Market Brief 08/04/2021

VIETNAM STOCK MARKET

1,234.89

1D -0.60%

YTD 12.31%

1,251.81

1D -0.47%

YTD 18.27%

293.75

1D 0.31%

YTD 49.04%

83.07

1D 0.62%

YTD 12.52%

16.57

1D 0.00%

YTD 0.00%

18,654.87

1D -7.72%

YTD 8.75%

- Foreigners were net sellers on HoSE on April 8, VRE was gathered strongly. On HOSE, foreign investors reduced their net selling value from 81.4% to 10.8 billion dong compared to the previous session. However, in terms of volume, they net bought 179,000 shares.

ETF & DERIVATIVES

20,900

1D -0.99%

YTD 11.17%

14,780

1D -0.07%

YTD 17.96%

15,690

1D 0.58%

YTD 17.70%

18,250

1D -0.27%

YTD 15.51%

17,170

1D -0.46%

YTD 25.79%

20,650

1D 0.19%

YTD 20.06%

16,270

1D -0.12%

YTD 16.63%

1,239

1D -0.89%

YTD 0.00%

1,241

1D -0.58%

YTD 0.00%

1,242

1D -0.74%

YTD 0.00%

1,243

1D -0.70%

YTD 0.00%

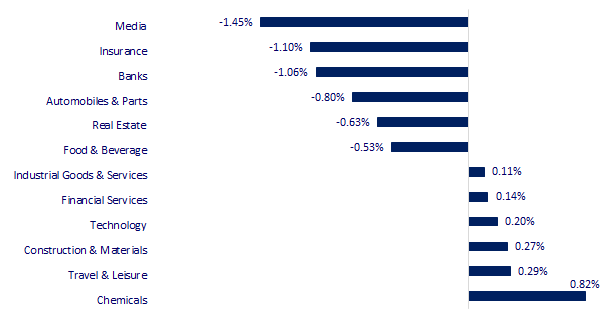

CHANGE IN PRICE BY SECTOR

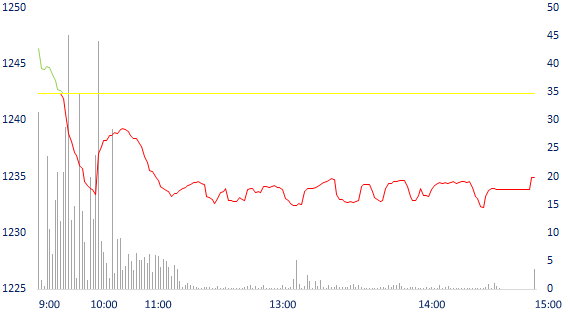

INTRADAY VNINDEX

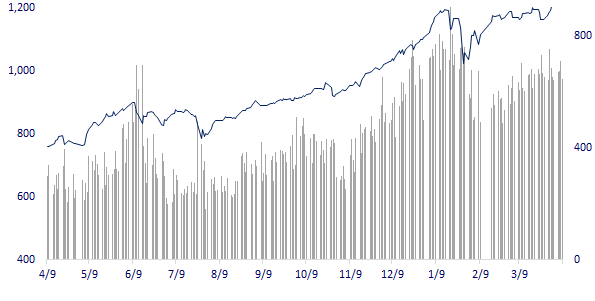

VNINDEX (12M)

GLOBAL MARKET

29,708.98

1D 0.21%

YTD 8.25%

3,482.55

1D 0.08%

YTD 1.99%

3,143.26

1D 0.19%

YTD 9.39%

29,016.37

1D 0.84%

YTD 6.89%

3,186.40

1D -0.29%

YTD 11.05%

1,558.83

1D 0.15%

YTD 7.55%

59.32

1D -0.03%

YTD 22.82%

1,746.75

1D 0.55%

YTD -8.24%

- Fed on April 7 announced the minutes of its March policy meeting, reaffirming the maintenance of a supportive monetary policy. Asian stocks mostly increased, Hong Kong market rose 0.84%. China market increased with Shanghai Composite up 0.08%, Shenzhen Component up 0.08%. In Japan, the Nikkei 225 increased by 0.21%. South Korea's Kospi Index rose 0.19%.

