Market brief 28/12/2021

VIETNAM STOCK MARKET

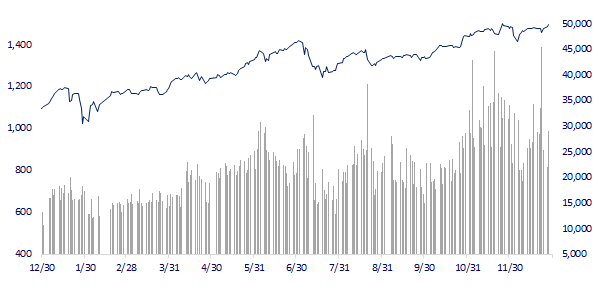

1,494.39

1D 0.37%

YTD 35.92%

1,523.54

1D 0.59%

YTD 43.95%

458.05

1D 1.92%

YTD 132.39%

110.44

1D 0.06%

YTD 49.59%

87.26

1D 0.00%

YTD 0.00%

35,774.50

1D 34.06%

YTD 108.56%

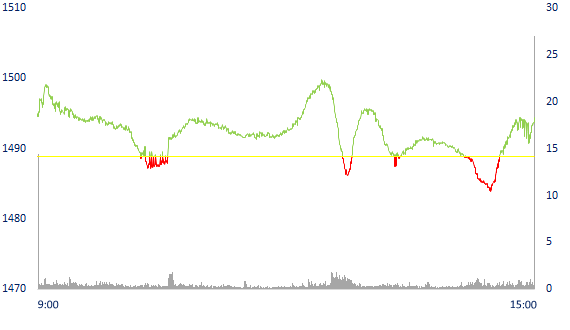

In today's trading session, market liquidity increased sharply compared to the previous session. Total matched value reached 32,046 billion dong, up 31.6%, of which, matched value on HoSE alone increased 29.84% to 26,526 billion dong. Foreign investors continued to be a net buy of 361 billion dong on HoSE, while net sold 280 billion dong on HNX.

ETF & DERIVATIVES

25,400

1D -0.39%

YTD 35.11%

17,890

1D 0.28%

YTD 42.78%

18,850

1D 5.84%

YTD 41.73%

22,900

1D 1.78%

YTD 44.94%

21,110

1D -0.89%

YTD 54.65%

27,550

1D -0.58%

YTD 60.17%

19,940

1D 0.55%

YTD 42.94%

1,517

1D 0.35%

YTD 0.00%

1,212

1D 0.00%

YTD 0.00%

1,520

1D 0.28%

YTD 0.00%

1,519

1D 0.26%

YTD 0.00%

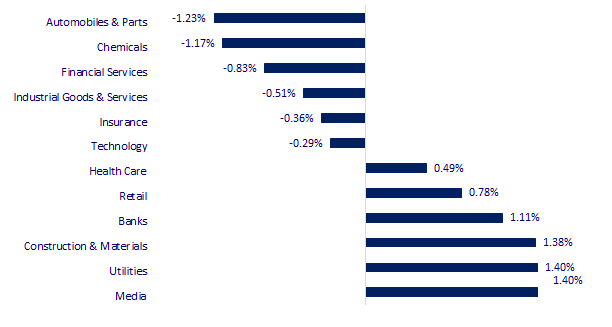

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,069.16

1D 0.31%

YTD 5.92%

3,630.11

1D 0.39%

YTD 6.32%

3,020.24

1D 0.69%

YTD 5.11%

23,280.56

1D 0.12%

YTD -14.24%

3,128.41

1D 0.78%

YTD 9.03%

1,641.52

1D 0.31%

YTD 13.26%

76.78

1D 1.20%

YTD 58.96%

1,819.20

1D 0.47%

YTD -4.44%

Asian shares rose after the S&P 500's 69th session high of the year. In Japan, the Nikkei rose 0.31%. The Chinese market went up. Shanghai Composite increased by 0.39%, Shenzhen Component increased by 0.831%. Hong Kong's Hang Seng rose 0.12%. South Korea's Kospi index rose 0.69%.

