Market Brief 12/10/2021

VIETNAM STOCK MARKET

1,394.80

1D 0.05%

YTD 26.86%

1,509.57

1D -0.05%

YTD 42.63%

375.68

1D 0.36%

YTD 90.60%

98.81

1D 0.01%

YTD 33.83%

-55.78

1D 0.00%

YTD 0.00%

27,028.70

1D -7.48%

YTD 57.57%

- Foreign investors net sold again 39 billion dong on HoSE in the session of 12/10. FMC was still the strongest net buying by foreign investors with 270 billion dong and most of them were through agreements.

ETF & DERIVATIVES

25,450

1D 0.20%

YTD 35.37%

17,760

1D -0.22%

YTD 41.74%

18,510

1D 3.93%

YTD 39.17%

22,200

1D 0.00%

YTD 40.51%

20,570

1D -0.82%

YTD 50.70%

26,800

1D -0.59%

YTD 55.81%

18,870

1D -0.47%

YTD 35.27%

1,510

1D -0.23%

YTD 0.00%

1,504

1D -0.36%

YTD 0.00%

1,493

1D -0.78%

YTD 0.00%

1,498

1D -0.21%

YTD 0.00%

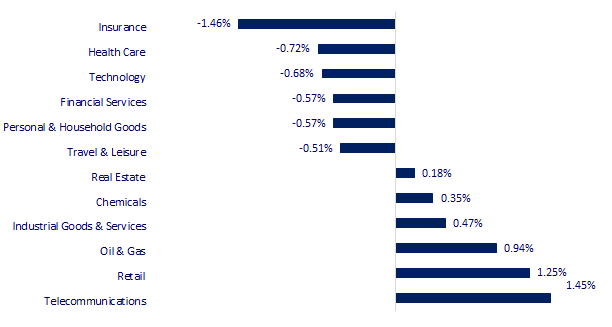

CHANGE IN PRICE BY SECTOR

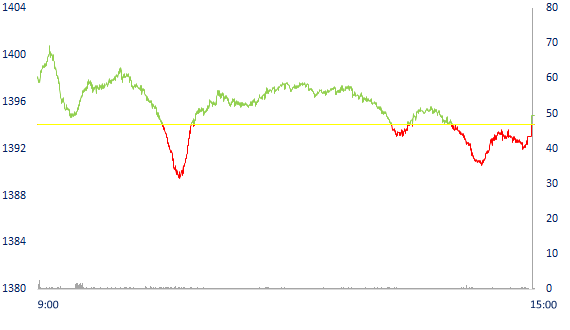

INTRADAY VNINDEX

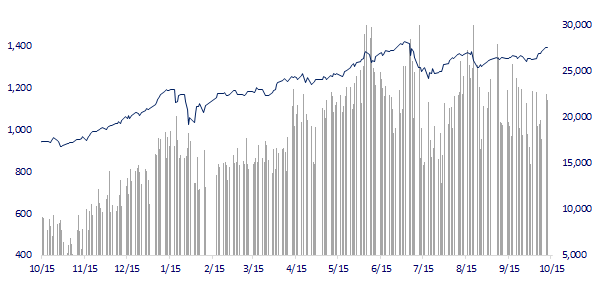

VNINDEX (12M)

GLOBAL MARKET

28,230.61

1D 0.03%

YTD 2.87%

3,546.94

1D -1.25%

YTD 3.88%

2,916.38

1D -1.35%

YTD 1.49%

24,962.59

1D -0.05%

YTD -8.05%

3,112.05

1D -0.05%

YTD 8.46%

1,641.20

1D 0.48%

YTD 13.24%

80.67

1D 0.80%

YTD 67.02%

1,760.75

1D 0.29%

YTD -7.51%

- Asian stocks are mixed, investors monitor oil price movements. In Japan, the Nikkei 225 gained 0.03%. The Chinese market fell with the Shanghai Composite down 1.25%. Hong Kong's Hang Seng fell 0.05%. South Korea's Kospi index fell 1.35%.