VIETNAM ECONOMY

0.29%

YTD (bps) 16

5.60%

YTD (bps) -20

1.37%

1D (bps) -1

YTD (bps) 15

2.21%

1D (bps) -2

YTD (bps) 18

23,180

1D (%) -0.02%

YTD (%) 0.01%

28,097

1D (%) 0.00%

YTD (%) -3.46%

3,594

1D (%) -0.11%

YTD (%) 0.59%

- Despite trying to boost credit, at the end of Q1 showed that the total credit balance in Hanoi was only 2.22 million billion dong. That means only 0.1% increase over the previous month and 0.7% compared to the end of 2020. Meanwhile, the overall credit growth rate of the whole economy in the first quarter of the year reached 2.04%. . Thus, credit growth in Hanoi is much slower than the overall credit growth rate of the whole country.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit growth in Hanoi increased by 0.7% in the first quarter

- Many ministries are concerned about real benefits when the petroleum market is open to foreign investors

- Banks forecasts credit growth around 15% in 2021 and 2022

- The IMF warned against tightening monetary policy anytime soon

- High demand and supply shortage push steel prices skyrocket globally

- The US President decided to increase corporate tax to 28% to have money for infrastructure investment

VN30

BANK

100,000

1D -1.86%

5D 3.20%

Buy Vol. 2,173,200

Sell Vol. 3,221,300

44,800

1D -1.65%

5D 1.93%

Buy Vol. 6,334,400

Sell Vol. 8,122,000

42,600

1D -0.93%

5D 3.78%

Buy Vol. 19,091,100

Sell Vol. 24,354,900

41,950

1D -0.59%

5D 2.32%

Buy Vol. 12,833,500

Sell Vol. 18,258,500

46,700

1D 0.43%

5D 1.74%

Buy Vol. 7,341,900

Sell Vol. 9,430,900

31,200

1D -1.89%

5D 6.85%

Buy Vol. 39,309,100

Sell Vol. 53,758,800

28,050

1D 1.08%

5D 4.66%

Buy Vol. 10,098,200

Sell Vol. 15,525,700

28,900

1D 0.35%

5D 3.21%

Buy Vol. 7,424,700

Sell Vol. 10,869,400

22,200

1D -0.45%

5D 2.78%

Buy Vol. 60,287,000

Sell Vol. 58,025,400

- TPB: Proposed a plan to grow 25% of profit before tax compared to 2020; retain all undistributed profits for business expansion. - STB: Kienlongbank has finished selling 176 million shares of STB

REAL ESTATE

88,800

1D 0.79%

5D 8.56%

Buy Vol. 3,783,100

Sell Vol. 4,556,000

26,000

1D -1.52%

5D 7.22%

Buy Vol. 11,562,100

Sell Vol. 20,749,800

31,400

1D 1.78%

5D 1.29%

Buy Vol. 6,482,700

Sell Vol. 5,776,800

68,700

1D 0.00%

5D 8.70%

Buy Vol. 3,449,200

Sell Vol. 3,457,500

- PDR: On April 14, 2021, officially traded more than 36.6 million additional listed shares due to dividend payment to existing shareholders.

OIL & GAS

89,000

1D -0.11%

5D -1.77%

Buy Vol. 901,800

Sell Vol. 1,797,300

13,800

1D -1.08%

5D 1.10%

Buy Vol. 24,092,700

Sell Vol. 46,102,000

55,900

1D 0.18%

5D -0.71%

Buy Vol. 1,525,800

Sell Vol. 2,104,500

- POW: After the audit, POW's consolidated profit after tax in 2020 reached VND 2,663 billion, an increase of more than VND 169 billion compared to the self-contained report.

VINGROUP

125,400

1D -1.80%

5D 1.95%

Buy Vol. 1,902,300

Sell Vol. 2,789,700

99,700

1D -0.80%

5D 0.71%

Buy Vol. 2,312,900

Sell Vol. 3,317,100

35,300

1D -0.28%

5D 4.28%

Buy Vol. 8,720,500

Sell Vol. 15,512,500

- VRE: Topped the list of stocks that were net bought by foreign investors today with a value of 72 billion dong.

