Market Brief 27/07/2021

VIETNAM STOCK MARKET

1,276.93

1D 0.33%

YTD 16.14%

1,409.85

1D 0.42%

YTD 33.21%

306.00

1D 1.03%

YTD 55.25%

84.77

1D 1.07%

YTD 14.82%

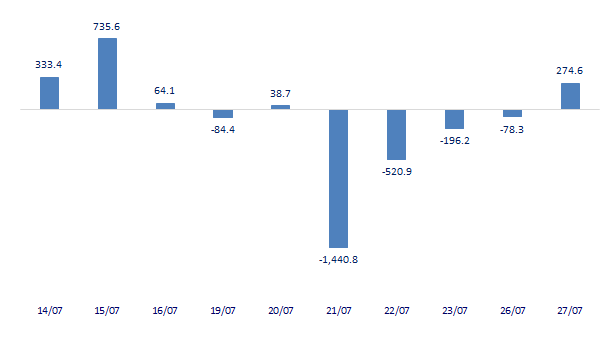

274.60

21,730.64

1D 19.64%

YTD 26.69%

- Foreign investors net bought a total of 274 billion dong on July 27. AGG was suddenly bought by foreign investors with a sudden net purchase of VND 372 billion and mainly through agreements. Specifically, this capital flow bought 45 million shares, worth 2,308 billion dong, while selling 37.4 million shares, worth 2,058 billion dong. Total net buying volume stood at 7.5 million shares.

ETF & DERIVATIVES

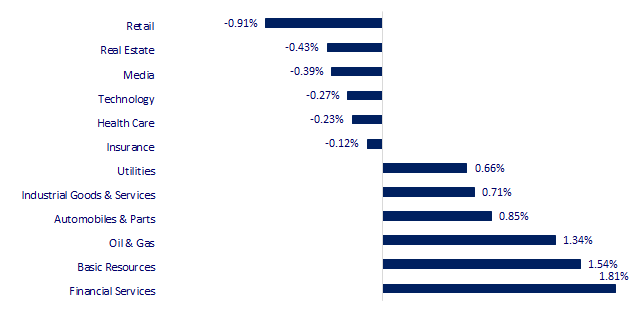

CHANGE IN PRICE BY SECTOR

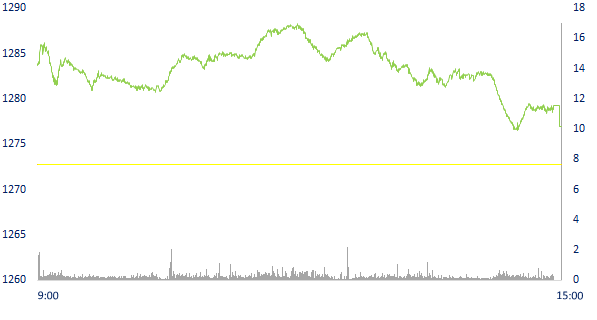

INTRADAY VNINDEX

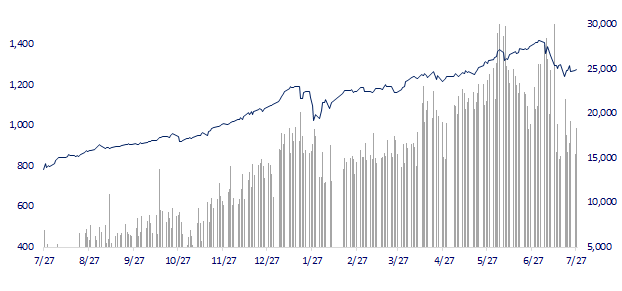

VNINDEX (12M)

GLOBAL MARKET

27,970.22

1D -0.04%

YTD 1.92%

3,381.18

1D -2.49%

YTD -0.97%

3,232.53

1D 0.24%

YTD 12.50%

25,060.87

1D -4.28%

YTD -7.68%

3,138.81

1D -0.01%

YTD 9.40%

1,537.63

1D -0.48%

YTD 6.09%

71.95

1D -0.18%

YTD 48.96%

1,795.70

1D 0.00%

YTD -5.67%

- Stock markets in Asia - Pacific were mixed in the session of July 27. Many big Chinese tech stocks in Hong Kong are still under selling pressure after the plunge at the beginning of the week. In Japan, the Nikkei 225 gained 0.04%. Mainland China market was strongly sold with Shanghai Composite down 2.49%, Shenzhen Component down 3,672%. Hong Kong's Hang Seng fell 4.28%, down more than 8% in just the first two sessions of the week.

