Morning Brief 23/03/2021

GLOBAL MARKET

32,731.20

1D 0.32%

YTD 7.63%

3,940.59

1D 0.70%

YTD 5.59%

13,377.54

1D 1.23%

YTD 3.94%

18.88

1D -9.88%

6,726.10

1D 0.26%

YTD 2.60%

14,657.21

1D 0.25%

YTD 6.84%

5,968.48

1D -0.49%

YTD 6.59%

61.75

1D 1.71%

YTD 27.85%

1,732.45

1D 0.04%

YTD -8.99%

- At the end of March 22nd, US stocks soared when technology stocks flourished, in the context that investors returned to growth stocks because bond yields fell. The Nasdaq Composite rose 1.2 percent to 13,377.54 points, as the yield on a 10-year Treasury note fell. The S&P 500 rose 0.7% to 3,940.59 points, ending two consecutive declining sessions. The Dow Jones industrial average rose 103.23 points, or 0.3%, to 32,731.20 points.

VIETNAM ECONOMY

0.26%

1D (bps) -1

YTD (bps) 13

5.80%

1.34%

1D (bps) 6

YTD (bps) 12

2.17%

1D (bps) -20

YTD (bps) 14

23,175

1D (%) 0.01%

YTD (%) -0.01%

28,248

1D (%) 0.46%

YTD (%) -2.94%

3,616

1D (%) 0.03%

YTD (%) 1.20%

- The banking industry's credit growth target for this year is about 12%. In the first quarter, credit is estimated to increase by 1 - 1.5% compared to the end of last year. In fact, in the week from March 8 to 15, 2021, many banks reduced deposit rates, from 0.1 to 0.2 percentage points, 1 year term fluctuated around 6% / year.

VIETNAM STOCK MARKET

1,194.43

1D 0.03%

YTD 8.63%

1,198.54

1D -0.40%

YTD 13.24%

274.84

1D -1.03%

YTD 39.44%

81.28

1D -0.25%

YTD 10.09%

-454.50

19,409.02

1D -8.06%

YTD 13.15%

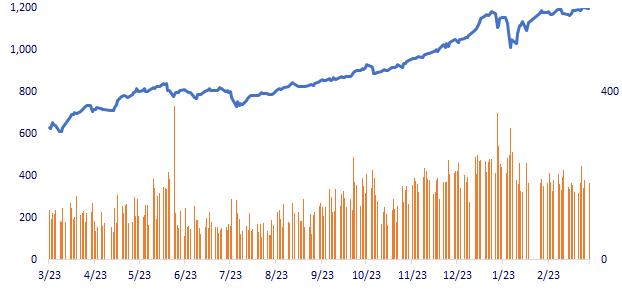

- Although VN-Index still gained yesterday, the slight increase did not help the index regain 1,200 points. The main reason for this was due to the group of banking stocks racing to adjust down, making efforts to increase prices in other stocks was not enough to create a spectacular rally for the market.

INTRADAY

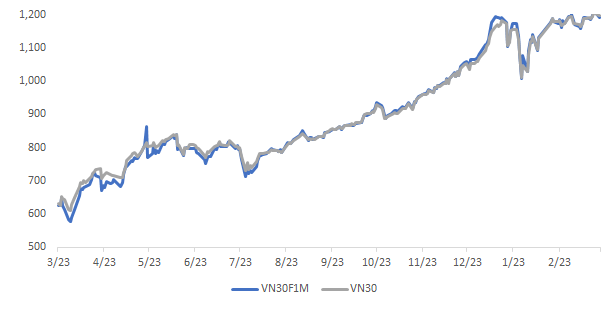

VN30 (12M)

SELECTED NEWS

- Credit is expected from Q2

- Logistics Vietnam: Supply and demand "out of phase" is difficult to create a vibrant market

- New generation FTA: An important milestone on the path of integration

- Diplomatic tensions between the EU and China

- USD suddenly increased sharply to the highest in 4 months

- House prices and consumer debt are too high, potentially risking negative impacts on the Korean economy

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.