Market Brief 13/09/2021

VIETNAM STOCK MARKET

1,341.43

1D -0.29%

YTD 22.00%

1,444.99

1D -0.23%

YTD 36.53%

349.05

1D -0.29%

YTD 77.09%

95.26

1D -0.16%

YTD 29.03%

-292.82

1D 0.00%

YTD 0.00%

29,002.28

1D 18.73%

YTD 69.08%

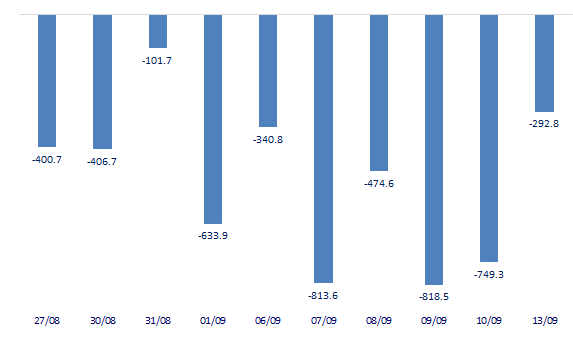

- Foreign investors had the 11th consecutive net selling session on HoSE with a value increase of 46% compared to the previous session and at VND 293 billion, corresponding to a net selling volume of 11.5 million shares. In the past 11 trading sessions, foreign investors on this floor sold a total of 4,855 billion dong.

ETF & DERIVATIVES

24,300

1D -0.78%

YTD 29.26%

17,120

1D -0.06%

YTD 36.63%

18,200

1D 2.19%

YTD 36.84%

21,200

1D 0.00%

YTD 34.18%

20,410

1D 0.49%

YTD 49.52%

25,840

1D 0.35%

YTD 50.23%

18,350

1D 0.27%

YTD 31.54%

1,438

1D -0.46%

YTD 0.00%

1,435

1D -0.73%

YTD 0.00%

1,440

1D -0.35%

YTD 0.00%

1,442

1D -0.35%

YTD 0.00%

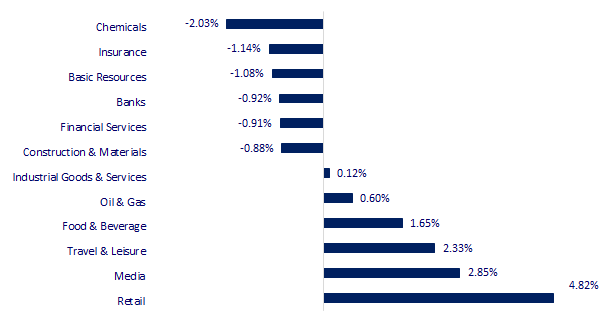

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

30,447.37

1D 0.40%

YTD 10.94%

3,715.37

1D 0.33%

YTD 8.81%

3,127.86

1D 0.07%

YTD 8.85%

25,813.81

1D 0.26%

YTD -4.91%

3,074.31

1D -0.79%

YTD 7.15%

1,633.76

1D -0.10%

YTD 12.72%

70.11

1D -0.20%

YTD 45.16%

1,790.75

1D 0.06%

YTD -5.93%

- Asian stocks mostly, Hong Kong market fell the most in the region. In Japan, the Nikkei 225 gained 0.4%. The Chinese market was mixed with Shanghai Composite up 0.33%, Shenzhen Component down 0.447%. Hong Kong's Hang Seng fell 0.26%. South Korea's Kospi index rose 0.07%.

VIETNAM ECONOMY

0.63%

1D (bps) -2

YTD (bps) 50

5.60%

YTD (bps) -20

1.10%

1D (bps) 13

YTD (bps) -12

1.82%

1D (bps) -7

YTD (bps) -21

22,865

1D (%) 0.00%

YTD (%) -1.35%

27,453

1D (%) -0.15%

YTD (%) -5.67%

3,597

1D (%) -0.17%

YTD (%) 0.67%

- Facing the current difficulties and obstacles that the FDI business community is facing, leaders of many FDI enterprises have made many recommendations to expect the localities as well as the Government to consider, solve and create favorable conditions for them. for efficient production and business, especially after the epidemic is under control.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Dong Nai will open its economy after September 15 in 2 phases

- Troubleshooting for a 4 billion USD project in Bac Lieu

- Retaining FDI enterprises: FDI enterprises recommend many important policies

- The global transportation industry is under the control of a few "big guys" causing many difficulties

- 'New sectors' in US-China strategic competition

- new outbreak broke out in China due to the Delta mutation

VN30

BANK

98,100

1D -1.11%

5D -1.90%

Buy Vol. 1,731,200

Sell Vol. 1,864,100

39,150

1D -1.26%

5D 0.13%

Buy Vol. 2,526,600

Sell Vol. 2,832,600

31,850

1D -1.39%

5D -0.62%

Buy Vol. 13,484,900

Sell Vol. 14,743,000

48,950

1D -0.71%

5D 0.00%

Buy Vol. 10,325,000

Sell Vol. 12,546,100

64,800

1D 0.31%

5D 6.06%

Buy Vol. 12,634,000

Sell Vol. 17,316,100

27,900

1D -1.06%

5D -1.41%

Buy Vol. 21,043,600

Sell Vol. 24,966,500

25,200

1D -2.70%

5D -4.36%

Buy Vol. 4,693,300

Sell Vol. 4,276,200

38,100

1D 1.87%

5D 9.48%

Buy Vol. 11,152,600

Sell Vol. 13,752,200

26,900

1D -1.10%

5D -2.36%

Buy Vol. 16,136,300

Sell Vol. 18,849,800

31,900

1D -1.24%

5D -0.47%

Buy Vol. 8,230,500

Sell Vol. 9,085,100

- VPB: Resolution of the Board of Directors on the issue of shares to existing shareholders at the rate of 80% with the expected issuance volume of nearly 2 billion shares.

