Market brief 08/11/2021

VIETNAM STOCK MARKET

1,460.01

1D 0.24%

YTD 32.79%

1,532.06

1D 0.02%

YTD 44.75%

432.10

1D 1.04%

YTD 119.23%

109.03

1D 0.77%

YTD 47.68%

518.91

1D 0.00%

YTD 0.00%

35,218.65

1D 9.36%

YTD 105.32%

- On HoSE, foreign investors boosted their net buying of nearly 9 million shares, with a net buying value of more than 504 billion dong. HPG steel stock today continued to be the stock receiving the strongest net buying with a value of 169 billion dong. Next on the list of net buyers are VHM (129 billion dong), GEX (85 billion dong), VNM (83 billion dong), STB (83 billion dong).

ETF & DERIVATIVES

25,950

1D -0.04%

YTD 38.03%

18,090

1D 0.00%

YTD 44.37%

19,030

1D 6.85%

YTD 43.08%

22,800

1D 0.88%

YTD 44.30%

21,250

1D 1.43%

YTD 55.68%

28,000

1D 0.00%

YTD 62.79%

19,600

1D 1.08%

YTD 40.50%

1,489

1D 0.00%

YTD 0.00%

1,538

1D 0.17%

YTD 0.00%

1,535

1D 0.07%

YTD 0.00%

1,533

1D 0.24%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

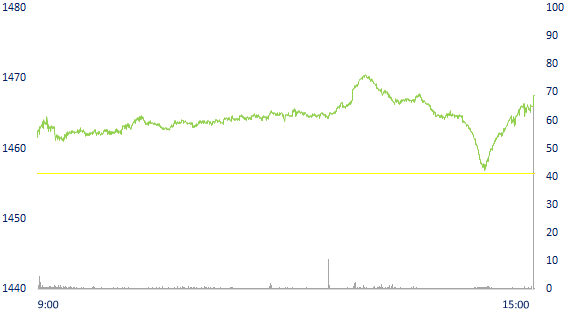

INTRADAY VNINDEX

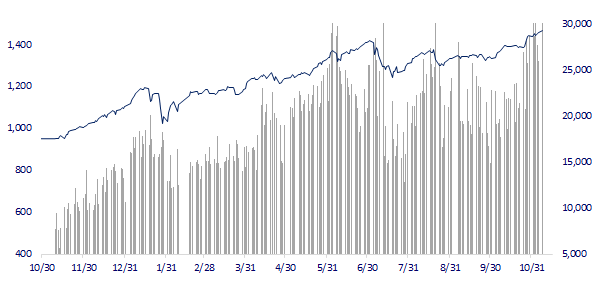

VNINDEX (12M)

GLOBAL MARKET

29,507.05

1D -0.29%

YTD 7.52%

3,498.63

1D 0.20%

YTD 2.47%

2,960.20

1D -0.31%

YTD 3.02%

24,763.77

1D 0.14%

YTD -8.78%

3,242.34

1D 0.00%

YTD 13.00%

1,626.13

1D -0.01%

YTD 12.20%

82.50

1D 0.17%

YTD 70.81%

1,818.90

1D 0.03%

YTD -4.45%

- Asian stocks mixed, oil prices rose 1%. In Japan, the Nikkei 225 fell 0.29%. The Chinese market rose with Shanghai Composite up 0.2%, Shenzhen Component up 0.32%. Hong Kong's Hang Seng rose 0.14%. South Korea's Kospi index fell 0.31%.

VIETNAM ECONOMY

0.62%

YTD (bps) 49

5.60%

YTD (bps) -20

1.21%

1D (bps) 6

YTD (bps) -1

1.94%

1D (bps) 9

YTD (bps) -9

22,760

1D (%) -0.04%

YTD (%) -1.80%

26,641

1D (%) -0.02%

YTD (%) -8.46%

3,612

1D (%) -0.03%

YTD (%) 1.09%

- The total investment capital required for the development of the airport system by 2030 is about VND 400,000 billion, accounting for about 22% of the investment capital demand of the entire transport - transportation industry. This is one of the important information in the Report on the approval of the master plan on development of the national airport and airport system for the period 2021-2030, with a vision to 2050, which has just been sent to the Prime Minister.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to invest in 6 new airports

