Market brief 25/10/2021

VIETNAM STOCK MARKET

1,385.40

1D -0.28%

YTD 26.00%

1,476.97

1D -0.79%

YTD 39.55%

395.88

1D 1.19%

YTD 100.85%

100.92

1D 0.56%

YTD 36.69%

-1,222.16

1D 0.00%

YTD 0.00%

32,653.42

1D 21.97%

YTD 90.36%

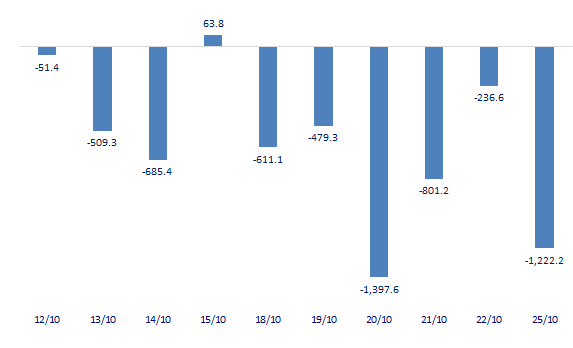

- Foreign investors boosted their net selling of more than 1,222 billion dong in the session of October 25. VJC was suddenly sold by foreign investors in this session with 417 billion dong and mainly through put-through method. HPG and NLG were still strongly net sold by foreign investors with the value of 141 billion dong and 116 billion dong, respectively.

ETF & DERIVATIVES

25,000

1D -1.96%

YTD 32.98%

17,480

1D -0.51%

YTD 39.51%

18,450

1D 3.59%

YTD 38.72%

21,700

1D -1.36%

YTD 37.34%

20,000

1D -1.82%

YTD 46.52%

27,010

1D -0.59%

YTD 57.03%

18,730

1D -0.58%

YTD 34.27%

1,489

1D 0.00%

YTD 0.00%

1,478

1D -0.92%

YTD 0.00%

1,476

1D -1.13%

YTD 0.00%

1,476

1D -0.81%

YTD 0.00%

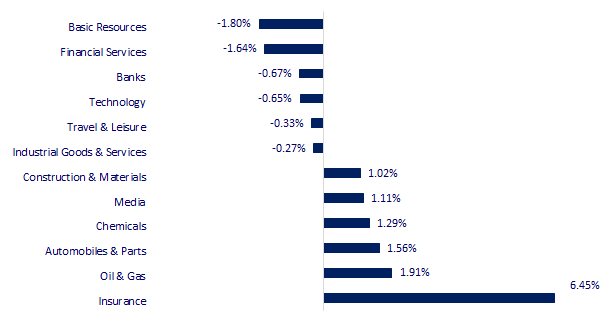

CHANGE IN PRICE BY SECTOR

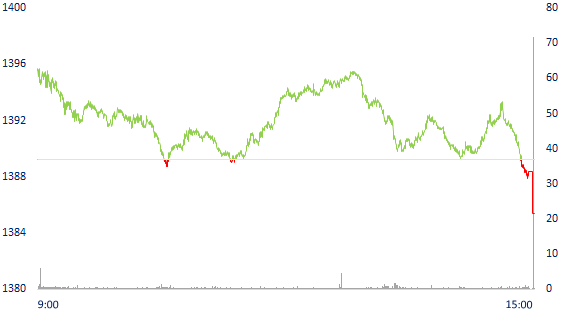

INTRADAY VNINDEX

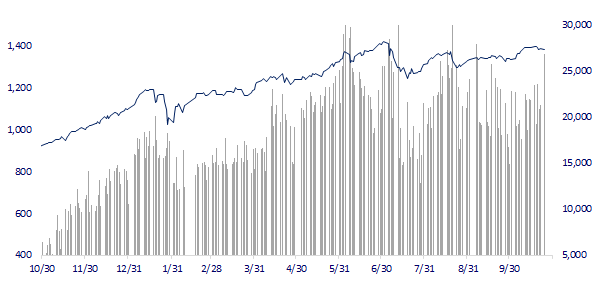

VNINDEX (12M)

GLOBAL MARKET

28,600.41

1D 0.03%

YTD 4.21%

3,609.86

1D 0.76%

YTD 5.72%

3,020.54

1D 0.48%

YTD 5.12%

26,132.03

1D 0.33%

YTD -3.74%

3,201.86

1D -0.10%

YTD 11.59%

1,634.20

1D -0.56%

YTD 12.75%

84.44

1D -0.01%

YTD 74.82%

1,800.85

1D 0.39%

YTD -5.40%

- Following the excitement from Walkl Street, Asian stocks rose. In Japan, the Nikkei 225 gained 0.03%. The Chinese market rose with the Shanghai Composite up 0.76% and the Shenzhen Component up 0.717%. Hong Kong's Hang Seng rose 0.33%. South Korea's Kospi index rose 0.48%.

