Market Brief 17/08/2021

VIETNAM STOCK MARKET

1,363.09

1D -0.57%

YTD 23.97%

1,494.12

1D -0.44%

YTD 41.17%

343.11

1D -0.12%

YTD 74.08%

84.20

1D -10.46%

YTD 14.05%

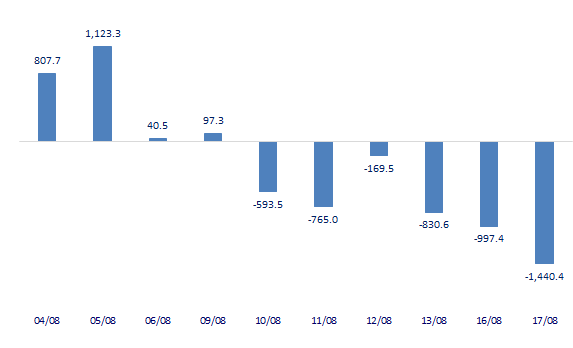

-1,440.43

1D 0.00%

YTD 0.00%

32,195.74

1D -5.89%

YTD 87.70%

- Session 17/8: Foreign investors net sold 1,440 billion dong on the whole market. VHM today continued to be the center of the transaction being sold the most by foreign investors with a value of 510 billion dong. VHM today also recorded a not-so-positive movement as it dropped by 4.3% to 111,000 dong/share.

ETF & DERIVATIVES

25,260

1D -0.16%

YTD 34.36%

17,760

1D -0.06%

YTD 41.74%

20,600

1D 15.67%

YTD 54.89%

21,990

1D 0.41%

YTD 39.18%

21,990

1D 2.04%

YTD 61.10%

26,030

1D -0.65%

YTD 51.34%

18,950

1D 1.07%

YTD 35.84%

1,498

1D 1.24%

YTD 0.00%

1,490

1D -0.59%

YTD 0.00%

1,492

1D -0.39%

YTD 0.00%

1,493

1D -0.67%

YTD 0.00%

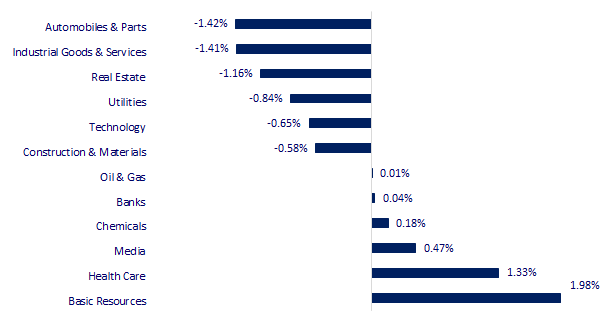

CHANGE IN PRICE BY SECTOR

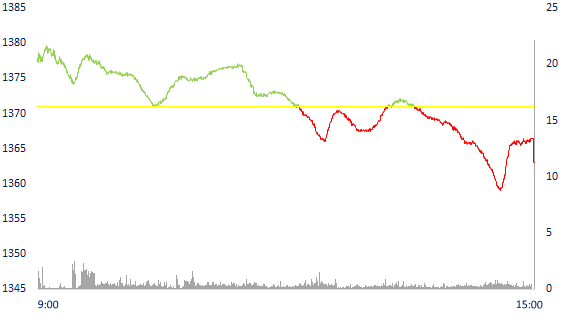

INTRADAY VNINDEX

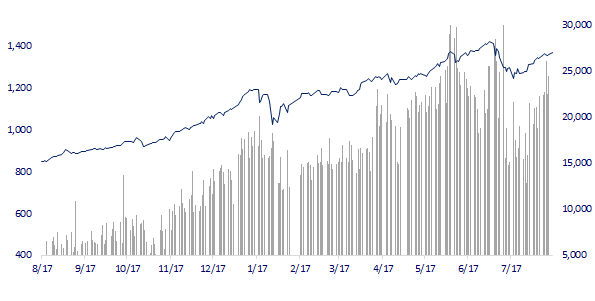

VNINDEX (12M)

GLOBAL MARKET

27,424.47

1D -0.64%

YTD -0.07%

3,446.98

1D -2.00%

YTD 0.95%

3,143.09

1D -0.58%

YTD 9.38%

25,745.87

1D -1.66%

YTD -5.16%

3,118.51

1D -0.86%

YTD 8.69%

1,544.22

1D 0.85%

YTD 6.55%

66.69

1D -0.91%

YTD 38.07%

1,796.15

1D 1.06%

YTD -5.65%

- Asian stocks fell despite Wall Street hitting consecutive peaks. In Japan, the Nikkei 225 fell 0.64%. The Chinese market fell the most in the region with the Shanghai Composite losing 2% and the Shenzhen Component down 2.335%. Hong Kong's Hang Seng fell 1.66%. South Korea's Kospi index fell 0.58%.

