Morning Brief 22/06/2021

GLOBAL MARKET

33,876.97

1D 1.76%

YTD 11.40%

4,224.79

1D 1.40%

YTD 13.20%

14,141.48

1D 0.79%

YTD 9.88%

17.89

1D -13.57%

YTD 0.00%

7,062.29

1D 0.64%

YTD 7.73%

15,603.24

1D 1.00%

YTD 13.74%

6,602.54

1D 0.51%

YTD 17.91%

73.14

1D 1.63%

YTD 51.43%

1,784.25

1D 0.75%

YTD -6.27%

- US stocks gained on Monday (June 21) as the market recovered from a deep decline due to the change in policy stance of the Fed. At the end of the session, the Dow Jones index jumped 586.89 points (1.76%) to 33,876.97 points, marking the strongest increase since May 3, 2021. The index has recovered from its worst week since October 2020. The S&P 500 index added 1.4% to 4,224.79 points, 1% away from a record high following Monday's rally. The Nasdaq Composite Index advanced just 0.8% to 14,141.48 points.

VIETNAM ECONOMY

0.99%

1D (bps) 4

YTD (bps) 86

5.60%

YTD (bps) -20

1.15%

1D (bps) -1

YTD (bps) -7

2.13%

YTD (bps) 10

23,120

28,205

3,630

- Foreign investors' trade was also not really active when they net sold more than 1,130 billion dong in the whole market. The selling focused on Blue-chips like NVL (-362 billion dong), HPG (-336 billion dong), VNM (-96 billion dong)…

VIETNAM STOCK MARKET

1,372.63

1D -0.37%

YTD 24.84%

1,478.29

1D -0.20%

YTD 39.67%

316.24

1D -0.78%

YTD 60.45%

89.71

1D -0.57%

YTD 21.51%

-1,130.96

1D 0.00%

YTD 0.00%

27,254.88

1D -5.73%

YTD 58.89%

- According to Mr. Pham Thanh Ha, Director of the Monetary Policy Department, the State Bank of Vietnam (SBV) said that the agency will keep the operating interest rates unchanged, continue to operate interest rates in line with the macroeconomic balance. scale, inflation, market movements and monetary policy objectives, creating conditions to reduce borrowing costs for people, businesses and the economy.

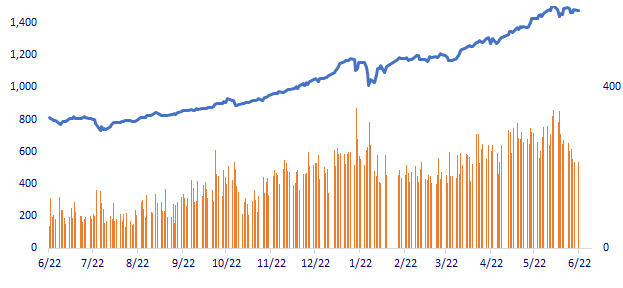

INTRADAY

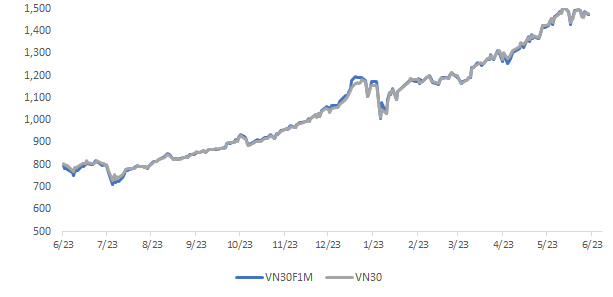

VN30 (12M)

SELECTED NEWS

- Inflation is not a concern, the SBV keeps the operating interest rates unchanged

- The business is exhausted

- Dong Nai will cancel the land use plan of 535 projects that are overdue and have not been implemented yet

- The Fed Chairman believes that inflation will gradually return to the target threshold

- China tightens control of coal market

- merican business groups urge the government to lift punitive tariffs on aluminum and steel

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.