Market brief 01/12/2025

VIETNAM STOCK MARKET

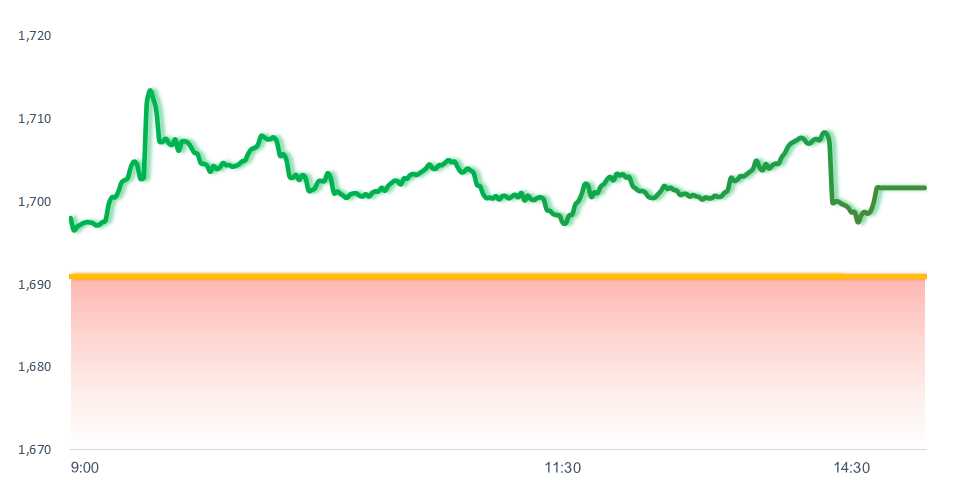

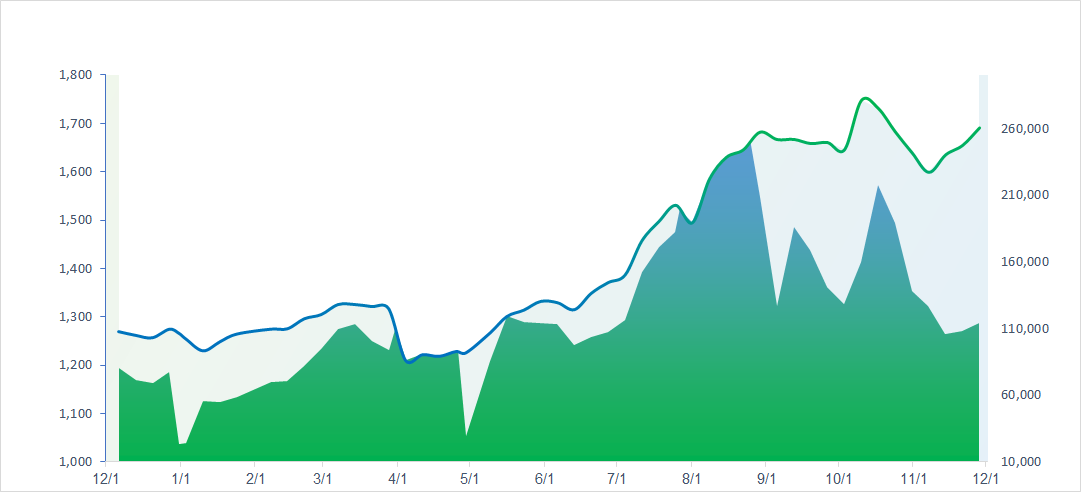

1,701.67

1D 0.63%

YTD 34.33%

257.91

1D -0.77%

YTD 13.40%

1,933.56

1D 0.50%

YTD 43.79%

119.35

1D -71.24%

YTD 25.55%

-316.66

1D 0.00%

YTD 0.00%

22,495.00

1D -11.97%

YTD 24.07%

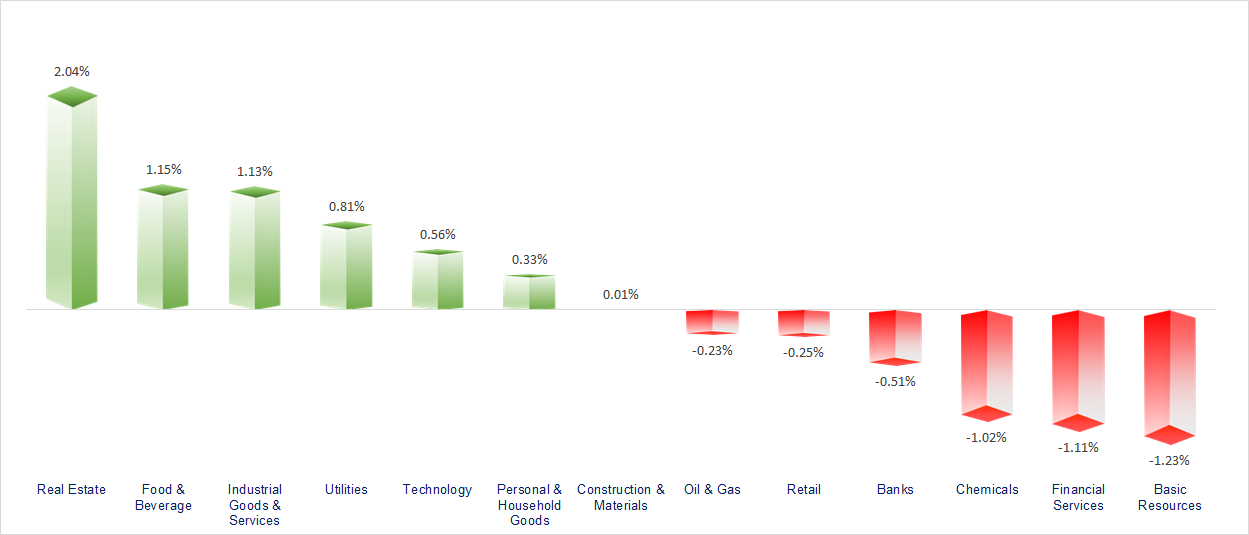

VN-Index continued to rise, though most sectors did not show truly positive performance. The Vin group and the F&B sector were the two standout gainers. Meanwhile, sectors such as Resources, Securities, Banking, and Oil & Gas showed rather lackluster movements.

ETF & DERIVATIVES

34,100

1D 0.98%

YTD 45.23%

23,480

1D 0.34%

YTD 44.23%

24,250

1D 3.19%

YTD 45.21%

28,090

1D 0.32%

YTD 39.75%

29,620

1D 0.03%

YTD 34.03%

37,670

1D 0.53%

YTD 12.38%

25,650

1D 0.23%

YTD 43.14%

1,933

1D 0.93%

YTD 0.00%

1,933

1D 0.68%

YTD 0.00%

1,927

1D 0.21%

YTD 0.00%

1,930

1D 0.77%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

49,253.36

1D -1.99%

YTD 23.46%

3,901.32

1D 0.33%

YTD 16.40%

25,966.71

1D 0.42%

YTD 29.45%

3,922.35

1D -0.11%

YTD 63.47%

85,933.14

1D 0.22%

YTD 9.36%

4,526.22

1D 0.05%

YTD 19.50%

1,276.57

1D 1.58%

YTD -8.83%

63.25

1D 1.39%

YTD -15.72%

4,255.00

1D 0.58%

YTD 61.48%

Asian stock markets moved mixed in today’s session. Leading the declines was Japan’s Nikkei 225, which dropped nearly 2% to 49,253.36 points following the BOJ Governor’s speech suggesting a 60% probability of an interest rate hike in December. On the other hand, the Shanghai Composite rose more than 0.3% to 3,901.32 points despite China’s November PMI falling below the 50-point threshold to 49.9.

