Market Brief 06/08/2021

VIETNAM STOCK MARKET

1,341.45

1D -0.30%

YTD 22.01%

1,476.79

1D -0.65%

YTD 39.53%

325.46

1D 0.00%

YTD 65.12%

88.28

1D 0.40%

YTD 19.57%

38.08

1D 0.00%

YTD 0.00%

28,414.44

1D 18.81%

YTD 65.65%

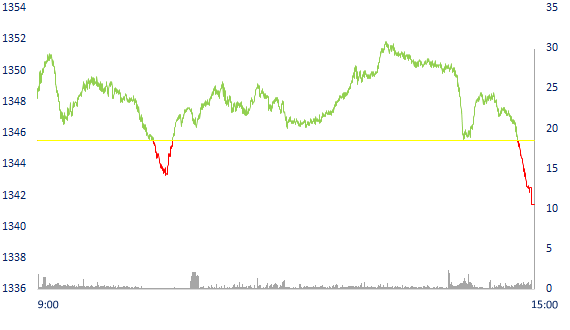

- VN-Index today recorded a decrease of 4.1 points, officially ending the series of 9 consecutive gaining sessions. Foreign investors' trade is considered a bright spot as they continued to record a net buying in today's session despite the pressure drop compared to the previous session. The total value on all 3 exchanges reached more than 38 billion dong.

ETF & DERIVATIVES

24,920

1D 0.73%

YTD 32.55%

17,440

1D -1.47%

YTD 39.19%

20,850

1D 17.07%

YTD 56.77%

21,800

1D 2.35%

YTD 37.97%

21,500

1D -1.38%

YTD 57.51%

25,800

1D 0.00%

YTD 50.00%

18,710

1D 0.59%

YTD 34.12%

1,484

1D -0.02%

YTD 0.00%

1,473

1D -0.89%

YTD 0.00%

1,472

1D -1.07%

YTD 0.00%

1,473

1D -0.95%

YTD 0.00%

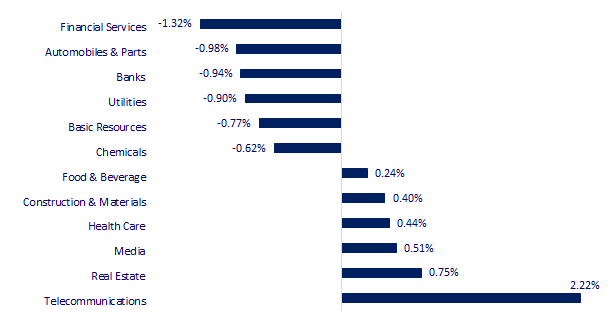

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

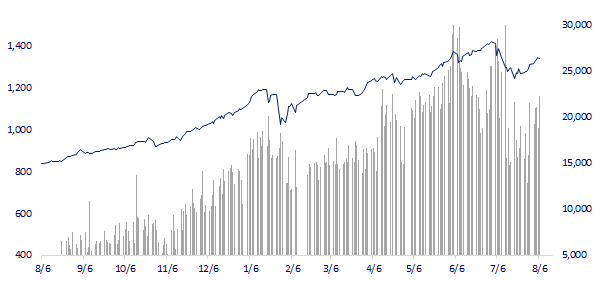

VNINDEX (12M)

GLOBAL MARKET

27,820.04

1D 0.24%

YTD 1.37%

3,458.23

1D -0.24%

YTD 1.28%

3,270.36

1D -0.18%

YTD 13.81%

26,179.40

1D 0.37%

YTD -3.56%

3,177.18

1D 0.07%

YTD 10.73%

1,521.72

1D -0.39%

YTD 4.99%

69.92

1D 1.41%

YTD 44.76%

1,800.10

1D -0.21%

YTD -5.44%

- Asian stocks mixed, awaiting US jobs report. In Japan, the Nikkei 225 gained 0.24%. The Chinese market fell with Shanghai Composite down 0.24%, Shenzhen Component down 0.301%. Hong Kong's Hang Seng rose 0.37%. South Korea's Kospi index fell 0.18%.

