Morning Brief 18/11/2021

GLOBAL MARKET

35,931.05

1D -0.58%

YTD 18.16%

4,688.67

1D -0.26%

YTD 25.63%

15,921.60

1D -0.33%

YTD 23.71%

17.11

1D 4.52%

7,291.20

1D -0.49%

YTD 11.22%

16,251.25

1D 0.02%

YTD 18.46%

7,156.85

1D 0.06%

YTD 27.81%

77.06

1D -2.82%

YTD 59.54%

1,870.40

1D 0.74%

YTD -1.75%

- The Dow Jones Industrial Average fell 211.17 points, or 0.5%, to 35,931.05 at the close of trading Wednesday. The composite lost 0.3% to 15,921.57, both indexes were close to 1% away from record highs Dow Jones was pressured by a 4.7% drop in Visa stock US stocks fell as investors weighed in. prompted strong earnings results from major retailers amid lingering inflation concerns.

VIETNAM ECONOMY

0.63%

1D (bps) -2

YTD (bps) 50

5.60%

YTD (bps) -20

0.93%

1D (bps) -21

YTD (bps) -29

1.92%

1D (bps) 7

YTD (bps) -11

-

1D (%) -

YTD (%) -

26,293

1D (%) 0.02%

YTD (%) -9.66%

3,622

1D (%) 0.25%

YTD (%) 1.37%

- At third quarter, most countries have recorded a high number of infections, forcing the application of distancing measures, causing certain economic impacts. - society. With what happened in the third quarter, Vietnam also recorded the deepest decrease (-6.17%) for the first time since calculating and announcing quarterly GDP so far. Previously, in the first and second quarters, Vietnam's growth rate was 4.48% and 6.61%, respectively.

VIETNAM STOCK MARKET

1,475.85

1D 0.64%

YTD 34.23%

1,519.58

1D 0.16%

YTD 43.57%

462.95

1D 2.37%

YTD 134.88%

112.21

1D 0.65%

YTD 51.98%

-221.52

32,588.06

1D -22.81%

YTD 89.98%

- Trading value at HOSE in the session of November 17 cooled down compared to the previous explosive sessions and was also the lowest liquidity level in November so far. The market ended up gaining positively with the biggest push coming from the real estate industry, while the steel industry continued to weaken.

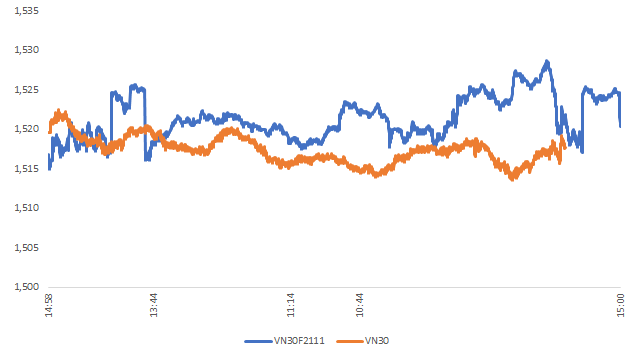

INTRADAY

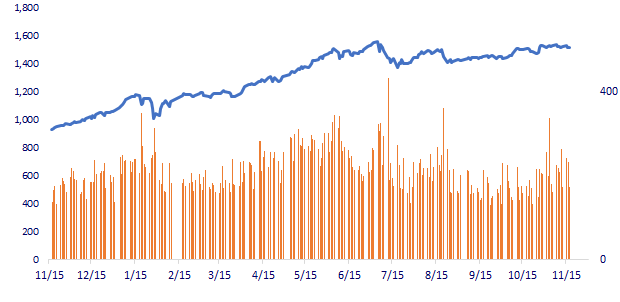

VN30 (12M)

SELECTED NEWS

- Dong Nai is expected to recover more than 4,000 hectares of land for 349 projects

- Resilience of Vietnam and 5 Southeast Asian economies as seen from GDP growth in the most 'stormy' quarter

- Hai Phong is not only a growth pole but also a development engine for the whole country

- UK inflation hits its highest level in nearly a decade

- The yuan and the distance to replace the dollar

- Asian currency markets wobbled by the rising USD and worries about the COVID-19 epidemic

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.