Market brief 10/11/2025

VIETNAM STOCK MARKET

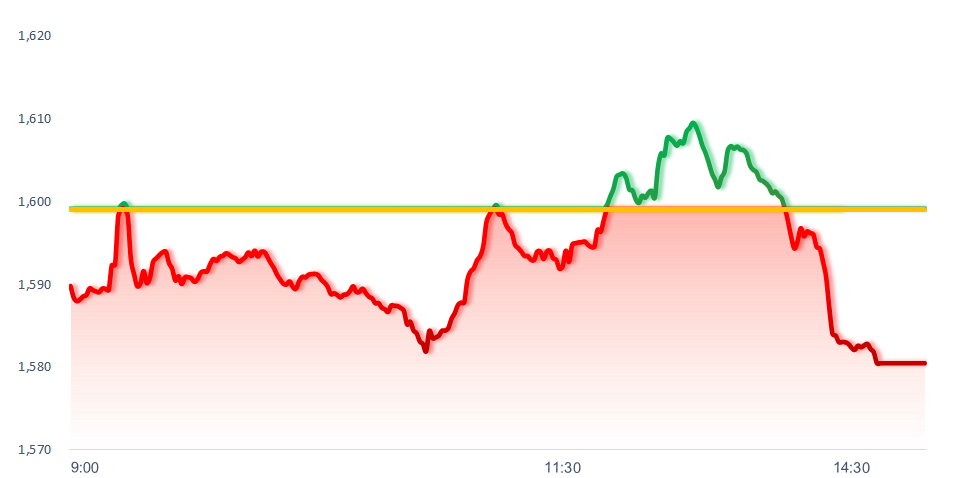

1,580.54

1D -1.16%

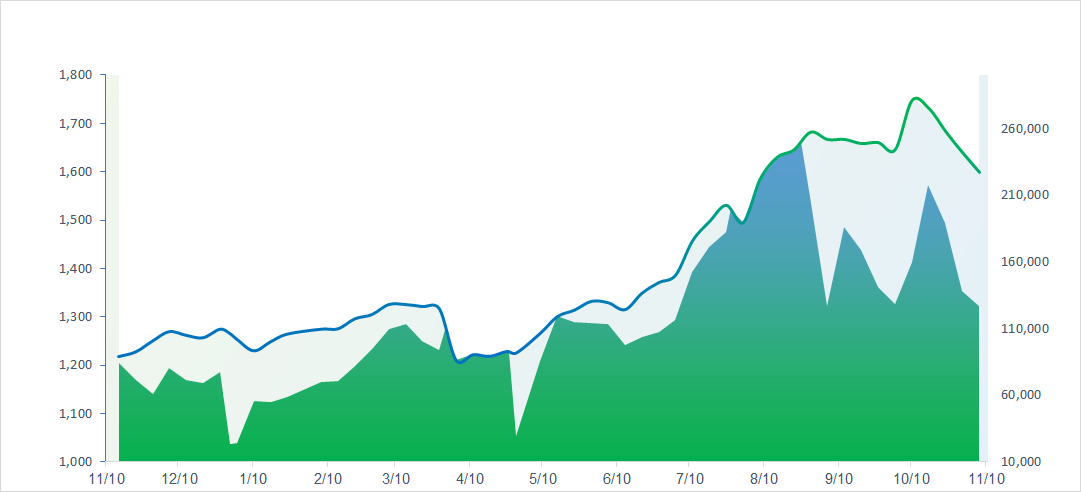

YTD 24.77%

258.18

1D -1.12%

YTD 13.52%

1,804.18

1D -1.13%

YTD 34.16%

117.45

1D 0.60%

YTD 23.55%

-319.54

1D 0.00%

YTD 0.00%

23,727.00

1D -15.06%

YTD 30.87%

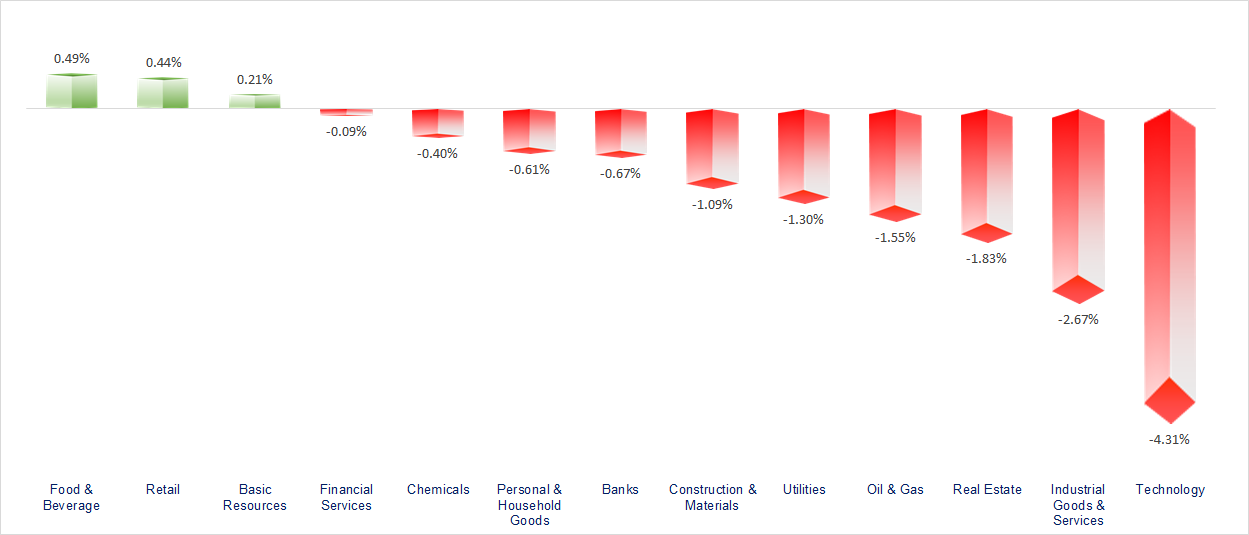

VN-Index unexpectedly dropped sharply at the end of the session, pressured by stocks in the Vingroup ecosystem, banking, real estate, and Gelex groups. Most sectors performed negatively today, with the technology, real estate, and Vingroup-related stocks being the weakest performers.

ETF & DERIVATIVES

32,190

1D -0.65%

YTD 37.10%

22,260

1D 0.63%

YTD 36.73%

22,970

1D 0.48%

YTD 37.54%

28,050

1D -0.71%

YTD 39.55%

29,020

1D -0.99%

YTD 31.31%

37,100

1D -1.85%

YTD 10.68%

25,690

1D 1.94%

YTD 43.36%

1,801

1D -1.45%

YTD 0.00%

1,800

1D -0.83%

YTD 0.00%

1,800

1D -1.13%

YTD 0.00%

1,797

1D -2.51%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,911.76

1D 1.26%

YTD 27.62%

4,018.60

1D 0.53%

YTD 19.90%

26,649.06

1D 1.55%

YTD 32.85%

4,073.24

1D 3.02%

YTD 69.75%

83,535.35

1D 0.38%

YTD 6.31%

4,488.13

1D -0.09%

YTD 18.50%

1,306.26

1D 0.26%

YTD -6.71%

64.03

1D 0.63%

YTD -14.68%

4,081.28

1D 1.17%

YTD 54.88%

