Market brief 12/11/2025

VIETNAM STOCK MARKET

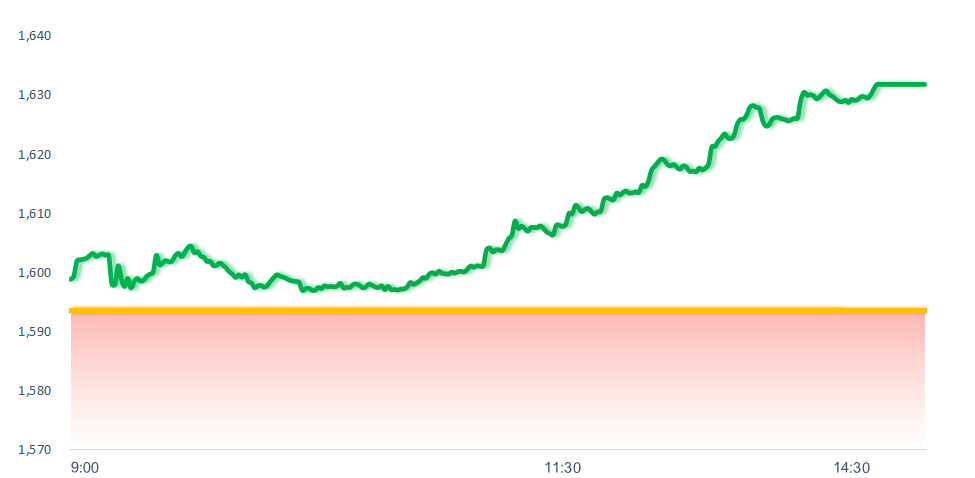

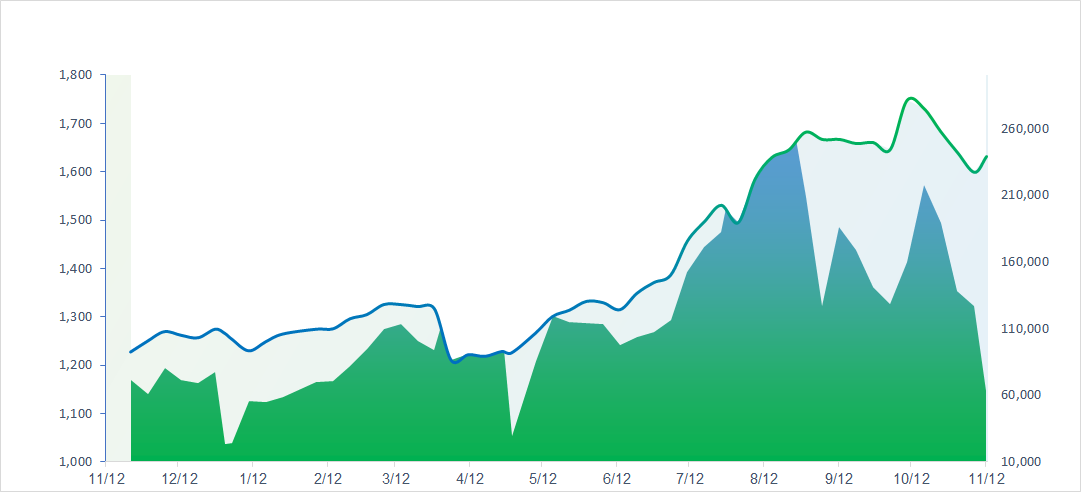

1,631.86

1D 2.40%

YTD 28.82%

246.79

1D -5.47%

YTD 8.51%

1,872.27

1D 2.78%

YTD 39.23%

119.72

1D 1.59%

YTD 25.94%

-458.57

1D 0.00%

YTD 0.00%

24,148.00

1D 10.90%

YTD 33.19%

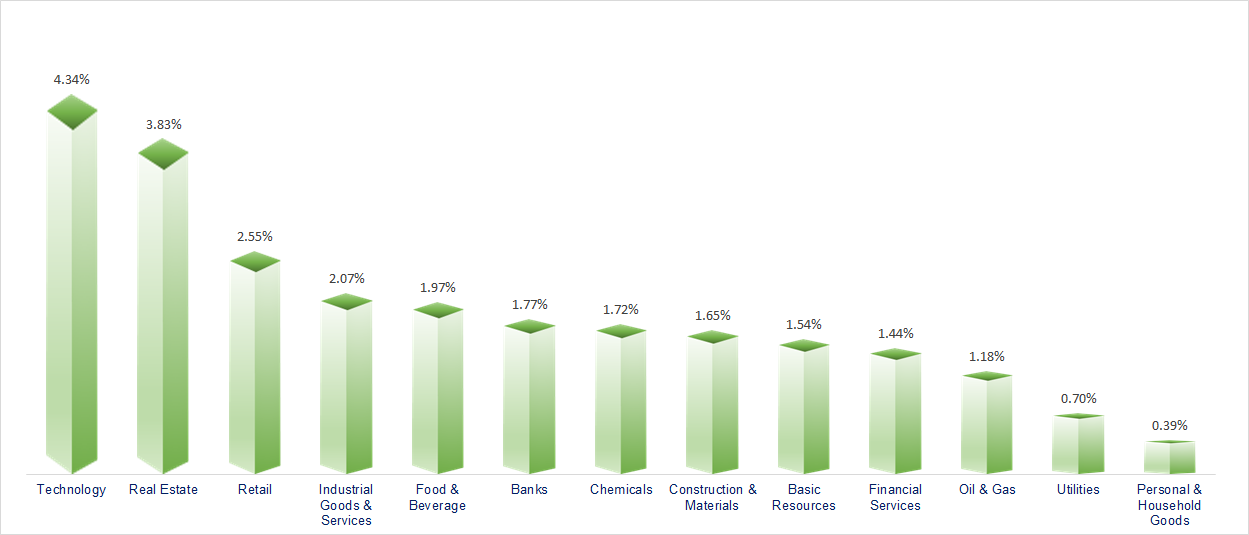

VN-Index continued its strong rebound, gaining nearly 40 points, driven by the Vingroup ecosystem, real estate, and banking sectors. Most industry groups posted positive performances today, with Vingroup stocks, banks, and real estate companies standing out as the main contributors.

ETF & DERIVATIVES

33,150

1D 2.54%

YTD 41.18%

22,810

1D 2.75%

YTD 40.11%

23,550

1D 2.39%

YTD 41.02%

28,500

1D 1.75%

YTD 41.79%

29,760

1D 2.09%

YTD 34.66%

37,950

1D 2.29%

YTD 13.22%

25,650

1D -0.16%

YTD 43.14%

1,871

1D 3.06%

YTD 0.00%

1,870

1D 3.43%

YTD 0.00%

1,868

1D 3.18%

YTD 0.00%

1,856

1D 2.96%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

51,063.31

1D 0.43%

YTD 28.00%

4,000.14

1D -0.07%

YTD 19.34%

26,922.73

1D 0.85%

YTD 34.22%

4,150.39

1D 1.07%

YTD 72.97%

84,466.51

1D 0.71%

YTD 7.50%

4,568.91

1D 0.59%

YTD 20.63%

1,284.81

1D -1.20%

YTD -8.24%

65.03

1D 0.00%

YTD -13.35%

4,131.00

1D 0.00%

YTD 56.77%