FOOD & BEVERAGE

99,900

1D -0.20%

5D -1.09%

Buy Vol. 5,698,500

Sell Vol. 6,089,400

93,000

1D -0.85%

5D 0.76%

Buy Vol. 1,576,600

Sell Vol. 2,811,500

22,650

1D -0.22%

5D -1.09%

Buy Vol. 3,192,300

Sell Vol. 6,436,400

- VNM: Ms. Nguyen Thi Tham has just resigned from the Board of Directors of Vinamilk

OTHERS

133,000

1D 0.00%

5D 0.38%

Buy Vol. 634,100

Sell Vol. 1,105,400

133,000

1D 0.00%

5D 0.38%

Buy Vol. 634,100

Sell Vol. 1,105,400

79,600

1D 0.00%

5D -0.13%

Buy Vol. 2,403,300

Sell Vol. 4,025,200

134,000

1D -0.37%

5D -0.22%

Buy Vol. 863,700

Sell Vol. 823,000

88,500

1D 0.00%

5D 3.51%

Buy Vol. 753,800

Sell Vol. 776,100

52,800

1D -0.94%

5D -2.04%

Buy Vol. 634,600

Sell Vol. 1,142,700

35,200

1D -0.42%

5D 3.68%

Buy Vol. 17,936,000

Sell Vol. 25,900,200

49,350

1D -0.20%

5D 1.75%

Buy Vol. 21,338,700

Sell Vol. 20,493,200

- SSI: Listed nearly 46.9 million additional shares from April 9, 2021 due to the issuance of shares to convert bonds. - PNJ: Will submit to the AGM on private placement to increase charter capital in 2021 in the next meeting. - FPT: FPT sets a plan for 2021 to reach 6,210b dong of pre-tax profit, an increase of 18% compared to the implementation in 2020. It is expected that first quarter revenue will reach 7,500b dong and profit of 1,400 billion dong.

Market by numbers

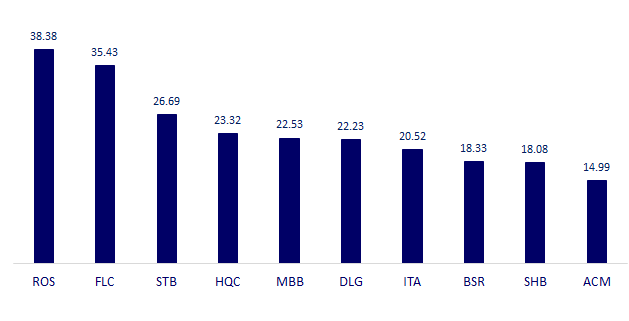

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

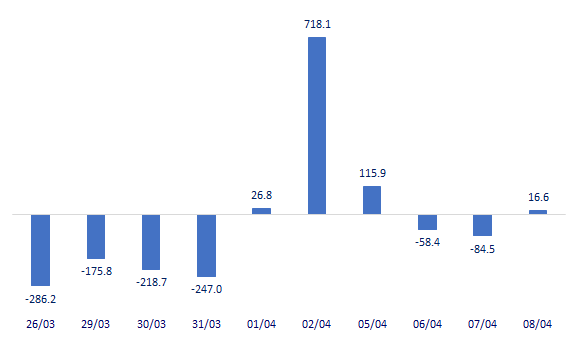

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

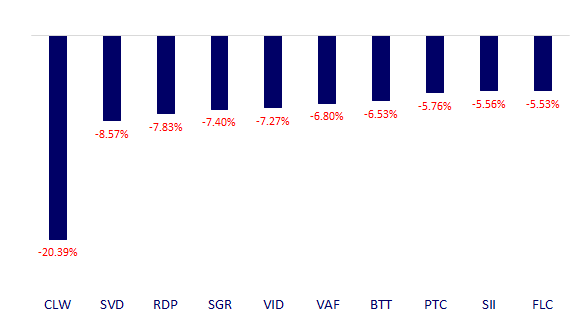

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.