Market Brief 15/04/2021

VIETNAM STOCK MARKET

1,247.25

1D -0.69%

YTD 13.44%

1,284.20

1D -0.51%

YTD 21.34%

296.12

1D 0.44%

YTD 50.24%

82.70

1D -0.84%

YTD 12.01%

-842.18

1D 0.00%

YTD 0.00%

24,694.62

1D 7.82%

YTD 43.97%

- Foreign investors continued to be net sellers on all 3 exchanges with a total value of 842 billion VND, the selling focused mainly on VHM (-298.1 billion VND), E1VFVN30 (-111.7 billion VND), GAS (-74, 4 billion) …

ETF & DERIVATIVES

21,590

1D 2.27%

YTD 14.84%

14,980

1D -0.33%

YTD 19.55%

16,100

1D 0.63%

YTD 20.78%

18,700

1D -1.06%

YTD 18.35%

17,160

1D -1.38%

YTD 25.71%

21,100

1D 0.48%

YTD 22.67%

16,700

1D 1.21%

YTD 19.71%

1,282

1D -0.37%

YTD 0.00%

1,281

1D 1.58%

YTD 0.00%

1,280

1D -0.77%

YTD 0.00%

1,284

1D -0.63%

YTD 0.00%

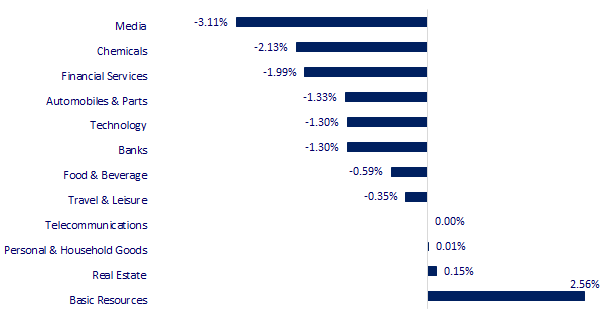

CHANGE IN PRICE BY SECTOR

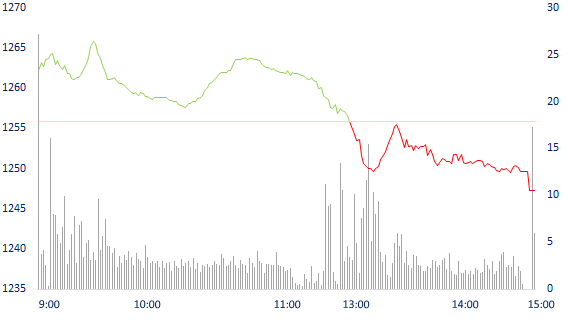

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,642.69

1D -0.11%

YTD 8.01%

3,398.99

1D -0.52%

YTD -0.45%

3,194.33

1D 0.38%

YTD 11.17%

28,765.00

1D -0.39%

YTD 5.96%

3,184.77

1D 0.17%

YTD 11.00%

1,541.12

1D 0.00%

YTD 6.33%

62.72

1D -0.24%

YTD 29.86%

1,747.50

1D 0.75%

YTD -8.20%

- Asian stocks are mixed after Wall Street left the top. In Japan, the Nikkei 225 decreased by 0.11%. The Chinese market dropped from the beginning with the Shanghai Composite down 0.52% and the Shenzhen Component down 0.42%. Hong Kong's Hang Seng decreased by 0.39%. The South Korea's Kospi increased by 0.38%.

VIETNAM ECONOMY

0.41%

1D (bps) -2

YTD (bps) 28

5.60%

YTD (bps) -20

1.36%

1D (bps) -4

YTD (bps) 14

2.23%

1D (bps) -1

YTD (bps) 20

23,168

1D (%) -0.02%

YTD (%) -0.04%

28,343

1D (%) 0.00%

YTD (%) -2.61%

3,605

1D (%) 0.11%

YTD (%) 0.90%

- Textile and Apparel Association: Textile exports have orders until the end of the second quarter and the end of the year. Textile and garment export turnover in the first quarter reached $7.2b, an increase of more than 1% over the same period last year. The average production index of the textile industry increased by 5.1% over the same period in 2020 and the apparel manufacturing index increased by 1.4% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Textile and Apparel Association: Textile exports have orders until the end of the second quarter and the end of the year

- Real estate credit balance reaches VND 1.85 million

- Bancassurance boom: 40% of new premiums come from banks

- The Fed President calls cryptocurrencies a vehicle for speculation

- Europe's economic recovery is under threat

- Cambodia blockade the capital Phnom Penh

VN30

BANK

97,500

1D -1.22%

5D -2.50%

Buy Vol. 3,366,100

Sell Vol. 4,640,200

43,050

1D -2.16%

5D -3.91%

Buy Vol. 5,891,700

Sell Vol. 6,694,300

42,200

1D -1.29%

5D -0.94%

Buy Vol. 23,046,000

Sell Vol. 28,025,300

40,900

1D -2.15%

5D -2.50%

Buy Vol. 20,932,300

Sell Vol. 24,576,800

50,000

1D -0.20%

5D 7.07%

Buy Vol. 11,955,200

Sell Vol. 13,706,300

30,600

1D -2.08%

5D -1.92%

Buy Vol. 28,845,500

Sell Vol. 31,234,400

27,350

1D -1.97%

5D -2.50%

Buy Vol. 8,423,400

Sell Vol. 12,341,700

28,800

1D -2.87%

5D -0.35%

Buy Vol. 8,712,100

Sell Vol. 11,735,200

22,350

1D -2.40%

5D 0.68%

Buy Vol. 63,123,600

Sell Vol. 67,819,800

- Bancassurance boom: 40% of new premiums come from banks. The strong growth in the bancassurance distribution channel in recent years is mainly due to the increasing number of exclusive handshake deals between insurance and banks. Most recently, MSB officially expanded its cooperation relationship from 2013 with Prudential Vietnam to a monopoly in 15 years. Before that, ACB also shook hands with Sunlife, Manulife with Vietinbank, or FWD and Vietcombank.