REAL ESTATE

103,000

1D -0.29%

5D -1.72%

Buy Vol. 3,145,800

Sell Vol. 3,257,700

41,250

1D 1.73%

5D 0.73%

Buy Vol. 9,094,100

Sell Vol. 8,666,000

80,500

1D -2.19%

5D -6.40%

Buy Vol. 4,432,800

Sell Vol. 4,163,200

- Thai Nguyen proposed to supplement the list of 312 projects that need land more than 3,600ha in 2021, including many large-scale urban and housing projects.

OIL & GAS

88,600

1D 0.00%

5D -1.99%

Buy Vol. 833,200

Sell Vol. 1,309,100

11,850

1D -2.07%

5D -4.44%

Buy Vol. 17,836,100

Sell Vol. 26,800,600

50,300

1D -0.40%

5D -1.57%

Buy Vol. 2,754,700

Sell Vol. 2,291,900

- PLX: From August 6 to September 3, ENEOS Corporation bought 2.7 million shares of PLX, increasing its holding ratio to 5.08% or 65.7 million shares.

VINGROUP

92,000

1D 0.77%

5D -3.16%

Buy Vol. 2,946,200

Sell Vol. 3,464,900

107,000

1D -0.47%

5D -1.29%

Buy Vol. 13,463,400

Sell Vol. 15,879,900

27,900

1D -0.36%

5D -0.71%

Buy Vol. 7,071,200

Sell Vol. 10,122,700

- VIC and VHM were the top stocks that were sold the most by foreign investors in today's session with the value of 182 billion dong and 162 billion dong, respectively

FOOD & BEVERAGE

87,200

1D 0.81%

5D 0.46%

Buy Vol. 5,888,600

Sell Vol. 5,523,500

130,600

1D 0.46%

5D -0.38%

Buy Vol. 2,232,400

Sell Vol. 1,936,100

161,500

1D 6.67%

5D 8.24%

Buy Vol. 1,632,500

Sell Vol. 1,560,000

- MSN: Separating the bran segment contributed 80% of Masan MEATLife's revenue and raised more than VND 7,000 billion

OTHERS

128,000

1D -1.39%

5D 1.83%

Buy Vol. 1,121,200

Sell Vol. 1,341,100

128,000

1D -1.39%

5D 1.83%

Buy Vol. 1,121,200

Sell Vol. 1,341,100

93,000

1D -0.53%

5D -2.00%

Buy Vol. 3,025,300

Sell Vol. 3,322,400

125,000

1D 5.13%

5D 12.61%

Buy Vol. 4,071,200

Sell Vol. 3,221,900

92,000

1D -2.13%

5D 6.36%

Buy Vol. 688,400

Sell Vol. 1,011,600

37,700

1D -4.07%

5D -4.07%

Buy Vol. 12,255,800

Sell Vol. 12,339,300

43,600

1D -0.46%

5D 6.07%

Buy Vol. 19,076,300

Sell Vol. 20,787,300

50,800

1D -1.36%

5D -0.78%

Buy Vol. 43,556,500

Sell Vol. 45,937,600

- VJC: Director of the Civil Aviation Authority of Vietnam Dinh Viet Thang has sent a written report to the Ministry of Transport to approve the plan to operate regular domestic passenger routes during the epidemic prevention period. Currently, only a few cargo flights are allowed.

Market by numbers

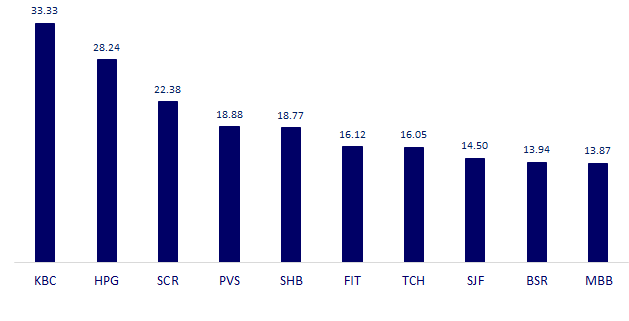

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

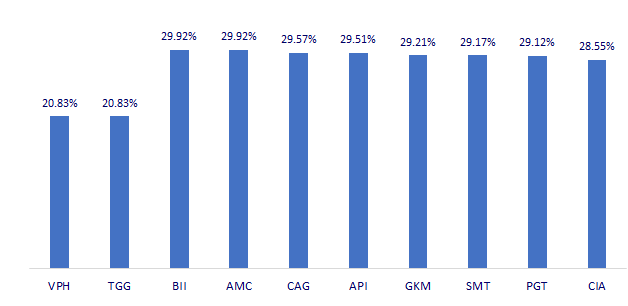

TOP INCREASES 3 CONSECUTIVE SESSIONS

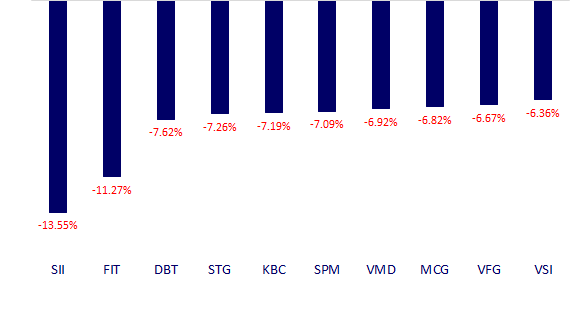

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.