Market Brief 22/06/2021

VIETNAM STOCK MARKET

1,379.97

1D 0.53%

YTD 25.51%

1,489.24

1D 0.74%

YTD 40.71%

317.09

1D 0.27%

YTD 60.88%

90.10

1D 0.43%

YTD 22.04%

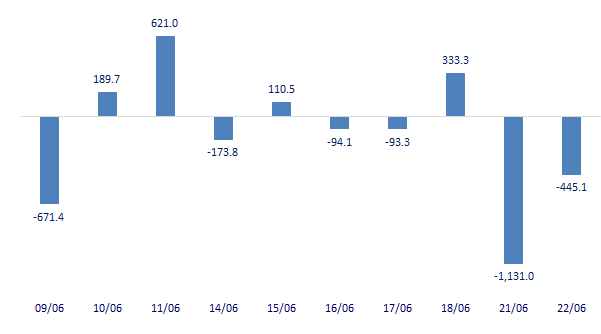

-445.05

27,962.75

1D 2.60%

YTD 63.02%

- Foreign investors bought 36.3 million shares, worth 1,978 billion dong, while selling 56 million shares, worth 2,412 billion dong. Total net selling volume was at 19.8 million shares, equivalent to a net selling value of over 445 billion dong. Particularly on HoSE, foreign investors net bought back nearly 102 billion dong, however, in terms of volume, this capital flow sold 4.7 million shares.

ETF & DERIVATIVES

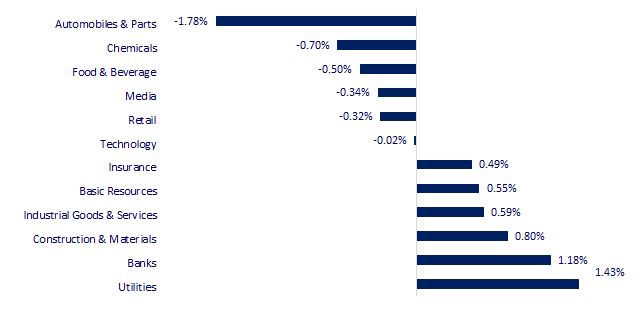

CHANGE IN PRICE BY SECTOR

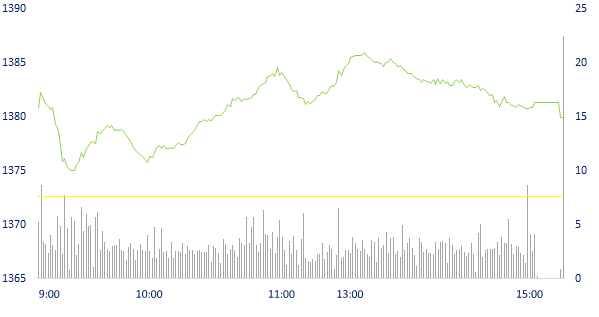

INTRADAY VNINDEX

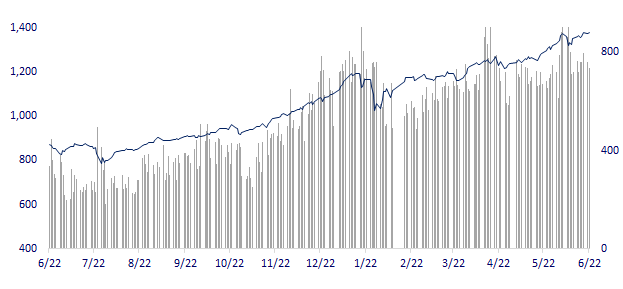

VNINDEX (12M)

GLOBAL MARKET

28,884.13

1D 0.83%

YTD 5.25%

3,557.41

1D 0.80%

YTD 4.19%

3,263.88

1D 0.71%

YTD 13.59%

28,254.37

1D -0.72%

YTD 4.08%

3,153.47

1D 0.00%

YTD 9.91%

1,599.23

1D -0.12%

YTD 10.34%

72.72

1D -0.57%

YTD 50.56%

1,785.35

1D 0.06%

YTD -6.21%

- Asian stocks mostly rose, Japanese markets recovered. In Japan, Nikkei 225 gained 0.83 after plunging more than 3% on June 21 session. Mainland China markets rose with Shanghai Composite up 0.8% and Shenzhen Component up 0.376%. Hong Kong's Hang Seng was in the opposite direction, down 0.72%. South Korea's Kospi index rose 0.71%.

