Market Brief 13/10/2021

VIETNAM STOCK MARKET

1,391.91

1D -0.21%

YTD 26.60%

1,505.55

1D -0.27%

YTD 42.25%

379.34

1D 0.97%

YTD 92.46%

98.78

1D -0.03%

YTD 33.79%

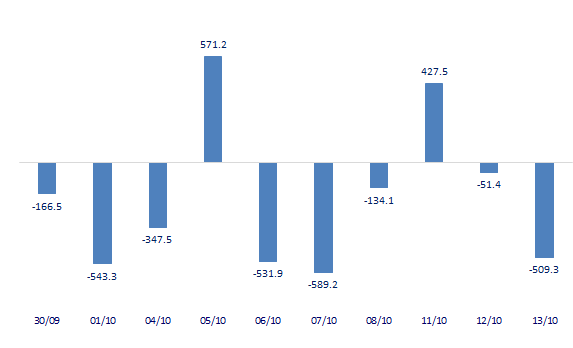

-509.27

1D 0.00%

YTD 0.00%

22,996.17

1D -14.92%

YTD 34.06%

- Foreign investors boosted a net selling of more than 509b dong in the session on October 13, HPG was still the focus. HPG was still being sold the most by foreign investors with 149b dong. SSI and VNM were net sold 70b dong and 66b dong respectively. On the other side, HAH was the strongest net buying in the market with 82b dong. VRE and HDG were net bought 44b dong and 31b dong respectively.

ETF & DERIVATIVES

25,400

1D -0.20%

YTD 35.11%

17,720

1D -0.23%

YTD 41.42%

18,800

1D 5.56%

YTD 41.35%

21,900

1D -1.35%

YTD 38.61%

20,340

1D -1.12%

YTD 49.01%

27,200

1D 1.49%

YTD 58.14%

19,010

1D 0.74%

YTD 36.27%

1,503

1D -0.46%

YTD 0.00%

1,500

1D -0.27%

YTD 0.00%

1,496

1D 0.17%

YTD 0.00%

1,497

1D -0.05%

YTD 0.00%

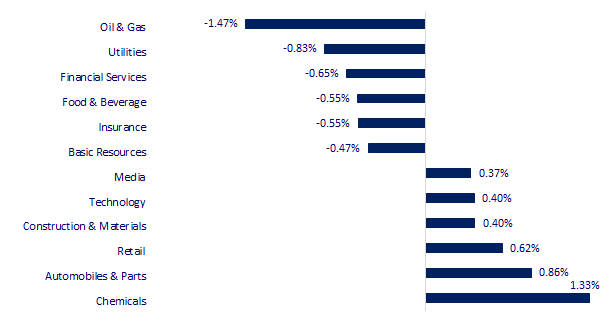

CHANGE IN PRICE BY SECTOR

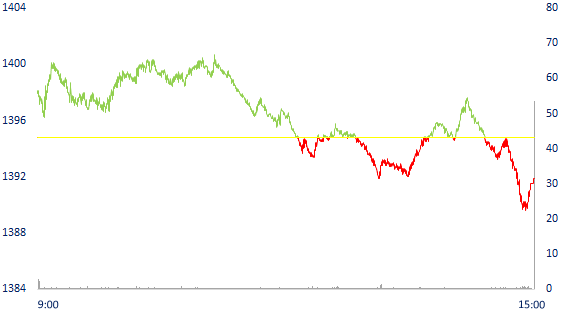

INTRADAY VNINDEX

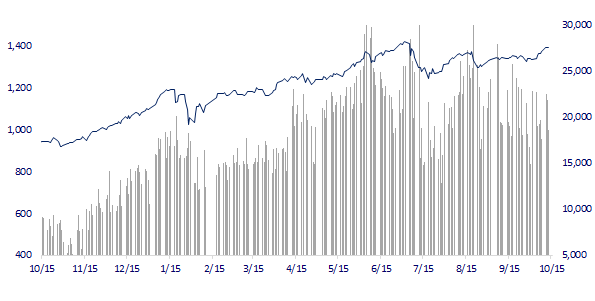

VNINDEX (12M)

GLOBAL MARKET

28,140.28

1D -0.10%

YTD 2.54%

3,561.76

1D 0.42%

YTD 4.31%

2,944.41

1D 0.96%

YTD 2.47%

25,020.34

1D 0.67%

YTD -7.83%

3,156.42

1D 1.43%

YTD 10.01%

1,643.64

1D 0.15%

YTD 13.41%

80.17

1D -0.61%

YTD 65.98%

1,769.45

1D 0.44%

YTD -7.05%

- China releases September trade data, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.1%. The Chinese market rose with the Shanghai Composite up 0.42% and the Shenzhen Component up 1.54%. South Korea's Kospi index rose 0.96%.

