Market Brief 07/09/2021

VIETNAM STOCK MARKET

1,341.90

1D -0.33%

YTD 22.05%

1,444.10

1D 0.18%

YTD 36.44%

346.48

1D 0.25%

YTD 75.79%

94.70

1D 0.04%

YTD 28.27%

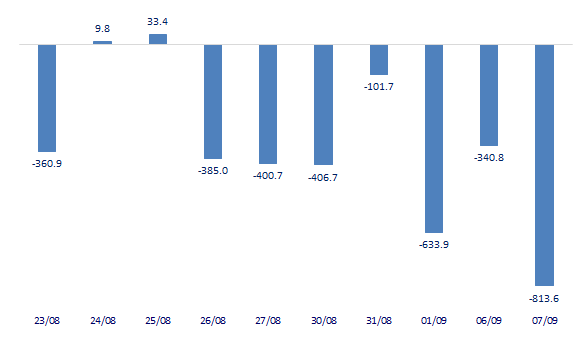

-813.57

1D 0.00%

YTD 0.00%

32,690.37

1D -4.89%

YTD 90.58%

- Foreign investors boosted net selling of more than 813b dong on September 7. VHM was sold the most by foreign investors with a value of 354b dong. SSI was also net sold 247b dong. VIC, HPG, MSN, VNM... are also on the list of strong net sellers of foreign investors. On the other side, VCB was bought the most with 44.7b dong. MBB and DCM were net bought 37b dong and 32b dong.

ETF & DERIVATIVES

24,550

1D 0.61%

YTD 30.59%

17,050

1D 0.29%

YTD 36.07%

18,220

1D 2.30%

YTD 36.99%

21,300

1D 0.00%

YTD 34.81%

20,680

1D -0.58%

YTD 51.50%

25,700

1D 2.02%

YTD 49.42%

18,700

1D 2.24%

YTD 34.05%

1,437

1D -0.28%

YTD 0.00%

1,440

1D -0.15%

YTD 0.00%

1,437

1D -0.34%

YTD 0.00%

1,441

1D -0.25%

YTD 0.00%

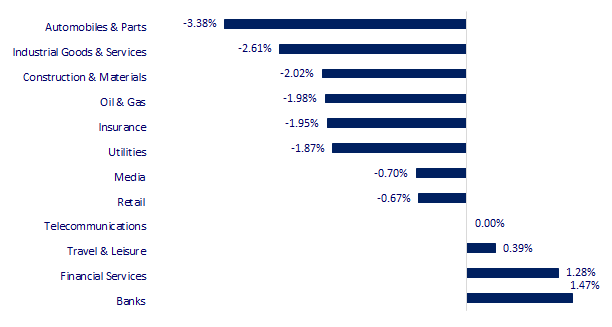

CHANGE IN PRICE BY SECTOR

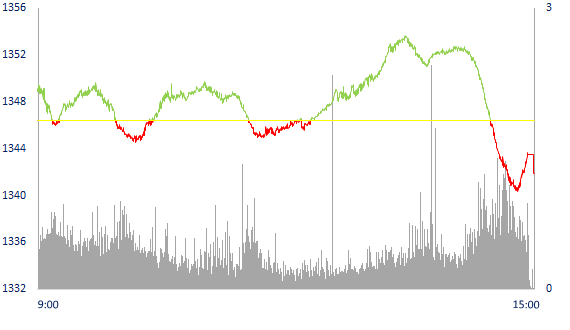

INTRADAY VNINDEX

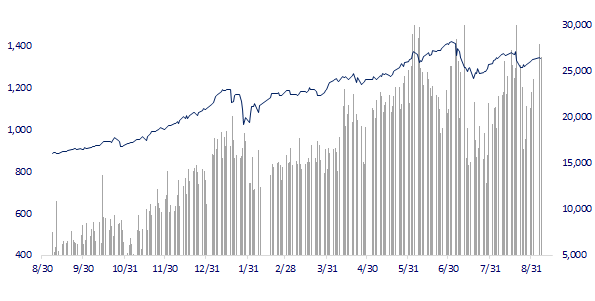

VNINDEX (12M)

GLOBAL MARKET

29,916.14

1D 0.17%

YTD 9.01%

3,676.59

1D 1.51%

YTD 7.68%

3,187.42

1D -0.50%

YTD 10.93%

26,353.63

1D 0.90%

YTD -2.92%

3,108.53

1D 0.24%

YTD 8.34%

1,636.45

1D -0.72%

YTD 12.91%

68.53

1D -0.61%

YTD 41.88%

1,811.85

1D -0.92%

YTD -4.82%

- China trade data positive, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.17%. The Chinese market rose with Shanghai Composite up 1.51%, Shenzhen Component up 1.074%. Hong Kong's Hang Seng rose 0.90%. China released August trade data today, with exports up 25.6% yoy, well ahead of analysts' forecasts for a 17.1% increase. South Korea's Kospi index fell 0.5%.