VIETNAM ECONOMY

1.10%

1D (bps) 11

YTD (bps) 97

5.60%

YTD (bps) -20

1.23%

1D (bps) 8

YTD (bps) 1

2.00%

1D (bps) -13

YTD (bps) -3

23,120

1D (%) 0.00%

YTD (%) -0.25%

28,205

1D (%) 0.00%

YTD (%) -3.09%

3,630

1D (%) 0.00%

YTD (%) 1.60%

- As of June 15, credit growth of the whole economy reached 5.1% compared to the end of last year, the same period in 2020 increased by 2.26%. Total M2 payment instruments increased by 3.96% and increased by 14.27% over the same period in 2020. The deposit and lending interest rates in April 2021 decreased by 0.3%/year compared to December 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- By June 15, credit growth of the whole economy reached 5.1%

- More than 1,700 billion VND to build 3 industrial clusters in Hai Duong

- The North is short of new power projects

- Fed Chairman continues to be optimistic about inflation

- China tightly controls, the cryptocurrency market faces a lot of pressure

- WHO establishes COVID-19 vaccine production center in South Africa

VN30

BANK

107,600

1D 0.94%

5D 4.67%

Buy Vol. 2,130,600

Sell Vol. 2,318,500

45,000

1D 0.00%

5D 0.22%

Buy Vol. 4,302,500

Sell Vol. 4,739,900

51,900

1D 3.18%

5D -0.38%

Buy Vol. 39,726,500

Sell Vol. 35,212,400

50,900

1D 0.99%

5D -2.68%

Buy Vol. 27,320,600

Sell Vol. 26,365,700

66,000

1D -0.75%

5D -0.75%

Buy Vol. 22,977,800

Sell Vol. 26,727,000

42,000

1D 3.32%

5D 6.87%

Buy Vol. 69,551,300

Sell Vol. 57,390,100

34,350

1D 2.08%

5D -1.15%

Buy Vol. 8,677,100

Sell Vol. 8,346,000

35,450

1D 0.57%

5D -1.53%

Buy Vol. 5,471,600

Sell Vol. 6,472,600

30,200

1D 1.17%

5D 0.33%

Buy Vol. 44,132,900

Sell Vol. 45,842,500

- The top 10 banks with the largest income from investment and securities trading are Techcombank, MB, OCB, HDBank, SCB, MSB, TPBank, VPBank, ACB, and Vietbank. It is worth noting that in these top banks there is no presence of the "big" state-owned banks (Vietcombank, VietinBank or BIDV). This shows that, in these banks, the securities segment is not a focus area, the proportion of total income is only 1%.

REAL ESTATE

113,500

1D 4.13%

5D 9.13%

Buy Vol. 4,599,000

Sell Vol. 4,448,500

22,700

1D -0.44%

5D 1.79%

Buy Vol. 8,833,500

Sell Vol. 12,402,200

37,300

1D -0.13%

5D 1.08%

Buy Vol. 2,989,800

Sell Vol. 3,162,300

88,400

1D -2.32%

5D -4.43%

Buy Vol. 4,661,900

Sell Vol. 4,684,300

- TCH: announces registration to buy 14.8m HHS shares from 25/6 to 24/7. The transaction method is an agreement through the exchange. If the transaction is completed, TCH will increase its ownership of HHS from 125.5m shares to 140.3m shares.

OIL & GAS

94,900

1D 2.04%

5D 6.99%

Buy Vol. 1,877,000

Sell Vol. 2,278,600

12,550

1D 0.40%

5D 4.15%

Buy Vol. 23,035,900

Sell Vol. 33,768,300

58,600

1D 2.09%

5D 9.17%

Buy Vol. 10,025,100

Sell Vol. 6,876,300

- Natural gas prices continue to fall due to weak demand. Gas price today decreased by more than 0.1% to 3.19 USD/mmBTU for natural gas contract delivered in July 2021 at 9:30 am (GMT)

