Market Brief 16/06/2021

VIETNAM STOCK MARKET

1,356.52

1D -0.79%

YTD 23.38%

1,465.58

1D -1.44%

YTD 38.47%

313.65

1D -1.46%

YTD 59.13%

88.82

1D -0.06%

YTD 20.30%

-94.06

1D 0.00%

YTD 0.00%

29,991.54

1D -7.12%

YTD 74.85%

- Foreign investors returned to a net selling of more than 94 billion dong, 3 exchanges dropped points in the session of June 16. Foreign investors' selling focused on MBB (-172.4 billion dong), KDC (-150 billion dong), SSI (-115 billion dong)…

ETF & DERIVATIVES

24,780

1D -1.08%

YTD 31.81%

17,300

1D -0.57%

YTD 38.07%

21,300

1D -1.16%

YTD 34.81%

22,380

1D -0.18%

YTD 63.96%

24,670

1D -2.10%

YTD 43.43%

18,570

1D -1.17%

YTD 33.12%

1,463

1D -0.87%

YTD 0.00%

1,484

1D 0.54%

YTD 0.00%

1,470

1D -0.93%

YTD 0.00%

1,469

1D -1.00%

YTD 0.00%

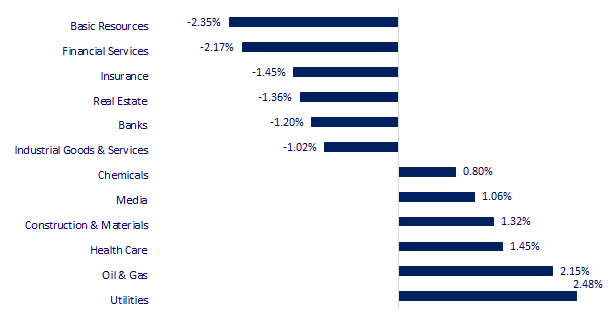

CHANGE IN PRICE BY SECTOR

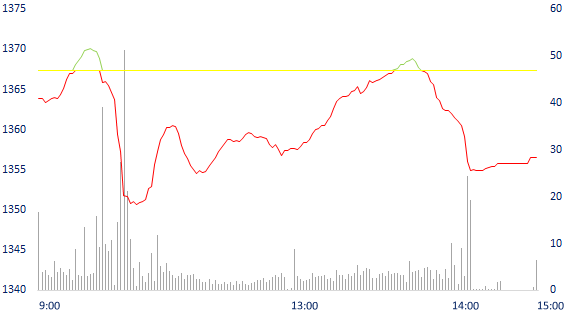

INTRADAY VNINDEX

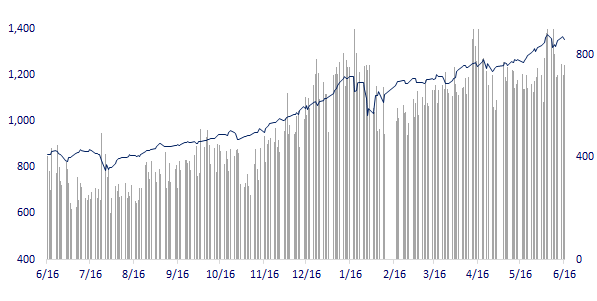

VNINDEX (12M)

GLOBAL MARKET

29,291.01

1D -0.21%

YTD 6.73%

3,518.33

1D -1.07%

YTD 3.04%

3,278.68

1D 0.62%

YTD 14.10%

28,451.87

1D -0.23%

YTD 4.81%

3,153.47

1D 0.00%

YTD 9.91%

1,624.79

1D 0.15%

YTD 12.10%

72.28

1D -0.48%

YTD 49.65%

1,857.35

1D 0.11%

YTD -2.43%

- Japan exports fall short of expectations, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.21%. The Chinese market fell the most in the region with the Shanghai Composite down 1.07%. Hong Kong's Hang Seng fell 0.23%. South Korea's Kospi index rose 0.62%.