VIETNAM ECONOMY

0.66%

1D (bps) -1

YTD (bps) 53

5.60%

YTD (bps) -20

1.04%

1D (bps) -16

YTD (bps) -18

2.03%

1D (bps) 11

22,856

1D (%) 0.03%

YTD (%) -1.39%

26,748

1D (%) 0.09%

YTD (%) -8.09%

3,596

1D (%) -0.03%

YTD (%) 0.64%

- According to the report of the Ministry of Transport, the investment project to build the North-South Expressway in the East in the 2017-2020 period is 654 km long, divided into 11 component projects, including: eight public investment projects and three projects. investment projects in the form of public-private partnership (PPP). Site clearance work started from June 2019. As of September 2021, local authorities have completed site clearance and handed over 642.4/652.3 km (98.4%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Khanh Hoa proposes to pilot international visitors with 'vaccine passports' from next month

- Report to the Politburo on the establishment of a free trade zone in Hai Phong

- Report to the National Assembly on the implementation progress of the North-South Expressway in the East

- US: OPEC+ needs to do more to support economic recovery

- EU expands sanctions list against Russia

- WB: Debt of low-income countries will increase 12% to a record of 860 billion USD in 2020

VN30

BANK

97,000

1D -0.51%

5D 1.46%

Buy Vol. 1,151,300

Sell Vol. 1,592,000

40,250

1D 0.63%

5D 2.42%

Buy Vol. 3,044,500

Sell Vol. 4,705,600

30,800

1D -0.65%

5D 4.41%

Buy Vol. 18,318,500

Sell Vol. 23,909,400

53,000

1D 0.00%

5D 7.94%

Buy Vol. 24,714,000

Sell Vol. 32,505,500

36,700

1D -0.27%

5D 5.52%

Buy Vol. 11,194,700

Sell Vol. 11,334,300

28,750

1D -0.17%

5D 4.93%

Buy Vol. 23,429,700

Sell Vol. 33,828,500

25,550

1D -0.39%

5D 4.29%

Buy Vol. 3,146,800

Sell Vol. 3,947,000

42,700

1D -0.93%

5D 0.47%

Buy Vol. 2,926,700

Sell Vol. 5,907,000

26,600

1D 0.38%

5D 3.30%

Buy Vol. 23,451,500

Sell Vol. 24,822,000

32,600

1D 0.00%

5D 3.49%

Buy Vol. 7,446,800

Sell Vol. 8,977,500

- HDB: HDBank has just completed paying the dividend for 2020 in shares at the rate of 25%. Previously, on August 27, 2021, HDBank closed the list of shareholders entitled to receive dividends in shares in 2020 at the rate of 25%. According to the approved profit distribution plan, HDBank issued 398.4m shares to pay dividends to shareholders. The source of capital for issuance is from accumulated undistributed profits according to the 2020 financial statements which have been audited and fully set aside funds in accordance with regulations. After completing the dividend payment, HDBank's charter capital is currently over VND20,073b.

REAL ESTATE

103,000

1D -0.96%

5D -1.34%

Buy Vol. 2,811,300

Sell Vol. 5,155,300

43,550

1D -0.23%

5D 4.81%

Buy Vol. 4,053,700

Sell Vol. 3,559,500

88,500

1D -0.34%

5D 5.36%

Buy Vol. 4,846,900

Sell Vol. 4,902,400

- Nghe An province is looking for investors for an urban area project in Quynh Ba commune, Quynh Luu commune with a scale of 9.2 ha, total investment of nearly 700 billion VND.

OIL & GAS

112,000

1D -0.44%

5D 2.75%

Buy Vol. 3,164,200

Sell Vol. 3,712,400

12,700

1D 2.42%

5D -0.39%

Buy Vol. 46,070,700

Sell Vol. 42,452,400

55,000

1D 0.18%

5D 2.04%

Buy Vol. 5,110,100

Sell Vol. 5,213,700

- GAS: in 9M2021, due to Covid-19 epidemic, customers' gas mobilization decreased, especially gas mobilization for electricity by about 72% of the same period last year.

VINGROUP

92,900

1D 1.09%

5D 4.85%

Buy Vol. 4,221,400

Sell Vol. 4,935,100

80,900

1D -0.12%

5D 1.89%

Buy Vol. 12,039,700

Sell Vol. 13,740,800

30,800

1D 1.15%

5D 8.26%

Buy Vol. 11,187,400

Sell Vol. 14,390,100

- VRE was in the top of the stocks that were bought the most by foreign investors in today's session with a value of more than 81 billion dong

FOOD & BEVERAGE

90,400

1D 0.44%

5D 0.89%

Buy Vol. 7,588,100

Sell Vol. 8,002,500

145,500

1D -1.02%

5D 3.05%

Buy Vol. 1,121,800

Sell Vol. 1,546,400

163,000

1D 0.00%

5D 1.56%

Buy Vol. 123,300

Sell Vol. 183,700

- SAB: In the third quarter, net revenue and net profit are expected to be VND 4,000 billion (down 50%) and VND 1,000 billion (down 30%) respectively due to prolonged social distancing regulations.