VIETNAM ECONOMY

0.65%

1D (bps) 1

YTD (bps) 52

5.60%

YTD (bps) -20

1.03%

1D (bps) -3

YTD (bps) -19

2.01%

1D (bps) -4

YTD (bps) -2

22,855

1D (%) 0.00%

YTD (%) -1.39%

26,881

1D (%) -0.19%

YTD (%) -7.63%

3,632

1D (%) -0.03%

YTD (%) 1.65%

- In 2020, growth is expected to be 6.8%, but for the whole year it is only 2.9%. In 2021, growth is expected to be 6%, however, the possibility of implementation is not more than 3%. That is, in the 2 years of the Covid-19 epidemic, it is estimated that the whole country lost about 7% of GDP (GDP is currently about 343 billion USD), equivalent to 24 billion USD in damage.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Covid-19 cost Vietnam $24 billion in growth

- Enterprises return to the track to restore production, accelerate for the most important quarter of the year

- The National Assembly's agency "promotes" the progress of the Ka Pet Reservoir Project (Binh Thuan)

- The risk of China's economic recession is deeper than the market's expectation

- The US House of Representatives is optimistic about the prospect of passing a huge spending bill

- Many factors affecting the USD are about to be announced

VN30

BANK

94,100

1D -0.21%

5D -1.98%

Buy Vol. 3,164,800

Sell Vol. 2,287,100

39,200

1D -0.25%

5D -0.25%

Buy Vol. 3,636,800

Sell Vol. 3,412,100

29,900

1D 0.84%

5D -0.99%

Buy Vol. 17,136,800

Sell Vol. 18,069,800

50,900

1D -2.68%

5D -3.78%

Buy Vol. 24,229,400

Sell Vol. 30,198,200

37,000

1D -0.54%

5D -3.65%

Buy Vol. 21,050,600

Sell Vol. 22,621,900

27,600

1D -1.08%

5D -2.82%

Buy Vol. 13,784,300

Sell Vol. 22,086,300

24,500

1D -0.20%

5D -4.67%

Buy Vol. 5,491,400

Sell Vol. 6,124,000

42,000

1D -2.78%

5D -4.55%

Buy Vol. 9,132,800

Sell Vol. 9,285,800

25,600

1D -2.29%

5D -4.83%

Buy Vol. 33,151,700

Sell Vol. 26,634,600

31,250

1D -1.11%

5D -2.34%

Buy Vol. 7,584,300

Sell Vol. 9,153,200

- VCB: After nearly 13 years of maintaining cash dividends, Vietcombank will pay a share dividend of more than 27% to increase its charter capital to VND47,300b. Specifically, the General Meeting of Shareholders of Vietcombank approved the increase of charter capital to over VND50,000b through 2 components. After the issuance, charter capital increased by 10,236b VND to more than 47,325b VND. In addition to issuing shares, Vietcombank's General Meeting of Shareholders in April this year also approved a private placement of shares with a maximum size of 6.5% of charter capital at the time of offering.

REAL ESTATE

103,800

1D 0.48%

5D 2.06%

Buy Vol. 3,291,700

Sell Vol. 3,703,700

46,600

1D 2.31%

5D 5.19%

Buy Vol. 6,251,200

Sell Vol. 5,854,900

98,000

1D -1.01%

5D 4.26%

Buy Vol. 6,512,000

Sell Vol. 5,491,200

- PDR: With a growth rate of nearly 60% in Q1 and 111% in Q2. 2021, according to the financial statements of the third quarter of 2021, PDR's pre-tax profit. reached over 760 billion VND

OIL & GAS

112,000

1D -0.09%

5D -3.86%

Buy Vol. 15,325,000

Sell Vol. 4,952,500

12,250

1D 1.24%

5D -0.81%

Buy Vol. 36,844,100

Sell Vol. 33,604,300

54,100

1D 2.27%

5D -0.55%

Buy Vol. 4,288,500

Sell Vol. 3,917,500

- GAS: Q3.2021 revenue reached 18,543 billion dong, up 16.3% over the same period last year, accumulated in 9 months reached 58,815 billion dong, up nearly 21%.