VIETNAM ECONOMY

0.96%

YTD (bps) 83

5.60%

YTD (bps) -20

1.26%

YTD (bps) 4

2.03%

1D (bps) -1

23,104

1D (%) -0.03%

YTD (%) -0.32%

27,733

1D (%) -0.19%

YTD (%) -4.71%

3,608

1D (%) -0.41%

YTD (%) 0.98%

- Disbursed foreign direct investment (FDI) capital reached 10.5 billion USD. increased by 3.8%, considered a "bright spot" in the FDI picture in the past 7 months. FDI capital invested in the processing and manufacturing industry is the most.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI realized capital in the first 7 months increased by 3.8%

- The State Bank of Vietnam officially issued a 0% interest rate lending mechanism for specially controlled banks

- Banks increase borrowing from each other, interest rate is around 1%/year

- China tightly controls the hidden debt of local governments

- Global shipping was disrupted again, this time due to flooding in Europe and China

- Cambodia detected SARS-CoV-2 in frozen meat imported from India

VN30

BANK

95,000

1D -1.04%

5D -5.19%

Buy Vol. 3,808,000

Sell Vol. 4,465,500

40,200

1D 0.50%

5D -1.95%

Buy Vol. 2,442,200

Sell Vol. 2,869,800

32,500

1D 1.09%

5D -2.26%

Buy Vol. 26,726,400

Sell Vol. 25,074,600

49,750

1D 1.53%

5D 0.51%

Buy Vol. 20,655,400

Sell Vol. 22,540,900

57,000

1D 0.53%

5D -5.94%

Buy Vol. 19,984,600

Sell Vol. 19,039,000

27,400

1D 0.74%

5D -1.79%

Buy Vol. 20,727,100

Sell Vol. 19,037,800

32,500

1D 0.00%

5D -2.69%

Buy Vol. 7,041,700

Sell Vol. 6,145,400

34,100

1D 3.65%

5D 3.33%

Buy Vol. 14,297,000

Sell Vol. 12,692,500

29,100

1D 1.39%

5D 3.56%

Buy Vol. 51,963,900

Sell Vol. 53,371,200

- TCB: The daughter of the Chairman of the Board of Directors of TCB has successfully purchased nearly 22.5 million shares of TCB (0.64%) through put-through transactions. Transaction time from 12/07/2021-07/26/2021 - CTG: Successfully issued more than 1 million shares to pay dividends, the time to transfer shares in August 2021, thereby helping to increase the total number of outstanding shares to more than 4.8 million shares. .

REAL ESTATE

106,500

1D -0.93%

5D 2.90%

Buy Vol. 5,751,400

Sell Vol. 7,077,900

18,800

1D 1.08%

5D -0.27%

Buy Vol. 7,800,100

Sell Vol. 8,038,500

39,250

1D 0.26%

5D 6.37%

Buy Vol. 7,639,200

Sell Vol. 7,796,400

89,800

1D -0.77%

5D -0.11%

Buy Vol. 4,008,800

Sell Vol. 3,952,000

- NVL: Additional listing of 5,952,034 shares, due to the issuance of shares to convert international convertible bonds. Effective date of listing change: July 28, 2021

OIL & GAS

89,000

1D 0.79%

5D 0.00%

Buy Vol. 1,609,300

Sell Vol. 1,836,500

10,800

1D 2.86%

5D 4.85%

Buy Vol. 32,423,900

Sell Vol. 23,570,000

50,300

1D 0.80%

5D 1.93%

Buy Vol. 1,524,800

Sell Vol. 1,879,500

- PLX: The Board of Directors has approved the plan to sell another 8 million treasury shares out of the remaining 25 million treasury shares.

VINGROUP

104,300

1D 0.10%

5D 1.26%

Buy Vol. 2,513,600

Sell Vol. 2,298,100

107,800

1D -1.64%

5D 1.13%

Buy Vol. 8,104,200

Sell Vol. 8,597,200

27,650

1D 3.36%

5D 3.56%

Buy Vol. 9,892,400

Sell Vol. 10,254,100

- VHM: adjusted foreign room room from 49% to 50%. Adjustment time from 22/07/2021.

