Market Brief 20/07/2021

VIETNAM STOCK MARKET

1,273.29

1D 2.39%

YTD 15.81%

1,411.02

1D 2.68%

YTD 33.32%

301.11

1D 3.10%

YTD 52.77%

83.69

1D 1.33%

YTD 13.36%

38.74

1D 0.00%

YTD 0.00%

20,888.59

1D -19.07%

YTD 21.78%

- Foreign investors' trade today was positive when they returned to a slight net buying of nearly 39 billion dong. Notably, on HNX, foreign investors strongly bought more than 341 billion dong of PVI shares, this amount of net buying caused foreign investors' cash flow to reverse to positive value. Besides, at HoSE and UpCOM, foreign investors continued to sell strongly today

ETF & DERIVATIVES

23,980

1D -2.12%

YTD 27.55%

16,500

1D -2.48%

YTD 31.68%

20,500

1D -1.44%

YTD 29.75%

20,440

1D -3.36%

YTD 49.74%

23,820

1D -3.56%

YTD 38.49%

17,640

1D -1.73%

YTD 26.45%

1,401

1D -

YTD 0.00%

1,405

1D 2.74%

YTD 0.00%

1,407

1D 2.69%

YTD 0.00%

1,405

1D 2.70%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

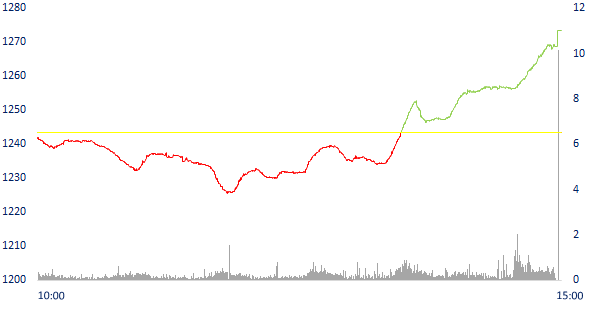

INTRADAY VNINDEX

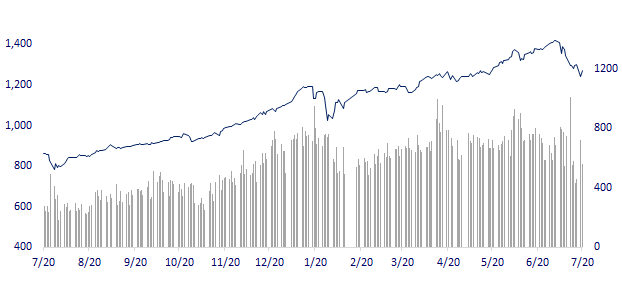

VNINDEX (12M)

GLOBAL MARKET

27,388.16

1D -0.48%

YTD -0.20%

3,536.79

1D -0.07%

YTD 3.58%

3,232.70

1D -0.35%

YTD 12.50%

27,213.12

1D -0.91%

YTD 0.24%

3,111.20

1D 0.00%

YTD 8.43%

1,538.86

1D -1.10%

YTD 6.18%

66.50

1D -0.37%

YTD 37.68%

1,817.35

1D -0.03%

YTD -4.53%

- Asian stocks fell after Wall Street's plunge. In Japan, the Nikkei 225 fell 0.48%. The Chinese market fell with the Shanghai Composite down 0.07%. Hong Kong's Hang Seng fell 0.91%. South Korea's Kospi index fell 0.35%.

VIETNAM ECONOMY

0.95%

1D (bps) 2

YTD (bps) 82

5.60%

YTD (bps) -20

1.11%

1D (bps) -13

YTD (bps) -11

2.06%

1D (bps) 6

YTD (bps) 3

23,125

1D (%) 0.02%

YTD (%) -0.23%

27,763

1D (%) 0.19%

YTD (%) -4.60%

3,624

1D (%) 0.19%

YTD (%) 1.43%

- ADB has just released an update to its Asia Development Outlook 2021 report, which lowered its forecast for Vietnam's economic growth this year to 5.8%, 0.9 percentage points lower than the previous forecast in April. This is due to the relatively slow implementation of vaccination, the application of prolonged distancing measures at the growth poles, which greatly affects the circulation of trade and limits economic activities

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- ADB lowers Vietnam's GDP growth forecast to 5.8%

- Pangasius export has just prospered, met the 4th Covid-19 'storm'

- Stop collecting fees for BOT projects in 19 southern provinces from today

- The US and its allies accuse China of global cyber attacks

- OPEC+ meets the requirements of the UAE but still favors Saudi Arabia and Russia

- US President: Inflation is only temporary

VN30

BANK

100,200

1D -2.24%

5D -3.09%

Buy Vol. 5,209,900

Sell Vol. 3,484,600

41,000

1D -3.53%

5D -3.30%

Buy Vol. 5,450,500

Sell Vol. 4,265,100

33,250

1D -4.04%

5D -3.90%

Buy Vol. 50,867,300

Sell Vol. 28,790,700

49,500

1D -4.07%

5D -8.16%

Buy Vol. 45,281,000

Sell Vol. 39,535,400

60,600

1D -6.05%

5D -5.31%

Buy Vol. 20,295,400

Sell Vol. 18,734,300

27,900

1D -4.12%

5D -6.38%

Buy Vol. 33,843,600

Sell Vol. 26,867,900

33,400

1D -0.15%

5D -1.62%

Buy Vol. 5,260,700

Sell Vol. 4,737,100

33,000

1D -2.65%

5D -5.17%

Buy Vol. 11,293,700

Sell Vol. 10,413,700

28,100

1D -1.23%

5D -2.09%

Buy Vol. 43,389,500

Sell Vol. 34,403,500

- CTG: The Board of Directors approved the plan to issue private bonds for the 5th period in 2021 with a value of VND 50 billion to increase the size of Tier 2 capital for issuers.

