Market brief 26/11/2025

VIETNAM STOCK MARKET

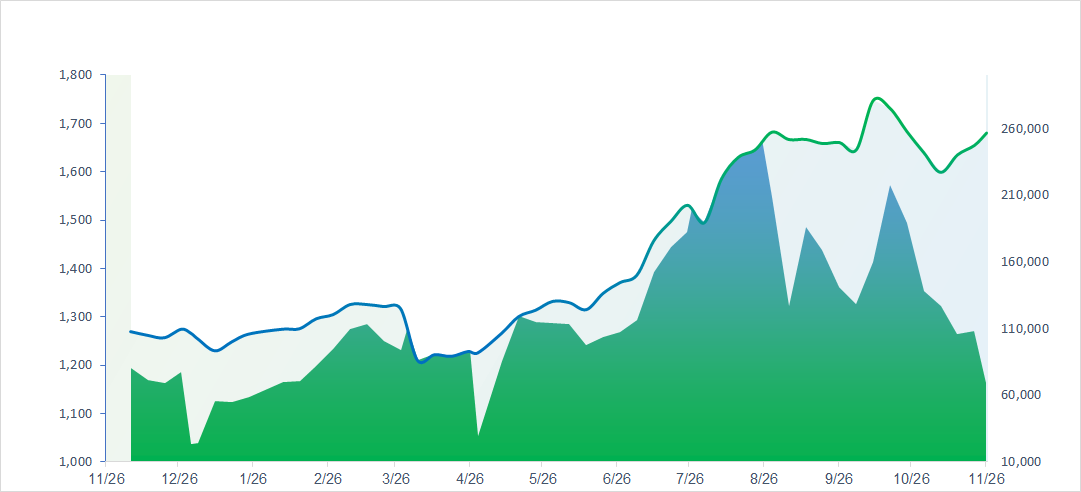

1,680.36

1D 1.20%

YTD 32.65%

261.91

1D 1.79%

YTD 15.16%

1,923.55

1D 0.73%

YTD 43.04%

119.24

1D 0.27%

YTD 25.44%

583.13

1D 0.00%

YTD 0.00%

26,682.00

1D -9.40%

YTD 47.16%

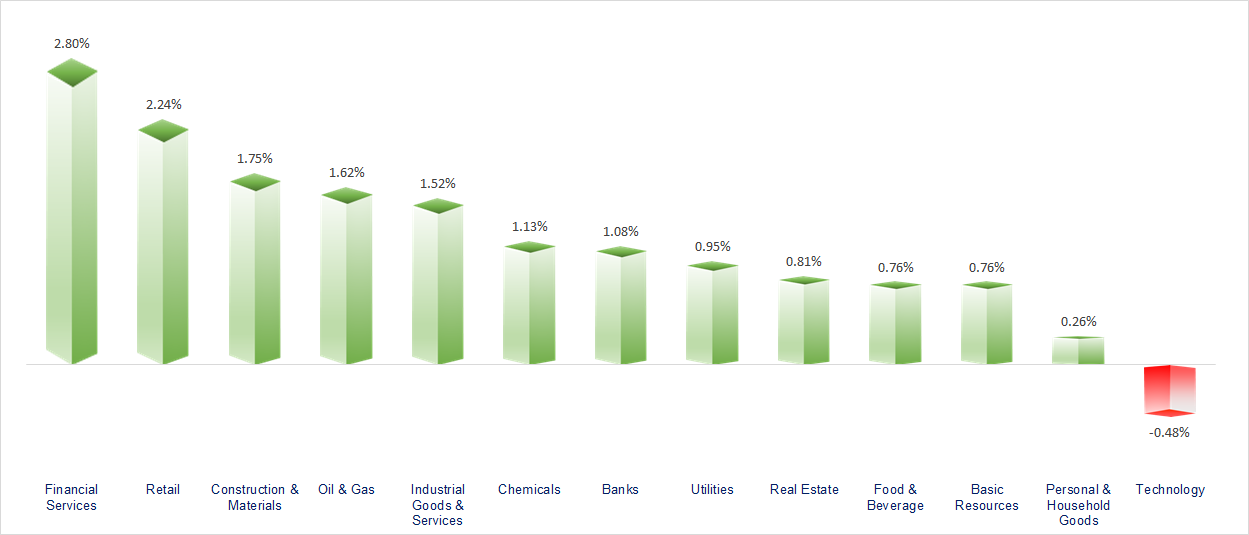

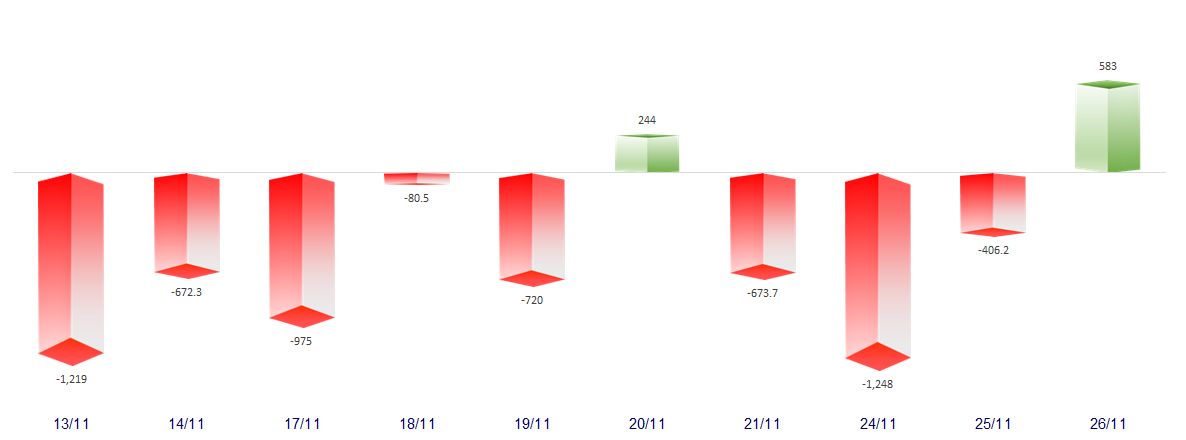

VN-Index surged by around 20 points, supported by nearly VND 600 billion in net foreign inflows. Almost all sectors on the market gained today, with the most positive performance seen in Securities, Retail, Banking, and Real Estate.

ETF & DERIVATIVES

34,050

1D 0.50%

YTD 45.02%

23,360

1D 0.65%

YTD 43.49%

24,080

1D 0.33%

YTD 44.19%

28,300

1D 0.53%

YTD 40.80%

29,800

1D 0.54%

YTD 34.84%

37,700

1D 1.05%

YTD 12.47%

25,600

1D 0.27%

YTD 42.86%

1,925

1D 0.98%

YTD 0.00%

1,924

1D 1.05%

YTD 0.00%

1,921

1D 0.68%

YTD 0.00%

1,922

1D 0.67%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

49,559.07

1D 1.85%

YTD 24.23%

3,864.18

1D -0.15%

YTD 15.29%

25,928.08

1D 0.13%

YTD 29.26%

3,960.87

1D 2.67%

YTD 65.07%

85,609.51

1D 1.21%

YTD 8.95%

4,501.56

1D 0.36%

YTD 18.85%

1,261.18

1D -0.60%

YTD -9.93%