VIETNAM ECONOMY

0.67%

1D (bps) 1

YTD (bps) 54

5.60%

YTD (bps) -20

1.08%

1D (bps) 4

YTD (bps) -14

2.05%

1D (bps) 2

YTD (bps) 2

22,861

1D (%) 0.03%

YTD (%) -1.37%

26,746

1D (%) 0.13%

YTD (%) -8.10%

3,602

1D (%) 0.11%

YTD (%) 0.81%

- According to the Vietnam macroeconomic update report of the World Bank (WB) in October 2021, in the first 9 months of the year, the budget recorded a surplus of VND 46.6 trillion. This was due to a 7.4% decrease in total expenditure (YoY), while total revenue increased by 10.5% thanks to strong revenue results in the first half of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Businesses lament that they are making spectators in the economic recovery

- The WB explains the reason why September recorded a large overspending, but the 9-month budget balance was still bountiful

- Dong Thap wants to bring 70% of businesses back to work this year

- IMF warns of sharp drop in stock prices as central banks tighten policy

- France invests $35 billion to become a leader in hydrogen production

- China has a record trade surplus with the US

VN30

BANK

97,000

1D 0.00%

5D 1.46%

Buy Vol. 1,896,400

Sell Vol. 2,764,200

39,900

1D -0.87%

5D 1.27%

Buy Vol. 2,864,000

Sell Vol. 3,392,700

30,700

1D -0.32%

5D 4.78%

Buy Vol. 15,349,900

Sell Vol. 17,813,400

52,400

1D -1.13%

5D 4.17%

Buy Vol. 22,884,500

Sell Vol. 27,694,100

36,850

1D 0.41%

5D 7.67%

Buy Vol. 7,384,600

Sell Vol. 9,415,600

28,600

1D -0.52%

5D 4.00%

Buy Vol. 18,334,300

Sell Vol. 28,884,300

25,700

1D 0.59%

5D 5.98%

Buy Vol. 4,127,600

Sell Vol. 5,654,800

42,400

1D -0.70%

5D 0.24%

Buy Vol. 3,807,400

Sell Vol. 5,727,200

26,250

1D -1.32%

5D 2.94%

Buy Vol. 19,764,200

Sell Vol. 20,341,400

32,600

1D 0.00%

5D 3.99%

Buy Vol. 6,686,200

Sell Vol. 10,689,700

- HDB: announced business results for 9M2021, completing 82% of the pre-tax profit plan, equivalent to VND 5,970 billion, up 36% compared to the same period last year. The individual bad debt ratio is less than 1%. By the end of September 30, the bank's total assets reached more than VND 346,000 billion, up 26.7% over the same period last year. Outstanding loans increased by 16.1% over the same period. The individual bad debt ratio remained below 1%, the consolidated bad debt ratio at 1.4%, both lower than the same period last year. Outstanding loans in potential high-risk areas and restructuring debts are well controlled.

REAL ESTATE

102,600

1D -0.39%

5D -2.29%

Buy Vol. 2,083,500

Sell Vol. 4,006,400

43,550

1D 0.00%

5D 3.69%

Buy Vol. 4,407,200

Sell Vol. 4,190,600

90,600

1D 2.37%

5D 7.47%

Buy Vol. 7,238,300

Sell Vol. 6,085,700

- NVL: NovaWorld Ho Tram introduces second home next to Binh Chau Onsen hot mineral spring