VIETNAM ECONOMY

0.75%

1D (bps) -2

YTD (bps) 62

5.60%

YTD (bps) -20

0.98%

1D (bps) -2

YTD (bps) -24

1.90%

1D (bps) -2

YTD (bps) -13

22,925

1D (%) -0.02%

YTD (%) -1.09%

27,477

1D (%) -0.15%

YTD (%) -5.59%

3,593

1D (%) -0.08%

YTD (%) 0.56%

- Previously, the VND interest rate on the interbank market was stable above 1% in short terms; overnight VND interest rate (accounting for around 80% of daily trading volume) is stable around 1%/year. By the end of last week, according to the data of the State Bank, the overnight interest rate on August 13 had fallen to an average of only 0.77%/year; The average 1 and 2 week short term terms are also only 0.85% and 0.96%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Savings interest rate in August: The highest is only 7.4%/year, personal deposits grow at a record slow

- Interbank interest rates fell continuously

- Consider reducing electricity prices for industries with export turnover of more than 1 billion USD

- China: Willing to work with the US to settle Afghanistan peacefully, but Mr. Biden has to give in

- Ports in the US are seriously congested: There is no mooring place for loading and unloading, long queues waiting for ships

- Thailand needs nearly 30 billion USD more to support the economy to overcome the pandemi

VN30

BANK

101,000

1D 0.40%

5D 2.02%

Buy Vol. 2,766,000

Sell Vol. 3,555,100

42,950

1D -0.81%

5D -0.81%

Buy Vol. 2,680,100

Sell Vol. 3,981,400

34,600

1D -1.42%

5D -0.14%

Buy Vol. 20,925,500

Sell Vol. 27,765,300

53,300

1D -1.30%

5D 1.91%

Buy Vol. 25,450,900

Sell Vol. 32,244,000

65,100

1D -0.76%

5D 7.60%

Buy Vol. 17,264,700

Sell Vol. 19,094,300

31,200

1D 0.65%

5D 5.23%

Buy Vol. 33,725,000

Sell Vol. 41,979,600

35,750

1D 0.00%

5D 0.56%

Buy Vol. 3,796,400

Sell Vol. 7,062,400

37,350

1D 0.67%

5D 3.75%

Buy Vol. 7,736,700

Sell Vol. 9,520,800

30,150

1D -0.50%

5D -1.47%

Buy Vol. 39,049,200

Sell Vol. 48,459,000

35,600

1D -0.28%

5D -2.47%

Buy Vol. 14,870,100

Sell Vol. 20,898,300

- VPB: Has issued 15,000,000 treasury shares for employees under the selection program in 2021. Accordingly, the number of treasury shares decreased to 60,219,600 shares.

REAL ESTATE

103,200

1D 147.48%

5D 146.30%

Buy Vol. 3,681,800

Sell Vol. 4,335,400

91,200

1D 118.71%

5D 117.66%

Buy Vol. 3,681,800

Sell Vol. 4,335,400

91,200

1D -0.55%

5D -1.83%

Buy Vol. 3,431,000

Sell Vol. 3,359,700

- PDR: Has issued 2,000 individual bonds with a term of 2 years and an interest rate of 13%/year, paying interest every 3 months, with a total par value of VND 200 billion.

OIL & GAS

92,400

1D -1.91%

5D -3.75%

Buy Vol. 1,740,900

Sell Vol. 1,867,500

11,350

1D -0.87%

5D 0.89%

Buy Vol. 13,889,300

Sell Vol. 21,751,500

51,600

1D -0.96%

5D -4.09%

Buy Vol. 2,781,100

Sell Vol. 2,731,300

- Oil and gas industry continued its long-lasting recovery from 2020. Profit in Q2.2021 increased more than 5 times QoQ, many enterprises PLX, OIL, BSR reported strong profits.

