Market brief 30/12/2021

VIETNAM STOCK MARKET

1,485.97

1D 0.01%

YTD 35.15%

1,519.62

1D 0.24%

YTD 43.58%

461.65

1D 0.83%

YTD 134.22%

111.56

1D 0.72%

YTD 51.10%

86.45

1D 0.00%

YTD 0.00%

27,393.05

1D -11.85%

YTD 59.70%

Foreign investors today traded more actively when buying 19.8 million shares, worth 735 billion dong, while selling 18.4 million shares, worth 637 billion dong. Total net buying volume was at 1.4 million shares, equivalent to a net buying value of 86 billion dong. On HoSE, foreign investors had the 5th net buying session in a row with a value down 71% compared to the previous session and at 67 billion dong.

ETF & DERIVATIVES

25,600

1D 0.39%

YTD 36.17%

17,890

1D 1.53%

YTD 42.78%

18,720

1D 5.11%

YTD 40.75%

22,600

1D -0.44%

YTD 43.04%

21,500

1D 0.66%

YTD 57.51%

27,800

1D 0.36%

YTD 61.63%

20,080

1D 0.25%

YTD 43.94%

1,526

1D 0.65%

YTD 0.00%

1,212

1D 0.00%

YTD 0.00%

1,526

1D 0.43%

YTD 0.00%

1,524

1D 0.28%

YTD 0.00%

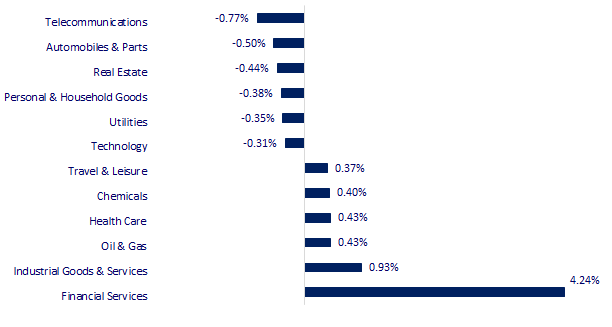

CHANGE IN PRICE BY SECTOR

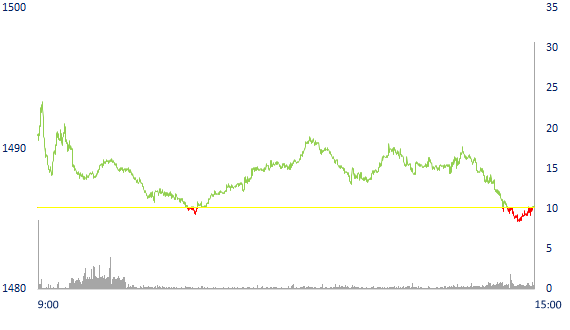

INTRADAY VNINDEX

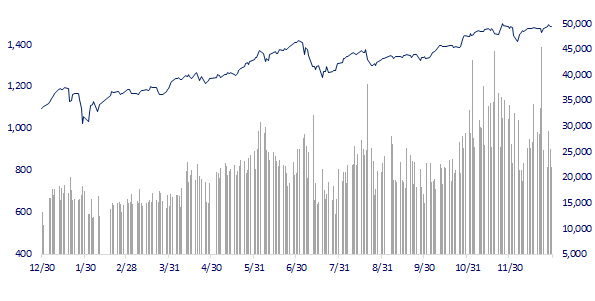

VNINDEX (12M)

GLOBAL MARKET

28,791.71

1D -0.33%

YTD 4.91%

3,619.19

1D 0.62%

YTD 6.00%

2,977.65

1D -0.52%

YTD 3.63%

23,112.01

1D -0.29%

YTD -14.86%

3,126.64

1D -0.36%

YTD 8.97%

1,657.62

1D 0.26%

YTD 14.37%

75.94

1D -1.08%

YTD 57.23%

1,802.05

1D -0.02%

YTD -5.34%

Asian stocks were mixed after the S&P 500 hit 70th session of the year. In Japan, the Nikkei 225 fell 0.33%. The Chinese market rose with Shanghai Composite up 0.62%, Shenzhen Component up 0.972%. Hong Kong's Hang Seng Index fell 0.29%. South Korea's Kospi index fell 0.52%.

