Market brief 06/01/2022

VIETNAM STOCK MARKET

1,528.57

1D 0.40%

YTD 2.02%

1,544.95

1D -0.07%

YTD 0.60%

484.89

1D 0.94%

YTD 2.30%

114.39

1D 0.11%

YTD 1.52%

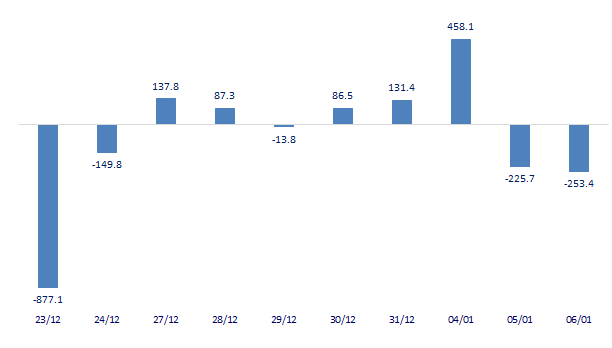

-253.36

1D 0.00%

YTD 0.00%

42,124.08

1D 5.79%

YTD 35.57%

Foreign investors continued to net sell 253b dong in session 6/1, focusing on collecting real estate stocks. VHM was the strongest net bought by foreign investors with the value of 117b dong. 2nd net buyers was KBC with 103b dong. The next positions all belong to the real estate group, which are DXG, BCM and KDH with a net buying value of VND61b, VND53b and VND38b, respectively.

ETF & DERIVATIVES

25,820

1D -0.65%

YTD -0.04%

18,200

1D 1.11%

YTD 0.61%

19,010

1D 6.74%

YTD 0.05%

23,690

1D 1.24%

YTD 3.45%

21,880

1D -0.55%

YTD -2.67%

27,850

1D -0.64%

YTD -0.71%

20,420

1D -0.78%

YTD -4.93%

1,542

1D -0.23%

YTD 0.00%

1,543

1D -0.30%

YTD 0.00%

1,543

1D -0.26%

YTD 0.00%

1,545

1D -0.25%

YTD 0.00%

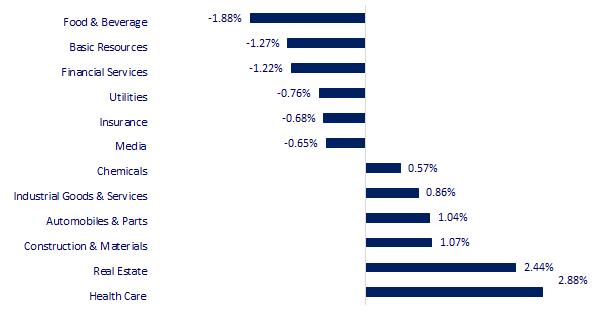

CHANGE IN PRICE BY SECTOR

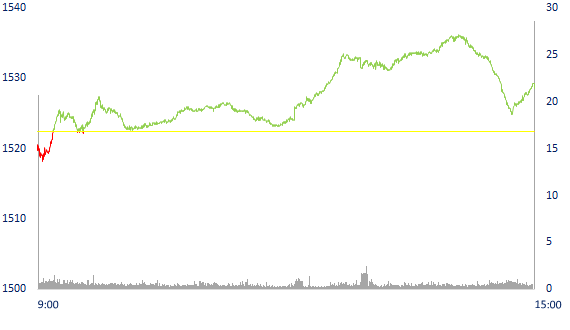

INTRADAY VNINDEX

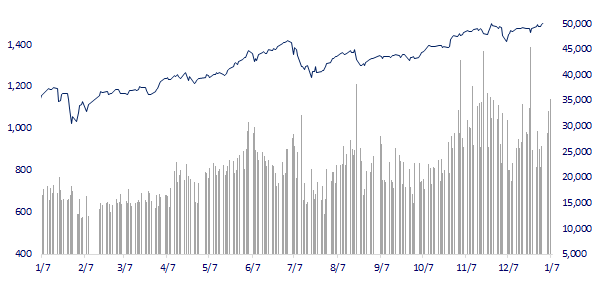

VNINDEX (12M)

