Market Brief 11/11/2021

VIETNAM STOCK MARKET

1,462.35

1D -0.18%

YTD 33.00%

1,514.36

1D -0.62%

YTD 43.08%

438.73

1D 0.11%

YTD 122.59%

109.21

1D -0.41%

YTD 47.92%

-1,219.51

1D 0.00%

YTD 0.00%

36,311.91

1D 0.00%

YTD 111.69%

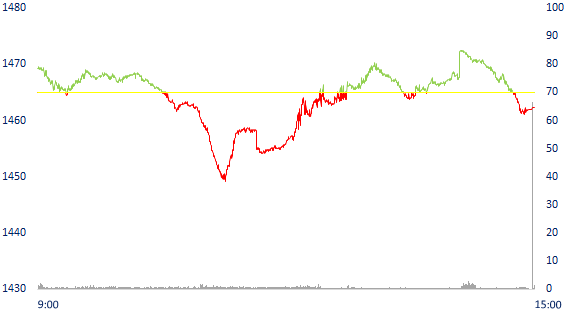

- The money flowed strongly into the market, VN30 stocks pulled VN-Index down. Market liquidity was very high, the total matched value reached 42,957 billion dong, up 23% compared to the previous session. Matching value on HoSE increased by 26% to 35,848 billion dong. Foreign investors boosted their net selling of about 1,200 billion dong on HoSE in this session.

ETF & DERIVATIVES

25,690

1D -0.08%

YTD 36.65%

17,830

1D -0.78%

YTD 42.30%

19,040

1D 6.91%

YTD 43.16%

23,100

1D 1.32%

YTD 46.20%

21,000

1D -0.94%

YTD 53.85%

27,790

1D 0.14%

YTD 61.57%

19,600

1D 0.51%

YTD 40.50%

1,489

1D 0.00%

YTD 0.00%

1,513

1D -1.07%

YTD 0.00%

1,511

1D -0.97%

YTD 0.00%

1,511

1D -0.94%

YTD 0.00%

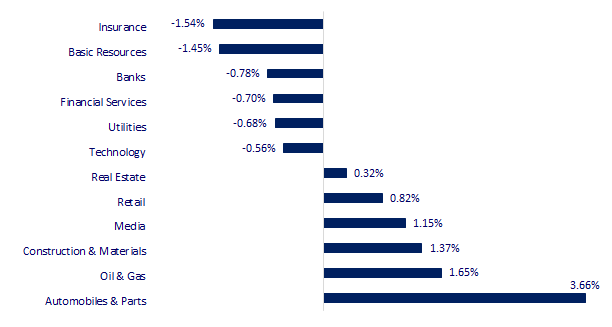

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

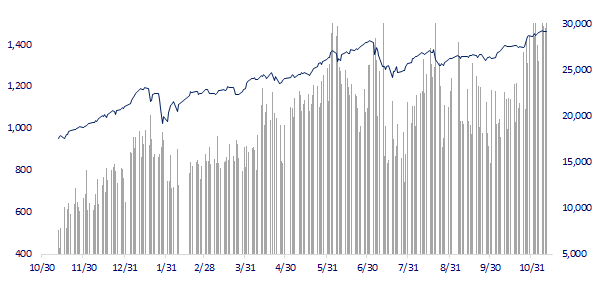

VNINDEX (12M)

GLOBAL MARKET

29,277.86

1D 0.06%

YTD 6.68%

3,532.79

1D 1.15%

YTD 3.47%

2,924.92

1D -0.18%

YTD 1.79%

25,247.99

1D 1.67%

YTD -7.00%

3,242.34

1D 0.00%

YTD 13.00%

1,632.44

1D 0.12%

YTD 12.63%

81.58

1D -0.31%

YTD 68.90%

1,863.55

1D 0.68%

YTD -2.11%

- US announced CPI, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.06%. The Chinese market went up with Shanghai Composite up 1.15%, Shenzhen Component up 1.267%. Hong Kong's Hang Seng rose 1.67%. South Korea's Kospi index fell 0.18%.