Across Asian markets, stocks mostly advanced on Monday as the U.S. government shutdown appeared close to resolution. The Kospi in South Korea climbed over 1% to 4,150.39 points, while Hong Kong’s Hang Seng Index rose 0.8%, closing at 26,922.73 points;

VIETNAM ECONOMY

6.10%

1D (bps) -10

YTD (bps) 213

4.60%

3.32%

YTD (bps) 85

3.70%

1D (bps) 1

YTD (bps) 85

26,385

1D (%) 0.05%

YTD (%) 3.26%

31,277

1D (%) 0.36%

YTD (%) 14.71%

3,759

1D (%) 0.15%

YTD (%) 5.55%

In the domestic market, gold prices unexpectedly reversed lower after two consecutive strong gains. SJC gold bars, plain rings, and 24K jewelry all fell by 100,000–700,000 VND/tael, bringing selling prices at many major retailers below 152 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Exports and imports surged, pushing state budget revenue up by more than VND 379 trillion;

- Hanoi is studying the development of a Red River landscape axis project covering 11,000 hectares with a total investment exceeding VND 400 trillion;

- The world’s largest fund, Vanguard, has opened a securities investment account in Vietnam following the country’s market reclassification;

- Russia expresses interest in joining the rare earth race;

- The U.S. dollar remains stable as trade tensions ease;

- The Japanese yen falls to its lowest level in nine months.

