Market brief 25/11/2025

VIETNAM STOCK MARKET

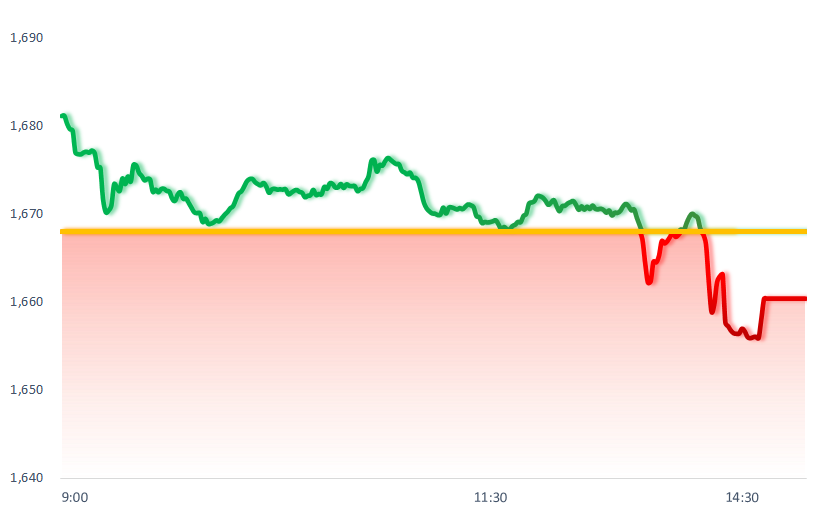

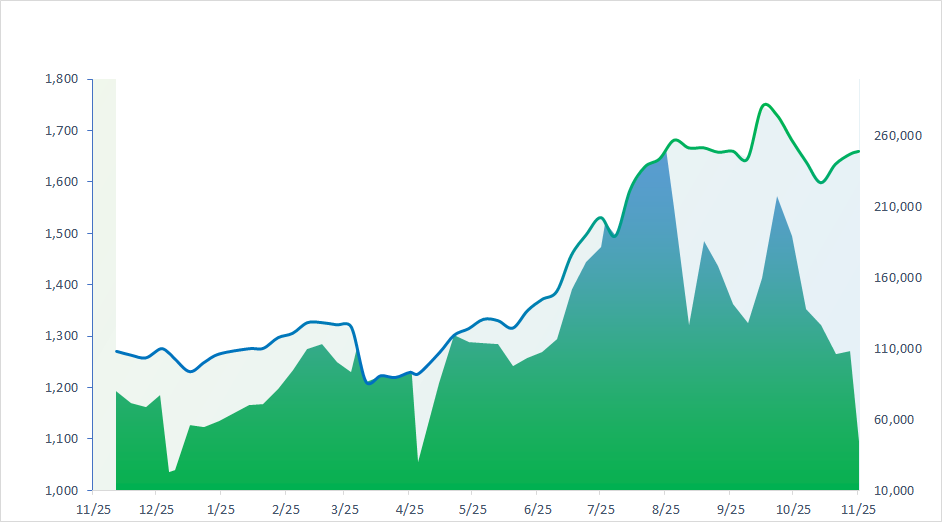

1,660.36

1D -0.46%

YTD 31.07%

257.30

1D -1.50%

YTD 13.13%

1,909.60

1D -0.35%

YTD 42.00%

118.92

1D -0.01%

YTD 25.10%

-406.28

1D 0.00%

YTD 0.00%

29,449.70

1D 57.58%

YTD 62.43%

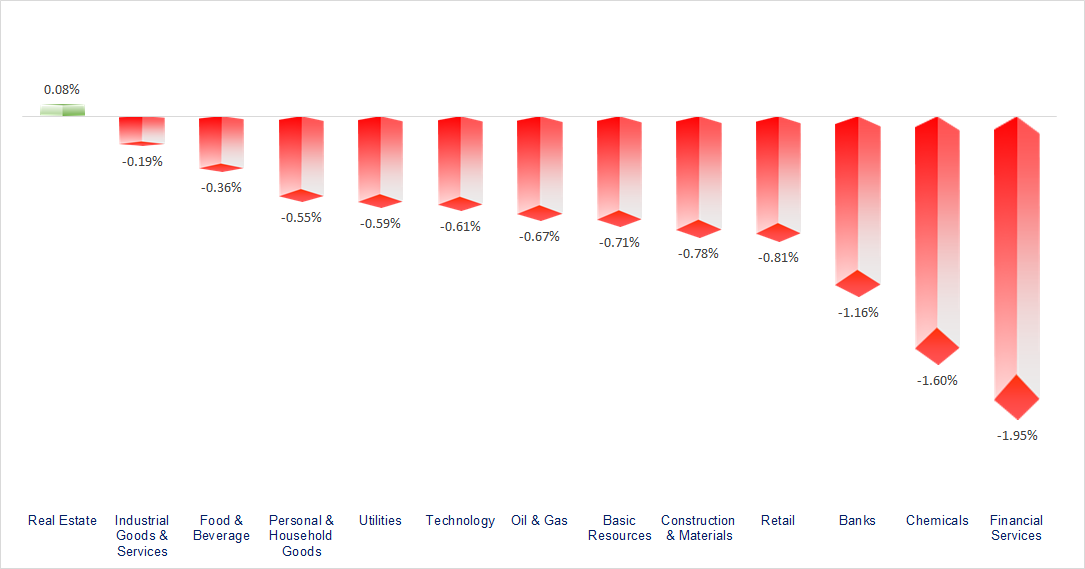

VN-Index reversed, dropping nearly 8 points as the brokerage sector fell sharply amid a spike in liquidity. Most sectors in the market posted losses, with the worst performers being Securities, Chemicals, and Banking.

ETF & DERIVATIVES

33,880

1D 0.33%

YTD 44.29%

23,210

1D -0.39%

YTD 42.57%

24,000

1D -2.04%

YTD 43.71%

28,150

1D -0.53%

YTD 40.05%

29,640

1D -1.04%

YTD 34.12%

37,310

1D -0.64%

YTD 11.31%

25,530

1D 0.00%

YTD 42.47%

1,908

1D 0.11%

YTD 0.00%

1,906

1D 0.08%

YTD 0.00%

1,904

1D -0.37%

YTD 0.00%

1,903

1D -0.42%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

48,659.52

1D 0.07%

YTD 21.97%

3,870.02

1D 0.87%

YTD 15.46%

25,894.55

1D 0.69%

YTD 29.09%

3,857.78

1D 0.30%

YTD 60.77%

84,587.01

1D -0.37%

YTD 7.65%

4,485.63

1D -0.24%

YTD 18.43%

1,268.78

1D 1.28%

YTD -9.39%

62.49

1D -0.16%

YTD -16.74%

4,132.12