VIETNAM ECONOMY

0.63%

1D (bps) 2

YTD (bps) 50

5.60%

YTD (bps) -20

1.18%

1D (bps) 15

YTD (bps) -4

1.90%

1D (bps) -8

YTD (bps) -13

22,744

1D (%) -0.02%

YTD (%) -1.87%

26,399

1D (%) -0.13%

YTD (%) -9.29%

3,607

1D (%) -0.22%

YTD (%) 0.95%

- According to the Ministry of Planning and Investment, while only 7 ministries and 20 localities have disbursement rates above 65%, 32/50 ministries, central agencies and 21/63 localities have a disbursement rate is less than 50%. Even up to this point, there are still 2 central agencies that have not disbursed capital plans.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Increasing transparency pressure on insurance companies

- Solving the challenge of slow disbursement of public investment capital

- There will be a special mechanism to mobilize private capital to develop inland waterways

- China's inflationary pressure raises concerns about global prices

- Inflation in the US increased to a record in 31 years

- USD peaked 16 months after the US announced CPI

VN30

BANK

98,300

1D 0.72%

5D -0.10%

Buy Vol. 2,543,700

Sell Vol. 1,807,400

42,800

1D -0.47%

5D -2.73%

Buy Vol. 4,291,500

Sell Vol. 4,472,800

31,950

1D -1.69%

5D -1.99%

Buy Vol. 22,571,300

Sell Vol. 23,124,600

51,500

1D -0.39%

5D -3.38%

Buy Vol. 35,981,900

Sell Vol. 32,174,900

36,500

1D -0.54%

5D -3.95%

Buy Vol. 15,365,800

Sell Vol. 13,583,000

28,100

1D -1.75%

5D -2.77%

Buy Vol. 21,933,900

Sell Vol. 24,827,900

27,700

1D -1.07%

5D 2.40%

Buy Vol. 8,594,600

Sell Vol. 9,885,900

43,000

1D -2.27%

5D -1.71%

Buy Vol. 3,823,900

Sell Vol. 3,820,300

27,700

1D -2.64%

5D 0.91%

Buy Vol. 29,601,000

Sell Vol. 41,519,200

33,000

1D -1.20%

5D -1.49%

Buy Vol. 10,726,900

Sell Vol. 11,863,200

- CTG: At VietinBank, according to reported figures, the total bad debt on the balance sheet as of the end of September 2021 also increased by 90.1%, to 18,097 billion dong. This is also the bank with the highest increase in bad debt in absolute terms (8,579 billion dong). The bank's bad debt/loan ratio also increased sharply from 0.94% to 1.67%.

REAL ESTATE

105,500

1D 1.44%

5D 1.44%

Buy Vol. 4,476,900

Sell Vol. 5,805,000

49,800

1D 3.11%

5D 4.95%

Buy Vol. 8,823,400

Sell Vol. 8,702,300

91,900

1D 3.03%

5D -1.92%

Buy Vol. 6,681,500

Sell Vol. 6,242,700

- NVL: NVL's liabilities as of September 30 were VND143,000b, a sharp increase compared to VND112,000b at the beginning of the year and 2.2 times higher than the figure at the beginning of 2020.

OIL & GAS

119,000

1D -1.16%

5D 1.62%

Buy Vol. 3,063,900

Sell Vol. 2,995,400

12,900

1D -1.53%

5D 1.98%

Buy Vol. 26,590,300

Sell Vol. 39,768,900

59,800

1D 2.57%

5D 13.47%

Buy Vol. 8,909,800

Sell Vol. 8,659,800

- Oil prices turned lower on Wednesday (November 10) after crude inventories in the United States rose slightly, a day after an industry report showed crude inventories had tightened.

VINGROUP

94,800

1D -0.11%

5D -0.21%

Buy Vol. 3,000,600

Sell Vol. 3,569,200

81,500

1D -1.33%

5D -1.45%

Buy Vol. 13,933,600

Sell Vol. 13,924,100

30,300

1D -1.94%

5D -3.96%

Buy Vol. 10,521,600

Sell Vol. 12,281,000

- Vingroup will start 4 projects with a total capital of 302,500 billion in Vung Ang economic zone in 2022

FOOD & BEVERAGE

89,600

1D -0.11%

5D 1.36%

Buy Vol. 5,327,100

Sell Vol. 6,115,600

146,900

1D -0.54%

5D -0.68%

Buy Vol. 3,167,300

Sell Vol. 2,689,900

172,000

1D -1.15%

5D 0.12%

Buy Vol. 89,800

Sell Vol. 191,200

- MSN: Masan and SK Group have just announced the signing of an agreement to buy back shares of The CrownX (TCX) with a total cash value of 345m USD, of which SK Group invests 340m USD.

