Market brief 05/01/2022

VIETNAM STOCK MARKET

1,522.50

1D -0.20%

YTD 1.62%

1,546.01

1D -0.82%

YTD 0.67%

480.36

1D 1.32%

YTD 1.34%

114.26

1D 0.47%

YTD 1.40%

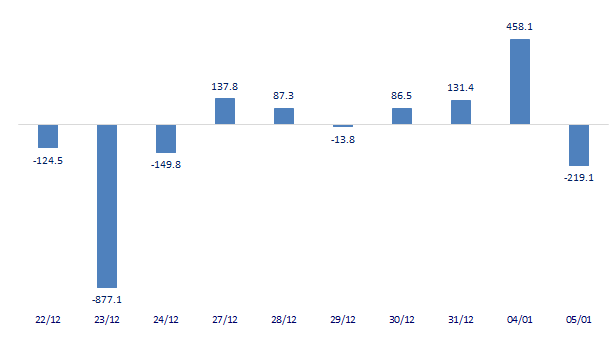

-219.11

1D 0.00%

YTD 0.00%

39,772.16

1D 16.84%

YTD 28.00%

Foreign investors' trade was no longer positive when they bought 38 million shares, worth 1,722 billion dong, while selling out 37.8 million shares, worth 1,903 billion dong. The total volume of net buying was 374,886 shares, but in terms of value, this capital flow was a net selling of 219 billion dong. On HoSE alone, foreign investors ended a series of 7 consecutive net buying sessions with a net selling of 255 billion dong

ETF & DERIVATIVES

25,990

1D -0.80%

YTD 0.62%

18,000

1D -1.96%

YTD -0.50%

19,000

1D 6.68%

YTD 0.00%

23,400

1D 0.43%

YTD 2.18%

22,000

1D -1.35%

YTD -2.14%

28,030

1D -1.99%

YTD -0.07%

20,580

1D -0.15%

YTD -4.19%

1,546

1D -0.61%

YTD 0.00%

1,548

1D -0.51%

YTD 0.00%

1,547

1D -0.54%

YTD 0.00%

1,549

1D -0.61%

YTD 0.00%

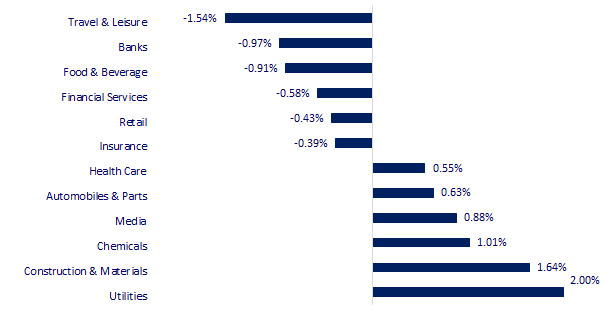

CHANGE IN PRICE BY SECTOR

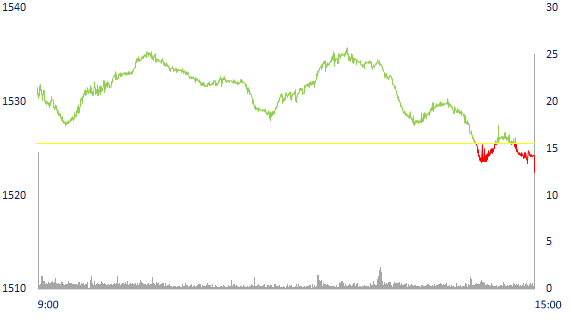

INTRADAY VNINDEX

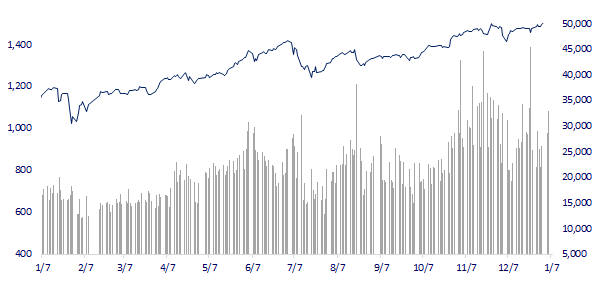

VNINDEX (12M)

GLOBAL MARKET

29,332.16

1D 0.11%

YTD 1.88%

3,595.18

1D -1.02%

YTD -1.23%

2,953.97

1D -1.18%

YTD -0.80%

22,907.25

1D -1.05%

YTD -2.10%

3,163.44

1D -0.56%

YTD 1.27%

1,676.79

1D 0.39%

YTD 1.16%

76.95

1D 0.14%

YTD 0.59%

1,819.20

1D 0.20%

YTD -0.09%

Asian stocks mixed according to Wall Street. In Japan, the Nikkei 225 gained 0.11%. The Chinese market fell with Shanghai Composite down 1.02%, Shenzhen Component down 1.795%. Hong Kong's Hang Seng Index fell 1.05%. South Korea's Kospi index fell 1.18%.