REAL ESTATE

103,500

1D -1.05%

5D -1.15%

Buy Vol. 5,294,900

Sell Vol. 3,770,600

18,850

1D -1.82%

5D -4.07%

Buy Vol. 43,885,400

Sell Vol. 12,872,800

36,900

1D -0.14%

5D 1.65%

Buy Vol. 5,066,000

Sell Vol. 5,797,600

89,900

1D -0.33%

5D 3.33%

Buy Vol. 4,791,700

Sell Vol. 3,430,500

- NVL: On July 19, 2021, USD 300 million of international convertible bonds were listed and traded on the Singapore Stock Exchange.

OIL & GAS

89,000

1D -1.11%

5D -2.73%

Buy Vol. 1,526,600

Sell Vol. 988,900

10,300

1D -2.83%

5D -2.37%

Buy Vol. 16,134,700

Sell Vol. 13,926,900

49,350

1D -3.42%

5D -3.24%

Buy Vol. 2,870,000

Sell Vol. 2,962,200

- POW: In 2021, POW sets a target of total revenue of VND28,404b and profit after tax of VND1,325b, after the first half of the year, the Company has achieved 58% of revenue and exceeded 5% of profit plan.

VINGROUP

103,000

1D -2.65%

5D 0.00%

Buy Vol. 3,731,500

Sell Vol. 3,143,600

106,600

1D -2.20%

5D -2.65%

Buy Vol. 7,436,200

Sell Vol. 5,498,900

26,700

1D -3.61%

5D -4.13%

Buy Vol. 13,002,900

Sell Vol. 9,529,900

- VIC and VRE were both strongly sold by foreign investors in today's session with the value of nearly 114 and 83 billion dong, respectively.

FOOD & BEVERAGE

85,900

1D 0.00%

5D 1.90%

Buy Vol. 5,079,300

Sell Vol. 4,533,900

123,000

1D 2.07%

5D 6.96%

Buy Vol. 3,440,200

Sell Vol. 2,855,000

18,500

1D -2.63%

5D 2.78%

Buy Vol. 7,115,500

Sell Vol. 6,445,100

- MSN: Sunflower Construction Company Limited registered to buy 1.5 million MSN shares, bringing the total ownership to nearly 158 million shares (13.38%)

OTHERS

114,500

1D -0.78%

5D -4.50%

Buy Vol. 745,400

Sell Vol. 793,700

114,500

1D -0.78%

5D -4.50%

Buy Vol. 745,400

Sell Vol. 793,700

86,800

1D 0.00%

5D -0.23%

Buy Vol. 5,074,200

Sell Vol. 4,031,800

164,600

1D -2.08%

5D -5.94%

Buy Vol. 1,830,300

Sell Vol. 1,675,900

92,000

1D -4.17%

5D -7.26%

Buy Vol. 1,525,600

Sell Vol. 1,308,900

51,700

1D -0.39%

5D -0.39%

Buy Vol. 1,157,100

Sell Vol. 864,200

52,700

1D -0.19%

5D 1.74%

Buy Vol. 28,880,100

Sell Vol. 23,555,700

47,300

1D 1.18%

5D 3.96%

Buy Vol. 78,940,400

Sell Vol. 60,208,300

- FPT: in the first 6 months, the company recorded revenue of 16,228 billion dong, profit before tax of 2,936 billion dong; up 19.2% and 21% respectively over the same period last year. Thus, after the first half of the year, the company has completed nearly 50% of the year's revenue and profit targets.

Market by numbers

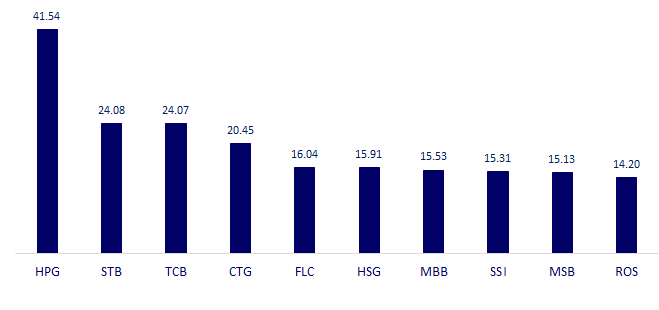

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

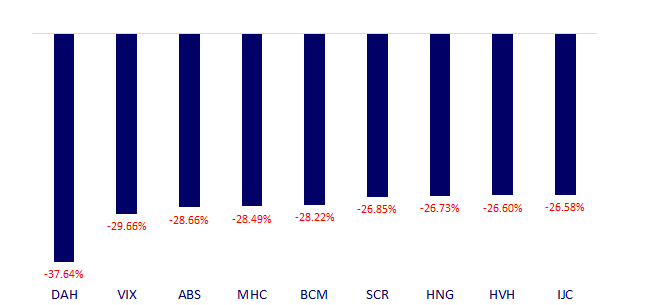

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.