- Ho Chi Minh City does not break the labor source

- Proposing to raise the public debt ceiling, issue many new support packages

- The energy crisis due to lack of coal is gradually settling down

- China's crude oil imports in October are the lowest in 3 years

- Japan will spend 265 billion USD to revive the economy before the pandemic

VN30

BANK

98,200

1D 0.72%

5D 1.24%

Buy Vol. 1,738,100

Sell Vol. 2,054,000

43,900

1D 0.69%

5D 5.02%

Buy Vol. 4,153,200

Sell Vol. 5,301,800

32,800

1D 0.31%

5D 1.86%

Buy Vol. 18,661,700

Sell Vol. 20,948,400

52,600

1D -0.75%

5D 1.94%

Buy Vol. 32,881,200

Sell Vol. 39,198,100

37,550

1D -1.05%

5D 0.00%

Buy Vol. 11,409,700

Sell Vol. 15,483,300

28,500

1D -0.52%

5D 0.35%

Buy Vol. 23,511,300

Sell Vol. 26,438,200

27,000

1D 1.12%

5D 6.72%

Buy Vol. 8,655,500

Sell Vol. 10,159,900

43,800

1D 0.69%

5D 0.92%

Buy Vol. 5,663,400

Sell Vol. 6,965,400

27,850

1D 0.72%

5D 4.70%

Buy Vol. 36,219,100

Sell Vol. 38,408,600

33,400

1D -0.30%

5D 2.14%

Buy Vol. 8,095,000

Sell Vol. 10,792,700

- VCB: approved the plan to issue private bonds in 2021 with a maximum volume of VND 4,000 billion. Bonds have maturities of at least 7 years and up to 10 years with fixed or floating interest rates. Release date is expected in the fourth quarter. Previously, Vietcombank announced to buy back nearly VND 4,000 billion of bonds issued in 2016. These are 10-year bonds issued for the purpose of expanding medium and long-term loans and diversifying loans. bank's capital mobilization channel. The time to exercise the right to redeem the bonds is in October, November and December 2021.

REAL ESTATE

104,600

1D -0.38%

5D -4.56%

Buy Vol. 3,838,700

Sell Vol. 4,258,300

48,050

1D -0.31%

5D -1.94%

Buy Vol. 4,991,500

Sell Vol. 4,501,400

93,100

1D -1.90%

5D 0.00%

Buy Vol. 5,181,500

Sell Vol. 6,068,000

- NVL: Domestic individuals net bought NVL with a value of 451 billion dong in the first trading week of November.

OIL & GAS

123,000

1D 0.49%

5D 1.40%

Buy Vol. 2,257,400

Sell Vol. 2,876,500

13,100

1D 0.77%

5D 0.00%

Buy Vol. 32,310,900

Sell Vol. 51,040,100

54,700

1D 1.48%

5D 1.48%

Buy Vol. 3,211,400

Sell Vol. 4,413,100

- For the whole week, WTI oil price dropped by nearly 2.8%, marking the 2nd consecutive week of decline after 9 weeks of price increases.

VINGROUP

94,900

1D -0.11%

5D -0.94%

Buy Vol. 2,651,300

Sell Vol. 3,323,400

82,400

1D 0.49%

5D -2.25%

Buy Vol. 11,666,600

Sell Vol. 13,540,500

30,850

1D -1.12%

5D -0.96%

Buy Vol. 12,204,500

Sell Vol. 14,184,000

- VIC: VinFast receives a tax credit of $20.5 million when it commits to setting up its headquarters in California, investing $200 million and creating at least 1,065 full-time jobs.

FOOD & BEVERAGE

90,800

1D 1.79%

5D 0.89%

Buy Vol. 9,061,200

Sell Vol. 11,376,300

152,000

1D 2.84%

5D 4.47%

Buy Vol. 2,591,800

Sell Vol. 2,811,600

173,700

1D 0.99%

5D 7.22%

Buy Vol. 211,900

Sell Vol. 248,400

- MSN: Along with the merger of the feed business, De Heus and Masan also agreed to enter into long-term strategic supply transactions in the mutual agreement between the two parties.

