Market Brief 03/08/2021

VIETNAM STOCK MARKET

1,332.44

1D 1.39%

YTD 21.19%

1,469.87

1D 1.50%

YTD 38.88%

319.13

1D 1.33%

YTD 61.91%

87.59

1D 0.27%

YTD 18.64%

166.79

1D 0.00%

YTD 0.00%

25,439.47

1D 9.99%

YTD 48.31%

- Foreign investors continued to be net buyers on all 3 exchanges with a total value of nearly 167 billion dong. SSI was the stock that was poured the most with a value of 122 billion dong, while in the opposite direction, foreign investors strongly dumped VIC with a value of more than 214 billion dong.

ETF & DERIVATIVES

24,700

1D 0.00%

YTD 31.38%

17,400

1D 1.81%

YTD 38.87%

18,800

1D 5.56%

YTD 41.35%

21,200

1D 0.47%

YTD 34.18%

21,480

1D 1.85%

YTD 57.36%

26,000

1D 1.17%

YTD 51.16%

18,580

1D 1.42%

YTD 33.19%

1,467

1D 1.28%

YTD 0.00%

1,466

1D 1.59%

YTD 0.00%

1,469

1D 1.42%

YTD 0.00%

1,475

1D 1.87%

YTD 0.00%

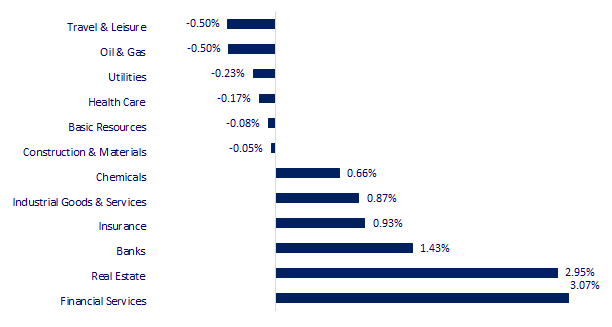

CHANGE IN PRICE BY SECTOR

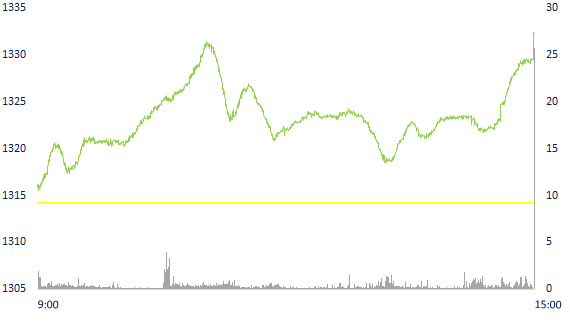

INTRADAY VNINDEX

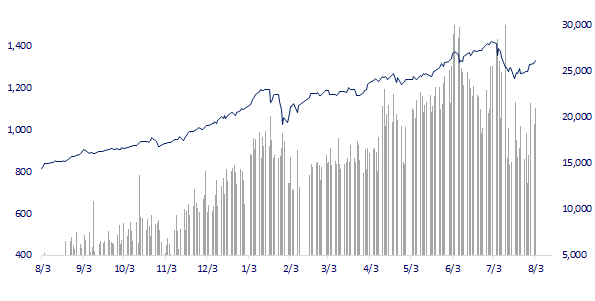

VNINDEX (12M)

GLOBAL MARKET

27,641.83

1D 0.29%

YTD 0.72%

3,447.99

1D -0.47%

YTD 0.98%

3,237.14

1D 0.44%

YTD 12.66%

26,194.82

1D 0.71%

YTD -3.51%

3,149.25

1D -0.38%

YTD 9.76%

1,540.51

1D 1.01%

YTD 6.29%

71.52

1D -0.01%

YTD 48.07%

1,812.95

1D -0.02%

YTD -4.76%

- Australia's interest rate decision, Asian stocks mixed. The Chinese market fell with Shanghai Composite down 0.47%, Shenzhen Component down 0.414%. Hong Kong's Hang Seng fell 0.16%. South Korea's Kospi index rose 0.44%.

