Market Brief 20/09/2021

VIETNAM STOCK MARKET

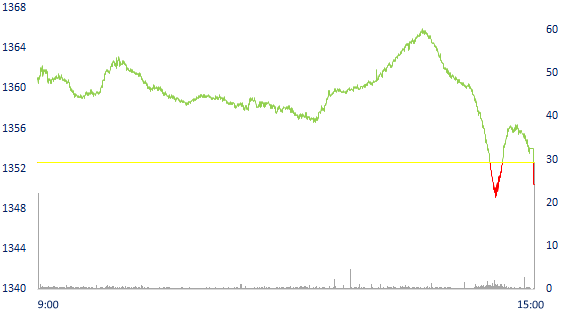

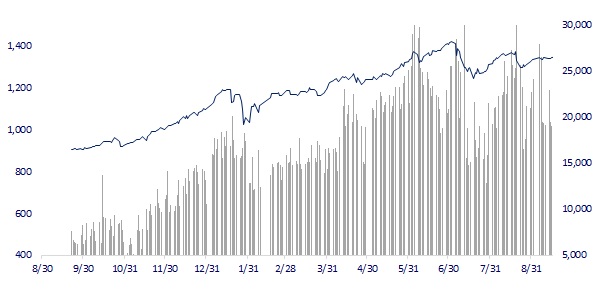

1,350.48

1D -0.16%

YTD 22.83%

1,458.66

1D 0.21%

YTD 37.82%

358.87

1D 0.25%

YTD 82.08%

97.45

1D 0.05%

YTD 31.99%

37.24

1D 0.00%

YTD 0.00%

31,370.65

1D -3.29%

YTD 82.89%

- Session 20/9: Foreign investors suddenly returned to a net buying of 37 billion dong on all 3 exchanges; On HoSE alone, the net buying was over 56 billion dong. In which, VCB was bought the most, while on the contrary, VIC continued to be sold strongly by foreign investors.

ETF & DERIVATIVES

24,990

1D 1.75%

YTD 32.93%

17,280

1D 0.47%

YTD 37.91%

18,260

1D 2.53%

YTD 37.29%

21,600

1D 0.93%

YTD 36.71%

20,660

1D 1.32%

YTD 51.36%

26,180

1D 0.31%

YTD 52.21%

18,400

1D 0.27%

YTD 31.90%

1,449

1D -0.28%

YTD 0.00%

1,454

1D 0.06%

YTD 0.00%

1,452

1D -0.33%

YTD 0.00%

1,450

1D 0.00%

YTD 0.00%

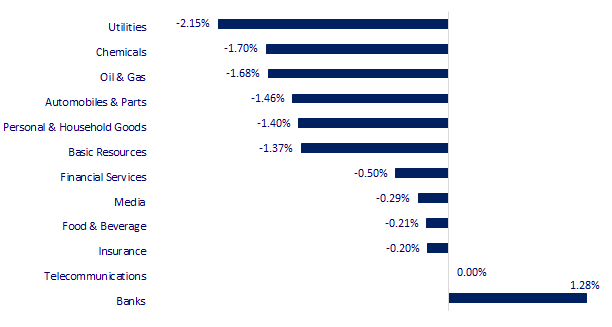

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

30,500.05

1D 0.00%

YTD 11.13%

3,613.97

1D 0.00%

YTD 5.84%

3,140.51

1D 0.00%

YTD 9.29%

24,099.14

1D -1.47%

YTD -11.23%

3,041.73

1D -0.96%

YTD 6.01%

1,603.06

1D -1.39%

YTD 10.61%

70.20

1D -1.63%

YTD 45.34%

1,759.65

1D 0.43%

YTD -7.56%

- Hong Kong's Hang Seng plunged more than 1.47%, Asian stocks fell. Japan market, Mainland China and Korea public holiday. Hong Kong's Hang Seng fell 3.3%. Shares of Chinese real estate group Evergrande continued to drop 10.24%, in one session losing up to 17% because of the risk of default. A series of insurance stocks listed in Hong Kong shared the same fate, AIA lost 4.94%, Ping An Insurance fell 5.78%.

VIETNAM ECONOMY

0.64%

YTD (bps) 51

5.60%

YTD (bps) -20

1.08%

YTD (bps) -14

1.86%

YTD (bps) -17

22,873

1D (%) 0.01%

YTD (%) -1.32%

27,280

1D (%) -0.11%

YTD (%) -6.26%

3,592

1D (%) 0.03%

YTD (%) 0.53%

- According to preliminary statistics of the General Department of Customs, corn imports of all kinds in the first 8 months of the year reached 6.9 million tons, worth over US$1.91 billion, down 2.8% in volume but up 32.2 % of turnover. Calculating, in the first 8 months of the year, each ton of corn had an average price of 278.9 USD, up 36% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ho Chi Minh City considers delaying the collection of seaport infrastructure fees

- Prices increased sharply, Vietnam spent more than $1.9 billion importing corn

- Low rate of Covid-19 vaccination challenges the recovery plan of the transport industry

- Europe is at risk of fertilizer shortage due to record high gas prices

- Inflation in the EU is the highest in 10 years

- Australia raised a request to consider admitting China to the CPTPP

VN30

BANK

99,600

1D 2.47%

5D 1.53%

39,900

1D -0.25%

5D 1.92%

31,850

1D 0.16%

5D 0.00%

50,700

1D 1.91%

5D 3.58%

67,500

1D 0.75%

5D 4.17%

28,250

1D 1.44%

5D 1.25%

25,700

1D 0.98%

5D 1.98%

40,100

1D -1.72%

5D 5.25%

27,100

1D 1.12%

5D 0.74%

32,100

1D 1.58%

5D 0.63%

- VCB: The Government has agreed to add more than 7,600 billion VND of State capital to Vietcombank. Additional capital from dividends for State shareholders, through the issuance of shares by Vietcombank to pay dividends from the remaining after-tax profit of 2019 after setting aside funds and paying dividends in cash. The State Bank of Vietnam owns 74.8% of Vietcombank's capital, by the end of 2020.

