Market brief 08/10/2021

VIETNAM STOCK MARKET

1,372.73

1D 0.49%

YTD 24.85%

1,476.54

1D 0.94%

YTD 39.51%

371.92

1D 0.41%

YTD 88.70%

98.30

1D 0.35%

YTD 33.14%

-121.19

1D 0.00%

YTD 0.00%

21,653.73

1D -10.26%

YTD 26.24%

- Session 8/10: Foreign investors reduced their net selling to 121 billion dong. Foreign investors still maintained the strongest net selling of HPG, besides VNM, PAN, SSI...; In the opposite direction, foreign capital was poured into stocks such as HAH, DHC, VHM.

ETF & DERIVATIVES

24,900

1D 1.22%

YTD 32.45%

17,400

1D 1.16%

YTD 38.87%

18,380

1D 3.20%

YTD 38.20%

21,600

1D 0.47%

YTD 36.71%

19,770

1D -0.10%

YTD 44.84%

26,590

1D 2.27%

YTD 54.59%

18,490

1D 0.82%

YTD 32.54%

1,475

1D 1.35%

YTD 0.00%

1,469

1D 1.17%

YTD 0.00%

1,468

1D 1.24%

YTD 0.00%

1,465

1D 1.05%

YTD 0.00%

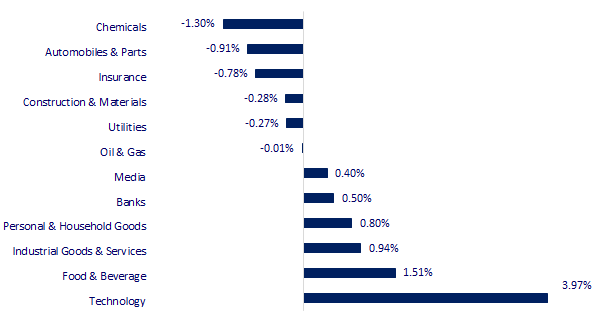

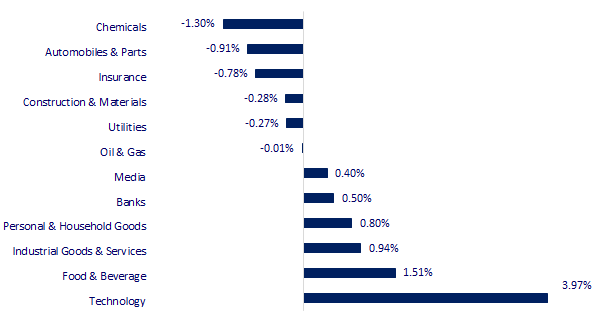

CHANGE IN PRICE BY SECTOR

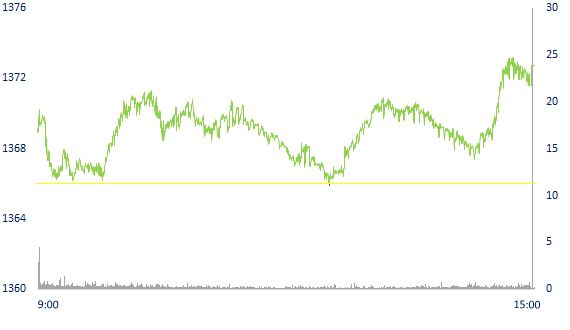

INTRADAY VNINDEX

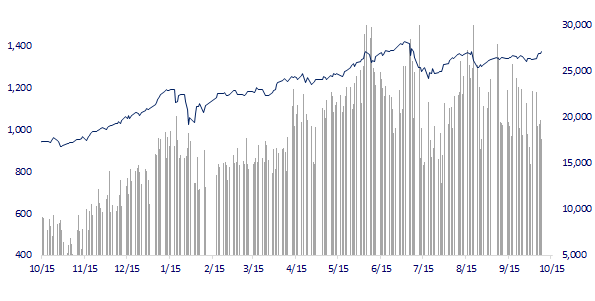

VNINDEX (12M)

GLOBAL MARKET

28,048.94

1D -0.63%

YTD 2.20%

3,592.17

1D 0.67%

YTD 5.20%

2,956.30

1D -0.11%

YTD 2.88%

24,837.85

1D 0.20%

YTD -8.51%

3,112.81

1D 0.38%

YTD 8.49%

1,639.41

1D 0.43%

YTD 13.11%

78.94

1D -0.08%

YTD 63.44%

1,761.85

1D 0.22%

YTD -7.45%

- Asian stocks mixed, China market prospered after the holiday week. In Japan, the Nikkei 225 fell 0.63%. The Chinese market is trading again after the holiday week. Shanghai Composite increased 0.67%, Shenzhen Component increased 0.74%. Hong Kong's Hang Seng rose 0.2%. South Korea's Kospi index fell 0.11%.