61.64

1D -0.26%

YTD -17.87%

4,160.34

1D 0.72%

YTD 57.88%

The uptrend on Wall Street continued to lift Asian markets, with many indices extending their prior session’s rally. In particular, the Nikkei 225 advanced 1.87% to 49,568.38 points, while South Korea’s Kospi climbed 2.27% to 3,945.21 points.

VIETNAM ECONOMY

5.80%

1D (bps) -70

YTD (bps) 183

4.60%

3.39%

1D (bps) 3

YTD (bps) 91

3.73%

1D (bps) 3

YTD (bps) 88

26,403

1D (%) 0.00%

YTD (%) 3.33%

31,288

1D (%) 0.33%

YTD (%) 14.75%

3,782

1D (%) 0.21%

YTD (%) 6.20%

Today, the domestic gold market remained vibrant as major brands simultaneously posted strong increases. SJC gold bars broke through the 153 million VND/tael threshold, while plain gold rings and 24K jewelry rose by 500,000 to 1.5 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi’s budget revenue hits an all-time high;

- Urgent notice from the Tax Department;

- From 2026, Hanoi targets growth of 11% or higher;

- The U.S. faces financial repercussions after prolonged government shutdown;

- Fed Chair’s ally paves the way for a December rate cut;

- Binance accused of enabling USD1 billion in illicit funds, building a system to evade oversight.

