Market Brief 22/07/2021

VIETNAM STOCK MARKET

1,293.67

1D 1.80%

YTD 17.66%

1,428.48

1D 1.56%

YTD 34.97%

305.97

1D 1.72%

YTD 55.24%

85.57

1D 1.51%

YTD 15.90%

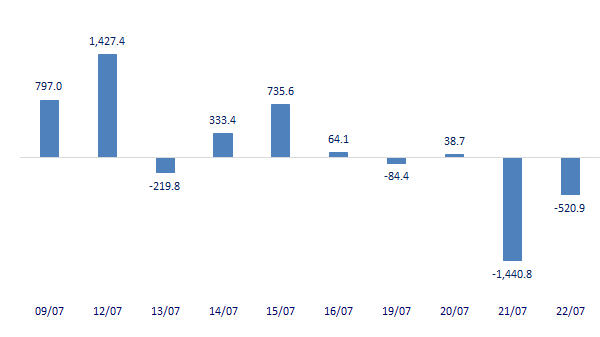

-520.93

1D 0.00%

YTD 0.00%

19,739.36

1D 10.36%

YTD 15.08%

- Session 22/7: VN-Index broke out, foreign investors continued to net sell nearly 521b HoSE. VIC is the stock with the most pressure from foreign investors with a value of 429b dong. Following, foreign investors focused on releasing another 130b dong of KDH shares. Foreign capital also withdrew from some other codes such as MSB (92b dong), SSI (53b dong), CTG (51b dong) and HPG (36b dong).

ETF & DERIVATIVES

24,000

1D 1.69%

YTD 27.66%

16,800

1D 0.42%

YTD 34.08%

20,600

1D 0.49%

YTD 30.38%

21,800

1D 6.50%

YTD 59.71%

24,750

1D 1.10%

YTD 43.90%

17,950

1D 2.22%

YTD 28.67%

1,429

1D 2.07%

YTD 0.00%

1,400

1D -0.88%

YTD 0.00%

1,427

1D 1.74%

YTD 0.00%

1,427

1D 1.79%

YTD 0.00%

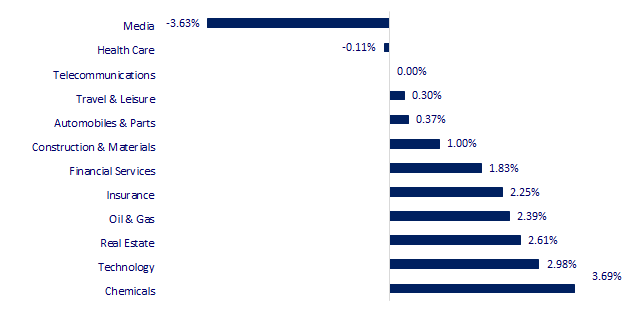

CHANGE IN PRICE BY SECTOR

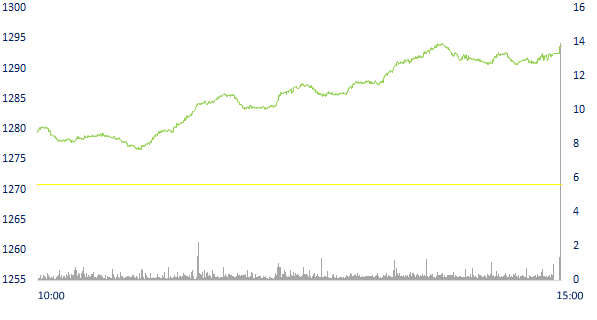

INTRADAY VNINDEX

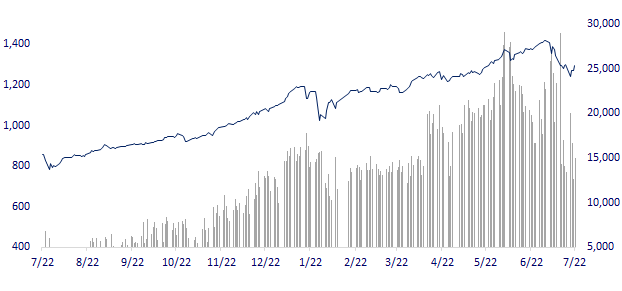

VNINDEX (12M)