VIETNAM ECONOMY

0.96%

1D (bps) -1

YTD (bps) 83

5.60%

YTD (bps) -20

1.21%

1D (bps) -5

YTD (bps) -1

1.96%

1D (bps) -9

YTD (bps) -7

23,040

1D (%) -0.04%

YTD (%) -0.60%

27,893

1D (%) 0.11%

YTD (%) -4.16%

3,619

1D (%) -0.06%

YTD (%) 1.29%

- Many banks tighten conditions for real estate lending because risks from this sector are expected to continue to increase in the last months of 2021. Previously, the SBV also repeatedly requested credit institutions to strictly control Tighten credit in potentially risky fields such as real estate, securities, BOT projects, BT traffic...

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Continue to tighten real estate loans

- Overcoming Bangladesh, Vietnam becomes the 2nd largest garment exporter in the world

- Many important manufacturing industries fell due to COVID-19

- The IMF approves the largest support package in history to help countries cope with COVID-19

- The Fed may announce a tightening of the asset purchase program from September 2021

- The Central Bank of Korea signaled to raise interest rates in 2021

VN30

BANK

98,800

1D 1.86%

5D 4.00%

Buy Vol. 2,497,200

Sell Vol. 2,338,700

43,350

1D 1.88%

5D 7.84%

Buy Vol. 5,090,900

Sell Vol. 4,565,400

34,100

1D 1.04%

5D 4.92%

Buy Vol. 40,963,700

Sell Vol. 35,550,600

51,800

1D 1.97%

5D 4.12%

Buy Vol. 37,762,900

Sell Vol. 40,722,800

60,800

1D 0.66%

5D 6.67%

Buy Vol. 14,370,500

Sell Vol. 14,256,500

29,300

1D 1.74%

5D 6.93%

Buy Vol. 30,607,700

Sell Vol. 34,199,800

34,900

1D 2.05%

5D 7.38%

Buy Vol. 5,995,200

Sell Vol. 6,878,000

34,550

1D 0.29%

5D 1.32%

Buy Vol. 6,637,500

Sell Vol. 7,130,000

29,800

1D 1.71%

5D 2.41%

Buy Vol. 50,841,500

Sell Vol. 48,769,000

- SBT: Successfully sold 81,562,287 treasury shares, adding to the number of outstanding shares to 1,885,215,716 shares. - TCB: Deputy General Director Phan Thanh Son sold 150,000 shares, reducing the number of ownership to 2,081,873 shares.

REAL ESTATE

105,500

1D 0.86%

5D -0.94%

Buy Vol. 3,376,000

Sell Vol. 3,651,600

19,200

1D 2.13%

5D 2.13%

Buy Vol. 13,369,400

Sell Vol. 16,014,900

40,950

1D 1.61%

5D 4.33%

Buy Vol. 8,330,400

Sell Vol. 9,683,500

93,900

1D 0.32%

5D 4.57%

Buy Vol. 3,750,900

Sell Vol. 3,638,400

- KDH: In the first 6 months, Khang Dien's net revenue was 1,949 billion dong, up 31% and net profit was 470 billion dong, up 15% over the same period.

OIL & GAS

93,000

1D -0.53%

5D 4.49%

Buy Vol. 1,654,100

Sell Vol. 1,574,800

10,800

1D 0.47%

5D 0.00%

Buy Vol. 12,500,100

Sell Vol. 13,545,600

51,200

1D -0.58%

5D 1.79%

Buy Vol. 2,771,900

Sell Vol. 2,332,100

- POW: Q2.2021 consolidated net revenue increased 3% to VND 7,956 billion. However, gross profit still decreased 14% to 1,144 billion dong due to higher cost of goods sold

VINGROUP

114,500

1D 6.51%

5D 9.78%

Buy Vol. 11,520,300

Sell Vol. 10,009,100

110,900

1D 2.59%

5D 2.88%

Buy Vol. 17,611,100

Sell Vol. 15,828,200

28,300

1D 2.91%

5D 2.35%

Buy Vol. 14,198,000

Sell Vol. 13,956,700

- VIC: Vingroup receives an exclusive transfer of technology to produce mRNA vaccines against Covid-19 in Vietnam.