VIETNAM ECONOMY

1.80%

1D (bps) 107

YTD (bps) 99

5.60%

1.00%

1D (bps) -16

YTD (bps) -1

2.00%

1D (bps) 14

22,975

1D (%) 0.35%

YTD (%) 0.15%

26,180

1D (%) -0.54%

YTD (%) -1.09%

3,643

1D (%) 0.05%

YTD (%) -0.41%

The government strives for GDP growth of 6-6.5% this year. GDP per capita is targeted at 3,900 USD. The Government's top priority task this year is to both control the Covid-19 epidemic well while recovering and developing the economy.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government strives for GDP growth of 6-6.5% this year

- Vietnam is in the top 6 countries with the highest vaccine coverage in the world

- The Prime Minister agrees to allow Da Nang to establish a non-tariff zone

- WHO says there is more evidence that Omicrons cause milder disease

- Demand for gold jewelry in China increased sharply

- OPEC+ agrees to increase production by 400,000 bpd

VN30

BANK

78,000

1D -1.27%

5D -1.89%

Buy Vol. 2,647,800

Sell Vol. 2,605,600

37,050

1D -0.94%

5D 5.26%

Buy Vol. 2,840,300

Sell Vol. 4,266,300

34,750

1D 0.00%

5D 1.76%

Buy Vol. 15,416,800

Sell Vol. 23,286,000

50,500

1D -0.79%

5D 2.85%

Buy Vol. 13,444,500

Sell Vol. 17,742,800

35,500

1D -1.53%

5D 2.16%

Buy Vol. 17,455,000

Sell Vol. 23,467,700

28,700

1D -1.37%

5D 1.41%

Buy Vol. 13,348,400

Sell Vol. 17,333,500

30,500

1D -1.93%

5D -0.33%

Buy Vol. 9,874,100

Sell Vol. 11,201,900

42,000

1D -1.75%

5D 1.57%

Buy Vol. 6,113,900

Sell Vol. 6,737,500

32,550

1D 1.40%

5D 10.34%

Buy Vol. 71,883,900

Sell Vol. 67,724,400

33,700

1D -2.03%

5D -0.30%

Buy Vol. 7,961,000

Sell Vol. 10,988,100

TPB: In 2021, the bank's total mobilization will reach over VND 262,000 billion, an increase of VND 77,000 billion compared to the end of 2020, in which, mobilized capital mainly comes from deposits from economic organizations and individuals. TPBank's total operating income also reached more than VND 13,500 billion, up more than 30% over the same period. In addition to interest income from lending activities, net interest income from the bank's services increased by nearly 65% compared to the same period at the end of 2020, reaching over VND 1,500 billion.

REAL ESTATE

89,100

1D 0.11%

5D 2.41%

Buy Vol. 3,345,000

Sell Vol. 3,239,500

55,700

1D 2.39%

5D 5.09%

Buy Vol. 5,871,800

Sell Vol. 5,786,800

93,800

1D -1.05%

5D 0.86%

Buy Vol. 4,347,700

Sell Vol. 4,677,600

NVL: Through the additional capital contribution to Saigon Infrastructure and Housing Development Investment Co., Ltd with a capital of 1,425 billion VND (99.99% of charter capital)

OIL & GAS

105,000

1D 3.04%

5D 8.25%

Buy Vol. 3,319,400

Sell Vol. 3,246,700

19,000

1D 1.60%

5D 5.56%

Buy Vol. 64,709,600

Sell Vol. 82,233,200

55,700

1D -0.36%

5D 3.15%

Buy Vol. 2,249,200

Sell Vol. 3,500,400

OPEC+, has decided to raise its output target by 400,000 bpd from next month. This move was much expected in the face of US pressure to increase supply.