Asian markets, however, rebounded today after last week’s steep losses led by technology shares. The Kospi led the gains, closing up more than 3%, supported by bank and insurance stocks, followed by the Hang Seng and Nikkei 225, which advanced 1.55% and 1.26%, respectively. Notably, the Shanghai Composite turned strongly positive after data showed that China’s October CPI rose 0.2% year-on-year, ending a four-month streak of declines.

VIETNAM ECONOMY

6.00%

1D (bps) 10

YTD (bps) 203

4.60%

3.26%

1D (bps) -7

YTD (bps) 78

3.75%

1D (bps) 5

YTD (bps) 90

26,361

1D (%) 0.01%

YTD (%) 3.17%

31,194

1D (%) 0.18%

YTD (%) 14.40%

3,752

1D (%) -0.07%

YTD (%) 5.38%

In the domestic market, gold prices surged again across all segments after pausing late last week. SJC gold bars, plain gold rings, and jewelry all rebounded sharply, rising by VND 1–1.7 million per tael, with plain gold rings climbing back to the 150 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- UOB raises its forecast for Vietnam’s GDP growth in 2025;

- Proposal to reduce personal income tax for couples with two children;

- Week 4 of the 10th National Assembly session: Parliament to review several key issues;

- After 40 days of deadlock, the U.S. Senate paves the way to end the government shutdown;

- President Donald Trump promises to give each American USD 2,000 from tariff revenues;

- In 2025, over 500,000 used cars exported from China — 80% of which have “never even been driven one kilometer.”