VN30

BANK

58,100

1D -0.17%

5D -2.19%

Buy Vol. 10,310,033

Sell Vol. 9,099,165

37,350

1D 0.95%

5D -1.97%

Buy Vol. 2,326,980

Sell Vol. 2,494,884

48,900

1D 1.56%

5D -0.91%

Buy Vol. 13,493,396

Sell Vol. 9,899,049

33,850

1D 1.20%

5D -2.73%

Buy Vol. 20,195,044

Sell Vol. 16,866,788

29,000

1D 2.84%

5D 3.20%

Buy Vol. 35,532,162

Sell Vol. 32,955,024

23,250

1D 1.75%

5D -1.06%

Buy Vol. 48,965,260

Sell Vol. 35,124,959

32,300

1D 1.57%

5D 3.19%

Buy Vol. 19,471,809

Sell Vol. 22,622,274

17,400

1D 2.65%

5D 1.46%

Buy Vol. 13,435,775

Sell Vol. 14,381,569

49,950

1D -0.10%

5D 0.91%

Buy Vol. 14,427,867

Sell Vol. 16,553,746

18,450

1D 0.82%

5D -1.34%

Buy Vol. 10,809,391

Sell Vol. 13,777,210

24,200

1D 0.00%

5D -2.81%

Buy Vol. 15,617,279

Sell Vol. 13,475,575

16,700

1D 1.83%

5D 1.52%

Buy Vol. 165,288,238

Sell Vol. 139,762,424

17,250

1D 0.88%

5D 0.29%

Buy Vol. 9,925,371

Sell Vol. 10,330,575

49,600

1D 1.22%

5D 0.20%

Buy Vol. 3,111,530

Sell Vol. 2,832,337

Overnight (ON) interest rate surged sharply to 6.5% yesterday before easing to around 5.8% in today’s session.

OIL & GAS

62,000

1D 1.97%

5D -0.32%

Buy Vol. 940,208

Sell Vol. 1,059,149

33,850

1D 1.04%

5D -2.45%

Buy Vol. 1,338,534

Sell Vol. 1,652,681

Oil prices fell more than 1% on Tuesday (November 25), after reports quoting a U.S. official said that Ukraine had agreed to a peace deal.

VINGROUP

245,000

1D 0.82%

5D 11.11%

Buy Vol. 14,679,676

Sell Vol. 14,180,016

102,100

1D -0.49%

5D 5.37%

Buy Vol. 7,454,524

Sell Vol. 8,445,975

33,850

1D 1.35%

5D 7.12%

Buy Vol. 11,756,439

Sell Vol. 13,575,106

VIC: Vingroup extended a 0% interest working capital loan to Pomina, giving priority for the company to become a steel supplier for VinFast, Vinhomes, and VinSpeed.

FOOD & BEVERAGE

62,800

1D 1.45%

5D 3.12%

Buy Vol. 6,027,144

Sell Vol. 9,740,519

78,600

1D 2.08%

5D -0.25%

Buy Vol. 6,566,300

Sell Vol. 7,311,464

46,500

1D 0.43%

5D -1.06%

Buy Vol. 896,790

Sell Vol. 1,425,187

MSN: Masan Group saw net foreign inflows exceeding VND 80 billion in today’s trading session.

OTHERS

66,400

1D 1.37%

5D 0.45%

Buy Vol. 328,975

Sell Vol. 471,296

95,800

1D 1.91%

5D -0.83%

Buy Vol. 2,534,971

Sell Vol. 2,474,147

207,800

1D -5.16%

5D 16.74%

Buy Vol. 2,857,262

Sell Vol. 3,868,401

99,000

1D -0.70%

5D 1.02%

Buy Vol. 9,264,529

Sell Vol. 11,731,366

80,200

1D 2.17%

5D -2.67%

Buy Vol. 7,467,015

Sell Vol. 7,200,489

27,500

1D 1.48%

5D -1.79%

Buy Vol. 2,109,372

Sell Vol. 2,417,904

34,000

1D 3.50%

5D -1.88%

Buy Vol. 51,223,904

Sell Vol. 51,567,836

27,100

1D 0.74%

5D -1.81%

Buy Vol. 44,723,183

Sell Vol. 43,658,440

VJC: Vietjet Aviation Joint Stock Company submitted a disclosure to the Hanoi Stock Exchange (HNX) regarding a private domestic bond issuance. Accordingly, the company issued 10,000 bonds (code VJC12504), with a par value of VND 100 million per bond, totaling VND 1,000 billion. The bonds were issued on November 24, 2025, with a 60-month tenor, and are set to mature on November 24, 2030. Vietjet completed distribution and fund collection from investors on November 24, 2025.