VIETNAM ECONOMY

0.93%

YTD (bps) 80

5.60%

YTD (bps) -20

1.18%

1D (bps) -4

YTD (bps) -4

1.93%

1D (bps) -6

YTD (bps) -10

23,025

1D (%) -0.04%

YTD (%) -0.66%

27,697

1D (%) -0.16%

YTD (%) -4.83%

3,614

1D (%) -0.17%

YTD (%) 1.15%

- Data from the Vietnam Food Association (VFA) shows that, for nearly 3 weeks now, many rice exporters in the Mekong Delta have stood still when the rice output purchased by many enterprises has decreased. decline. They also face difficulties due to the lack of shipping containers, high domestic freight rates, and various costs incurred during circulation.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Foreign shipping lines increase many types of fees: Enterprises buckling

- Reducing taxes as a lifesaving blood source for businesses

- Nikkei Asia: Vietnam is among the most competitive fintech markets in Asia

- New Covid-19 cases in the US highest in 6 months

- US trade deficit reached nearly 76 billion USD, a record high

- World gold dropped to around 1,800 USD/oz

VN30

BANK

98,100

1D -1.31%

5D 0.10%

Buy Vol. 2,379,200

Sell Vol. 2,584,700

42,900

1D -0.12%

5D 4.38%

Buy Vol. 10,027,800

Sell Vol. 12,508,900

34,150

1D -0.15%

5D -0.73%

Buy Vol. 35,738,800

Sell Vol. 55,741,800

51,800

1D -1.33%

5D 1.37%

Buy Vol. 35,824,400

Sell Vol. 41,025,100

60,600

1D -1.94%

5D -0.66%

Buy Vol. 48,715,500

Sell Vol. 50,540,000

29,650

1D -1.17%

5D 2.60%

Buy Vol. 29,714,800

Sell Vol. 39,559,500

35,000

1D -1.41%

5D 3.86%

Buy Vol. 8,860,500

Sell Vol. 11,547,300

35,500

1D -1.11%

5D 1.43%

Buy Vol. 11,042,800

Sell Vol. 27,181,600

30,300

1D -2.42%

5D 1.34%

Buy Vol. 52,649,000

Sell Vol. 92,372,600

- VCB: In 6 months of 2021, the highest profit scale continues to be Vietcombank. Previously, Vietcombank announced 6 months' pre-tax profit estimated at 14,560 billion dong. But the actual profit of Vietcombank in the first 6 months was 13,570 billion dong, up 24% over the same period last year and 7% lower than the estimate.

REAL ESTATE

35,550

1D -1.25%

5D -1.66%

Buy Vol. 17,749,900

Sell Vol. 21,535,500

107,500

1D 162.20%

5D 164.13%

Buy Vol. 4,070,100

Sell Vol. 4,348,200

93,500

1D 128.05%

5D 129.73%

Buy Vol. 4,070,100

Sell Vol. 4,348,200

93,500

1D -0.32%

5D 1.08%

Buy Vol. 5,015,500

Sell Vol. 5,070,700

OIL & GAS

92,400

1D -1.49%

5D 3.13%

Buy Vol. 1,873,900

Sell Vol. 2,268,100

11,000

1D 1.85%

5D 2.80%

Buy Vol. 19,265,000

Sell Vol. 22,170,600

52,900

1D 0.95%

5D 3.12%

Buy Vol. 5,951,800

Sell Vol. 3,733,900

- Petrol prices on August 6: Continuing increase of more than 1% because of tensions in Middle East. Brent crude oil price for October delivery increased 0.13% to $71.28/barrel.

VINGROUP

113,300

1D -0.61%

5D 5.69%

Buy Vol. 3,694,900

Sell Vol. 4,567,200

113,900

1D 1.97%

5D 5.17%

Buy Vol. 5,308,000

Sell Vol. 7,350,300

27,950

1D 0.00%

5D 1.08%

Buy Vol. 10,737,800

Sell Vol. 9,229,400

- VIC: On August 18, Vingroup will close the list of shareholders to issue more than 422.8 million shares to pay dividends to shareholders. The issuance rate is 12.5%.

FOOD & BEVERAGE

87,200

1D 0.69%

5D 1.28%

Buy Vol. 6,249,100

Sell Vol. 8,247,800

134,500

1D -0.37%

5D 0.37%

Buy Vol. 4,287,100

Sell Vol. 3,331,700

155,200

1D -0.32%

5D -2.39%

Buy Vol. 108,500

Sell Vol. 155,100

- VNM ranked first in value of foreign net-sold stocks in today's session with a value of 81 billion dong.

