Market Brief 19/04/2021

VIETNAM STOCK MARKET

1,260.58

1D 1.77%

YTD 14.65%

1,306.22

1D 2.30%

YTD 23.42%

295.75

1D 0.90%

YTD 50.05%

81.99

1D 0.24%

YTD 11.05%

-756.49

1D 0.00%

YTD 0.00%

23,052.71

1D -13.66%

YTD 34.39%

- Foreigners were net sellers on all 3 exchanges with a total value of 756 billion dong. The selling focused on Bluechips such as VNM (-262.8 billion), VHM (-145.03 billion dong), MBB (-85.5 billion dong) …

ETF & DERIVATIVES

21,980

1D 2.23%

YTD 16.91%

14,930

1D -2.10%

YTD 19.15%

16,220

1D 1.69%

YTD 21.68%

19,000

1D 2.15%

YTD 20.25%

17,150

1D 2.08%

YTD 25.64%

21,000

1D 0.10%

YTD 22.09%

16,560

1D 0.00%

YTD 18.71%

1,309

1D 2.68%

YTD 0.00%

1,310

1D 2.33%

YTD 0.00%

1,317

1D 3.41%

YTD 0.00%

1,312

1D 2.19%

YTD 0.00%

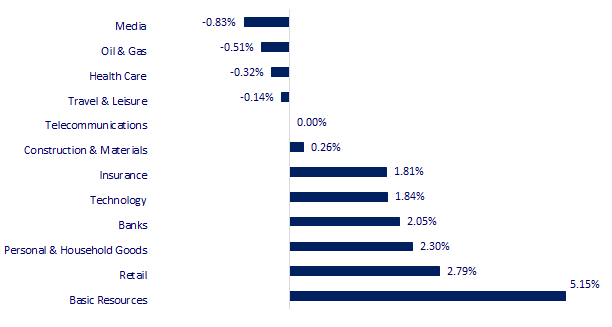

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,685.37

1D 0.11%

YTD 8.17%

3,477.55

1D 1.49%

YTD 1.85%

3,198.84

1D 0.01%

YTD 11.32%

29,117.00

1D 0.84%

YTD 7.26%

3,209.72

1D 0.25%

YTD 11.87%

1,574.91

1D 1.68%

YTD 8.66%

63.12

1D -0.11%

YTD 30.68%

1,785.85

1D 0.52%

YTD -6.19%

- Asian stocks rallied, Ant Group refused to let Jack Ma leave. The Chinese market reversed and went up with the Shanghai Composite up 1.49% and the Shenzhen Component up 2.8%. Hong Kong's Hang Seng increased by 0.84%. In Japan, the Nikkei 225 increased by 0.11%. Korean market with Kospi increased 0.01%.

VIETNAM ECONOMY

0.43%

1D (bps) 2

YTD (bps) 30

5.60%

YTD (bps) -20

1.34%

1D (bps) -5

YTD (bps) 12

2.18%

1D (bps) -5

YTD (bps) 15

23,178

1D (%) 0.03%

YTD (%) 0.00%

28,483

1D (%) 0.66%

YTD (%) -2.13%

3,616

1D (%) 0.22%

YTD (%) 1.20%

- The Ministry of Foreign Affairs has officially spoken about the US Department of Finance announced the report "Macroeconomic policies and foreign exchange of major trading partners of the US" on April 16, in which Vietnam is no longer attached. The label is the currency manipulator.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Dong Nai will pay an additional 1,200 billion in compensation for Long Thanh airport

- Governor: Credit balance/GDP is over 140%, controlling loans to real estate and securities

- The US took Vietnam out of the list of currency manipulation

- Asia is moving from 'factories' to 'creative industrial hubs' of the world

- The world still needs hundreds of billions of barrels of crude oil by 2050

- China turned on the green light for commercial banks to collect hundreds of tons of gold