OTHERS

128,600

1D -0.85%

5D -0.77%

Buy Vol. 976,800

Sell Vol. 1,196,500

128,600

1D -0.85%

5D -0.77%

Buy Vol. 976,800

Sell Vol. 1,196,500

96,000

1D -1.03%

5D 0.00%

Buy Vol. 3,807,800

Sell Vol. 3,785,900

135,000

1D 2.66%

5D 3.93%

Buy Vol. 6,290,700

Sell Vol. 6,683,200

104,500

1D 1.46%

5D 0.48%

Buy Vol. 2,160,200

Sell Vol. 1,850,800

41,900

1D 1.95%

5D 4.88%

Buy Vol. 11,197,600

Sell Vol. 13,376,200

44,150

1D -1.23%

5D 2.67%

Buy Vol. 39,418,000

Sell Vol. 41,772,700

54,000

1D -2.35%

5D -4.09%

Buy Vol. 83,071,700

Sell Vol. 92,649,800

- HPG: As of the end of September this year, Hoa Phat's inventory value was VND 46,072 billion, up 75% compared to the beginning of the period and accounting for 26% of total assets. In which, raw materials accounted for 21,550 billion dong of inventory value, twice as high as at the beginning of the period. The value of finished products also doubled to more than 11,464 billion VND.

Market by numbers

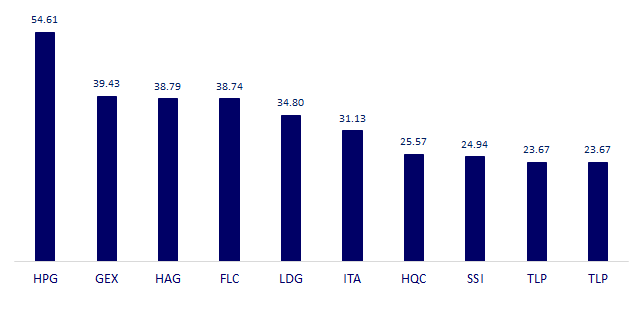

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

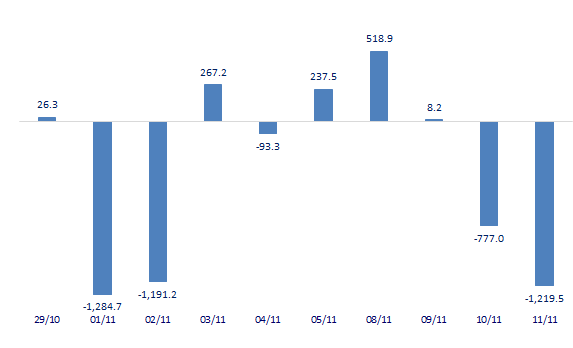

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

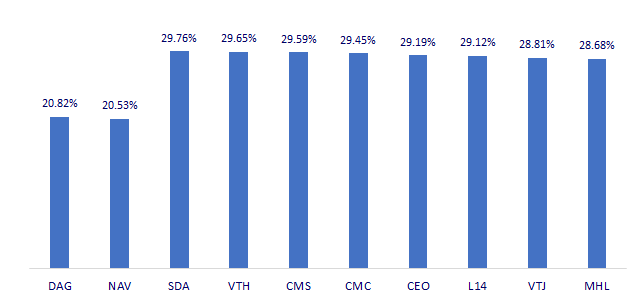

TOP INCREASES 3 CONSECUTIVE SESSIONS

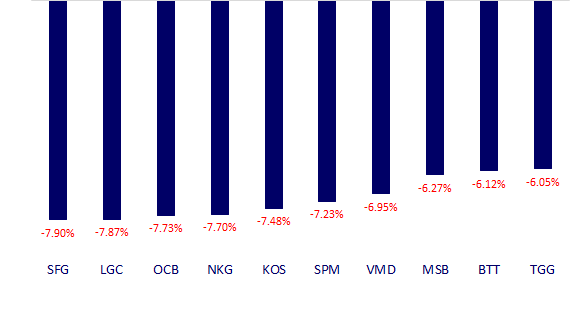

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.