OTHERS

131,800

1D 1.38%

5D 1.38%

Buy Vol. 1,219,800

Sell Vol. 1,611,100

131,800

1D 1.38%

5D 1.38%

Buy Vol. 1,219,800

Sell Vol. 1,611,100

97,400

1D -0.20%

5D 1.67%

Buy Vol. 2,901,900

Sell Vol. 4,329,300

131,600

1D -0.30%

5D 1.23%

Buy Vol. 1,606,100

Sell Vol. 2,540,000

108,000

1D 0.00%

5D 6.82%

Buy Vol. 640,300

Sell Vol. 841,600

40,700

1D 1.50%

5D 3.43%

Buy Vol. 7,169,200

Sell Vol. 8,613,900

44,500

1D 3.73%

5D 7.49%

Buy Vol. 45,123,100

Sell Vol. 53,545,900

56,800

1D 0.35%

5D 1.97%

Buy Vol. 32,599,700

Sell Vol. 43,807,300

- VJC: Vietjet and Airbus have reached a strategic partnership agreement on the implementation of a contract for 119 ordered aircraft, cooperation in developing a wide-body fleet and many other supports after the pandemic. Right in November, Vietjet will receive and put into operation three leased A330 ships, in the plan to deploy wide-body aircraft under the low-cost airline model.

Market by numbers

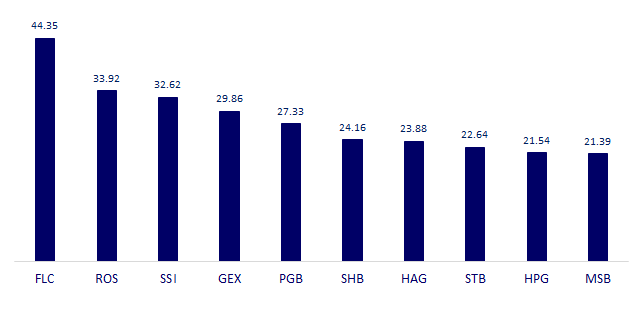

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

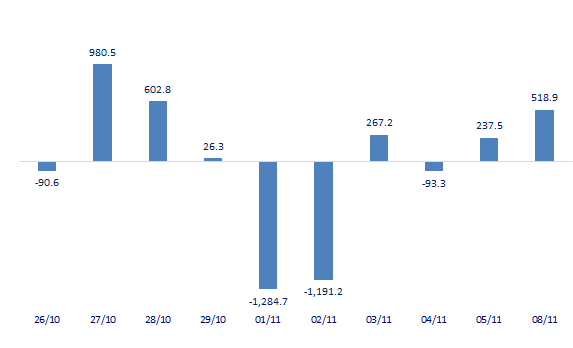

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

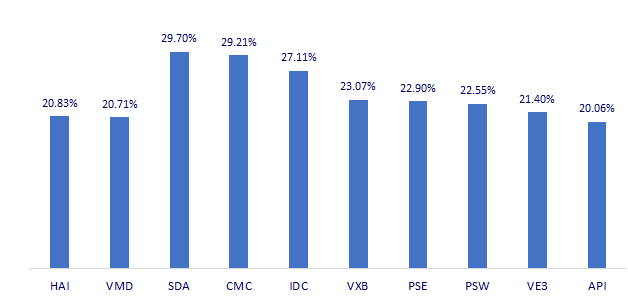

TOP INCREASES 3 CONSECUTIVE SESSIONS

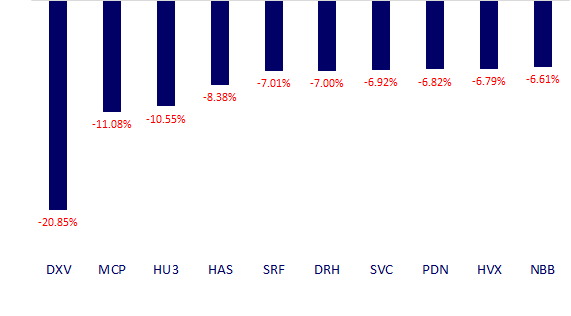

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.