VN30

BANK

59,500

1D 1.02%

5D -2.14%

Buy Vol. 4,036,984

Sell Vol. 3,922,994

38,250

1D 0.66%

5D -1.03%

Buy Vol. 3,265,861

Sell Vol. 3,981,660

49,200

1D 1.44%

5D -4.09%

Buy Vol. 10,233,169

Sell Vol. 11,227,448

35,000

1D 4.01%

5D 2.64%

Buy Vol. 20,059,411

Sell Vol. 16,046,858

28,000

1D 1.82%

5D -4.27%

Buy Vol. 46,542,845

Sell Vol. 44,729,212

23,700

1D 2.16%

5D -0.84%

Buy Vol. 44,037,392

Sell Vol. 29,571,747

30,000

1D 1.35%

5D -3.38%

Buy Vol. 27,002,830

Sell Vol. 23,083,374

17,300

1D 2.37%

5D 2.37%

Buy Vol. 17,021,288

Sell Vol. 18,318,310

50,600

1D 1.91%

5D -5.42%

Buy Vol. 14,176,868

Sell Vol. 13,870,023

18,650

1D 2.47%

5D -0.53%

Buy Vol. 10,662,449

Sell Vol. 9,965,574

25,200

1D 1.41%

5D -1.56%

Buy Vol. 11,657,621

Sell Vol. 11,510,887

16,300

1D 3.16%

5D 0.62%

Buy Vol. 161,425,989

Sell Vol. 131,050,690

17,150

1D 3.31%

5D -2.00%

Buy Vol. 5,363,087

Sell Vol. 4,401,261

48,650

1D 2.42%

5D -5.53%

Buy Vol. 3,392,572

Sell Vol. 2,454,996

On November 12, the State Bank of Vietnam (SBV) continued offering Open Market Operations (OMO) loans with a record-long maturity of 105 days, at an interest rate of 4% per year. Previously, SBV’s OMO tenors typically ranged between 7 and 91 days. Specifically, the central bank offered a total of VND 6,778 billion across four maturities, all at 4% interest. This included VND 2,235 billion for 14 days, VND 2,827 billion for 28 days, and VND 1,717 billion for 105 days.

OIL & GAS

61,900

1D 1.31%

5D -1.75%

Buy Vol. 1,277,136

Sell Vol. 1,246,898

34,050

1D 0.89%

5D -3.27%

Buy Vol. 2,277,926

Sell Vol. 1,858,858

Brent crude oil prices rose nearly 2% in the previous session, as expectations of the U.S. government reopening lifted hopes for stronger demand.

VINGROUP

211,200

1D 5.07%

5D 2.28%

Buy Vol. 5,607,303

Sell Vol. 5,468,655

94,000

1D 4.44%

5D -5.62%

Buy Vol. 6,846,922

Sell Vol. 7,491,067

32,800

1D 5.64%

5D 0.92%

Buy Vol. 12,413,440

Sell Vol. 12,346,222

VIC: Foreign investors were net buyers of VIC shares, with a value exceeding VND 258 billion, marking the largest net purchase on the market today.

FOOD & BEVERAGE

59,800

1D 1.53%

5D 3.10%

Buy Vol. 8,432,665

Sell Vol. 10,223,147

79,200

1D 1.28%

5D -1.25%

Buy Vol. 10,043,789

Sell Vol. 11,814,407

46,950

1D 0.32%

5D 1.62%

Buy Vol. 1,473,416

Sell Vol. 1,874,249

SAB: Sabeco approved an interim cash dividend payment for 2025 at a 20% payout ratio. The record date is January 13, 2026, and the payment date is expected on February 12, 2026.