VINGROUP

100,000

1D -0.99%

5D 4.71%

Buy Vol. 5,785,200

Sell Vol. 5,883,000

84,000

1D -1.29%

5D 2.82%

Buy Vol. 10,031,200

Sell Vol. 15,144,800

33,300

1D 6.90%

5D 9.00%

Buy Vol. 27,601,800

Sell Vol. 13,211,600

In 2021, although the VinFast car factory faces many difficulties, it still pays nearly 5,000 billion VND in tax. This is the highest tax paying enterprise in Hai Phong city

FOOD & BEVERAGE

86,200

1D -0.58%

5D 1.17%

Buy Vol. 4,586,300

Sell Vol. 5,876,500

161,000

1D -5.29%

5D -6.40%

Buy Vol. 1,964,500

Sell Vol. 3,141,000

159,300

1D 1.46%

5D 7.42%

Buy Vol. 448,600

Sell Vol. 520,900

Market cap. of SAB and VNM dropped the most with 22% and 17.5% respectively. 2021 continues to be a difficult year for the F&B industry group due to the heavy influence of the Covid-19.

OTHERS

123,000

1D -2.38%

5D -1.76%

Buy Vol. 874,700

Sell Vol. 656,000

123,000

1D -2.38%

5D -1.76%

Buy Vol. 874,700

Sell Vol. 656,000

93,600

1D 0.11%

5D 0.00%

Buy Vol. 2,171,200

Sell Vol. 2,096,500

137,100

1D -0.51%

5D 2.01%

Buy Vol. 1,672,300

Sell Vol. 2,145,800

95,100

1D -1.45%

5D 2.04%

Buy Vol. 876,100

Sell Vol. 910,800

38,400

1D 2.13%

5D 4.07%

Buy Vol. 9,254,100

Sell Vol. 9,810,900

52,800

1D -0.38%

5D 6.34%

Buy Vol. 28,152,100

Sell Vol. 36,154,400

46,800

1D 0.11%

5D 2.18%

Buy Vol. 28,148,600

Sell Vol. 31,970,000

GVR: said that the complicated development of the Covid-29 epidemic and the implementation of prolonged distance affected the production and business results of the parent company of the group. Therefore, the Board of Directors agreed to reduce the parent corporation's revenue plan from 4,291 billion VND to 3,799 billion VND, or 11.4% decrease; The planned profit after tax also decreased by 982 billion VND from 3,041 billion to 2,059 billion VND, equivalent to a decrease of 33%.

Market by numbers

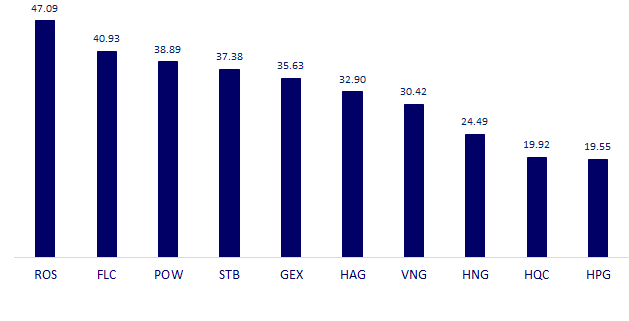

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

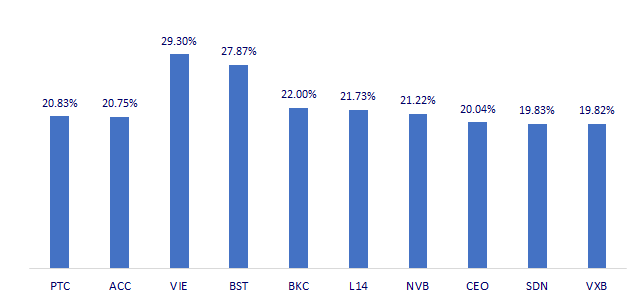

TOP INCREASES 3 CONSECUTIVE SESSIONS

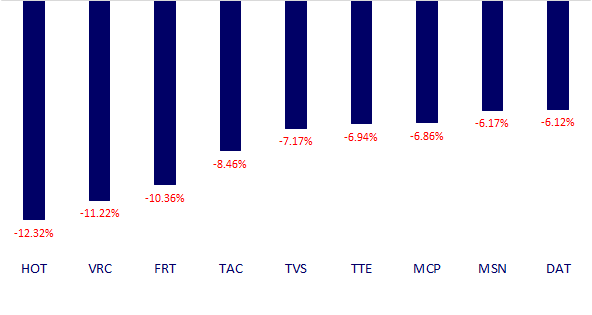

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.