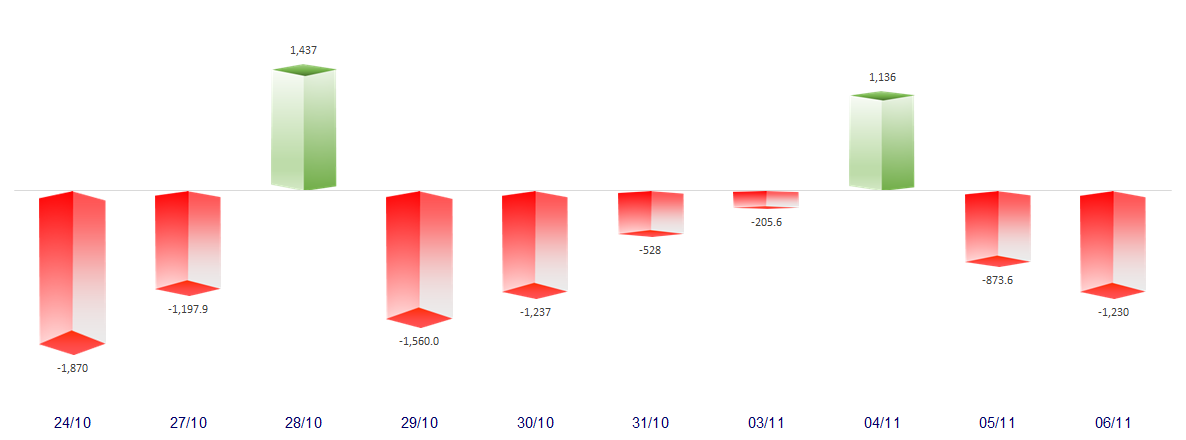

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

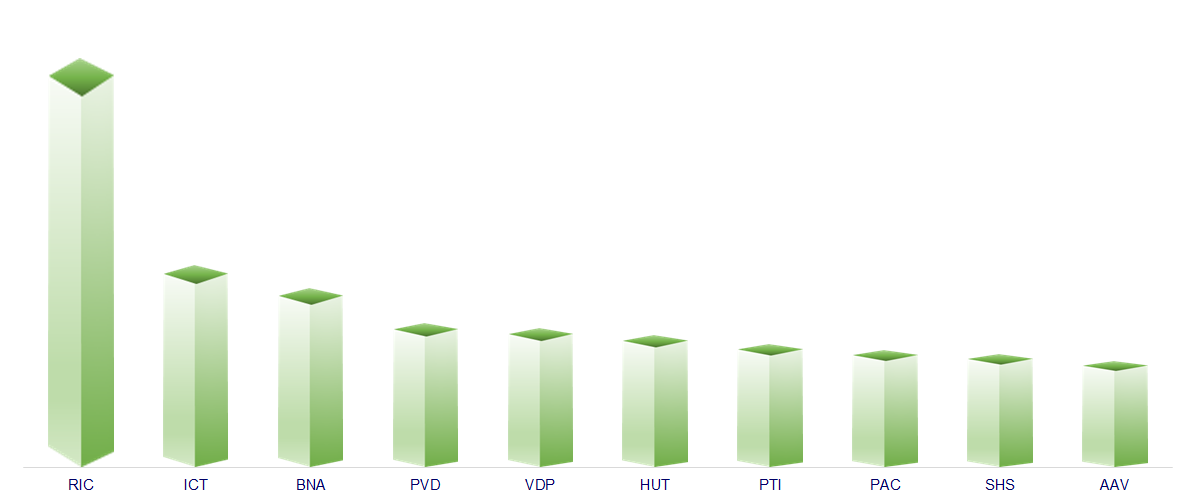

TOP INCREASES 3 CONSECUTIVE SESSIONS

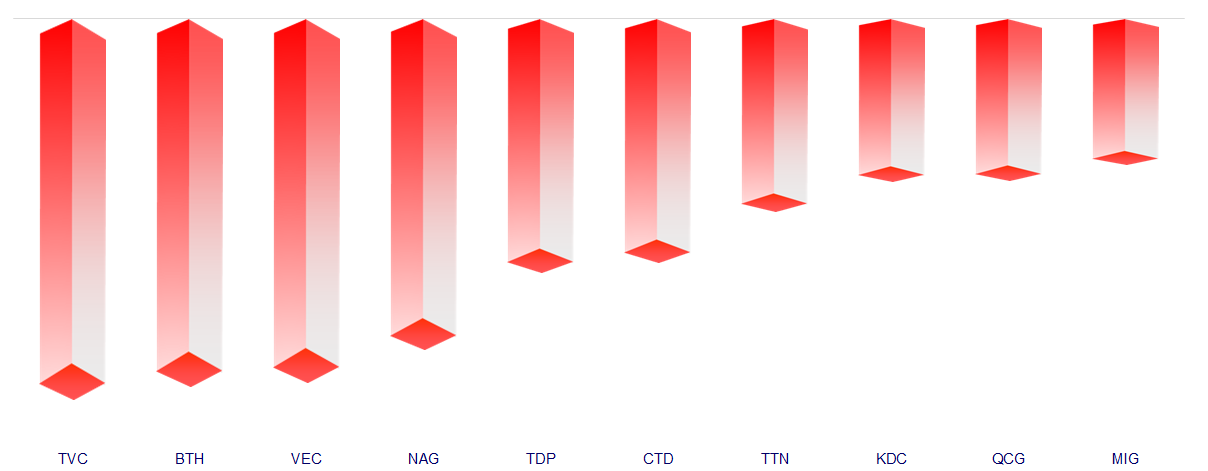

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.