VIETNAM ECONOMY

0.67%

1D (bps) 1

YTD (bps) 54

5.60%

YTD (bps) -20

1.02%

1D (bps) 1

YTD (bps) -20

1.99%

1D (bps) 5

YTD (bps) -4

22,855

1D (%) 0.00%

YTD (%) -1.39%

26,753

1D (%) 0.06%

YTD (%) -8.07%

3,599

1D (%) -0.03%

YTD (%) 0.73%

- The VASEP said that in the first half of September 2021, seafood exports continued to be heavily affected by production interruptions, so it decreased deeply by 31% over the same period last year. The easing of the gap since mid-September has boosted the production recovery somewhat, reflected in the export results in the second half of the month. Accordingly, seafood export turnover in September 2021 reached over USD 628 million, down 23% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Seafood exports in September 2021 continued to decrease by 23%

- National Assembly Chairman: 'There will be a larger support package, with the goal of rebuilding the economy'

- Many breakthroughs in the development planning of Vietnam's seaport system

- Minimum global tax rate agreement makes new progress as Ireland agrees

- Europe is becoming a 'hostage' of the Russian gas giant

- Europe divided over how to respond to the energy crisis

VN30

BANK

97,000

1D 0.21%

5D 1.15%

Buy Vol. 1,781,600

Sell Vol. 1,158,500

39,200

1D 0.13%

5D 1.03%

Buy Vol. 2,496,300

Sell Vol. 2,106,900

29,450

1D 0.34%

5D -1.01%

Buy Vol. 11,998,700

Sell Vol. 13,038,400

50,700

1D 1.40%

5D 3.47%

Buy Vol. 12,325,700

Sell Vol. 15,715,400

35,900

1D 0.70%

5D 1.12%

Buy Vol. 9,041,400

Sell Vol. 10,541,400

27,700

1D 0.18%

5D 0.91%

Buy Vol. 12,098,100

Sell Vol. 16,156,700

24,350

1D 1.04%

5D -2.01%

Buy Vol. 2,895,300

Sell Vol. 2,382,000

42,150

1D 0.36%

5D -1.06%

Buy Vol. 5,526,000

Sell Vol. 6,594,900

25,700

1D 0.78%

5D 4.05%

Buy Vol. 17,298,600

Sell Vol. 20,881,100

31,450

1D 0.80%

5D -0.16%

Buy Vol. 7,541,900

Sell Vol. 6,574,900

- CTG: Successfully issued a lot of bonds with a total par value of VND50 billion, term of 8 years, actual issuance interest rate of 6.43%. Non-convertible, unsecured bonds, satisfying the conditions to be included in Tier 2 capital according to regulations. - BID: The Board of Directors decided on approving the pre-payment transaction of part of BIDV's deposit contract at Bank for Investment and Development of Cambodia (BIDC) and Laos-Vietnam Joint Venture Bank (LVB).

REAL ESTATE

104,500

1D 0.38%

5D 2.45%

Buy Vol. 2,091,300

Sell Vol. 2,818,300

43,550

1D 2.83%

5D 5.45%

Buy Vol. 9,620,600

Sell Vol. 8,700,900

87,000

1D 1.87%

5D 3.57%

Buy Vol. 5,110,400

Sell Vol. 4,520,800

- Recently, Quang Nam province has issued a document to agree to adjust the planning, not to arrange the social housing land fund in the Northwest model urban area project.

OIL & GAS

112,400

1D 1.26%

5D 8.60%

Buy Vol. 3,215,000

Sell Vol. 3,801,300

12,450

1D -1.58%

5D 2.05%

Buy Vol. 37,776,900

Sell Vol. 42,541,900

53,900

1D -0.19%

5D 3.85%

Buy Vol. 1,599,300

Sell Vol. 2,863,500

- The $2.3 billion LNG gas power project in Quang Tri belongs to a consortium of T&T Group, Hanwha Energy, South Korea Power Corporation (KOSPO) and Korea Gas Corporation (KOGAS).