VINGROUP

92,100

1D 0.33%

5D -0.54%

Buy Vol. 2,575,500

Sell Vol. 4,179,700

78,500

1D 0.64%

5D -0.51%

Buy Vol. 8,179,700

Sell Vol. 7,702,300

30,400

1D -0.82%

5D -1.30%

Buy Vol. 8,342,200

Sell Vol. 10,656,400

- Ha Long Xanh mixed-use urban complex, implemented by a consortium of investors Vingroup and Vinhomes, with an area of about 4,110 hectares, was started on October 24.

FOOD & BEVERAGE

90,100

1D -0.44%

5D 0.33%

Buy Vol. 6,909,800

Sell Vol. 4,814,500

140,400

1D 0.21%

5D -1.82%

Buy Vol. 1,189,500

Sell Vol. 1,426,200

156,700

1D 0.13%

5D -2.06%

Buy Vol. 336,300

Sell Vol. 383,400

- VNM: From October 27 to November 25, Platinum Victory PTE.LTD, registered to buy 20.9 million VNM shares, raising the holding rate to 11.62% or 242.75 million shares.

OTHERS

131,800

1D 0.00%

5D 0.46%

Buy Vol. 962,900

Sell Vol. 1,042,400

131,800

1D 0.00%

5D 0.46%

Buy Vol. 962,900

Sell Vol. 1,042,400

94,900

1D -1.35%

5D -4.14%

Buy Vol. 3,841,500

Sell Vol. 4,180,600

128,400

1D 0.63%

5D -1.76%

Buy Vol. 2,298,500

Sell Vol. 2,723,000

99,100

1D 0.10%

5D 0.10%

Buy Vol. 1,286,900

Sell Vol. 1,445,100

39,300

1D 2.61%

5D 3.83%

Buy Vol. 6,087,600

Sell Vol. 10,127,400

38,300

1D -2.30%

5D -6.24%

Buy Vol. 19,202,700

Sell Vol. 20,060,000

55,100

1D -2.82%

5D -4.84%

Buy Vol. 35,729,000

Sell Vol. 38,099,800

- BVH: The Ministry of Finance has just sent a document to SCIC to sell capital in enterprises to pay money to the fund to support production and business development. Specifically, the Ministry of Finance requested SCIC to deploy BVH, BMI and NTP. Proceeds from divestment of capital at the above 3 enterprises shall be remitted to the Enterprise Arrangement and Development Support Fund before December 20 to remit to the State budget.

Market by numbers

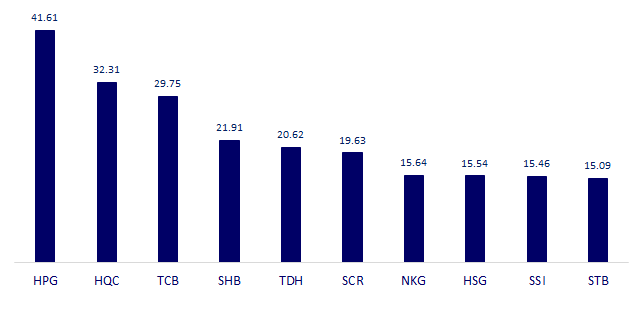

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

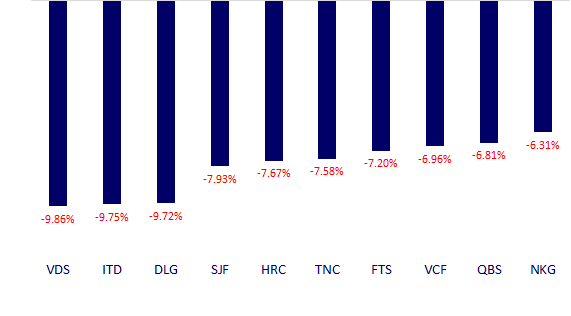

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.