VIETNAM ECONOMY

0.65%

1D (bps) 15

YTD (bps) 52

5.60%

YTD (bps) -20

0.98%

YTD (bps) -24

1.94%

1D (bps) 3

YTD (bps) -9

22,865

1D (%) 0.03%

YTD (%) -1.35%

27,631

1D (%) -0.10%

YTD (%) -5.06%

3,592

1D (%) -0.06%

YTD (%) 0.53%

- VCCI suggested reducing rent by 50% instead of 30% as at present, in order to support businesses facing difficulties due to the complicated developments of the Covid-19 epidemic, according to which the state budget will lose more 300b dong. However, the shortfall in revenue according to VCCI does not affect this year's budget revenue plan when it is expected to exceed revenue by VND 42,000-47,000 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Leaders of the State Bank: 8 months' credit increased by 7.4%, about to announce the revised Circular on debt structure

- VCCI proposes to reduce rent by 50% for businesses

- Domestic revenue starts to lose steam, the risk of tax debt escalates

- China imports at records of iron ore

- Australia declares its economy stable in the face of Chinese pressure

- China's import and export set records thanks to booming demand in the US and Europe

VN30

BANK

100,000

1D 0.00%

5D 0.60%

Buy Vol. 1,481,700

Sell Vol. 1,924,400

39,700

1D 1.53%

5D 1.93%

Buy Vol. 3,039,700

Sell Vol. 3,147,800

32,650

1D 1.87%

5D 2.67%

Buy Vol. 24,606,200

Sell Vol. 20,863,100

49,650

1D 1.43%

5D 2.37%

Buy Vol. 17,927,800

Sell Vol. 20,362,500

63,500

1D 3.93%

5D 3.08%

Buy Vol. 19,548,200

Sell Vol. 16,954,600

28,600

1D 1.06%

5D 2.51%

Buy Vol. 31,583,700

Sell Vol. 32,146,100

26,700

1D 1.33%

5D 2.89%

Buy Vol. 3,287,700

Sell Vol. 4,171,100

36,400

1D 4.60%

5D 6.74%

Buy Vol. 19,263,400

Sell Vol. 16,573,200

27,900

1D 1.27%

5D 2.01%

Buy Vol. 22,324,000

Sell Vol. 25,968,100

32,500

1D 1.40%

5D 1.56%

Buy Vol. 15,032,700

Sell Vol. 13,208,600

- In today's trading session, bank stocks gained, foreign investors gathered MBB, STB, and CTG. MBB led in terms of trading volume with more than 20.3 million shares. Foreign investors continued to be net buyers of 1.3 million shares. SHB ranked second with more than 15.8 million units traded. Following, STB had nearly 13.8 million shares, foreign investors net bought 800,000 shares. Stocks like TCB, TPB, CTG, ACB, VPB... had trading volume of 10-11 million units. CTG was also net bought by foreign investors about 800,000 shares.

REAL ESTATE

104,800

1D 0.00%

5D 0.38%

Buy Vol. 3,682,100

Sell Vol. 3,586,800

40,600

1D -0.85%

5D 2.14%

Buy Vol. 2,962,400

Sell Vol. 4,241,600

83,000

1D -3.49%

5D -5.57%

Buy Vol. 3,599,400

Sell Vol. 4,249,400

- KDH: wants to sell all 19,850,640 treasury shares. Expected transaction time from September 14, 2021 to October 13, 2021

OIL & GAS

88,700

1D -1.88%

5D -0.78%

Buy Vol. 942,700

Sell Vol. 1,489,400

12,050

1D -2.82%

5D 1.69%

Buy Vol. 23,807,500

Sell Vol. 32,519,700

50,400

1D -1.37%

5D 1.41%

Buy Vol. 3,514,100

Sell Vol. 2,520,200

- PLX reduced treasury shares from 25m to 23.3m shares, accounting for only 1.8% of charter capital. The average selling price reached 53,740 VND/share.