OTHERS

117,400

1D 0.77%

5D 3.89%

Buy Vol. 740,200

Sell Vol. 987,200

117,400

1D 0.77%

5D 3.89%

Buy Vol. 740,200

Sell Vol. 987,200

96,600

1D 0.00%

5D 2.77%

Buy Vol. 3,331,800

Sell Vol. 5,360,700

171,500

1D -0.87%

5D 4.51%

Buy Vol. 1,282,000

Sell Vol. 1,565,500

96,200

1D 0.42%

5D 0.42%

Buy Vol. 1,854,900

Sell Vol. 1,903,900

34,200

1D -1.87%

5D 1.48%

Buy Vol. 11,329,400

Sell Vol. 15,222,900

56,400

1D -1.91%

5D 3.30%

Buy Vol. 22,652,400

Sell Vol. 27,245,200

48,400

1D -0.82%

5D 2.33%

Buy Vol. 63,847,100

Sell Vol. 71,538,100

- FPT: announced on August 17 the final registration to close the list of shareholders to advance the first dividend of 2021 billion in cash at the rate of 10% (1 share will receive 1,000 VND), August 16 is the trading day not entitled. With more than 907 million shares outstanding, FPT plans to spend more than 907 billion dong to pay this dividend. Payment date is 1/9.

Market by numbers

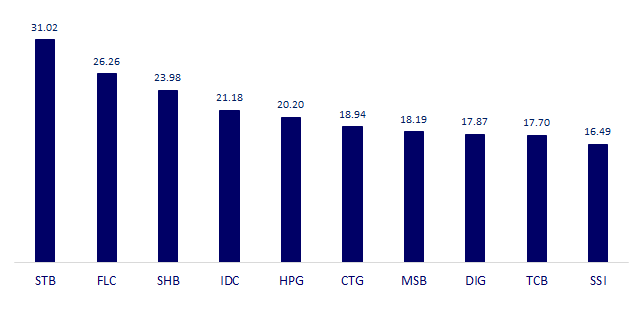

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

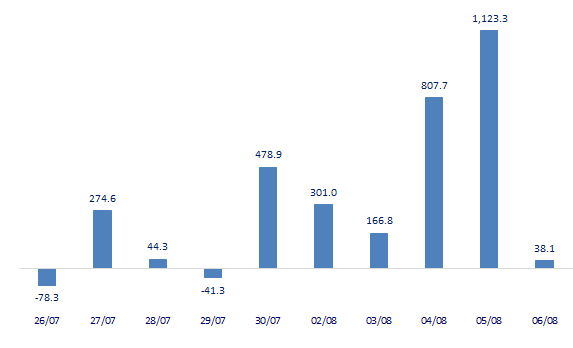

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

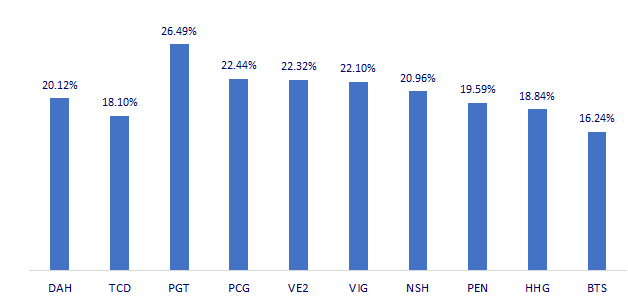

TOP INCREASES 3 CONSECUTIVE SESSIONS

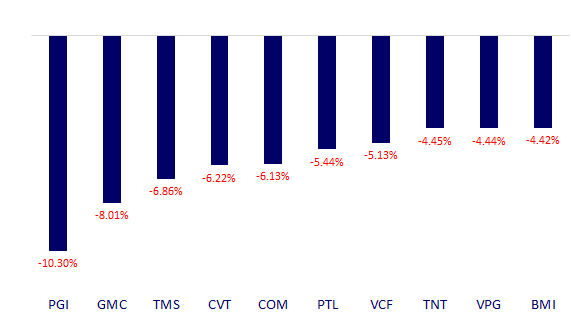

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.