Market Brief 17/05/2021

VIETNAM STOCK MARKET

1,258.70

1D -0.60%

YTD 14.48%

1,371.36

1D -0.63%

YTD 29.57%

296.79

1D 0.70%

YTD 50.58%

80.42

1D -0.72%

YTD 8.93%

-1,291.21

1D 0.00%

YTD 0.00%

27,797.96

1D 5.98%

YTD 62.06%

- Foreign investors' trade was also not really positive as they continued to be a strong net selling with a total value of 1,291 billion dong. Foreign investors' selling focused on Bluechips such as VPB (-243 billion dong), VIC (-148 billion dong), VNM (-146 billion dong), HPG (-125 billion dong)...

ETF & DERIVATIVES

23,000

1D 0.00%

YTD 22.34%

16,310

1D -0.18%

YTD 30.17%

17,220

1D 0.12%

YTD 29.18%

19,900

1D 0.76%

YTD 25.95%

19,600

1D -0.25%

YTD 43.59%

22,750

1D -0.35%

YTD 32.27%

17,330

1D -0.29%

YTD 24.23%

1,356

1D -0.86%

YTD 0.00%

1,356

1D -0.52%

YTD 0.00%

1,360

1D -0.64%

YTD 0.00%

1,367

1D -0.51%

YTD 0.00%

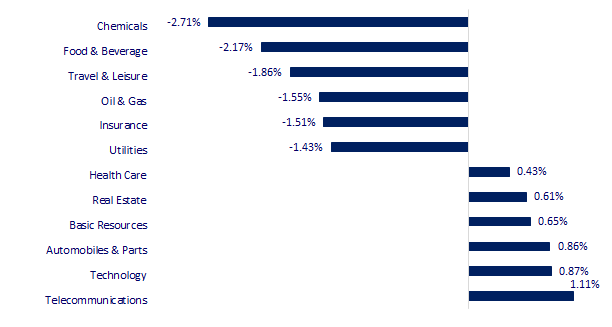

CHANGE IN PRICE BY SECTOR

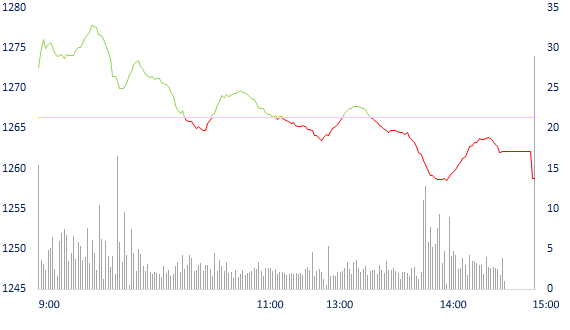

INTRADAY VNINDEX

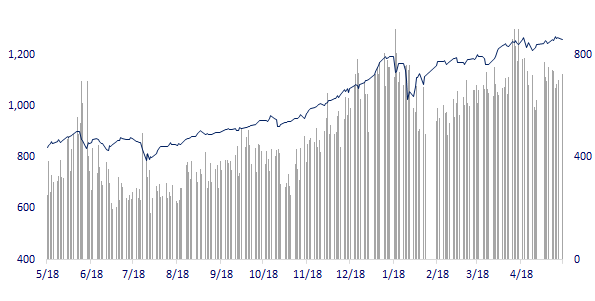

VNINDEX (12M)

GLOBAL MARKET

27,824.83

1D -0.65%

YTD 1.39%

3,517.62

1D 0.78%

YTD 3.02%

3,134.52

1D -0.60%

YTD 9.08%

28,143.00

1D -0.33%

YTD 3.67%

3,079.69

1D 0.81%

YTD 7.34%

1,549.16

1D -0.02%

YTD 6.89%

65.38

1D -0.32%

YTD 35.36%

1,849.55

1D -0.16%

YTD -2.84%

- Asian stocks mixed, investors keep an eye on China economic data. In Japan, the Nikkei 225 fell 0.65%. The Chinese market rose with the Shanghai Composite up 0.78% and the Shenzhen Component up 1.744%. Hong Kong's Hang Seng fell 0.33%. South Korea's Kospi index fell 0.6 percent.

VIETNAM ECONOMY

1.22%

1D (bps) -2

YTD (bps) 109

5.60%

YTD (bps) -20

1.32%

1D (bps) -11

YTD (bps) 10

2.12%

1D (bps) -18

YTD (bps) 9

23,138

1D (%) -0.03%

YTD (%) -0.17%

28,830

1D (%) 0.21%

YTD (%) -0.94%

3,647

1D (%) -0.08%

YTD (%) 2.07%

- According to a report of the Ministry of Industry and Trade, the production of some key industrial products in the first 4 months of 2021 increased sharply compared to the same period last year, in which, rolled steel products increased by 61.8%; iron and crude steel also increased by 17.4%. Regarding import and export, iron and steel is also in the group of goods with an export turnover of over 1 billion USD in the first 4 months of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Tighten management, prevent tax loss with rental activities

- Iron and steel exports increased sharply

- UK Export Minister: Few markets in the world offer greater potential than Vietnam

