Market Brief 15/07/2021

VIETNAM STOCK MARKET

1,293.92

1D 1.09%

YTD 17.68%

1,430.29

1D 1.42%

YTD 35.14%

306.30

1D 3.19%

YTD 55.40%

84.98

1D 0.50%

YTD 15.10%

735.64

1D 0.00%

YTD 0.00%

18,173.70

1D -16.64%

YTD 5.95%

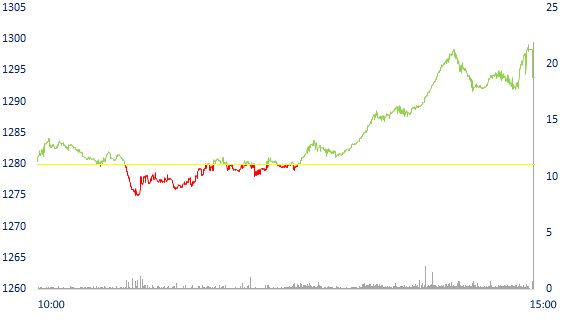

- Session 15/7, foreign investors strongly poured over 735 billion dong, VN-Index recovered after a deep drop. Foreign investors' buying power focused on Bluechips such as HPG (VND 227.3 billion), SSI (VND 150.9 billion), STB (VND 119.4 billion), VNM (VND 86 billion)...

ETF & DERIVATIVES

24,250

1D 0.58%

YTD 28.99%

16,920

1D 0.65%

YTD 35.04%

20,600

1D 0.98%

YTD 30.38%

21,170

1D 2.77%

YTD 55.09%

24,900

1D -0.32%

YTD 44.77%

17,900

1D 1.70%

YTD 28.32%

1,439

1D 2.33%

YTD 0.00%

1,440

1D -0.37%

YTD 0.00%

1,437

1D 1.71%

YTD 0.00%

1,432

1D 1.62%

YTD 0.00%

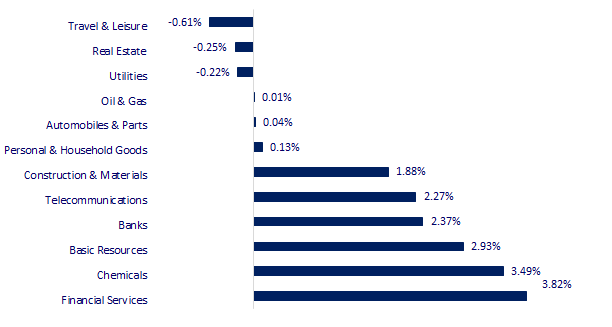

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

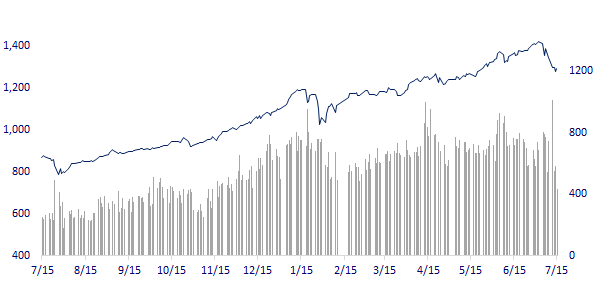

VNINDEX (12M)

GLOBAL MARKET

28,279.09

1D -0.32%

YTD 3.04%

3,564.59

1D 1.02%

YTD 4.40%

3,286.22

1D 0.66%

YTD 14.36%

27,973.37

1D 0.33%

YTD 3.04%

3,139.98

1D -0.42%

YTD 9.44%

1,572.01

1D 0.15%

YTD 8.46%

72.07

1D -0.14%

YTD 49.21%

1,827.60

1D -0.11%

YTD -3.99%

- China announced second quarter GDP, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.32%. The Chinese market rallied with the Shanghai Composite up 1.02%. Hong Kong's Hang Seng rose 0.33%. South Korea's Kospi index rose 0.66%.