VN30

BANK

98,500

1D 2.28%

5D -0.40%

Buy Vol. 2,178,500

Sell Vol. 2,167,700

43,000

1D 2.38%

5D -3.91%

Buy Vol. 6,633,100

Sell Vol. 4,925,300

42,500

1D 1.19%

5D -1.62%

Buy Vol. 27,311,700

Sell Vol. 27,649,200

41,600

1D 2.84%

5D -1.30%

Buy Vol. 19,209,600

Sell Vol. 19,091,600

49,550

1D 1.23%

5D 1.12%

Buy Vol. 10,514,200

Sell Vol. 8,716,000

30,500

1D 0.99%

5D -3.63%

Buy Vol. 26,980,400

Sell Vol. 22,740,000

27,300

1D 2.44%

5D -2.15%

Buy Vol. 6,458,900

Sell Vol. 7,628,700

28,300

1D 2.17%

5D -2.92%

Buy Vol. 7,625,100

Sell Vol. 7,714,500

22,900

1D 3.62%

5D -2.35%

Buy Vol. 58,524,500

Sell Vol. 50,081,000

- CTG: In annual shareholder meeting 2021, credit balance growth plan of 6-12%, capital mobilized from economic organizations and residents in accordance with expected capital use of 8-12%. Individual profit in 2020 is expected to be 16,800 billion dong.

REAL ESTATE

109,000

1D 0.93%

5D 14.38%

Buy Vol. 5,932,300

Sell Vol. 6,155,800

23,350

1D 1.74%

5D -9.85%

Buy Vol. 13,071,500

Sell Vol. 12,750,500

33,100

1D 5.41%

5D 3.12%

Buy Vol. 11,639,200

Sell Vol. 10,760,900

75,900

1D 6.90%

5D 11.13%

Buy Vol. 8,232,500

Sell Vol. 5,591,700

- TCH: The resolution approves the sale of all 9,722,540 treasury shares via order matching or agreement method.

OIL & GAS

87,200

1D 1.40%

5D -0.80%

Buy Vol. 1,040,600

Sell Vol. 1,282,700

13,100

1D -0.76%

5D -8.07%

Buy Vol. 23,809,400

Sell Vol. 24,837,100

52,500

1D -0.57%

5D -6.08%

Buy Vol. 2,469,400

Sell Vol. 2,255,400

- PLX: In 2021, PLX plans to have a flat profit before tax with nearly 190 billion dong. BLĐ continues to forecasts that the asphalt segment will grow strongly in 2022 and 2023.

VINGROUP

144,000

1D 0.70%

5D 9.09%

Buy Vol. 4,041,800

Sell Vol. 4,116,000

104,500

1D 3.47%

5D 2.65%

Buy Vol. 13,687,100

Sell Vol. 13,425,000

33,950

1D 0.00%

5D -3.82%

Buy Vol. 8,223,100

Sell Vol. 7,504,100

- VIC: Vingroup issued 500 million USD of international bonds, option to receive VHM shares at 123,000 VND/share.

FOOD & BEVERAGE

96,100

1D -0.83%

5D -3.90%

Buy Vol. 11,004,400

Sell Vol. 9,115,500

107,100

1D 6.99%

5D 16.54%

Buy Vol. 10,455,100

Sell Vol. 8,025,000

21,600

1D -1.82%

5D -4.00%

Buy Vol. 3,881,300

Sell Vol. 5,732,100

- VNM: VNM was the focus of net selling of foreign investors today with the value of nearly 263 billion dong.

OTHERS

129,200

1D 0.16%

5D -1.97%

Buy Vol. 748,800

Sell Vol. 1,225,800

129,200

1D 0.16%

5D -1.97%

Buy Vol. 748,800

Sell Vol. 1,225,800

81,500

1D 2.26%

5D -0.73%

Buy Vol. 3,809,500

Sell Vol. 4,136,200

137,400

1D 2.54%

5D 1.85%

Buy Vol. 2,004,100

Sell Vol. 1,885,900

94,000

1D 3.41%

5D 2.40%

Buy Vol. 1,954,200

Sell Vol. 2,317,200

52,700

1D 3.33%

5D -1.68%

Buy Vol. 1,028,600

Sell Vol. 830,600

34,800

1D 2.35%

5D -4.66%

Buy Vol. 20,341,600

Sell Vol. 19,626,900

57,800

1D 5.86%

5D 12.89%

Buy Vol. 63,216,400

Sell Vol. 53,050,700

- PNJ: Total revenue in the first quarter was about VND 7,217 billion, up 43% over the same period in 2020 and up 30% over the same period in 2019. The company plans to achieve net revenue in 2021 to reach 21,006 billion, up 20%; profit after tax is 1,230 billion dong, up by 15%. Thus, after the first quarter of the year, PNJ has implemented 34% of the revenue plan and 43% of the profit after tax plan.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.