OTHERS

66,900

1D -0.15%

5D -0.45%

Buy Vol. 562,206

Sell Vol. 600,051

93,500

1D 1.85%

5D -1.58%

Buy Vol. 2,356,684

Sell Vol. 2,268,138

176,100

1D 0.69%

5D -4.55%

Buy Vol. 2,338,364

Sell Vol. 2,880,243

100,600

1D 4.68%

5D -0.30%

Buy Vol. 9,878,501

Sell Vol. 11,459,613

80,500

1D 3.21%

5D 0.37%

Buy Vol. 8,600,142

Sell Vol. 7,727,174

28,450

1D 1.97%

5D -2.07%

Buy Vol. 3,003,514

Sell Vol. 3,314,540

35,500

1D 1.87%

5D 1.72%

Buy Vol. 57,388,774

Sell Vol. 57,532,400

27,000

1D 1.50%

5D 2.66%

Buy Vol. 53,703,078

Sell Vol. 65,811,421

FPT: FPT signed a strategic partnership with EmbedIT, a global fintech company under PPF Group, which operates in 25 countries. The collaboration aims to develop next-generation digital solutions to accelerate digital transformation in finance, banking, and insurance sectors across Europe and Asia.

Market by numbers

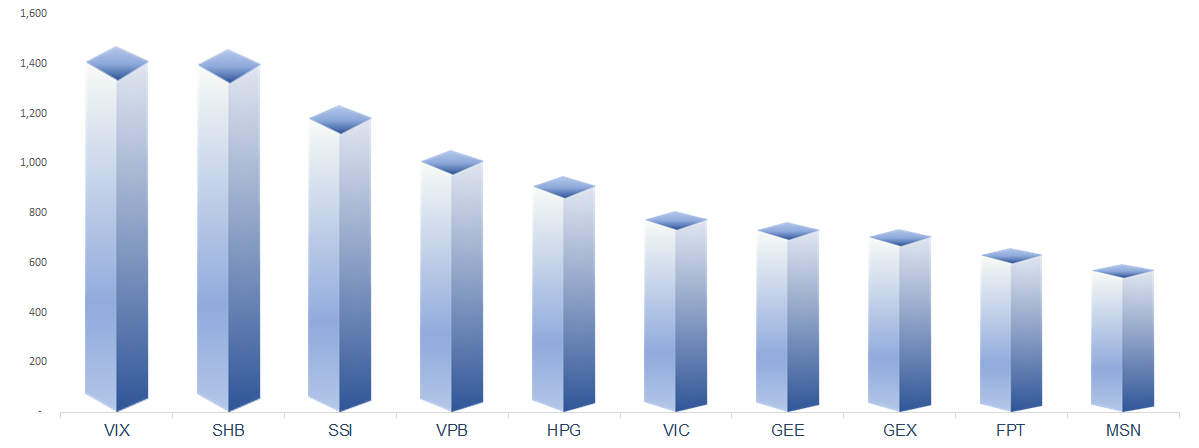

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

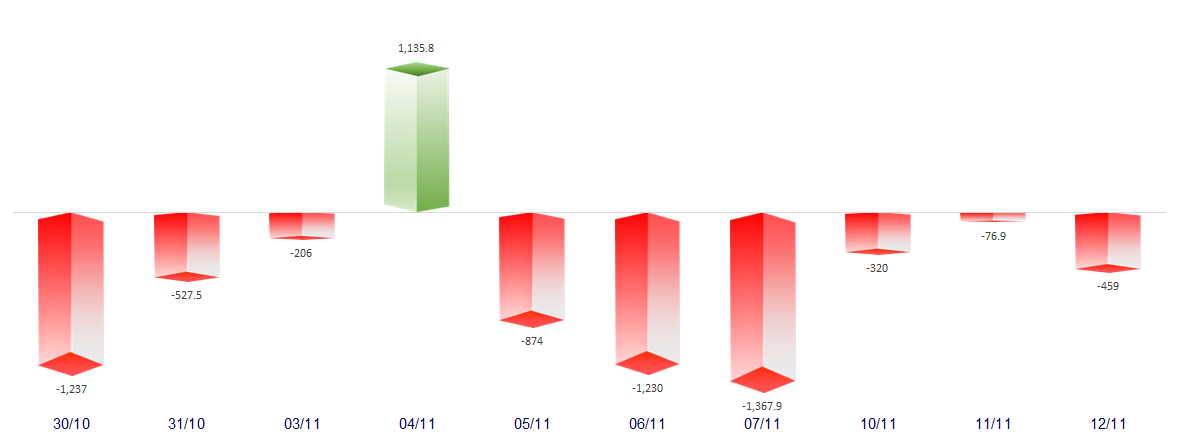

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

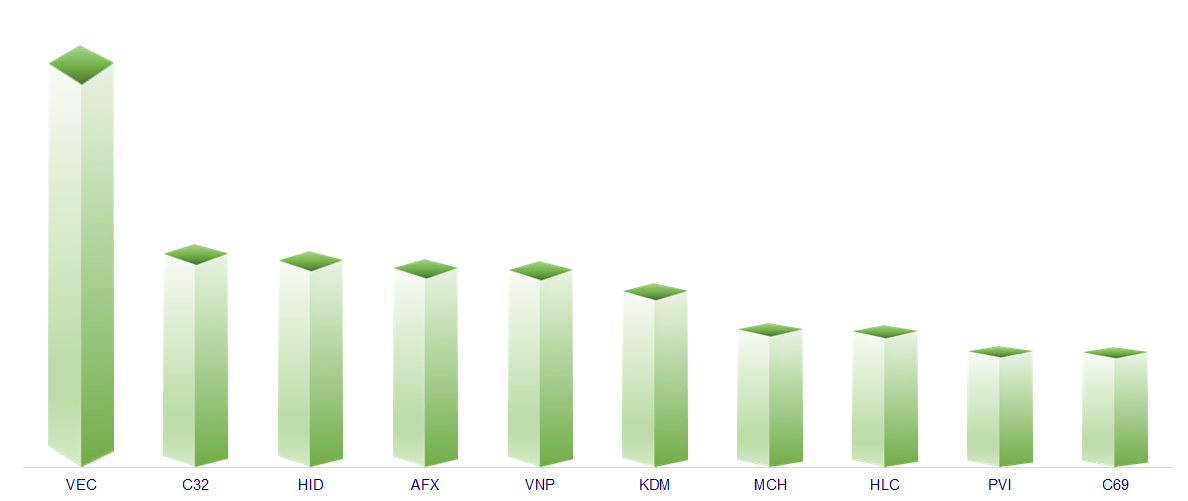

TOP INCREASES 3 CONSECUTIVE SESSIONS

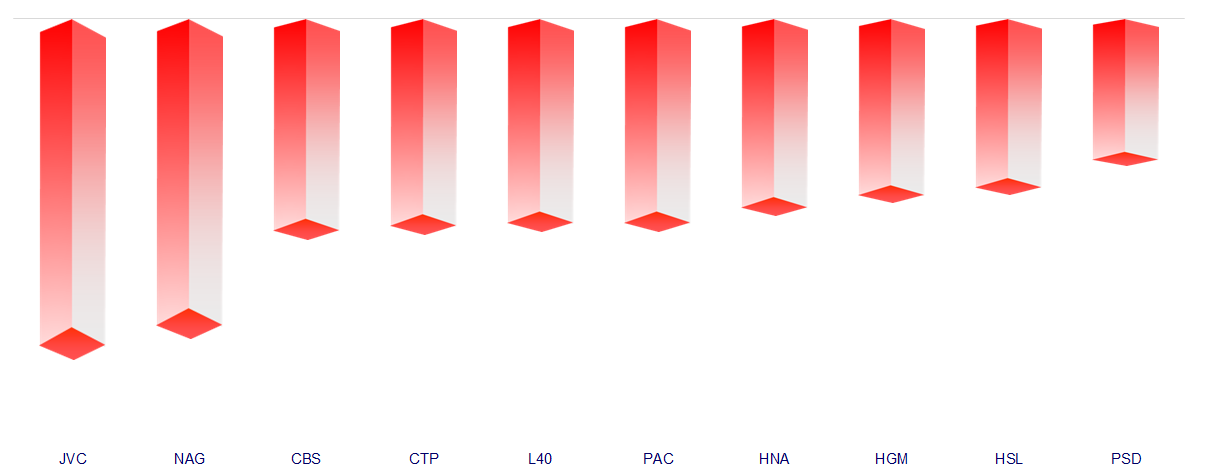

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.