VIETNAM ECONOMY

0.92%

1D (bps) -1

YTD (bps) 79

5.60%

YTD (bps) -20

1.11%

1D (bps) -20

YTD (bps) -11

2.09%

1D (bps) -1

YTD (bps) 6

23,105

1D (%) -0.02%

YTD (%) -0.31%

27,769

1D (%) -0.04%

YTD (%) -4.58%

3,632

1D (%) 0.14%

YTD (%) 1.65%

- After the land plot fever at the beginning of the year, up to now, this market has basically been controlled and gradually stabilized. However, the volume of transactions is still low. Meanwhile, the field of retail real estate, resort tourism and social housing development still face many difficulties...

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ministry of Construction: Land plots are discounted 10-20%

- The Ministry of Finance advises investors to be cautious when buying corporate bonds

- 76 business organizations urge the US not to impose tariffs on Vietnamese goods

- The Fed announced that it will continue to support until the US economy fully recovers

- Fed Chairman: Inflation may continue to escalate for the next few months before stabilizing again

- Disagreement Saudi Arabia - UAE and future OPEC +

VN30

BANK

102,500

1D 0.69%

5D -7.66%

Buy Vol. 4,226,600

Sell Vol. 2,833,300

42,700

1D 0.23%

5D -6.77%

Buy Vol. 3,451,000

Sell Vol. 4,071,400

35,000

1D 3.86%

5D -9.33%

Buy Vol. 41,258,400

Sell Vol. 25,480,300

52,100

1D 2.16%

5D -7.95%

Buy Vol. 44,263,400

Sell Vol. 35,710,100

64,000

1D 4.07%

5D -7.65%

Buy Vol. 31,802,200

Sell Vol. 26,186,600

29,300

1D 1.56%

5D -6.04%

Buy Vol. 31,098,300

Sell Vol. 25,717,200

33,200

1D 1.68%

5D -7.65%

Buy Vol. 5,179,100

Sell Vol. 4,568,200

33,700

1D 2.12%

5D -10.73%

Buy Vol. 6,344,000

Sell Vol. 4,707,200

28,800

1D 5.11%

5D -4.64%

Buy Vol. 57,634,100

Sell Vol. 35,217,000

- VPB: is expected to issue a total of nearly 1.98 billion shares to pay dividends and reward shareholders, corresponding to the right exercise rate of 80%. The total value of issuance at the maximum par value is nearly VND 19,758 billion.

REAL ESTATE

104,000

1D 0.00%

5D -6.14%

Buy Vol. 4,038,400

Sell Vol. 3,801,400

19,150

1D 0.26%

5D -9.03%

Buy Vol. 6,578,400

Sell Vol. 9,081,600

36,350

1D -1.22%

5D -1.09%

Buy Vol. 2,483,900

Sell Vol. 2,502,200

87,200

1D -0.34%

5D -7.92%

Buy Vol. 3,920,300

Sell Vol. 3,758,300

- NVL: is expected to raise capital from 1 to 2 billion USD from domestic and international sources. In particular, the company said it will focus on mid-high-end real estate with a land fund of about 5,400 hectares

OIL & GAS

90,500

1D -0.88%

5D -2.69%

Buy Vol. 1,071,000

Sell Vol. 845,200

10,700

1D 2.39%

5D -5.73%

Buy Vol. 14,138,900

Sell Vol. 10,674,100

50,900

1D 0.00%

5D -2.68%

Buy Vol. 2,190,700

Sell Vol. 1,905,500

- Oil prices fell sharply on Wednesday (July 14), after Reuters reported that Saudi Arabia and the UAE had reached a compromise to unlock the OPEC+ deal.

VINGROUP

102,000

1D -0.97%

5D -8.11%

Buy Vol. 4,463,400

Sell Vol. 3,409,300

110,300

1D 0.73%

5D -4.09%

Buy Vol. 7,252,000

Sell Vol. 6,891,900

28,000

1D -0.88%

5D -6.35%

Buy Vol. 5,834,300

Sell Vol. 6,691,100

- VIC and VRE were both among the top net sellers in today's session with a value of 59.5 and 18 billion dong, respectively.