1D -0.14%

YTD 56.81%

The upward momentum on Wall Street extended to Asian stock markets, with several indices continuing the previous session’s gains. Notably, the Shanghai Composite rose 0.9% to 3,871.56 points, and South Korea’s Kospi increased 0.3% to 3,857.78 points.

VIETNAM ECONOMY

6.50%

1D (bps) 67

YTD (bps) 253

4.60%

3.36%

1D (bps) -2

YTD (bps) 88

3.70%

1D (bps) -3

YTD (bps) 85

26,403

1D (%) 0.01%

YTD (%) 3.33%

31,187

1D (%) 0.09%

YTD (%) 14.38%

3,774

1D (%) 0.06%

YTD (%) 5.98%

The domestic gold market saw strong price increases across all segments following a previous flat session. SJC gold bars surged, approaching 153 million VND/tael; plain rings and jewelry gold also rose sharply by 1.4 – 2.6 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam’s largest USD16 billion super airport reached a key progress milestone;

- Vietnam aims to become a leading regional hub for UAV innovation and production;

- The government proposed spending over VND125,000 billion on healthcare for citizens from 2026–2035;

- Trump and Xi held an unexpected phone call;

- Trump is considering selling advanced AI chips to China;

- Coordination among the ‘ally faction’ and the Fed Chairman’s final decision.