VIETNAM ECONOMY

1.12%

YTD (bps) 99

5.60%

YTD (bps) -20

1.17%

1D (bps) 19

YTD (bps) -5

1.91%

1D (bps) -6

YTD (bps) -12

23,050

1D (%) 0.44%

YTD (%) -0.55%

26,305

1D (%) -0.65%

YTD (%) -9.61%

3,654

1D (%) 0.11%

YTD (%) 2.27%

In November, imports of iron and steel of all kinds reached 826,144 tons with a turnover of 914.7 million USD, down 1.9% in volume, down 1% in turnover with the previous month. Generally from the beginning of the year, imports of this item reached 11.41 million tons with 10.51 billion USD, down 28.4% in volume but 17.8% in turnover.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam spent more than 900 million USD importing iron and steel in November

- State Bank: Remittance to Vietnam is more than 12 billion USD

- The bank pumped more than 237,000 billion dong into the market after a month

- China injects 31 billion USD into the economy

- US President signed a defense bill worth 770 billion USD

- China's industrial profits slow down because of high commodity prices

VN30

BANK

80,000

1D 0.25%

5D 4.48%

Buy Vol. 1,923,700

Sell Vol. 2,459,200

35,200

1D -0.28%

5D 1.55%

Buy Vol. 2,026,700

Sell Vol. 2,884,600

33,900

1D 1.50%

5D 5.94%

Buy Vol. 20,652,100

Sell Vol. 27,464,800

49,150

1D 0.61%

5D -0.20%

Buy Vol. 11,422,800

Sell Vol. 13,625,100

34,550

1D 0.58%

5D 1.17%

Buy Vol. 14,420,900

Sell Vol. 17,891,600

28,300

1D 0.53%

5D 1.25%

Buy Vol. 12,396,600

Sell Vol. 15,068,000

30,500

1D 6.09%

5D 3.74%

Buy Vol. 14,165,500

Sell Vol. 12,797,200

42,050

1D 3.19%

5D 8.38%

Buy Vol. 12,911,600

Sell Vol. 11,816,700

30,050

1D 6.94%

5D 6.56%

Buy Vol. 71,916,600

Sell Vol. 59,320,300

33,650

1D 1.51%

5D 2.59%

Buy Vol. 5,871,800

Sell Vol. 6,556,100

STB: On December 27, 2021, Sacombank and Dai-ichi Life Vietnam Insurance Company signed to elevate the exclusive insurance agency contract on the basis of the cooperation established by the two parties on June 6. September 2017.

REAL ESTATE

87,000

1D -2.25%

5D -2.26%

Buy Vol. 2,223,800

Sell Vol. 3,009,800

52,500

1D -0.94%

5D 4.58%

Buy Vol. 2,654,400

Sell Vol. 3,059,800

94,100

1D -0.53%

5D -1.77%

Buy Vol. 3,272,800

Sell Vol. 3,456,200

NVL: On December 27, 2021, HBC and NVL announced a long-term cooperation agreement in the construction of key project clusters of Novaland in the period of 2022–2025.

OIL & GAS

98,100

1D 2.29%

5D 4.36%

Buy Vol. 1,979,700

Sell Vol. 2,110,400

18,350

1D -0.54%

5D -1.87%

Buy Vol. 42,786,300

Sell Vol. 59,274,500

53,800

1D -0.55%

5D 1.51%

Buy Vol. 1,348,800

Sell Vol. 2,129,500

Currently, OPEC+ remains open to the possibility that member countries will adjust output policies at the meeting on January 4, 2022.

VINGROUP

98,400

1D -0.61%

5D 0.31%

Buy Vol. 2,486,800

Sell Vol. 3,678,600

82,800

1D 0.00%

5D -3.72%

Buy Vol. 7,804,700

Sell Vol. 9,411,600

30,800

1D -1.60%

5D -1.91%

Buy Vol. 8,428,600

Sell Vol. 10,469,800

VIC: Vingroup mobilizes the first green syndicated loan worth $400 million. The loan is used to serve the development needs of VinFast and its member companies.

FOOD & BEVERAGE

85,500

1D -0.70%

5D 0.00%

Buy Vol. 2,853,500

Sell Vol. 3,658,900

171,500

1D 1.48%

5D 2.94%

Buy Vol. 8,525,100

Sell Vol. 10,818,700

148,300

1D 0.27%

5D -0.40%

Buy Vol. 232,900

Sell Vol. 240,200

VNM: will advance the second dividend of 2021 in cash to shareholders. With more than 2 billion shares outstanding, VNM is expected to spend nearly VND2,926 billion to pay dividends.