FOOD & BEVERAGE

85,200

1D 0.24%

5D -3.62%

Buy Vol. 5,616,900

Sell Vol. 4,927,000

115,000

1D -1.03%

5D -4.01%

Buy Vol. 2,223,500

Sell Vol. 2,253,800

18,700

1D 6.86%

5D -3.11%

Buy Vol. 7,270,000

Sell Vol. 4,048,900

- SBT: Collecting shareholders' written opinions on the registration and listing of bonds issued to the public.

OTHERS

114,800

1D -1.88%

5D -4.57%

Buy Vol. 1,635,100

Sell Vol. 1,407,600

114,800

1D -1.88%

5D -4.57%

Buy Vol. 1,635,100

Sell Vol. 1,407,600

85,400

1D 0.23%

5D -4.90%

Buy Vol. 5,598,000

Sell Vol. 4,108,700

167,100

1D 0.36%

5D -3.13%

Buy Vol. 2,351,600

Sell Vol. 1,676,700

95,100

1D -0.94%

5D -9.94%

Buy Vol. 1,924,500

Sell Vol. 1,610,000

51,200

1D 0.20%

5D -3.40%

Buy Vol. 828,600

Sell Vol. 572,100

53,700

1D 5.29%

5D -1.29%

Buy Vol. 29,346,300

Sell Vol. 22,761,900

46,500

1D 3.33%

5D -5.10%

Buy Vol. 57,620,800

Sell Vol. 45,675,400

- MWG: Bach Hoa Xanh increased the price of fresh goods due to increased input costs. MWG, the owner of Bach Hoa Xanh store chain, said that before the price fluctuations and the sudden increase in shopping demand during this 4th outbreak, the company confirmed that there is no owner to increase retail prices to make a profit. During the pandemic

Market by numbers

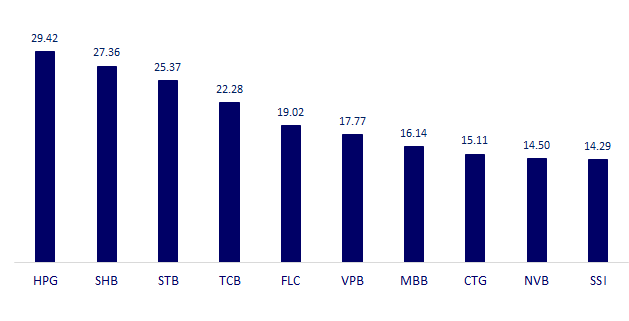

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

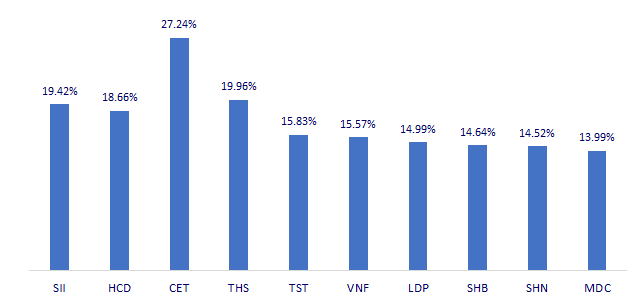

TOP INCREASES 3 CONSECUTIVE SESSIONS

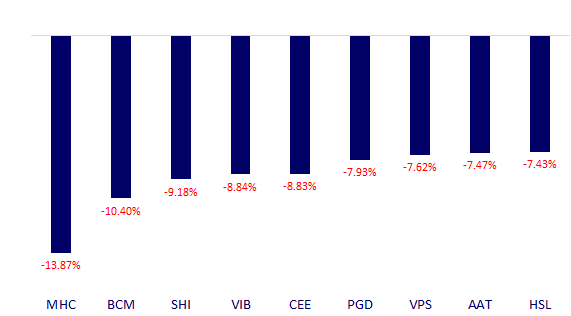

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.