VN30

BANK

58,200

1D -1.02%

5D -2.84%

Buy Vol. 4,555,249

Sell Vol. 5,126,765

37,000

1D -1.73%

5D -3.65%

Buy Vol. 2,473,643

Sell Vol. 3,321,090

48,150

1D -1.33%

5D -2.53%

Buy Vol. 9,158,427

Sell Vol. 9,121,282

33,450

1D -1.47%

5D -5.37%

Buy Vol. 20,487,235

Sell Vol. 21,240,611

28,200

1D -2.76%

5D -2.08%

Buy Vol. 20,559,176

Sell Vol. 27,599,136

22,850

1D -1.30%

5D -3.59%

Buy Vol. 31,913,489

Sell Vol. 31,603,037

31,800

1D 2.25%

5D 4.43%

Buy Vol. 67,725,699

Sell Vol. 74,291,928

16,950

1D -1.74%

5D -3.69%

Buy Vol. 10,381,552

Sell Vol. 12,476,328

50,000

1D 0.00%

5D 1.01%

Buy Vol. 13,083,645

Sell Vol. 14,161,527

18,300

1D -1.08%

5D -2.14%

Buy Vol. 11,742,600

Sell Vol. 16,631,028

24,200

1D -1.63%

5D -3.59%

Buy Vol. 21,446,442

Sell Vol. 21,620,928

16,400

1D -0.91%

5D -0.61%

Buy Vol. 126,080,090

Sell Vol. 129,183,198

17,100

1D -1.72%

5D -1.44%

Buy Vol. 27,723,764

Sell Vol. 28,851,367

49,000

1D 0.93%

5D -1.11%

Buy Vol. 2,706,362

Sell Vol. 2,075,822

On November 25, Orient Commercial Bank (OCB), OCBS Securities Joint Stock Company (OCBS), and Hoang Anh Gia Lai Joint Stock Company (HAGL) officially signed a strategic cooperation agreement, aiming to promote green finance and sustainable development.

OIL & GAS

60,800

1D -0.33%

5D -2.56%

Buy Vol. 802,750

Sell Vol. 875,357

33,500

1D -1.03%

5D -3.04%

Buy Vol. 2,139,301

Sell Vol. 2,636,552

Proposals to study policies supporting retailers of E5 and E10 biofuels.

VINGROUP

243,000

1D 1.46%

5D 10.45%

Buy Vol. 11,406,231

Sell Vol. 11,209,129

102,600

1D -0.10%

5D 5.77%

Buy Vol. 6,639,581

Sell Vol. 7,956,990

33,400

1D -3.05%

5D 3.25%

Buy Vol. 15,775,985

Sell Vol. 21,395,591

VIC: Vingroup lent working capital to Pomina at 0% interest, prioritizing it as a steel supplier for VinFast, Vinhomes, and VinFast VinSpeed.

FOOD & BEVERAGE

61,900

1D -1.75%

5D 1.98%

Buy Vol. 6,691,991

Sell Vol. 11,271,823

77,000

1D -1.03%

5D -2.53%

Buy Vol. 7,457,809

Sell Vol. 9,512,068

46,300

1D 0.33%

5D -1.91%

Buy Vol. 1,116,901

Sell Vol. 1,170,991

VNM: Foreign investors continued net buying, purchasing more than VND97 billion worth of Vinamilk shares today.