GLOBAL MARKET

28,487.87

1D -1.38%

YTD -1.06%

3,586.08

1D -0.25%

YTD -1.48%

2,920.53

1D -1.13%

YTD -1.92%

23,072.86

1D 0.33%

YTD -1.39%

3,184.30

1D 0.66%

YTD 1.94%

1,653.03

1D -1.42%

YTD -0.28%

79.04

1D 2.34%

YTD 3.32%

1,800.55

1D -0.54%

YTD -1.11%

Stock markets in Asia - Pacific fell in session 6/1. In Japan, the Nikkei 225 fell 1.38%. The Chinese market fell with Shanghai Composite down 0.25%, Shenzhen Component down 0.663%. Hong Kong's Hang Seng rose 0.33%. South Korea's Kospi index fell 1.13%.

VIETNAM ECONOMY

1.47%

1D (bps) -33

YTD (bps) 66

5.60%

1.20%

1D (bps) 20

YTD (bps) 19

1.90%

1D (bps) -10

YTD (bps) -10

22,965

1D (%) 0.31%

YTD (%) 0.11%

26,167

1D (%) -0.77%

YTD (%) -1.14%

3,636

1D (%) -0.25%

YTD (%) -0.60%

State budget revenue in 2021 is estimated at 1,563.3 trillion dong, equaling 116.4% of the estimate, up 3.7% compared to 2020. In which, revenue mainly comes from crude oil, income from import and export activities and collection of land use levy; domestic tax and fee collection from production and business activities (exceeding 14.5% of the estimate, increasing by 11.3% compared to the implementation in 2020); the rate of mobilization into the state budget reached 18.6% of GDP.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The state budget in 2021 is still a bountiful nearly VND 220,000 billion

- Vietnam surpassed China to become the main production base for Nike

- Spent 74,000 billion VND to fight the epidemic and support people in difficulty

- The Fed is expected to start raising interest rates in March of this year

- The US bond market was sold strongly

- China's December PMI rose rapidly despite the impact of Covid

VN30

BANK

79,100

1D 1.41%

5D 0.89%

Buy Vol. 2,256,600

Sell Vol. 2,383,300

38,000

1D 2.56%

5D 7.34%

Buy Vol. 9,498,000

Sell Vol. 9,038,200

34,000

1D -2.16%

5D 0.59%

Buy Vol. 19,602,100

Sell Vol. 20,358,300

49,900

1D -1.19%

5D 1.22%

Buy Vol. 15,086,300

Sell Vol. 17,636,500

35,150

1D -0.99%

5D -0.71%

Buy Vol. 21,436,100

Sell Vol. 21,532,400

28,350

1D -1.22%

5D -0.35%

Buy Vol. 16,922,200

Sell Vol. 18,206,600

30,500

1D 0.00%

5D -0.33%

Buy Vol. 11,357,400

Sell Vol. 10,431,300

42,000

1D 0.00%

5D 3.07%

Buy Vol. 9,193,700

Sell Vol. 9,911,700

32,700

1D 0.46%

5D 7.21%

Buy Vol. 70,727,500

Sell Vol. 72,639,900

33,750

1D 0.15%

5D -0.44%

Buy Vol. 8,969,100

Sell Vol. 8,834,000

CTG: As of December 31, 2021, the average outstanding balance increased by 12.3% yoy. The proportion of retail loans and SME customers reached 57%, a positive improvement yoy. Non-interest income increased by over 20%. Demand deposits (CASA) increased by more than 20% yoy, the proportion of CASA/total capital in 2021 reached 20%. Last year, VietinBank reduced its profit by more than VND 7,000 billion to deploy many support solutions on credit, debt restructuring, loan interest rate reduction, service fees in order to promptly remove difficulties and accompany customers to overcome difficulties.

REAL ESTATE

88,200

1D -1.01%

5D 2.20%

Buy Vol. 3,377,600

Sell Vol. 4,223,600

56,800

1D 1.97%

5D 9.02%

Buy Vol. 4,819,100

Sell Vol. 4,846,600

93,800

1D 0.00%

5D -0.64%

Buy Vol. 3,659,000

Sell Vol. 3,320,400

PDR: Collecting shareholders' written opinions on the plan to implement a foreign loan entitled to be converted into common shares for the Borrower.