VIETNAM ECONOMY

7.17%

1D (bps) 187

YTD (bps) 320

4.60%

3.40%

1D (bps) -7

YTD (bps) 93

3.76%

1D (bps) 11

YTD (bps) 91

26,413

1D (%) 0.00%

YTD (%) 3.37%

31,377

1D (%) 0.13%

YTD (%) 15.08%

3,785

1D (%) -0.02%

YTD (%) 6.30%

Today, the domestic gold market continued to witness strong increases across all segments. Notably, SJC gold bar prices at Doji soared to 155.7 million VND/tael — currently the highest in the market — and are nearly 1 million VND/tael more expensive than gold rings. Gold rings and jewelry gold at many major brands also recorded simultaneous increases.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The National Assembly agrees to amend Resolution 98 on piloting special mechanisms and policies for Ho Chi Minh City’s development;

- PMI November 2025: Vietnam’s manufacturing sector continued to grow despite storm-related disruptions;

- Minister Tran Duc Thang: 21 provinces and cities possess rare earth resources, and raw exports will be restricted;

- Japan’s central bank governor signals a possible interest rate hike in December;

- Many major corporations are moving to dominate Hong Kong’s capital market;

- China’s manufacturing unexpectedly contracts.

VN30

BANK

57,500

1D 0.17%

5D -2.21%

Buy Vol. 4,710,621

Sell Vol. 4,624,280

36,950

1D -0.40%

5D -1.86%

Buy Vol. 2,546,114

Sell Vol. 2,684,103

48,400

1D -1.22%

5D -0.82%

Buy Vol. 6,291,346

Sell Vol. 7,805,641

33,200

1D -1.63%

5D -2.21%

Buy Vol. 14,129,850

Sell Vol. 13,424,825

29,300

1D 0.17%

5D 1.03%

Buy Vol. 24,226,041

Sell Vol. 29,249,009

23,200

1D -0.22%

5D 0.22%

Buy Vol. 20,169,678

Sell Vol. 19,011,232

31,500

1D -1.56%

5D 1.29%

Buy Vol. 10,210,342

Sell Vol. 15,882,292

17,000

1D -1.73%

5D -1.45%

Buy Vol. 12,724,481

Sell Vol. 14,947,258

49,000

1D 0.82%

5D -2.00%

Buy Vol. 11,078,460

Sell Vol. 9,013,028

18,350

1D -0.81%

5D -0.81%

Buy Vol. 8,017,011

Sell Vol. 8,497,536

24,000

1D -1.03%

5D -2.44%

Buy Vol. 21,689,834

Sell Vol. 21,718,738

17,000

1D 1.19%

5D 2.72%

Buy Vol. 120,028,383

Sell Vol. 100,962,053

17,200

1D -0.58%

5D -1.15%

Buy Vol. 6,437,272

Sell Vol. 6,166,819

47,900

1D -1.44%

5D -1.34%

Buy Vol. 1,815,654

Sell Vol. 1,492,190

Interbank lending rates surged unexpectedly today, rising above the 7% per annum threshold.

OIL & GAS

65,400

1D 3.15%

5D 7.21%

Buy Vol. 4,560,163

Sell Vol. 4,247,201

34,450

1D 1.62%

5D 1.77%

Buy Vol. 2,719,033

Sell Vol. 2,831,777

Brent oil prices experienced sharp volatility in today’s trading session, unexpectedly falling more than 1% by late afternoon.

VINGROUP

269,900

1D 3.65%

5D 12.69%

Buy Vol. 14,683,997

Sell Vol. 14,686,709

105,700

1D 2.72%

5D 2.92%

Buy Vol. 10,641,310

Sell Vol. 11,135,804

34,900

1D 1.90%

5D 1.31%

Buy Vol. 18,441,276

Sell Vol. 22,818,394

On December 8, Vingroup will finalize the list of shareholders for issuing more than 3.85 billion bonus shares at a 1:1 ratio.

FOOD & BEVERAGE

64,900

1D 1.41%

5D 3.02%

Buy Vol. 11,795,130

Sell Vol. 18,161,582

78,800

1D 1.81%

5D 1.29%

Buy Vol. 11,528,041

Sell Vol. 10,018,577

49,000

1D 5.60%

5D 6.18%

Buy Vol. 6,577,236

Sell Vol. 6,320,861

VNM: Vinamilk recorded its 20th consecutive net-buying session by foreign investors, with today’s net buying value reaching VND 66 billion.