FOOD & BEVERAGE

87,100

1D 0.69%

5D -0.46%

Buy Vol. 4,241,800

Sell Vol. 5,538,300

137,800

1D 1.17%

5D 9.80%

Buy Vol. 2,413,400

Sell Vol. 2,102,300

19,000

1D 0.53%

5D 3.83%

Buy Vol. 3,260,300

Sell Vol. 4,231,500

- MSN: Masan MeatLife's revenue grew thanks to increasing integrated meat segment (36%), animal feed (33%) and contribution of VND630b from 3F Viet Company.

OTHERS

116,000

1D 0.43%

5D 0.96%

Buy Vol. 671,500

Sell Vol. 730,200

116,000

1D 0.43%

5D 0.96%

Buy Vol. 671,500

Sell Vol. 730,200

95,800

1D 0.21%

5D 2.79%

Buy Vol. 6,046,700

Sell Vol. 6,078,800

169,900

1D 0.00%

5D 7.53%

Buy Vol. 1,426,400

Sell Vol. 1,779,800

96,500

1D 0.94%

5D 7.10%

Buy Vol. 867,700

Sell Vol. 1,107,300

54,300

1D 0.56%

5D 2.84%

Buy Vol. 828,100

Sell Vol. 966,600

56,500

1D 2.73%

5D 8.65%

Buy Vol. 31,337,400

Sell Vol. 30,971,200

47,250

1D 0.00%

5D 2.27%

Buy Vol. 44,651,800

Sell Vol. 49,496,300

- VJC: During the period of low passenger exploitation, Vietjet focused on perfecting the exploitation processes and enhancing cargo operations; corresponding to the results in the period, more than 37 thousand tons of goods were transported, an increase of more than 40% - 45% over the same period.

Market by numbers

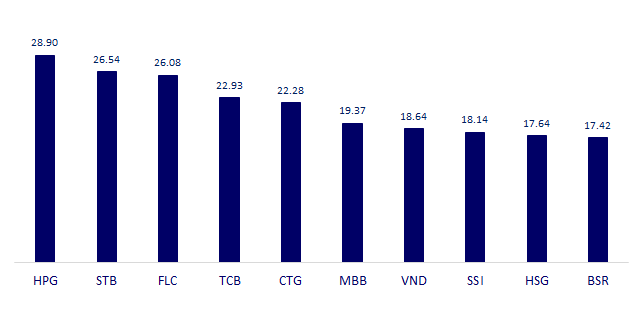

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

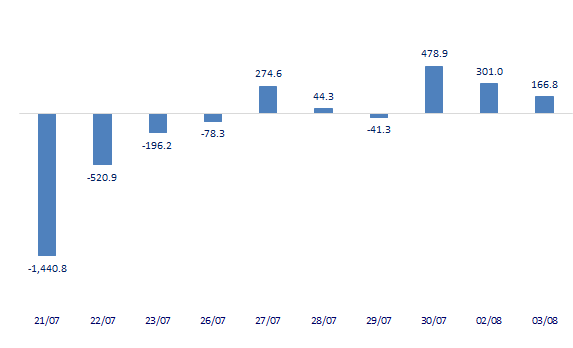

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

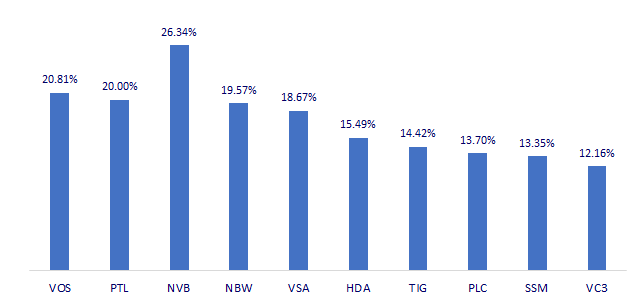

TOP INCREASES 3 CONSECUTIVE SESSIONS

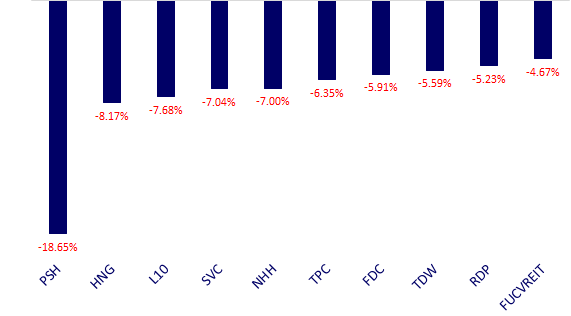

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.