VINGROUP

93,900

1D -1.16%

5D -0.21%

Buy Vol. 3,220,400

Sell Vol. 3,471,900

109,600

1D 1.11%

5D 3.01%

Buy Vol. 17,320,000

Sell Vol. 16,509,800

27,200

1D -3.20%

5D -0.37%

Buy Vol. 5,730,600

Sell Vol. 7,523,100

- VIC sold nearly 100.5m VHM shares from August 19 to September 6. After the transaction, Vingroup also owns 2.2b shares of VHM, accounting for 66.66% of Vinhomes capital.

FOOD & BEVERAGE

86,300

1D -0.57%

5D 0.45%

Buy Vol. 3,981,900

Sell Vol. 5,054,300

129,800

1D -0.99%

5D -3.85%

Buy Vol. 2,605,400

Sell Vol. 1,954,100

148,700

1D -0.34%

5D -0.87%

Buy Vol. 247,100

Sell Vol. 441,300

- SAB: Efforts to reduce costs, profit after tax in the first half of the year still increased slightly to VND 2,057 billion despite Covid-19

OTHERS

124,600

1D -0.88%

5D -1.50%

Buy Vol. 868,400

Sell Vol. 1,161,100

124,600

1D -0.88%

5D -1.50%

Buy Vol. 868,400

Sell Vol. 1,161,100

93,500

1D -1.48%

5D 1.19%

Buy Vol. 3,269,100

Sell Vol. 4,741,800

110,300

1D -0.63%

5D -0.63%

Buy Vol. 1,224,300

Sell Vol. 1,624,300

86,200

1D -0.35%

5D 0.23%

Buy Vol. 1,410,100

Sell Vol. 1,604,700

38,850

1D -1.15%

5D 0.26%

Buy Vol. 11,467,600

Sell Vol. 10,800,200

60,400

1D 0.67%

5D -2.27%

Buy Vol. 38,071,600

Sell Vol. 39,203,400

50,700

1D -0.98%

5D 2.84%

Buy Vol. 46,999,300

Sell Vol. 64,402,200

- GVR: Member of the Board of Directors Pham Van Thanh sold 71,600 shares by order matching method from August 19 to September 1, reducing the holding amount to 200,000 units, accounting for 0.005% of the capital.

Market by numbers

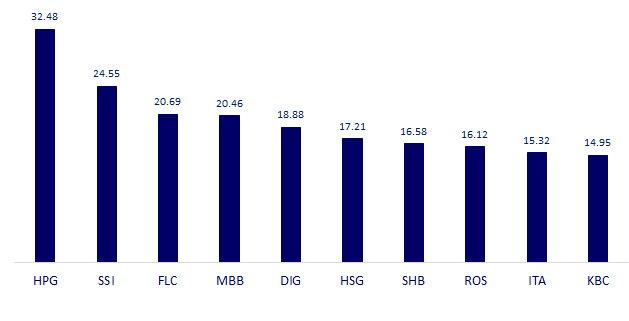

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

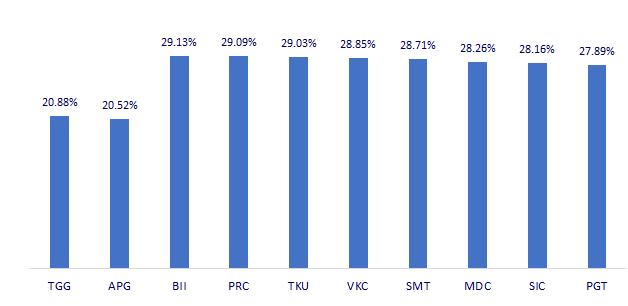

TOP INCREASES 3 CONSECUTIVE SESSIONS

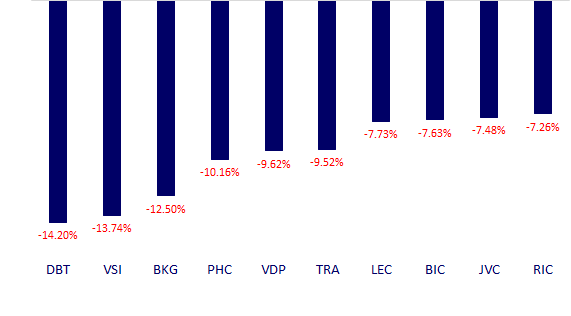

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.