- Gold is forecasted to continue to increase in price next week

- China's economic recovery shows signs of slowing down

- Supply cannot keep up with demand when the US economy recovers

VN30

BANK

96,000

1D -0.93%

5D -2.14%

Buy Vol. 2,738,200

Sell Vol. 2,913,200

41,800

1D -1.30%

5D 0.97%

Buy Vol. 4,411,700

Sell Vol. 6,935,200

46,750

1D -0.53%

5D 4.35%

Buy Vol. 34,453,600

Sell Vol. 32,121,100

47,850

1D -1.64%

5D -0.52%

Buy Vol. 29,287,200

Sell Vol. 29,522,400

65,800

1D -1.20%

5D 5.62%

Buy Vol. 59,600,700

Sell Vol. 45,856,700

32,900

1D -0.30%

5D -0.90%

Buy Vol. 30,387,400

Sell Vol. 36,849,800

31,150

1D -0.16%

5D 1.14%

Buy Vol. 15,986,900

Sell Vol. 16,959,600

32,600

1D 2.03%

5D 4.82%

Buy Vol. 12,217,400

Sell Vol. 15,799,500

25,950

1D -1.70%

5D 6.79%

Buy Vol. 70,192,700

Sell Vol. 70,590,800

-According to the financial statements of Q1.2021 of 27 banks, the total assets of the surveyed banks reached more than 10 million billion dong, up 1.36% compared to the end of last year. In which, BIDV is the bank with the largest total assets with nearly VND 1.56 million billion, up 2.8% after the first three months of the year. VietinBank is next with assets of more than 1.34 million billion dong, a slight increase of 0.2%. Vietcombank ranked third with total assets of nearly 1.28 million billion dong, down 3.6%

REAL ESTATE

137,600

1D 2.61%

5D 7.08%

Buy Vol. 3,091,900

Sell Vol. 2,237,700

22,900

1D 1.78%

5D 4.81%

Buy Vol. 10,841,600

Sell Vol. 13,825,400

36,500

1D -2.01%

5D 0.14%

Buy Vol. 6,187,800

Sell Vol. 6,821,100

70,200

1D -2.50%

5D 0.43%

Buy Vol. 4,214,600

Sell Vol. 4,729,800

- NVL: Changed listing of 4,213,005 shares due to international bond conversion. Effective date of listing change: May 18, 2021

OIL & GAS

82,500

1D -1.90%

5D -4.07%

Buy Vol. 2,525,400

Sell Vol. 1,900,700

12,150

1D -0.82%

5D -0.41%

Buy Vol. 15,709,400

Sell Vol. 24,098,000

54,000

1D -1.46%

5D 1.31%

Buy Vol. 4,088,800

Sell Vol. 4,559,700

- The price of US WTI crude oil increased by 0.26% at 7:10 am (GMT) on May 17. While the price of Brent crude oil for July delivery fell slightly by 0.03% to $68.81/barrel.

VINGROUP

124,000

1D -1.04%

5D -6.42%

Buy Vol. 3,975,500

Sell Vol. 3,750,400

100,800

1D 3.70%

5D 1.72%

Buy Vol. 10,930,700

Sell Vol. 11,560,900

30,700

1D 0.16%

5D -3.31%

Buy Vol. 9,642,700

Sell Vol. 11,616,500

- VHM: sets a profit after tax of VND35,000b, paying a dividend in 2020 at the rate of 45%, including 15% in cash; and 30% by stock.

FOOD & BEVERAGE

87,200

1D -2.57%

5D -6.24%

Buy Vol. 9,588,200

Sell Vol. 8,535,100

104,200

1D -3.61%

5D 2.56%

Buy Vol. 3,381,400

Sell Vol. 4,356,100

19,600

1D -2.97%

5D 2.89%

Buy Vol. 4,419,900

Sell Vol. 4,189,100

- VNM: F&N Dairy Investment Pte. Ltd continued to register to buy 20.1m VNM from May 12 to June 10. Currently, these funds own nearly 370m VNM shares before the transaction

OTHERS

114,000

1D -3.31%

5D -4.36%

Buy Vol. 750,600

Sell Vol. 730,100

114,000

1D -3.31%

5D -4.36%

Buy Vol. 750,600

Sell Vol. 730,100

85,700

1D 1.06%

5D -0.12%

Buy Vol. 4,670,700

Sell Vol. 3,499,600

141,500

1D -0.70%

5D 2.46%

Buy Vol. 1,105,400

Sell Vol. 1,195,700

94,000

1D -0.21%

5D 0.43%

Buy Vol. 326,100

Sell Vol. 609,700

55,200

1D -1.43%

5D -2.65%

Buy Vol. 644,100

Sell Vol. 924,700

35,450

1D 0.42%

5D 2.16%

Buy Vol. 29,021,900

Sell Vol. 37,217,600

61,900

1D 0.81%

5D -1.75%

Buy Vol. 65,318,200

Sell Vol. 55,099,800

- HPG: All of Hoa Phat's iron and steel production complexes have brought into full play their designed capacity to serve the peak season market demand. Accumulating 4 months, Hoa Phat Group has produced more than 2.7 million tons of crude steel, up 58% over the same period in 2020.

Market by numbers

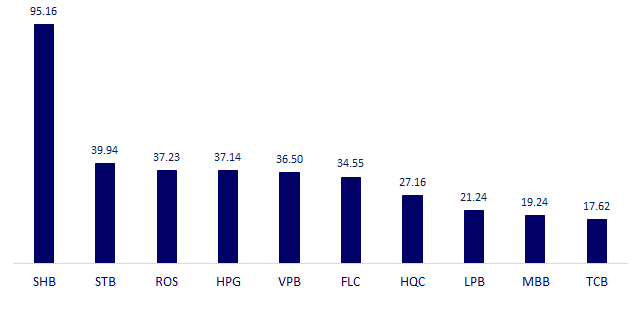

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.