OTHERS

65,500

1D -1.80%

5D -3.25%

Buy Vol. 293,046

Sell Vol. 459,487

94,000

1D -2.08%

5D -4.86%

Buy Vol. 4,058,073

Sell Vol. 4,050,214

219,100

1D 6.98%

5D 22.33%

Buy Vol. 4,328,339

Sell Vol. 3,820,458

99,700

1D -0.50%

5D -0.30%

Buy Vol. 8,342,196

Sell Vol. 9,766,365

78,500

1D -1.01%

5D -5.42%

Buy Vol. 6,687,651

Sell Vol. 7,325,934

27,100

1D -2.17%

5D -4.07%

Buy Vol. 3,821,495

Sell Vol. 4,538,387

32,850

1D -4.51%

5D -7.59%

Buy Vol. 78,596,852

Sell Vol. 78,909,471

26,900

1D -0.74%

5D -2.18%

Buy Vol. 46,119,586

Sell Vol. 45,121,391

VJC: Vietjet Air plans to issue 118.3 million shares as dividends at a 20% ratio, meaning shareholders holding 100 shares will receive 20 additional shares. The issuance is expected from Q4/2025 to Q1/2026. After this issuance, Vietjet’s charter capital will increase from VND5,916 billion to VND7,100 billion.

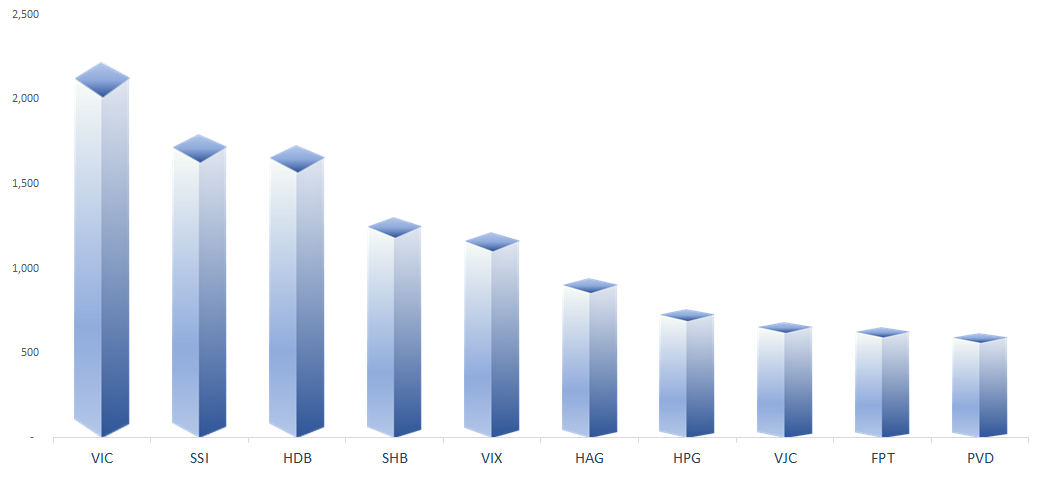

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

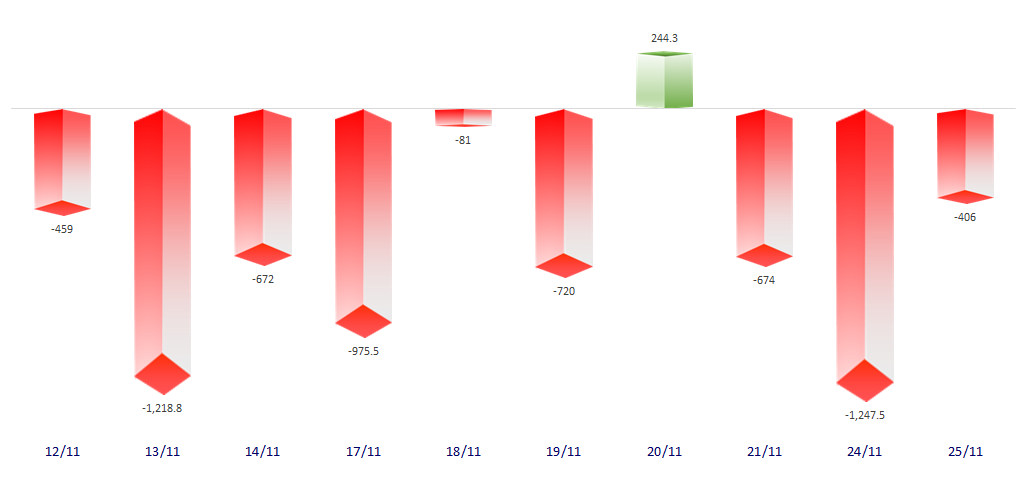

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

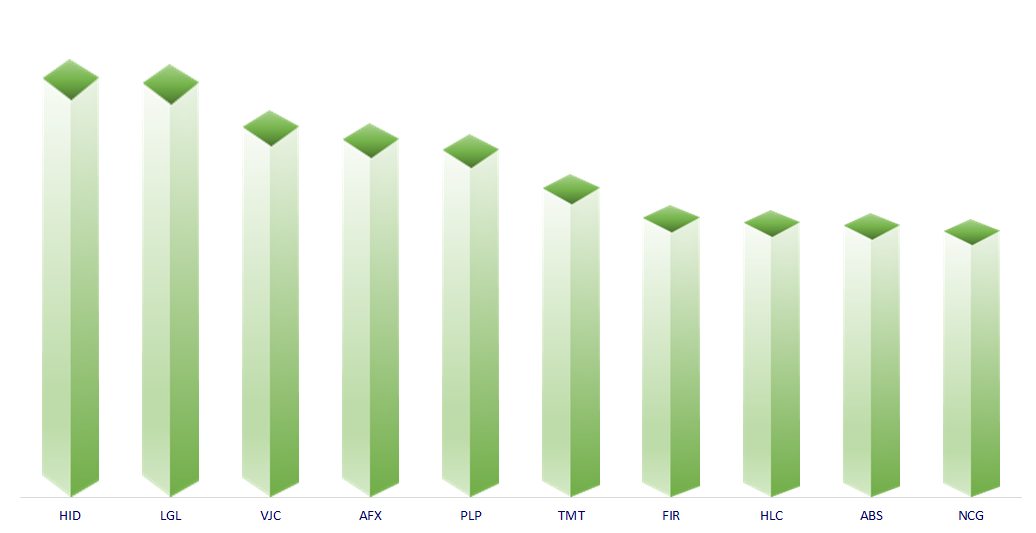

TOP INCREASES 3 CONSECUTIVE SESSIONS

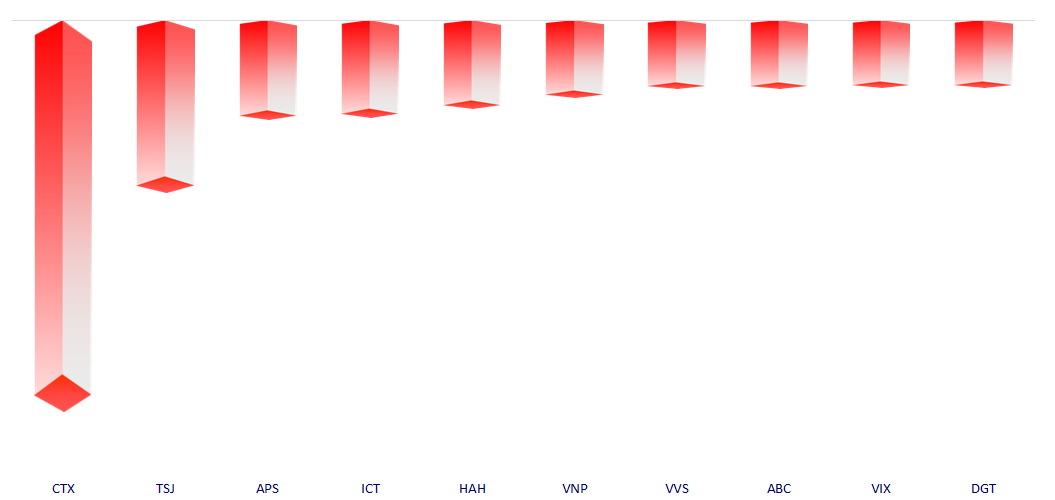

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.