VIETNAM ECONOMY

0.98%

1D (bps) 2

YTD (bps) 85

5.60%

YTD (bps) -20

1.29%

1D (bps) 11

YTD (bps) 7

2.06%

1D (bps) -11

YTD (bps) 3

23,045

1D (%) -0.02%

YTD (%) -0.57%

28,622

1D (%) -0.01%

YTD (%) -1.65%

3,657

1D (%) 0.11%

YTD (%) 2.35%

- Vietnam exports 2.5 million tons of fresh fruit to China. According to the Ministry of Agriculture and Rural Development of Vietnam, the top 9 fruits exported through official channels to China is dragon fruit with 1.2 million tons, up 138% over the same period; followed by mango and watermelon. Accordingly, mango reached 468,000 tons, up 156.8 percent; watermelon reached over 290,000 tons, up 131.8%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam exports 2.5 million tons of fresh fruit to China

- Super project of 36 trillion VND highway connecting Ho Chi Minh City - Thu Dau Mot - Chon Thanh

- Domestic meat prices are low, farmers start to lose

- The price of wood in the US plunged more than 40% from the peak, companies from hoarding to selling strongly

- China launched more measures to control commodity prices

- USD in the world market is the highest in 1 month, Asian money drops sharply

VN30

BANK

104,000

1D 1.17%

5D 1.96%

Buy Vol. 3,976,400

Sell Vol. 4,742,600

45,300

1D 0.89%

5D -0.33%

Buy Vol. 6,761,400

Sell Vol. 7,818,800

50,500

1D -3.07%

5D 0.00%

Buy Vol. 29,432,200

Sell Vol. 30,617,900

50,700

1D -3.06%

5D -0.20%

Buy Vol. 28,689,000

Sell Vol. 32,178,700

66,800

1D 0.45%

5D -6.96%

Buy Vol. 36,317,500

Sell Vol. 36,465,200

38,700

1D -1.53%

5D 0.39%

Buy Vol. 32,250,700

Sell Vol. 33,574,800

33,800

1D -2.73%

5D 1.20%

Buy Vol. 5,799,800

Sell Vol. 7,022,800

35,600

1D -1.11%

5D -0.84%

Buy Vol. 8,901,700

Sell Vol. 9,695,000

29,200

1D -2.99%

5D -1.35%

Buy Vol. 49,060,700

Sell Vol. 53,606,900

- HDB: implementing the upgrade of Basel II standards to Basel III. Up to now, the Bank has applied 2 LCR - Liquidity Coverage Ratio and NSFR - Net Stable Fund Ratio of Basel III. Moreover, the NSFR index has reached 150%, higher than the minimum of 100%.

REAL ESTATE

103,500

1D -0.48%

5D -2.63%

Buy Vol. 1,508,900

Sell Vol. 3,080,500

22,500

1D 0.90%

5D 2.27%

Buy Vol. 12,153,500

Sell Vol. 15,986,700

36,900

1D 0.00%

5D 4.34%

Buy Vol. 3,624,600

Sell Vol. 3,313,100

92,000

1D -0.54%

5D 11.92%

Buy Vol. 6,861,500

Sell Vol. 6,752,000

- NVL: The resolution of the Board of Directors has just approved a loan of VND 1,600 billion with the main collateral being NVL shares

OIL & GAS

91,900

1D 3.61%

5D 5.15%

Buy Vol. 3,120,200

Sell Vol. 3,257,600

12,050

1D 0.00%

5D -0.41%

Buy Vol. 15,091,500

Sell Vol. 21,357,500

56,000

1D 2.19%

5D 4.09%

Buy Vol. 11,731,100

Sell Vol. 6,556,400

- GAS: GAS plans to spend VND5,700 billion to pay dividends at the rate of 30% and the payment date is October 6, 2021.

VINGROUP

119,100

1D -2.14%

5D 0.25%

Buy Vol. 1,811,600

Sell Vol. 2,397,300

110,000

1D -2.31%

5D 3.68%

Buy Vol. 5,912,900

Sell Vol. 7,365,500

32,800

1D -0.15%

5D 3.47%

Buy Vol. 7,795,400

Sell Vol. 13,197,800

- VIC: VinFast Lux SA2.0 offers 60-80 million VND on the occasion of the 2nd anniversary of the factory's inauguration and officially handing over the first cars to customers.