GLOBAL MARKET

27,548.00

1D 0.00%

YTD 0.38%

3,574.73

1D 0.34%

YTD 4.69%

3,250.21

1D 1.07%

YTD 13.11%

27,700.62

1D 0.22%

YTD 2.04%

3,159.26

1D 1.29%

YTD 10.11%

1,552.36

1D 0.75%

YTD 7.11%

71.09

1D 1.47%

YTD 47.18%

1,795.30

1D -0.33%

YTD -5.69%

- Following Wall Street, Asian stocks rose. The Chinese market rose from the beginning with the Shanghai Composite up 0.34%, Shenzhen Component up 0.326%. Hong Kong's Hang Seng rose 0.22%. South Korea's Kospi index rose 1.07%. Japanese market holiday.

VIETNAM ECONOMY

0.95%

YTD (bps) 82

5.60%

YTD (bps) -20

1.29%

1D (bps) 12

YTD (bps) 7

2.06%

1D (bps) -6

YTD (bps) 3

23,113

1D (%) -0.01%

YTD (%) -0.28%

27,747

1D (%) -0.02%

YTD (%) -4.66%

3,629

1D (%) 0.03%

YTD (%) 1.57%

- The Malaysian Government has decided to impose anti-dumping duties on imported colored corrugated iron originating from or exported from China and Vietnam for a period of 5 years from July 20, 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Malaysia imposes anti-dumping tax on color steel sheet from Vietnam and China

- Thanh Hoa approved the investment policy of an urban area of 940 billion VND in Nhu Thanh district

- The Government sets a target of the average GDP growth rate of 5 years (2021-2025) around 6.5-7%

- BMPA: UK food supply chain on the verge of collapse

- WHO warns of the risk of appearing more dangerous variants than Delta

- IMF leaders commented on the recovery process of the world economy

VN30

BANK

100,300

1D 1.31%

5D -2.15%

Buy Vol. 2,709,600

Sell Vol. 2,267,300

41,000

1D 0.74%

5D -3.98%

Buy Vol. 3,048,000

Sell Vol. 3,128,100

33,500

1D 1.98%

5D -4.29%

Buy Vol. 24,923,000

Sell Vol. 23,393,300

51,100

1D 1.59%

5D -1.92%

Buy Vol. 27,408,300

Sell Vol. 24,648,800

60,800

1D 0.83%

5D -5.00%

Buy Vol. 11,920,300

Sell Vol. 11,252,000

28,350

1D 1.25%

5D -3.24%

Buy Vol. 20,746,500

Sell Vol. 20,089,300

32,400

1D 0.62%

5D -2.41%

Buy Vol. 5,472,200

Sell Vol. 4,247,700

33,850

1D 2.27%

5D 0.45%

Buy Vol. 9,269,400

Sell Vol. 9,754,400

28,000

1D 0.54%

5D -2.78%

Buy Vol. 29,385,700

Sell Vol. 28,927,300

- BID: The Board of Directors approved the adjustment of the plan to issue BIDV bonds to the public by underwriting method with a total par value of VND 1,200 billion. Release time in 3Q2021

REAL ESTATE

104,900

1D 1.75%

5D 0.87%

Buy Vol. 4,616,500

Sell Vol. 3,372,600

19,150

1D 1.32%

5D 0.00%

Buy Vol. 12,973,700

Sell Vol. 13,043,200

39,200

1D 6.96%

5D 7.84%

Buy Vol. 24,484,100

Sell Vol. 19,204,700

90,100

1D 1.92%

5D 3.33%

Buy Vol. 4,285,900

Sell Vol. 3,882,600

- TCH: The charter capital of nearly 2,555 billion VND due to the capital increase due to the share issuance will be invested in 02 projects Hoang Huy Commerce (1,800 billion VND) and Hoang Huy Project (755 billion VND).

OIL & GAS

89,400

1D 2.29%

5D -1.22%

Buy Vol. 910,200

Sell Vol. 872,500

10,350

1D 0.98%

5D -3.27%

Buy Vol. 19,842,900

Sell Vol. 18,756,500

50,900

1D 1.80%

5D 0.00%

Buy Vol. 1,537,300

Sell Vol. 1,772,000

- GAS: in Q2.2021, GAS recorded revenue of 22,702b dong, up 45% QoQ, cost of goods sold increased at a slower rate, so gross profit reached 3,782b dong, up nearly 57.5%.

