Market brief 13/01/2026

VIETNAM STOCK MARKET

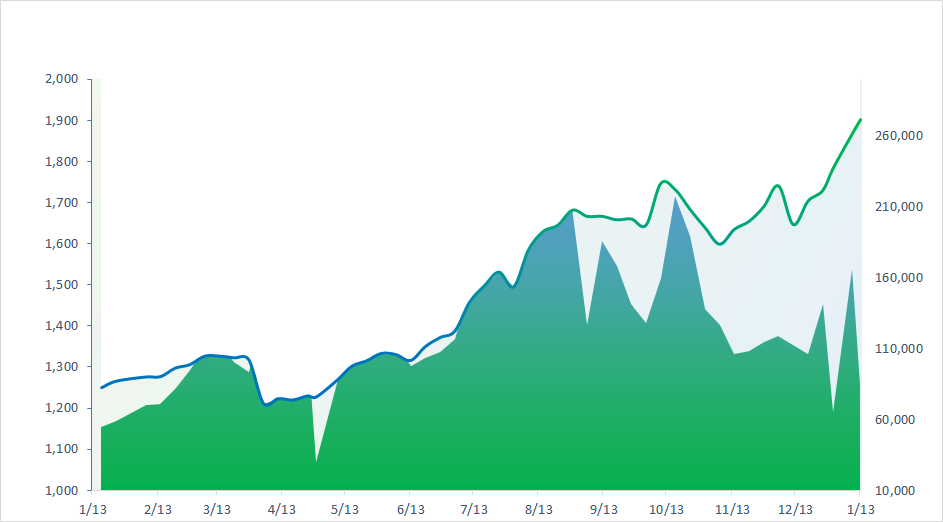

1,902.93

1D 1.36%

YTD 6.64%

252.85

1D 0.39%

YTD 1.64%

2,089.21

1D 0.43%

YTD 2.88%

123.24

1D 0.55%

YTD 1.88%

-589.53

1D 0.00%

YTD 0.00%

46,018.52

1D 1.68%

YTD 89.41%

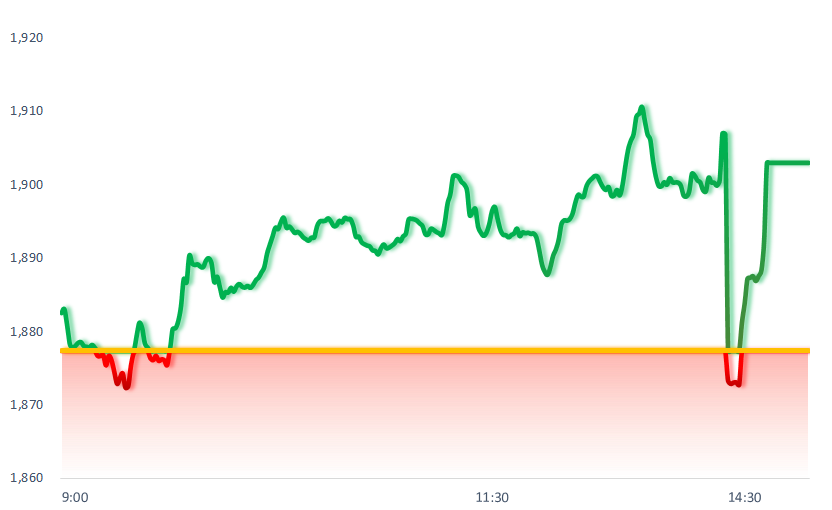

VN-Index conquered the 1,900-point milestone, driven by a strong surge in oil and gas stocks. Many sectors advanced in today’s session, with standout gains from the Oil & Gas, Chemicals, and Vingroup-related stocks. In contrast, the Materials and Technology sectors recorded rather subdued performance.

ETF & DERIVATIVES

37,030

1D 0.35%

YTD 2.60%

25,380

1D 0.16%

YTD 2.30%

26,080

1D 0.50%

YTD 2.31%

30,500

1D 0.53%

YTD 7.32%

32,350

1D 0.59%

YTD 6.55%

39,770

1D -0.55%

YTD 3.84%

26,950

1D 1.70%

YTD 5.60%

2,085

1D 0.24%

YTD 0.00%

2,089

1D 0.68%

YTD 0.00%

2,085

1D 0.93%

YTD 0.00%

2,083

1D 0.86%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

53,549.16

1D 3.10%

YTD 6.38%

4,138.76

1D -0.64%

YTD 4.28%

26,848.47

1D 0.90%

YTD 4.75%

4,692.64

1D 1.47%

YTD 11.35%

83,628.57

1D -0.30%

YTD -1.99%

4,807.13

1D 0.85%

YTD 3.46%

1,235.90

1D -0.51%

YTD -1.89%

64.82

1D 0.98%

YTD 6.70%

4,586.96

1D -0.01%

YTD 5.92%

Asian stock markets mostly moved higher today as traders shrugged off geopolitical flashpoints in Iran and Venezuela, as well as a criminal investigation targeting U.S. Federal Reserve Chair Jerome Powell. The most notable move was Japan’s Nikkei 225, which jumped 3.1%, leading gains across the region. According to national broadcaster NHK, Japan’s ruling Liberal Democratic Party is expected to dissolve the Lower House this month and call an early general election, potentially to be held in February.