VN30

BANK

58,800

1D -0.84%

5D -0.84%

Buy Vol. 4,389,689

Sell Vol. 4,846,365

37,400

1D -0.27%

5D 0.81%

Buy Vol. 4,315,840

Sell Vol. 3,927,144

48,000

1D -2.04%

5D -1.03%

Buy Vol. 12,790,293

Sell Vol. 11,306,686

33,400

1D 1.21%

5D -0.60%

Buy Vol. 18,924,837

Sell Vol. 17,399,923

27,500

1D 0.00%

5D -0.36%

Buy Vol. 47,243,131

Sell Vol. 38,890,544

23,100

1D -0.86%

5D 0.00%

Buy Vol. 38,182,549

Sell Vol. 30,249,864

29,600

1D -1.33%

5D -3.11%

Buy Vol. 26,453,587

Sell Vol. 22,373,507

16,500

1D 0.00%

5D -0.90%

Buy Vol. 8,989,377

Sell Vol. 10,844,994

48,500

1D 0.31%

5D -7.27%

Buy Vol. 19,824,354

Sell Vol. 16,613,802

18,250

1D -0.27%

5D -0.54%

Buy Vol. 7,913,015

Sell Vol. 7,318,110

24,800

1D -0.40%

5D -2.55%

Buy Vol. 11,017,038

Sell Vol. 12,066,793

15,300

1D 0.00%

5D -4.08%

Buy Vol. 110,717,646

Sell Vol. 90,295,723

16,850

1D -2.03%

5D -5.07%

Buy Vol. 3,517,354

Sell Vol. 4,666,475

48,300

1D -2.03%

5D -4.73%

Buy Vol. 2,931,082

Sell Vol. 2,299,187

Between November 3 and November 7, the State Bank of Vietnam (SBV) lent a total of VND 128,668 billion to member banks through the secured lending channel (OMO) at an interest rate of 4% per year. During the same period, the maturity volume reached nearly VND 72,194 billion. Meanwhile, no transactions were recorded via the bill issuance channel. As a result, the SBV net injected VND 56,474 billion into the banking system over the week.

OIL & GAS

61,200

1D -2.70%

5D -0.49%

Buy Vol. 1,092,465

Sell Vol. 1,733,897

33,900

1D -0.29%

5D -1.17%

Buy Vol. 2,719,619

Sell Vol. 2,507,714

Global oil prices edged up slightly on expectations that Hungary will continue using Russian oil.

VINGROUP

199,000

1D -0.35%

5D 1.84%

Buy Vol. 3,897,396

Sell Vol. 4,239,204

86,900

1D -5.54%

5D -11.78%

Buy Vol. 10,095,722

Sell Vol. 11,247,800

29,800

1D -4.94%

5D -4.94%

Buy Vol. 12,143,105

Sell Vol. 12,984,752

VIC: On November 10, Vingroup expanded into the cultural sector by establishing three companies operating in film production, arts, and event organization.

FOOD & BEVERAGE

57,000

1D -1.04%

5D -0.52%

Buy Vol. 4,814,131

Sell Vol. 5,826,111

76,000

1D -1.04%

5D -1.30%

Buy Vol. 8,335,196

Sell Vol. 8,988,183

46,000

1D -0.22%

5D -0.65%

Buy Vol. 1,061,581

Sell Vol. 1,334,131

MSN: Masan Group saw foreign investors net buy for the fifth consecutive session, with a total value of VND 53 billion.

OTHERS

66,000

1D -2.94%

5D 0.00%

Buy Vol. 300,727

Sell Vol. 677,059

91,500

1D -1.72%

5D -4.19%

Buy Vol. 2,943,443

Sell Vol. 2,734,980

176,500

1D -0.84%

5D -3.81%

Buy Vol. 2,308,993

Sell Vol. 2,647,347

96,200

1D -4.75%

5D -8.38%

Buy Vol. 14,997,453

Sell Vol. 18,776,078

76,800

1D 0.39%

5D -5.19%

Buy Vol. 11,426,775

Sell Vol. 9,834,259

27,950

1D 0.54%

5D -1.41%

Buy Vol. 4,141,465

Sell Vol. 5,054,541

33,600

1D 1.97%

5D 3.38%

Buy Vol. 64,681,349

Sell Vol. 52,312,857

26,450

1D 1.54%

5D 1.54%

Buy Vol. 85,639,397

Sell Vol. 78,760,991

MWG: Mobile World Investment Corporation (MWG) announced a plan to repurchase 10,000,000 treasury shares. The repurchase will use VND 12,582 billion from retained earnings (based on the 2024 audited financial statements). The purchase price will be less than or equal to the reference price + (reference price × 50% of the trading band). The transaction will be conducted via order matching from November 19, 2025, to December 18, 2025.