VINGROUP

106,200

1D 2.12%

5D 4.12%

Buy Vol. 3,851,400

Sell Vol. 4,058,400

111,000

1D 2.78%

5D 0.63%

Buy Vol. 5,564,000

Sell Vol. 5,278,300

28,200

1D 2.92%

5D 0.71%

Buy Vol. 7,873,300

Sell Vol. 7,656,000

- VIC continued to be net withdrawn by foreign investors of nearly 429 billion dong in today's session.

FOOD & BEVERAGE

86,800

1D 1.76%

5D 1.88%

Buy Vol. 4,191,000

Sell Vol. 3,947,500

122,900

1D 0.74%

5D 6.87%

Buy Vol. 2,000,000

Sell Vol. 2,052,400

18,450

1D 0.27%

5D -1.34%

Buy Vol. 4,760,400

Sell Vol. 4,514,000

- MSN: Masan JSC.(related to the Chairman of BOD) registered to buy 3.5m shares. Accordingly, Masan Joint Stock Company will increase its ownership rate to 31.58% if the transaction is successful

OTHERS

114,000

1D 0.00%

5D -0.70%

Buy Vol. 686,100

Sell Vol. 702,500

114,000

1D 0.00%

5D -0.70%

Buy Vol. 686,100

Sell Vol. 702,500

89,400

1D 3.23%

5D 4.68%

Buy Vol. 8,256,900

Sell Vol. 8,218,900

165,200

1D 1.10%

5D -1.14%

Buy Vol. 1,896,500

Sell Vol. 1,778,600

93,100

1D 2.08%

5D -2.10%

Buy Vol. 1,002,200

Sell Vol. 832,200

52,800

1D 1.15%

5D 3.13%

Buy Vol. 878,800

Sell Vol. 578,600

52,200

1D 1.36%

5D -2.79%

Buy Vol. 18,464,800

Sell Vol. 20,619,800

47,200

1D 0.96%

5D 1.51%

Buy Vol. 38,865,300

Sell Vol. 39,793,300

- PNJ: announced 6 months' accumulated net revenue of VND 11,637 billion, up 50%; profit after tax is 736 billion dong, up 67.4% over the same period last year. The enterprise has completed 60% of the annual profit plan. PNJ's retail sales increased by 47%, the wholesale channel by 29% and gold bars by 73% over the same period. In the revenue structure, the proportion of gold bars contributing to total revenue increased from 23% to 26.6%, retail decreased from 58% to 57%, wholesale decreased by 16.6% to 14.2%.

Market by numbers

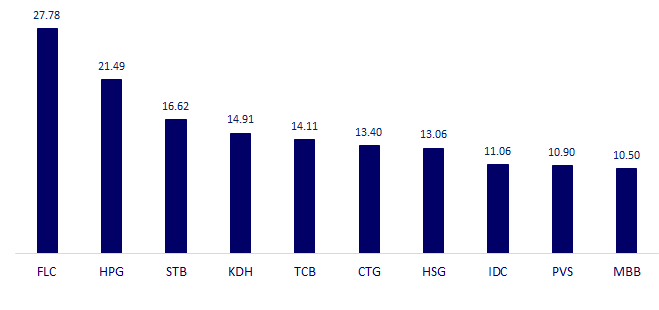

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

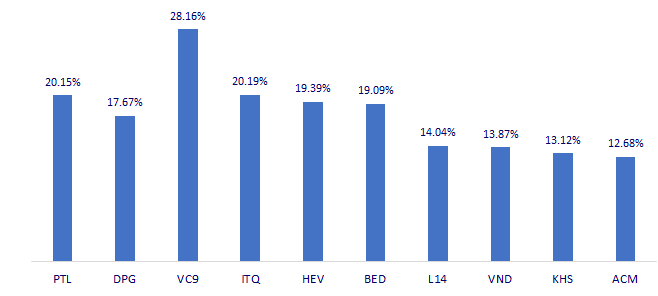

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.