VIETNAM ECONOMY

4.00%

1D (bps) 10

YTD (bps) -410

5.20%

1D (bps) 60

YTD (bps) 60

3.58%

1D (bps) 3

YTD (bps) 21

3.97%

1D (bps) 3

YTD (bps) 5

26,385

1D (%) 0.00%

YTD (%) 0.03%

31,457

1D (%) 0.13%

YTD (%) -0.62%

3,828

1D (%) 0.06%

YTD (%) 0.16%

Today, SJC gold bar prices were temporarily flat around 162 million VND/tael following the previous session’s sharp rise. Meanwhile, gold ring prices continued to be adjusted upward, while 24K jewelry gold prices showed mixed movements across different companies.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Prime Minister has requested the State Bank of Vietnam to tighten control over real estate credit;

- International experts have expressed high expectations for the International Financial Center in Da Nang;

- Four banks have committed nearly VND25.5 trillion to the Ring Road 4 project;

- Cambodia’s billion-dollar economic sector has experienced a broad-based decline;

- The U.S. has advised its citizens to immediately leave Iran;

- The Fed may delay interest rate cuts until mid-year.

VN30

BANK

74,000

1D 1.79%

5D 29.14%

Buy Vol. 39,365,300

Sell Vol. 43,046,317

51,000

1D 3.55%

5D 31.11%

Buy Vol. 35,316,112

Sell Vol. 31,400,643

41,300

1D -0.48%

5D 14.09%

Buy Vol. 46,752,141

Sell Vol. 44,919,886

37,350

1D -1.71%

5D 3.75%

Buy Vol. 31,907,538

Sell Vol. 40,234,702

30,500

1D 0.99%

5D 5.72%

Buy Vol. 62,380,374

Sell Vol. 74,791,365

27,550

1D -2.30%

5D 3.38%

Buy Vol. 80,881,009

Sell Vol. 78,151,274

28,450

1D 0.89%

5D -2.07%

Buy Vol. 23,431,469

Sell Vol. 22,240,994

17,900

1D -1.65%

5D 4.99%

Buy Vol. 35,629,382

Sell Vol. 52,985,002

54,100

1D 0.56%

5D -4.59%

Buy Vol. 24,562,232

Sell Vol. 31,685,545

18,550

1D 0.00%

5D 4.51%

Buy Vol. 15,389,981

Sell Vol. 17,923,549

24,900

1D -2.35%

5D 3.75%

Buy Vol. 30,985,011

Sell Vol. 37,541,500

16,700

1D -1.76%

5D 3.09%

Buy Vol. 117,701,678

Sell Vol. 199,912,250

17,700

1D -0.28%

5D 2.31%

Buy Vol. 3,771,825

Sell Vol. 4,705,464

41,900

1D -1.18%

5D 0.48%

Buy Vol. 4,746,636

Sell Vol. 4,036,471

VCB: There are rumors that the bank plans a private placement of up to 543.1 million shares. The offering would be made to a maximum of 55 investors, including strategic partner Mizuho Bank (Japan) and other professional securities investors. The expected offering price is estimated to range between 96,000 and 10,000 VND/share.

OIL & GAS

103,700

1D 6.91%

5D 25.24%

Buy Vol. 7,343,382

Sell Vol. 5,681,459

45,350

1D 6.96%

5D 17.03%

Buy Vol. 26,257,752

Sell Vol. 11,233,012

PLX: The company ended fiscal year 2025 with consolidated revenue of approximately VND290 trillion.

VINGROUP

167,900

1D 2.57%

5D -3.00%

Buy Vol. 13,254,415

Sell Vol. 12,021,141

134,000

1D 2.92%

5D -5.50%

Buy Vol. 15,231,111

Sell Vol. 11,532,481

33,550

1D 2.91%

5D -11.83%

Buy Vol. 15,824,401

Sell Vol. 13,649,842

VIC: Vingroup’s Olympic Sports Urban Area project, valued at VND925 trillion, has reached a key milestone and is set to commence implementation as early as February.

FOOD & BEVERAGE

63,300

1D 0.96%

5D 4.11%

Buy Vol. 9,204,173

Sell Vol. 13,064,561

79,300

1D 0.89%

5D 2.99%

Buy Vol. 13,253,368

Sell Vol. 19,134,965

50,200

1D 6.81%

5D 10.08%

Buy Vol. 6,433,735

Sell Vol. 3,726,631

MSN: Foreign investors recorded net selling of more than VND92 billion in MSN shares today.

OTHERS

68,600

1D -2.00%

5D 7.52%

Buy Vol. 3,509,941

Sell Vol. 4,052,327

63,100

1D -0.94%

5D 0.16%

Buy Vol. 7,006,519

Sell Vol. 6,898,893

195,000

1D 0.00%

5D -8.11%

Buy Vol. 2,759,647

Sell Vol. 2,966,127

98,900

1D -0.60%

5D 5.21%

Buy Vol. 11,873,820

Sell Vol. 19,539,530

87,100

1D -0.46%

5D -1.91%

Buy Vol. 9,433,448

Sell Vol. 12,150,354

34,000

1D 5.59%

5D 23.41%

Buy Vol. 20,764,608

Sell Vol. 19,104,441

32,750

1D 0.92%

5D 10.46%

Buy Vol. 69,149,071

Sell Vol. 106,024,790

27,250

1D -0.91%

5D 5.01%

Buy Vol. 64,258,003

Sell Vol. 89,075,715

SSI: Japan’s Daiwa Securities Group successfully exercised its rights to purchase 63.4 million shares of SSI Securities Corporation, raising its ownership stake to 15.265%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.