Market by numbers

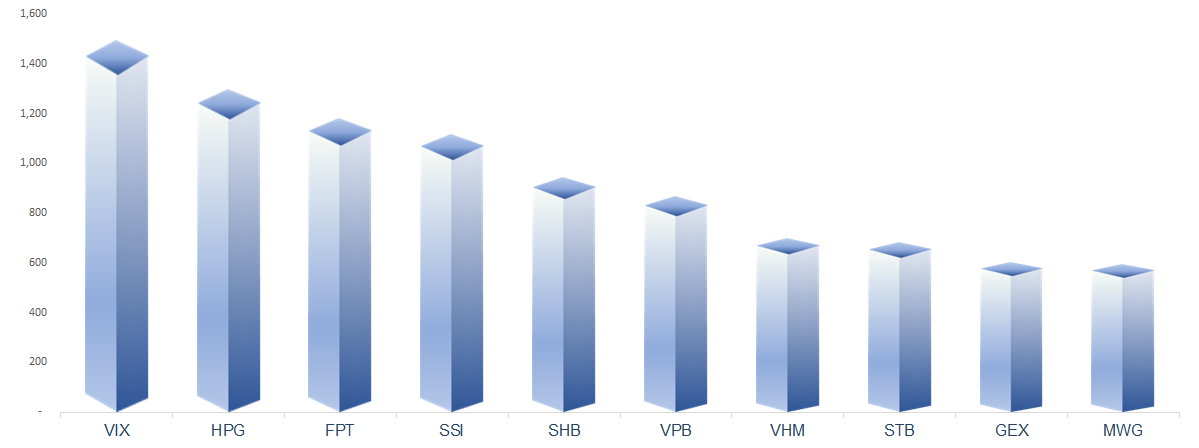

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

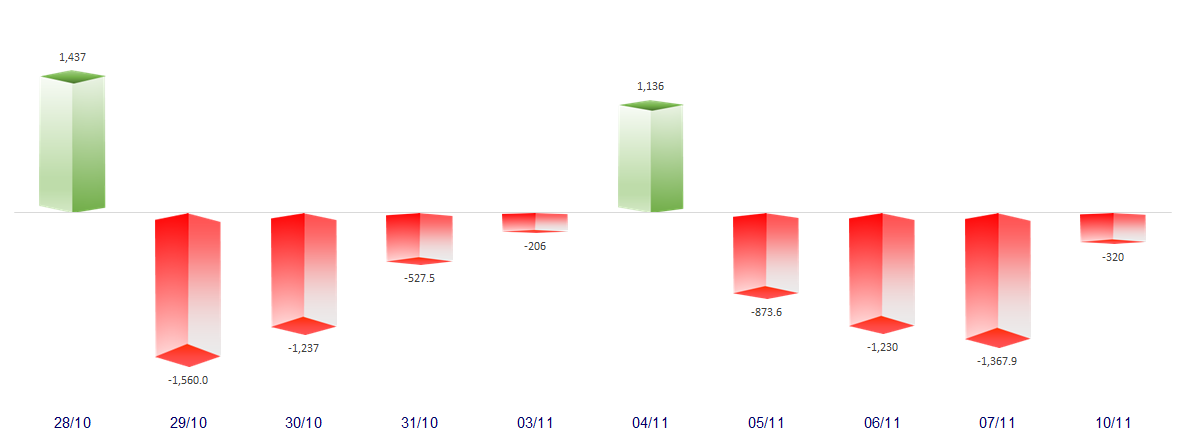

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

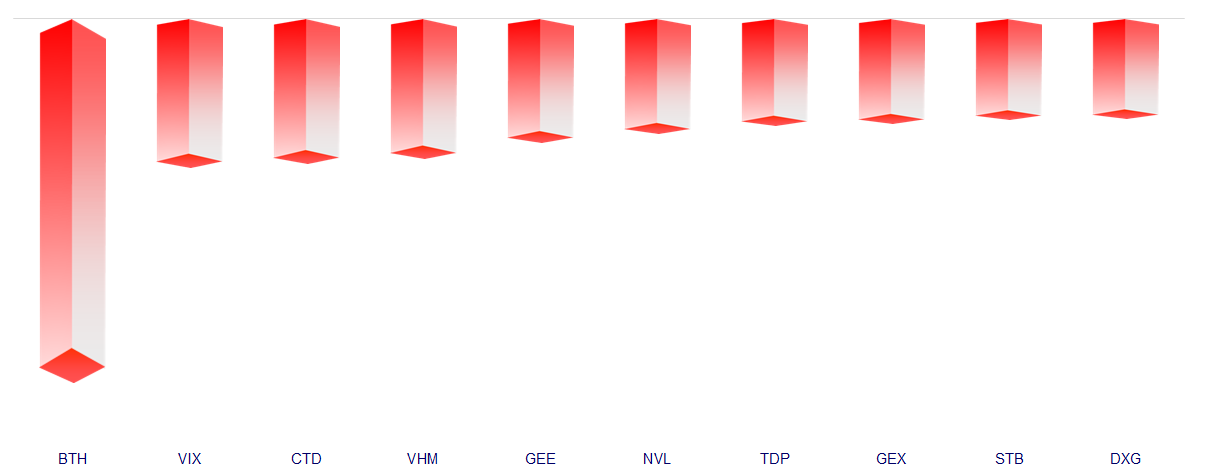

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.