VINGROUP

117,500

1D 0.09%

5D -3.45%

Buy Vol. 3,284,700

Sell Vol. 3,533,900

111,500

1D -0.45%

5D -0.98%

Buy Vol. 3,848,300

Sell Vol. 4,843,700

31,500

1D -0.94%

5D -4.11%

Buy Vol. 5,137,600

Sell Vol. 7,117,100

- VRE: one of the top foreign net selling stocks in today's trading session with a value of VND 45.6 billion

FOOD & BEVERAGE

90,600

1D 0.00%

5D -2.48%

Buy Vol. 4,002,900

Sell Vol. 4,671,800

108,500

1D -0.18%

5D 1.88%

Buy Vol. 1,932,600

Sell Vol. 2,712,300

22,200

1D -0.45%

5D 8.29%

Buy Vol. 9,914,000

Sell Vol. 10,588,400

- SBT: may be excluded from the VN30 index's list because it does not meet the ranking criteria for capitalization.

OTHERS

115,000

1D 0.88%

5D -1.71%

Buy Vol. 677,700

Sell Vol. 724,900

59,900

1D 0.34%

5D -2.12%

Buy Vol. 2,242,700

Sell Vol. 3,559,600

85,400

1D -0.23%

5D 2.64%

Buy Vol. 2,505,600

Sell Vol. 3,884,900

146,000

1D 0.14%

5D 5.87%

Buy Vol. 1,241,500

Sell Vol. 1,178,300

98,500

1D 0.41%

5D 2.60%

Buy Vol. 492,200

Sell Vol. 848,600

57,600

1D -1.03%

5D 1.23%

Buy Vol. 974,200

Sell Vol. 1,172,100

49,500

1D 1.02%

5D -4.81%

Buy Vol. 13,683,400

Sell Vol. 16,975,100

51,700

1D 0.98%

5D -2.82%

Buy Vol. 31,763,900

Sell Vol. 33,362,500

- HPG: through the increase of capital in its subsidiary - Hoa Phat Steel Products Joint Stock Company from VND 3,500 billion to VND 5,500 billion. The additional capital of VND 2,000 billion will be contributed no later than July 11th. Hoa Phat's ownership rate after capital increase is 99.994%. Vice Chairman of the Board of Directors Nguyen Manh Tuan was assigned to manage Hoa Phat's capital contribution in this subsidiary.

Market by numbers

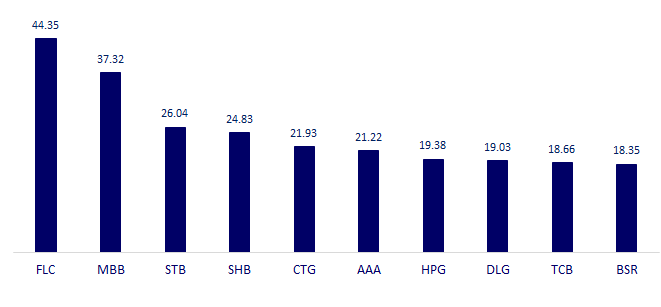

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

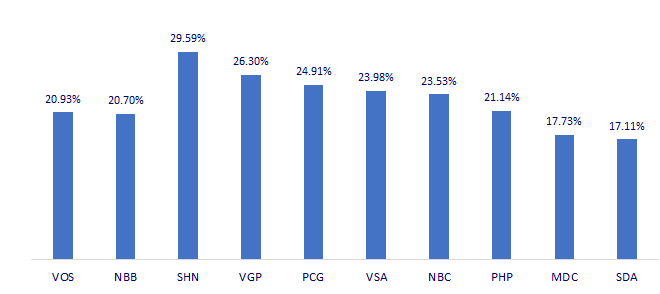

TOP INCREASES 3 CONSECUTIVE SESSIONS

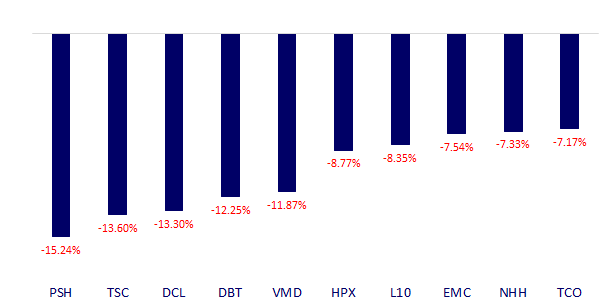

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.