REAL ESTATE

103,000

1D -0.19%

5D 0.00%

42,200

1D 0.48%

5D 2.30%

82,900

1D 3.63%

5D 2.98%

- PDR: After completing the M&A deal, PDR officially owns a rare land bank with 3 fronts with an area of nearly 3,000 m2 at the intersection of Bach Dang - Tran Phu - Le Hong Phong.

OIL & GAS

88,800

1D -3.37%

5D 0.23%

11,750

1D 0.00%

5D -0.84%

50,000

1D -1.38%

5D -0.60%

- GAS: In July and August, GAS estimated revenue of 11,730b dong, NPAT of 1,340b dong. Average revenue in these months decreased by 12.5% compared first half; profits fell 29%.

VINGROUP

86,700

1D -0.12%

5D -5.76%

79,900

1D -1.60%

5D -1.54%

29,300

1D 0.34%

5D 5.02%

- VHM: Vinhomes is currently the largest enterprise by market capitalization in Vietnam with US$17.1 billion, in the real estate sector.

FOOD & BEVERAGE

88,700

1D 2.54%

5D 1.72%

143,000

1D -2.05%

5D 9.49%

158,300

1D -1.68%

5D -1.98%

- VNM: F&N Dairy Investment PTE.LTD, a unit related to Board member Lee Meng Tat, registered to buy 20.9 million VNM shares from September 22 to October 21.

OTHERS

124,200

1D -0.56%

5D -2.97%

124,200

1D -0.56%

5D -2.97%

94,400

1D -1.36%

5D 1.51%

123,000

1D 0.00%

5D -1.60%

91,000

1D -1.62%

5D -1.09%

37,400

1D -2.98%

5D -0.80%

42,800

1D -0.47%

5D -1.83%

51,300

1D -0.97%

5D 0.98%

- VJC: has just announced its semi-annual review financial report 2021 by PWC Auditing Company. The report shows that in the first 6 months of the year, the parent company achieved air transport revenue of VND5,022b. Total profit after tax reached VND34.2b, up 102% over the same period in 2020 thanks to the profit from investment in new projects. Compared to the financial statements prepared by Vietjet, the review report recorded a 148% increase in NPAT.

Market by numbers

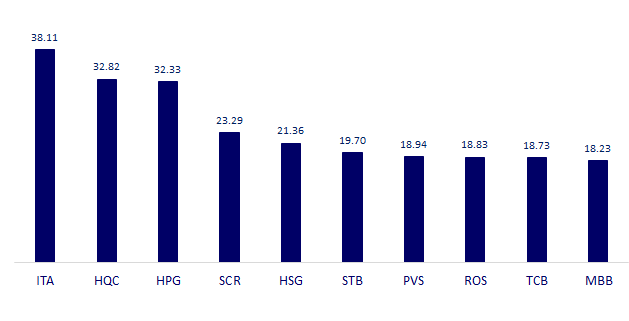

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

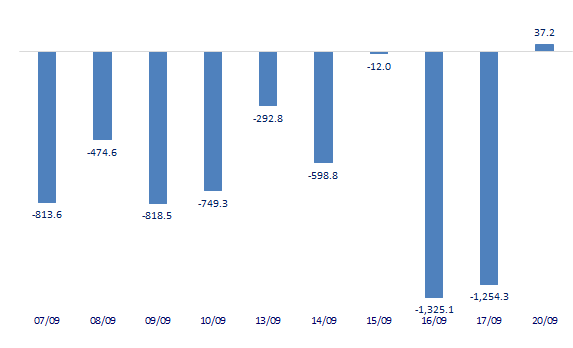

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

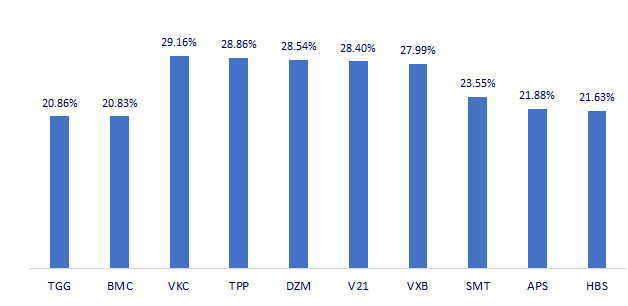

TOP INCREASES 3 CONSECUTIVE SESSIONS

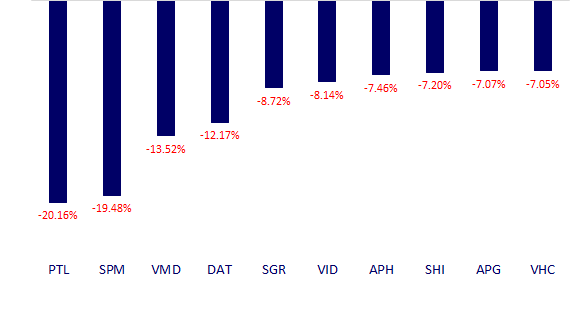

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.