VINGROUP

98,900

1D 0.60%

5D -1.54%

Buy Vol. 7,897,700

Sell Vol. 7,797,000

111,000

1D -4.31%

5D -5.13%

Buy Vol. 31,779,900

Sell Vol. 28,565,200

28,050

1D -1.58%

5D -1.06%

Buy Vol. 7,144,300

Sell Vol. 8,294,600

- VHM: will pay 30% stock dividend from September- October. VHM increased payment cash and share amount to pay dividends due to the sale of treasury shares.

FOOD & BEVERAGE

89,300

1D -0.22%

5D -0.11%

Buy Vol. 4,679,000

Sell Vol. 4,581,300

132,500

1D -0.75%

5D -4.33%

Buy Vol. 1,300,200

Sell Vol. 1,235,700

145,500

1D -4.02%

5D -5.58%

Buy Vol. 1,044,400

Sell Vol. 1,036,500

- MSN: Korea Investment PE Fund is expected to invest 200 million USD, becoming the next Korean investor to pour capital into Masan Group after SK Group, IMM Corp and NPS.

OTHERS

117,300

1D 0.00%

5D -1.18%

Buy Vol. 672,500

Sell Vol. 635,900

117,300

1D 0.00%

5D -1.18%

Buy Vol. 672,500

Sell Vol. 635,900

93,800

1D -0.85%

5D -3.07%

Buy Vol. 4,691,100

Sell Vol. 4,778,700

169,900

1D -0.12%

5D -2.30%

Buy Vol. 1,637,600

Sell Vol. 1,794,400

95,500

1D 1.06%

5D -0.31%

Buy Vol. 612,100

Sell Vol. 688,700

37,500

1D 0.81%

5D 7.14%

Buy Vol. 11,213,200

Sell Vol. 15,975,900

61,300

1D -1.29%

5D 3.20%

Buy Vol. 22,112,000

Sell Vol. 22,990,400

50,400

1D 1.92%

5D 2.02%

Buy Vol. 73,601,100

Sell Vol. 82,981,000

- FPT: reported profit before tax in the first 7 months of the year, increasing by nearly 20% compared to the same period in 2020. In July 2021, FPT's revenue is estimated at 2,774 billion VND, up 18.2% and profit before tax is 492 billion VND, up 13.4% over the same period last year. Profit after tax for shareholders of parent company and EPS reached VND 2,233 billion and VND 2,467 respectively, up 16.2% and 15.7%, equivalent to 102% of the plan.

Market by numbers

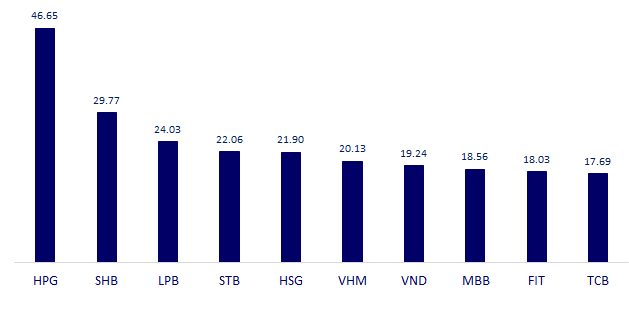

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

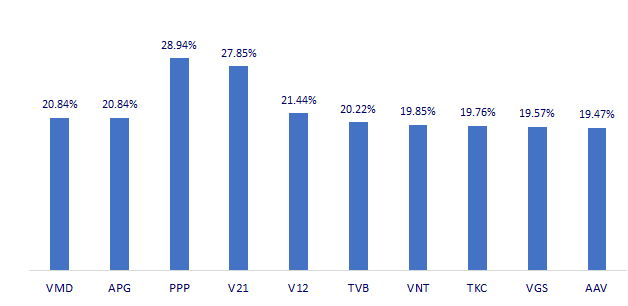

TOP INCREASES 3 CONSECUTIVE SESSIONS

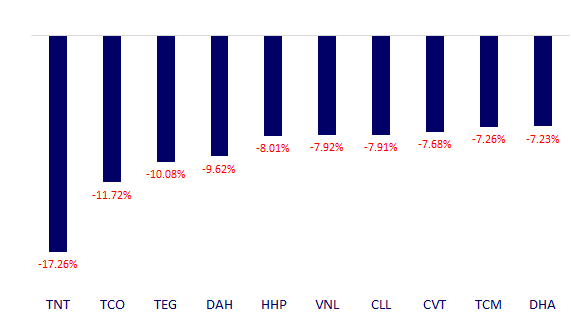

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.