FOOD & BEVERAGE

91,800

1D -1.18%

5D 3.03%

Buy Vol. 4,376,100

Sell Vol. 5,877,900

104,200

1D -2.16%

5D -0.29%

Buy Vol. 1,547,300

Sell Vol. 2,052,300

21,100

1D 2.93%

5D 0.48%

Buy Vol. 7,826,400

Sell Vol. 10,015,200

- SBT may be excluded from VN30 during the 3rd quarter portfolio restructuring period due to the freefloat capitalization being less than 30 added stocks.

OTHERS

116,500

1D -0.43%

5D 1.04%

Buy Vol. 732,800

Sell Vol. 782,000

116,500

1D -0.43%

5D 1.04%

Buy Vol. 732,800

Sell Vol. 782,000

83,100

1D -0.12%

5D 1.71%

Buy Vol. 3,908,100

Sell Vol. 4,425,100

137,000

1D -0.65%

5D 0.44%

Buy Vol. 1,677,100

Sell Vol. 804,100

95,100

1D -0.94%

5D -0.73%

Buy Vol. 893,900

Sell Vol. 907,000

56,900

1D 0.00%

5D 2.52%

Buy Vol. 1,033,800

Sell Vol. 1,048,700

49,400

1D -5.00%

5D 7.82%

Buy Vol. 32,364,300

Sell Vol. 34,527,200

51,800

1D -2.63%

5D 2.98%

Buy Vol. 43,809,700

Sell Vol. 49,267,000

- VJC: just announced that it has issued 10 million bonds with a total par value of 1,000 billion dong. This is a regular, non-convertible, unsecured corporate bond with a term of 60 months and maturity on June 9, 2026.

Market by numbers

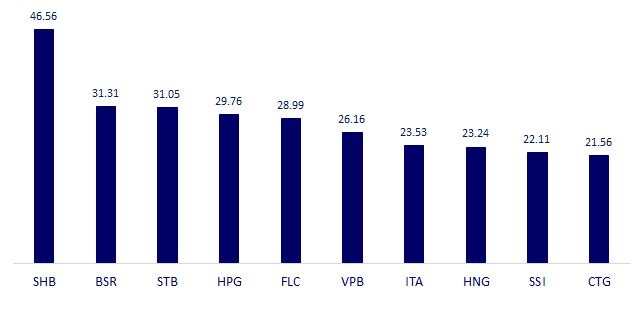

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

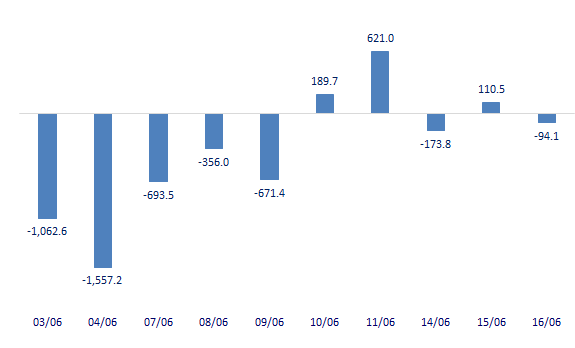

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

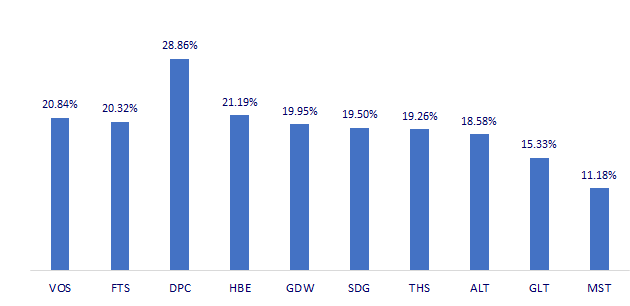

TOP INCREASES 3 CONSECUTIVE SESSIONS

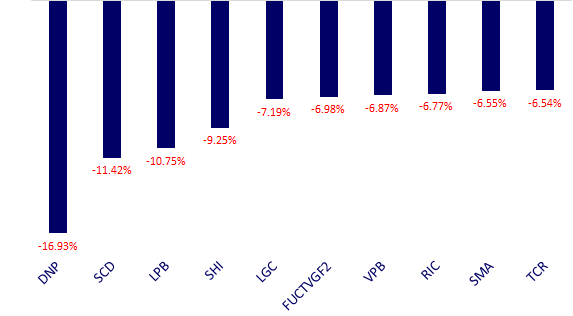

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.