Market by numbers

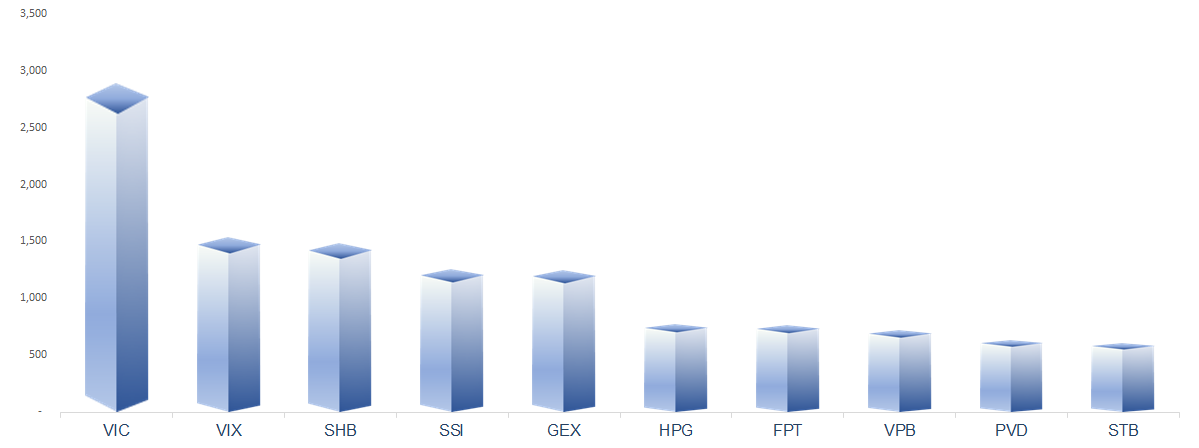

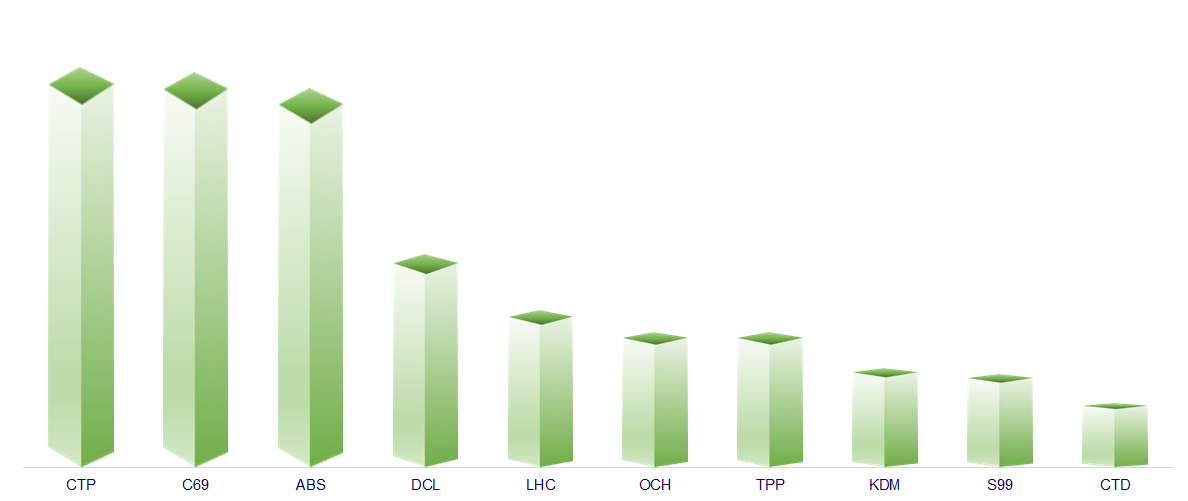

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

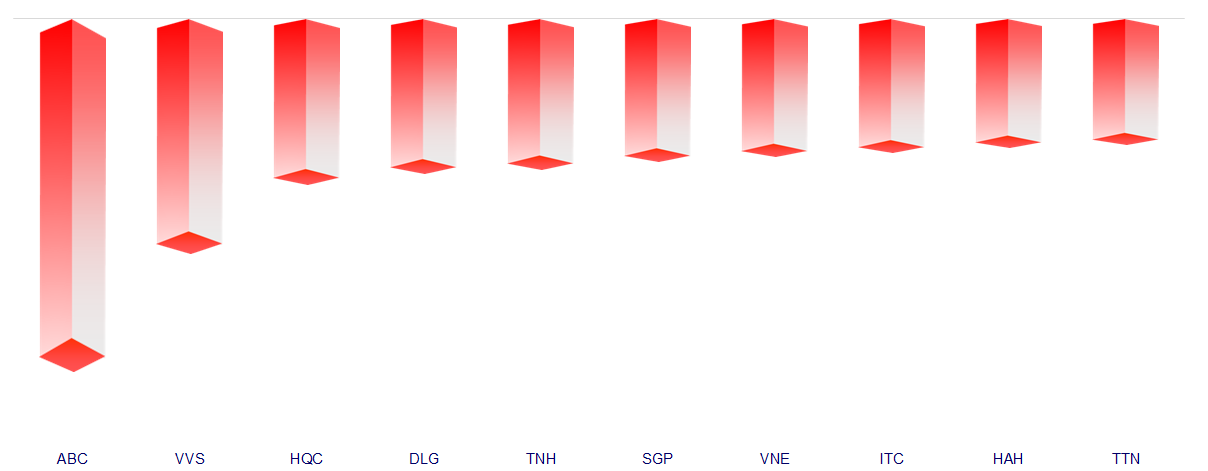

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.