OTHERS

125,200

1D 0.16%

5D 2.20%

Buy Vol. 858,700

Sell Vol. 1,035,800

125,200

1D 0.16%

5D 2.20%

Buy Vol. 858,700

Sell Vol. 1,035,800

94,500

1D 0.00%

5D -0.74%

Buy Vol. 1,080,600

Sell Vol. 1,340,600

135,800

1D 0.67%

5D 2.11%

Buy Vol. 1,259,000

Sell Vol. 1,390,500

95,600

1D -0.42%

5D 0.84%

Buy Vol. 604,600

Sell Vol. 682,100

37,850

1D -1.94%

5D 0.40%

Buy Vol. 6,752,200

Sell Vol. 8,680,400

48,800

1D -0.71%

5D -7.05%

Buy Vol. 14,905,400

Sell Vol. 17,090,200

45,800

1D -0.22%

5D -0.65%

Buy Vol. 21,154,800

Sell Vol. 24,926,000

PNJ: Shareholders approved the private placement plan of up to 15 million shares, accounting for 6.6% of the total number of outstanding shares. Charter capital is expected to increase from 2,276 billion VND to 2,426 billion VND.

Market by numbers

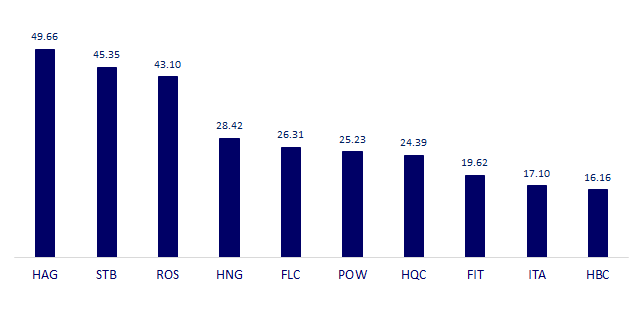

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

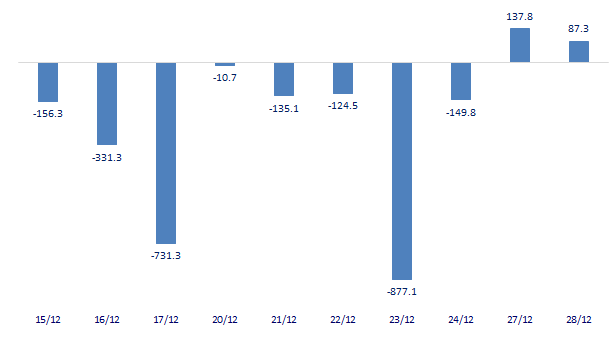

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

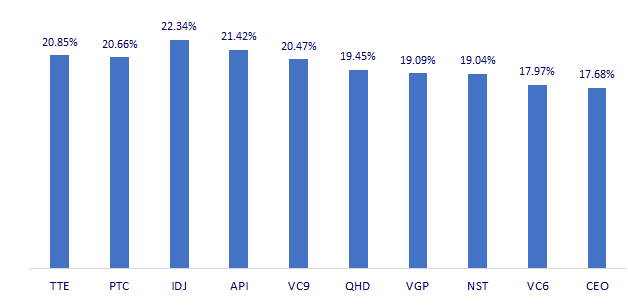

TOP INCREASES 3 CONSECUTIVE SESSIONS

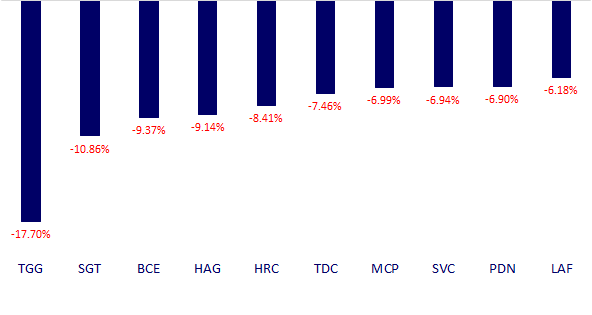

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.