OTHERS

65,600

1D -1.50%

5D -1.65%

Buy Vol. 325,257

Sell Vol. 433,753

95,000

1D 0.74%

5D -1.04%

Buy Vol. 1,934,463

Sell Vol. 2,295,550

203,900

1D 0.20%

5D -0.44%

Buy Vol. 3,220,144

Sell Vol. 3,672,056

96,600

1D 0.52%

5D -2.59%

Buy Vol. 7,068,580

Sell Vol. 8,319,529

80,000

1D 0.13%

5D 0.88%

Buy Vol. 4,814,132

Sell Vol. 7,507,705

26,700

1D -2.20%

5D -3.61%

Buy Vol. 2,576,252

Sell Vol. 3,097,344

32,000

1D -2.44%

5D -6.98%

Buy Vol. 40,137,516

Sell Vol. 45,838,827

26,500

1D -0.19%

5D -2.21%

Buy Vol. 43,537,412

Sell Vol. 39,398,881

On December 2, FPT Corporation will finalize the list of shareholders eligible to receive the first 2025 cash dividend prepayment at a rate of 10%, equivalent to 1,000 VND/share.

Market by numbers

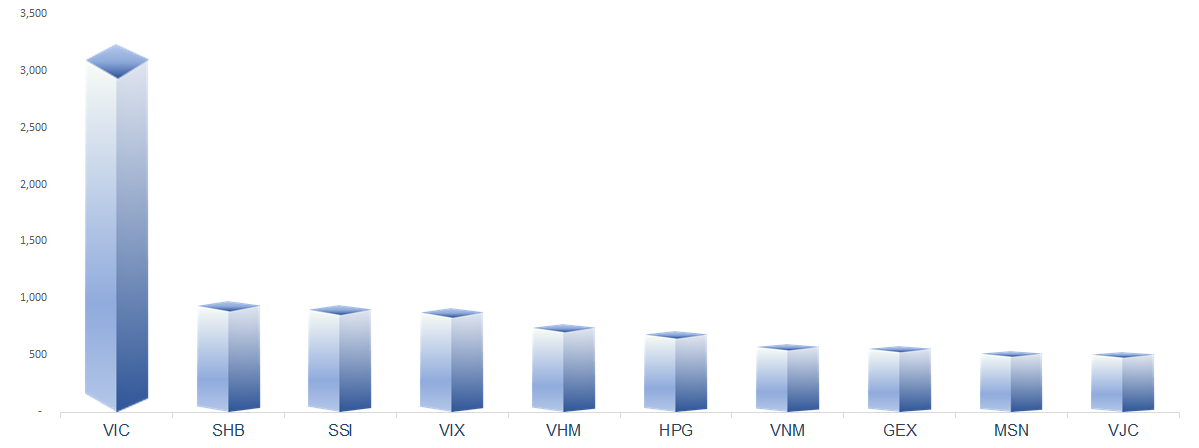

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

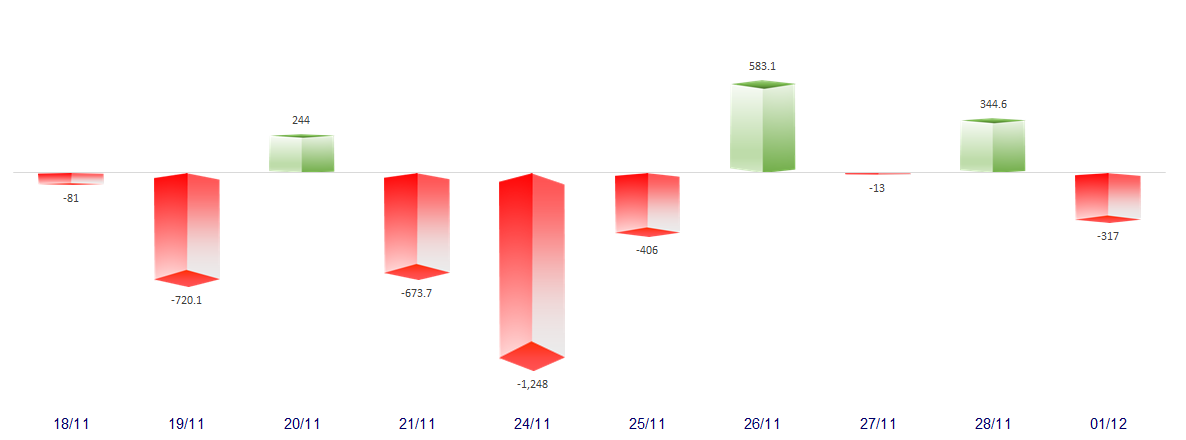

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

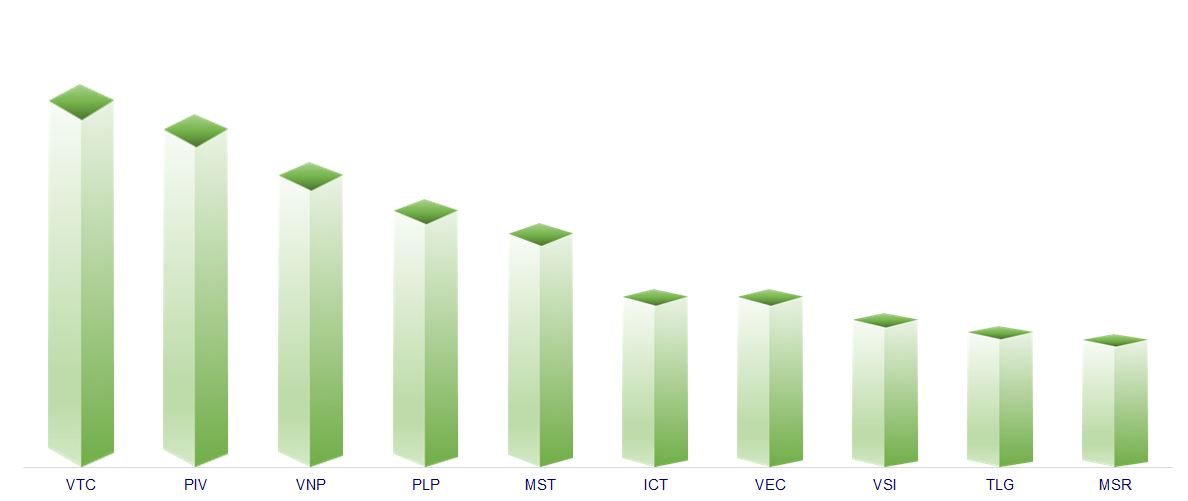

TOP INCREASES 3 CONSECUTIVE SESSIONS

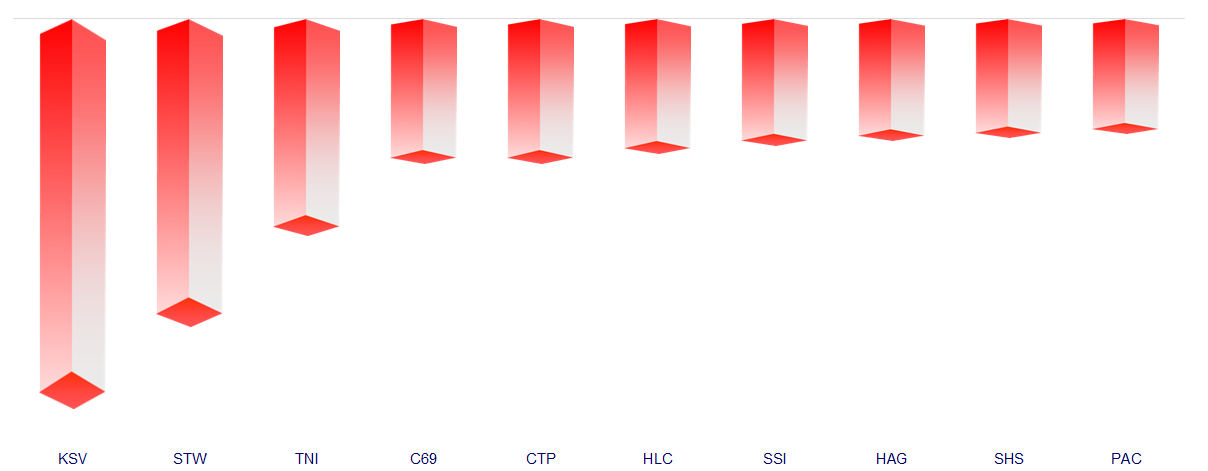

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.