FOOD & BEVERAGE

87,500

1D -1.57%

5D 1.86%

Buy Vol. 3,333,100

Sell Vol. 5,754,400

125,500

1D 3.63%

5D 2.03%

Buy Vol. 3,281,700

Sell Vol. 2,943,900

18,300

1D -1.08%

5D -1.08%

Buy Vol. 2,968,900

Sell Vol. 3,443,300

- SBT: Collecting shareholders' written opinions on the payment of 5% stock dividend. The expected number of shares to be issued is 30,857,907 shares

OTHERS

114,900

1D 0.79%

5D 0.35%

Buy Vol. 905,400

Sell Vol. 778,500

50,500

1D -0.20%

5D 1.20%

Buy Vol. 1,106,200

Sell Vol. 1,314,900

93,200

1D -0.53%

5D 7.37%

Buy Vol. 7,742,400

Sell Vol. 9,164,900

158,000

1D -1.43%

5D -4.01%

Buy Vol. 2,206,300

Sell Vol. 2,332,200

90,100

1D -0.66%

5D -2.07%

Buy Vol. 1,407,600

Sell Vol. 1,510,300

52,800

1D 1.54%

5D 2.13%

Buy Vol. 948,800

Sell Vol. 914,400

52,000

1D 2.36%

5D -1.33%

Buy Vol. 24,504,900

Sell Vol. 29,139,300

46,200

1D 1.32%

5D -2.33%

Buy Vol. 33,484,200

Sell Vol. 33,449,400

- SSI: Q2 individual revenue reached VND1,741b, up 26% QoQ. In which, revenue from securities brokerage business reached more than VND623b, 3.2 times higher than QoQ. Individual pre-tax profit reached VND703.5b, growing at nearly 8%. SSI's margin loan balance reached VND15,539b, an increase of 72% compared to the beginning of the year and also a record for margin lending activities of this company. Revenue from margin lending and receivables reached VND338b, 2.1 times higher than QoQ.

Market by numbers

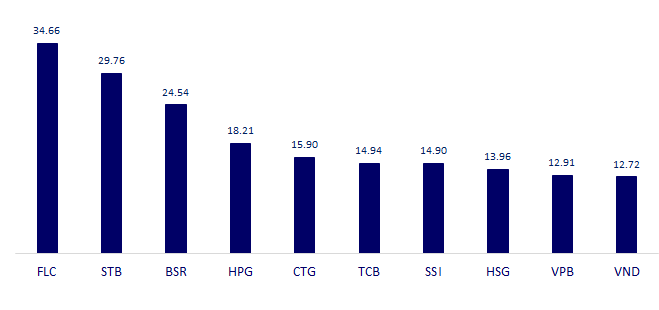

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

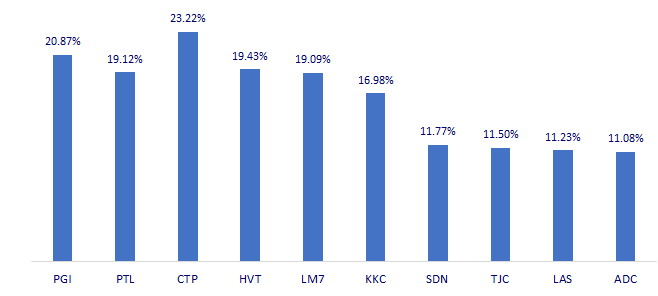

TOP INCREASES 3 CONSECUTIVE SESSIONS

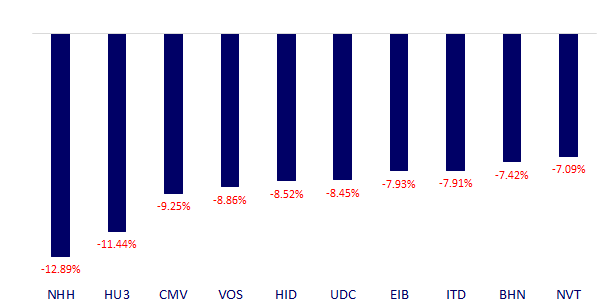

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.