VIETNAM ECONOMY

0.81%

1D (bps) -17

YTD (bps) 68

5.60%

YTD (bps) -20

1.03%

1D (bps) 3

YTD (bps) -19

2.03%

1D (bps) 1

22,985

1D (%) 0.11%

YTD (%) -0.83%

26,199

1D (%) -1.27%

YTD (%) -9.98%

3,641

1D (%) -0.33%

YTD (%) 1.90%

In 2021, the merchandise trade balance is estimated to have a trade surplus of $4 billion, compared with a trade surplus of $19.94 billion in 2020 and $10.57 billion in 2019. This year, the US is the country's largest export market. Vietnam, estimated at 95.6 billion USD. China is Vietnam's largest import market, estimated at 109.9 billion USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has a trade surplus of 4 billion USD in 2021

- Consumer price index rose to lowest level since 2016

- Recommendations for small and medium-sized tourism businesses to borrow capital with 0% interest rate

- Europe suffers from an outbreak of Omicron strain on the eve of the new year

- China continues its ambition to internationalize the renminbi

- RCEP is about to take effect, China can become the "recovery engine" in the largest free trade bloc

VN30

BANK

78,400

1D -1.38%

5D 2.48%

Buy Vol. 1,379,000

Sell Vol. 1,621,100

35,400

1D 0.57%

5D 2.61%

Buy Vol. 1,702,800

Sell Vol. 2,349,400

33,800

1D -1.02%

5D 4.97%

Buy Vol. 8,714,600

Sell Vol. 15,395,100

49,300

1D 0.41%

5D 4.12%

Buy Vol. 8,585,000

Sell Vol. 10,067,000

35,400

1D 1.87%

5D 9.26%

Buy Vol. 15,354,500

Sell Vol. 18,774,000

28,450

1D 0.53%

5D 4.21%

Buy Vol. 9,120,300

Sell Vol. 21,099,300

30,600

1D 0.00%

5D 13.97%

Buy Vol. 6,795,500

Sell Vol. 9,016,900

40,750

1D -1.45%

5D 11.04%

Buy Vol. 5,051,600

Sell Vol. 6,046,500

30,500

1D 3.39%

5D 11.31%

Buy Vol. 53,415,000

Sell Vol. 55,262,700

33,900

1D 0.30%

5D 4.31%

Buy Vol. 3,152,900

Sell Vol. 4,778,400

Race bank issues ESOP shares to retain employees and increase capital. HDB employees will receive 20m ESOP shares, priced at 10,000 VND/share. The number of shares to be issued accounts for 1.004% of the outstanding shares. VPB issued 15m ESOP shares right in August 2021 according to the plan approved by the 2021 Annual General Meeting of Shareholders, from treasury shares, equivalent to 0.611% of the total number of outstanding shares. TCB completed the issuance of 6m ESOP shares at the price of 10,000 VND/share at the end of September 2021 to 238 individuals under the employee selection program.

REAL ESTATE

86,300

1D -0.80%

5D 0.04%

Buy Vol. 2,158,400

Sell Vol. 2,327,700

52,100

1D -1.70%

5D 0.77%

Buy Vol. 3,146,300

Sell Vol. 4,013,400

94,400

1D 1.51%

5D -0.42%

Buy Vol. 4,018,100

Sell Vol. 3,791,800

KDH: Hanwha Life Vietnam Insurance Company Limited - the related organization of the two leaders at KDH register to buy another 20,000 shares to increase ownership to 30,800 shares.

OIL & GAS

97,000

1D 0.00%

5D 1.89%

Buy Vol. 963,400

Sell Vol. 1,285,800

17,450

1D -3.06%

5D -5.68%

Buy Vol. 42,855,600

Sell Vol. 51,066,900

54,000

1D 0.00%

5D 2.27%

Buy Vol. 1,012,700

Sell Vol. 1,771,200

Ending Wednesday's session, the Brent oil contract advanced 29 cents (or 0.37%) to $79.23 per barrel. The WTI oil contract added 58 cents, or 0.76%, to $76.56 a barrel.

VINGROUP

95,000

1D -0.52%

5D -1.04%

Buy Vol. 2,488,000

Sell Vol. 2,795,700

81,600

1D -0.12%

5D -1.09%

Buy Vol. 9,239,600

Sell Vol. 9,379,100

30,500

1D -0.16%

5D -1.61%

Buy Vol. 6,102,200

Sell Vol. 8,204,700

VHM: In 2022-2024 period, VHM will start a new development cycle with the opening and sale of 3 projects: Vinhomes Dream City, Vinhomes Wonder Park and Vinhomes Co Loa.