OTHERS

132,500

1D 0.00%

5D 1.30%

Buy Vol. 993,300

Sell Vol. 1,103,700

132,500

1D 0.00%

5D 1.30%

Buy Vol. 993,300

Sell Vol. 1,103,700

99,000

1D -0.20%

5D 4.87%

Buy Vol. 2,281,200

Sell Vol. 2,850,200

132,100

1D 2.01%

5D 4.18%

Buy Vol. 3,404,900

Sell Vol. 4,046,400

100,000

1D -1.96%

5D 3.09%

Buy Vol. 543,100

Sell Vol. 946,600

37,800

1D 0.00%

5D 0.80%

Buy Vol. 7,386,200

Sell Vol. 9,904,800

41,400

1D -1.19%

5D 2.48%

Buy Vol. 12,660,000

Sell Vol. 16,596,100

57,000

1D -0.35%

5D 3.07%

Buy Vol. 31,930,200

Sell Vol. 35,559,600

- PNJ: has just approved a bank loan credit limit of VND1,260b to supplement capital for business and guarantee activities. By the end of the second quarter, PNJ had no long-term debt, short-term debt of nearly 2,126b dong, an increase of 15% compared to the beginning of the year. 92% of loans, equivalent to more than 1,952b dong, are loans from banks such as Vietcombank (nearly 547 billion dong), BIDV (420 billion dong), VietinBank (more than 370 billion dong), SeABank (201 billion dong)...

Market by numbers

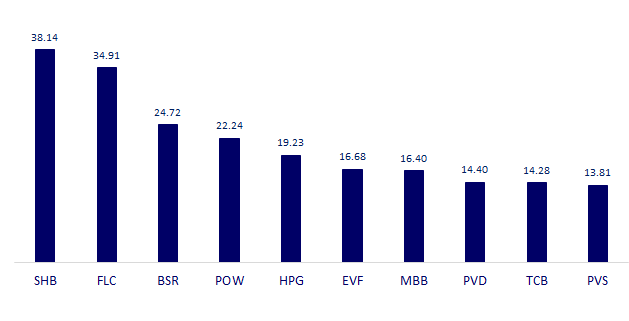

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

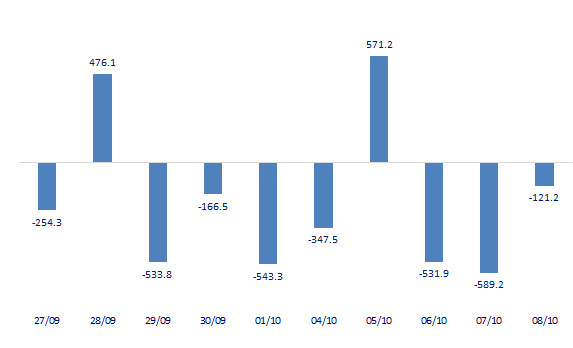

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

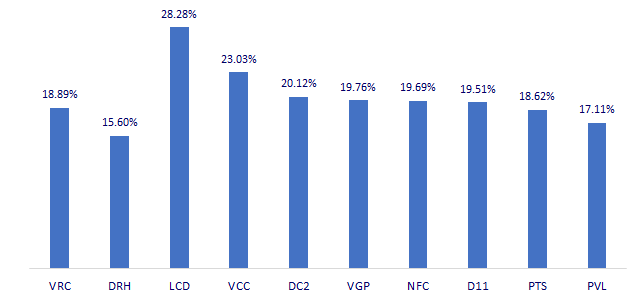

TOP INCREASES 3 CONSECUTIVE SESSIONS

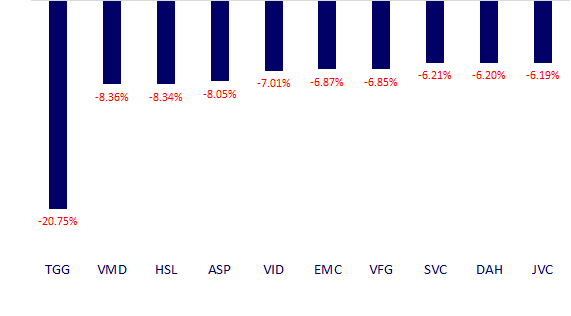

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.