OIL & GAS

111,000

1D -0.89%

5D -2.20%

Buy Vol. 5,249,100

Sell Vol. 3,109,100

12,500

1D -1.57%

5D -2.72%

Buy Vol. 25,792,200

Sell Vol. 40,435,000

53,800

1D -2.18%

5D -0.19%

Buy Vol. 2,782,500

Sell Vol. 4,037,200

- GAS: Gas demand down 30-40% y/y, 9-month NPAT flat at VND6,220 billion

VINGROUP

93,100

1D 0.22%

5D 5.08%

Buy Vol. 3,647,400

Sell Vol. 4,894,700

80,000

1D -1.11%

5D -0.62%

Buy Vol. 7,519,700

Sell Vol. 10,608,600

30,400

1D -1.30%

5D 3.40%

Buy Vol. 7,079,200

Sell Vol. 9,941,400

- VIC: Doanh số VinFast tháng 9, Fadil ổn định, Lux SA tăng doanh số 55 lần

FOOD & BEVERAGE

90,100

1D -0.33%

5D 0.90%

Buy Vol. 5,754,800

Sell Vol. 8,076,600

143,100

1D -1.65%

5D 0.63%

Buy Vol. 1,620,600

Sell Vol. 2,021,200

161,000

1D -1.23%

5D 1.64%

Buy Vol. 217,500

Sell Vol. 348,000

- VNM and MSN continued to be the focus of foreign investors' net selling in today's session with the value of 66 billion dong and 44 billion dong, respectively.

OTHERS

133,900

1D 1.06%

5D 3.48%

Buy Vol. 988,400

Sell Vol. 1,003,800

133,900

1D 1.06%

5D 3.48%

Buy Vol. 988,400

Sell Vol. 1,003,800

99,400

1D 0.40%

5D 5.30%

Buy Vol. 5,140,400

Sell Vol. 6,928,100

133,900

1D 1.36%

5D 4.36%

Buy Vol. 2,691,500

Sell Vol. 3,659,200

101,000

1D 1.00%

5D 2.96%

Buy Vol. 758,300

Sell Vol. 1,054,700

37,500

1D 0.81%

5D 0.68%

Buy Vol. 4,203,300

Sell Vol. 5,749,500

41,000

1D -0.97%

5D 2.63%

Buy Vol. 12,539,200

Sell Vol. 13,808,500

56,800

1D -0.35%

5D 1.25%

Buy Vol. 26,431,700

Sell Vol. 30,334,200

- HPG: Quang Ngai will adjust the name and area of the Hoa Phat Dung Quat 2 Iron and Steel Production Complex project in the 2021 land use plan of Binh Son district. Previously, in June, the Management Board of Dung Quat Economic Zone and Quang Ngai Industrial Parks issued a decision approving the investment policy of Hoa Phat Dung Quat 2 Iron and Steel Production Complex project with a total area of nearly 280 hectares. , estimated investment capital is about 85,000 billion dong.

Market by numbers

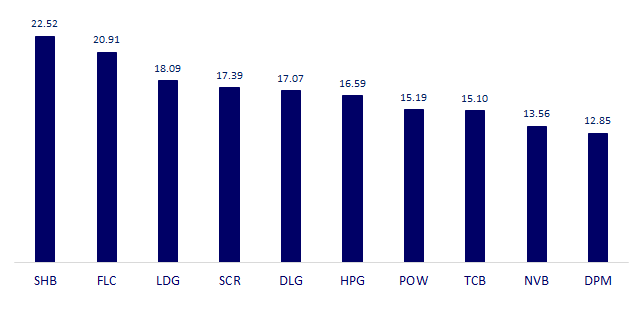

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

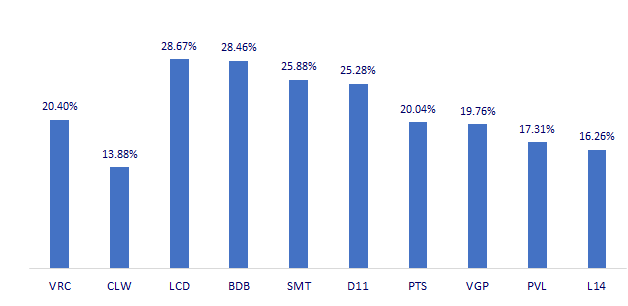

TOP INCREASES 3 CONSECUTIVE SESSIONS

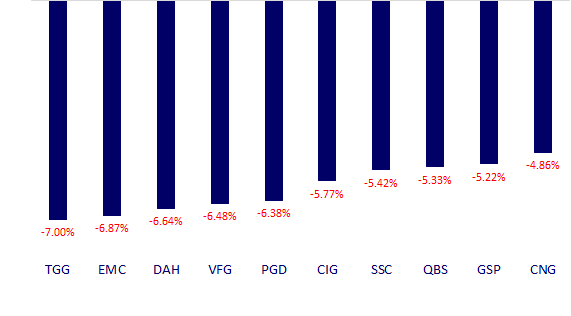

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.