REAL ESTATE

102,500

1D 2.40%

5D 15.43%

Buy Vol. 8,759,700

Sell Vol. 6,781,200

23,950

1D -2.24%

5D -7.88%

Buy Vol. 10,720,100

Sell Vol. 18,033,700

31,100

1D -1.89%

5D -0.96%

Buy Vol. 4,195,400

Sell Vol. 5,704,600

67,600

1D 0.00%

5D -1.60%

Buy Vol. 3,941,200

Sell Vol. 3,284,800

- NVL: NVL was the focus of most net buying by foreign investors today with the value of 112.5 billion dong.

OIL & GAS

86,000

1D -0.58%

5D -3.37%

Buy Vol. 2,218,800

Sell Vol. 2,733,800

13,400

1D -2.90%

5D -2.90%

Buy Vol. 36,901,500

Sell Vol. 47,705,100

54,400

1D -1.45%

5D -2.68%

Buy Vol. 3,184,800

Sell Vol. 4,499,100

- GAS: lowest 5-year profit expected with total consolidated revenue in 2021 of 70,169 billion, up 9% compared to the result in 2020.

VINGROUP

140,900

1D 0.64%

5D 12.36%

Buy Vol. 4,898,300

Sell Vol. 5,242,200

101,200

1D 0.70%

5D 1.50%

Buy Vol. 12,429,600

Sell Vol. 13,751,900

34,000

1D -2.86%

5D -3.68%

Buy Vol. 8,764,200

Sell Vol. 13,514,200

- VIC: Invested in Fiscus Consultancy Pte. Ltd. was established in January 2015, in Singapore with the main business lines of consulting and financial management.

FOOD & BEVERAGE

99,100

1D -0.20%

5D -0.80%

Buy Vol. 5,497,700

Sell Vol. 8,048,700

100,000

1D -0.70%

5D 7.53%

Buy Vol. 4,513,800

Sell Vol. 5,931,300

22,000

1D -1.12%

5D -2.87%

Buy Vol. 4,670,900

Sell Vol. 5,498,700

- SBT: Want to mobilize 1,200 billion dong of bonds, the issuance time is expected to be issued in the second quarter of 2021.

OTHERS

131,700

1D -0.23%

5D -0.98%

Buy Vol. 979,700

Sell Vol. 1,478,600

131,700

1D -0.23%

5D -0.98%

Buy Vol. 979,700

Sell Vol. 1,478,600

80,000

1D -1.23%

5D 0.50%

Buy Vol. 3,265,500

Sell Vol. 3,617,200

133,700

1D -1.26%

5D -0.22%

Buy Vol. 1,524,400

Sell Vol. 2,221,100

92,000

1D 0.55%

5D 3.95%

Buy Vol. 1,350,800

Sell Vol. 1,285,300

51,700

1D -2.27%

5D -2.08%

Buy Vol. 930,000

Sell Vol. 1,070,000

34,850

1D -3.06%

5D -0.99%

Buy Vol. 30,216,400

Sell Vol. 39,364,700

54,500

1D 2.83%

5D 10.44%

Buy Vol. 57,166,500

Sell Vol. 54,309,700

- REE: In 2021 business plan, REE targets the electricity segment to contribute 23% of revenue and 37% of profit after tax, up 37% and down 3.6% year-on-year, respectively.

Market by numbers

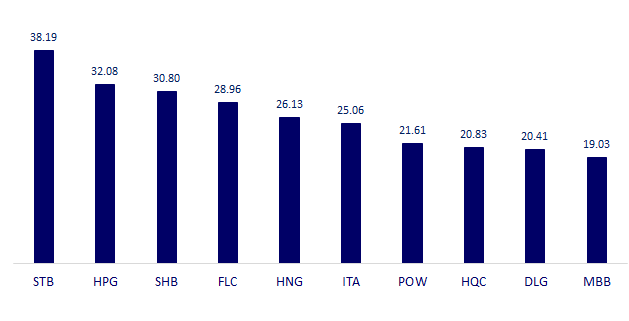

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

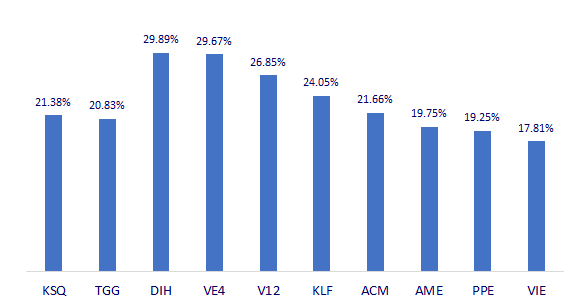

TOP INCREASES 3 CONSECUTIVE SESSIONS

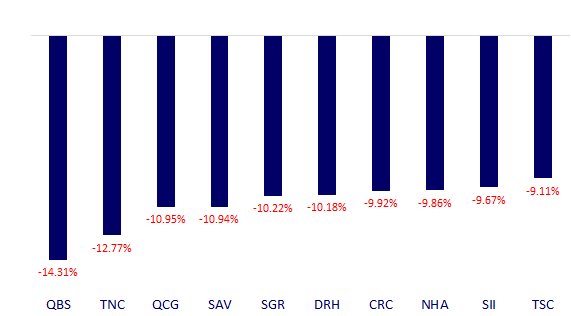

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.