VINGROUP

89,300

1D 0.56%

5D 1.82%

Buy Vol. 2,257,200

Sell Vol. 3,233,200

79,900

1D -0.13%

5D 3.77%

Buy Vol. 5,870,800

Sell Vol. 6,527,200

29,150

1D -0.51%

5D 3.37%

Buy Vol. 5,142,400

Sell Vol. 6,656,200

- VRE: Hung Yen is looking for investors for a complex of shopping centers and townhouses of nearly 4 hectares, once planned by Vincom Retail

FOOD & BEVERAGE

89,600

1D 0.90%

5D -0.22%

Buy Vol. 6,427,700

Sell Vol. 4,751,500

145,500

1D 2.68%

5D 3.93%

Buy Vol. 1,578,000

Sell Vol. 1,780,400

162,700

1D 2.59%

5D 5.51%

Buy Vol. 270,300

Sell Vol. 309,400

- MSN: VN Consumer Meat II has just registered to sell more than 23.16 million shares of Masan MEATLife JSC, equivalent to 7.1% of charter capital. Expected transaction from 11/10/2021 to 9/11/2021

OTHERS

128,900

1D 0.08%

5D 0.08%

Buy Vol. 855,800

Sell Vol. 901,900

128,900

1D 0.08%

5D 0.08%

Buy Vol. 855,800

Sell Vol. 901,900

98,900

1D 4.88%

5D 6.46%

Buy Vol. 14,451,300

Sell Vol. 15,424,300

128,800

1D 0.63%

5D 2.06%

Buy Vol. 2,313,700

Sell Vol. 3,016,300

99,500

1D 2.58%

5D 0.51%

Buy Vol. 1,193,200

Sell Vol. 1,239,400

37,650

1D -1.44%

5D 4.29%

Buy Vol. 5,957,900

Sell Vol. 7,955,100

40,850

1D 0.37%

5D 4.21%

Buy Vol. 12,187,700

Sell Vol. 14,127,800

55,700

1D 0.18%

5D 4.31%

Buy Vol. 43,658,800

Sell Vol. 42,381,400

- MWG: Mobile World suggests that before October 25, the owner of the premises will respond to the rental reduction proposal that has been made by the company. If after October 25, the site owner does not respond, MWG will expedite the contract liquidation procedures under the force majeure conditions stated in the contract signed by the two parties.

Market by numbers

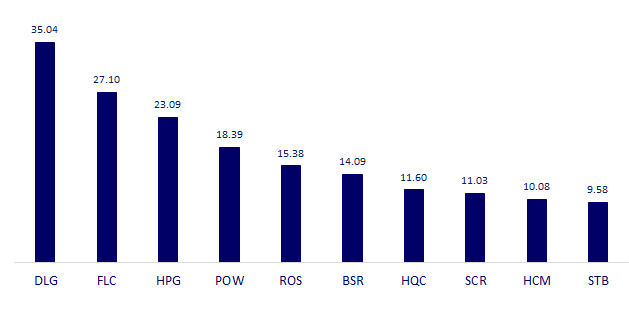

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

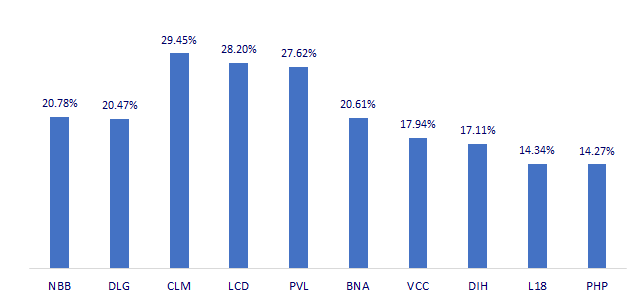

TOP INCREASES 3 CONSECUTIVE SESSIONS

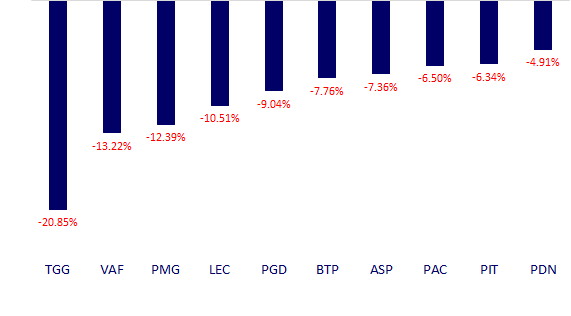

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.