FOOD & BEVERAGE

85,300

1D 0.12%

5D 0.71%

Buy Vol. 2,181,200

Sell Vol. 2,165,500

171,500

1D -0.29%

5D 0.29%

Buy Vol. 5,681,800

Sell Vol. 7,576,900

148,900

1D 0.40%

5D 1.36%

Buy Vol. 179,800

Sell Vol. 210,800

MSN: December 31, 2021 is the first trading day of 115 million listed convertible bonds of Masan Group JSC.

OTHERS

126,000

1D 0.64%

5D 1.69%

Buy Vol. 1,084,800

Sell Vol. 1,109,000

126,000

1D 0.64%

5D 1.69%

Buy Vol. 1,084,800

Sell Vol. 1,109,000

93,600

1D 0.00%

5D 0.43%

Buy Vol. 1,312,000

Sell Vol. 1,507,300

134,300

1D -0.07%

5D 0.52%

Buy Vol. 1,512,900

Sell Vol. 1,346,000

92,500

1D -0.75%

5D -1.28%

Buy Vol. 881,300

Sell Vol. 949,600

37,000

1D 0.27%

5D -5.13%

Buy Vol. 3,604,800

Sell Vol. 4,362,500

52,600

1D 5.94%

5D 7.35%

Buy Vol. 26,577,900

Sell Vol. 28,232,100

45,700

1D -0.22%

5D 1.67%

Buy Vol. 17,762,900

Sell Vol. 20,200,900

VJC: Vietjet sharply increased the frequency of domestic routes from December 29 to serve the demand for passenger transportation in the peak season at the end of the year and the Lunar New Year. From December 29 to January 18, 2022, Vietjet increased the frequency of the Hanoi - Ho Chi Minh City backbone route to 49 round-trip flights/week, similar to the routes connecting Ho Chi Minh City, Hanoi to Da Nang also increased. 42 round-trip flights/week.

Market by numbers

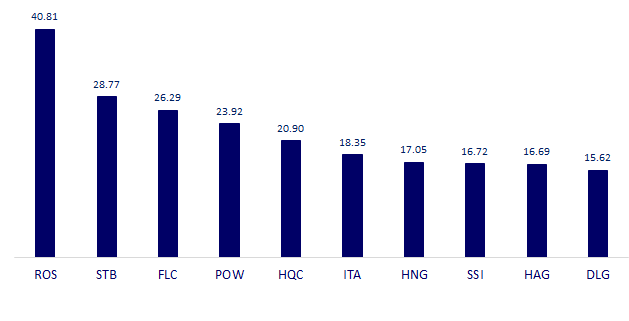

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

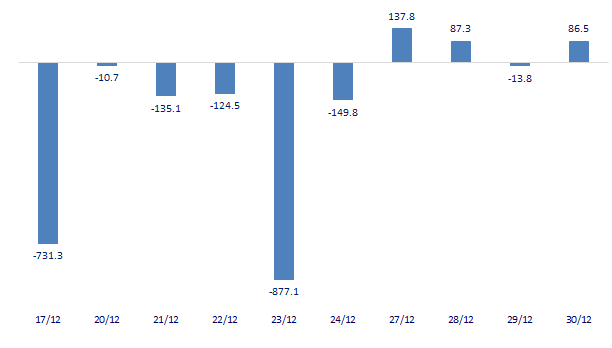

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

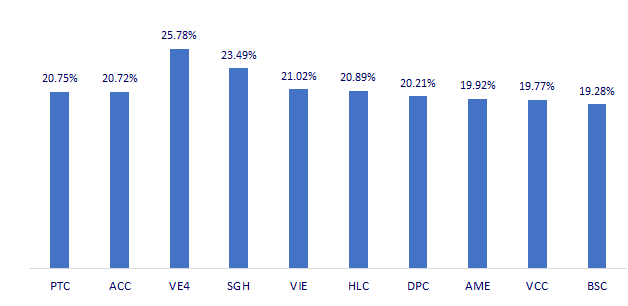

TOP INCREASES 3 CONSECUTIVE SESSIONS

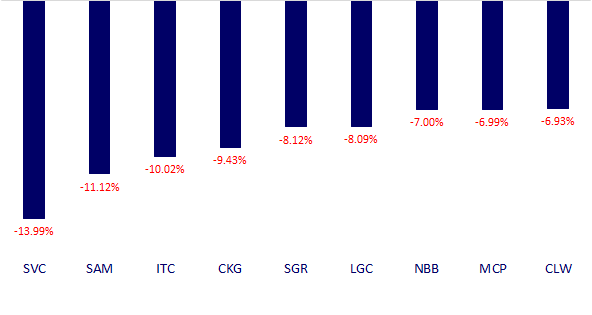

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.