OIL & GAS

103,700

1D -1.24%

5D 6.91%

Buy Vol. 1,391,800

Sell Vol. 1,600,000

19,250

1D 1.32%

5D 10.32%

Buy Vol. 54,129,900

Sell Vol. 63,447,100

55,500

1D -0.36%

5D 2.78%

Buy Vol. 1,977,600

Sell Vol. 2,404,600

PLX: Non-cash payment and Petrolimex ID membership registration officially operated by PLX from November 19, 2021.

VINGROUP

104,500

1D 4.50%

5D 10.00%

Buy Vol. 8,380,400

Sell Vol. 9,776,100

85,300

1D 1.55%

5D 4.53%

Buy Vol. 16,134,000

Sell Vol. 20,649,600

35,600

1D 6.91%

5D 16.72%

Buy Vol. 41,572,600

Sell Vol. 31,567,500

VinFast plans to manufacture and assemble electric vehicle batteries at a complex of factories in the US. VinFast will initially assemble electric vehicle batteries with battery cells first.

FOOD & BEVERAGE

85,400

1D -0.93%

5D 0.12%

Buy Vol. 4,816,100

Sell Vol. 4,786,800

153,800

1D -4.47%

5D -10.32%

Buy Vol. 2,484,500

Sell Vol. 2,987,900

156,600

1D -1.69%

5D 5.17%

Buy Vol. 181,000

Sell Vol. 235,800

MSN and VNM were both stocks that were sold the most by foreign investors in today's session with a value of 122 billion dong and 106 billion dong, respectively.

OTHERS

123,800

1D 0.65%

5D -1.75%

Buy Vol. 718,000

Sell Vol. 840,700

123,800

1D 0.65%

5D -1.75%

Buy Vol. 718,000

Sell Vol. 840,700

93,500

1D -0.11%

5D -0.11%

Buy Vol. 1,809,400

Sell Vol. 2,091,200

137,500

1D 0.29%

5D 2.38%

Buy Vol. 1,135,600

Sell Vol. 1,624,400

94,600

1D -0.53%

5D 2.27%

Buy Vol. 574,100

Sell Vol. 553,000

38,600

1D 0.52%

5D 4.32%

Buy Vol. 7,139,900

Sell Vol. 9,587,100

51,900

1D -1.70%

5D -1.33%

Buy Vol. 23,094,500

Sell Vol. 23,734,500

46,100

1D -1.50%

5D 0.88%

Buy Vol. 25,065,900

Sell Vol. 26,909,000

HPG: Hoa Phat Hai Duong Steel Company became the largest tax payer in Hai Duong province. In which, the amount paid separately in Hai Duong is 1,758 billion VND, up 53% yoy. Hoa Phat Hai Duong Steel Joint Stock Company (belonging to Hoa Phat Group) is currently operating Hoa Phat Iron and Steel Complex in Kinh Mon Town - Hai Duong Province, with a capacity of 2.5 million tons/year. The company creates jobs and stable income for 5,000 employees, mainly local people.

Market by numbers

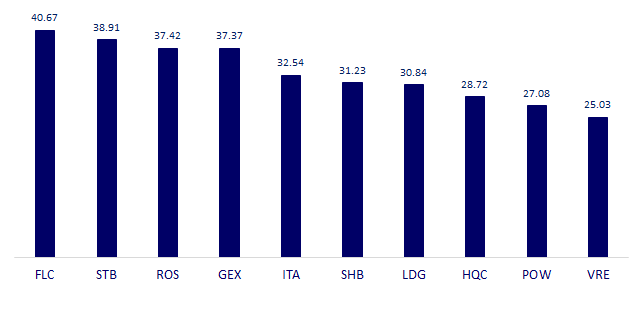

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

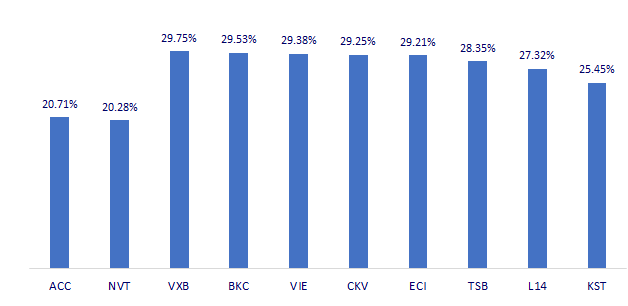

TOP INCREASES 3 CONSECUTIVE SESSIONS

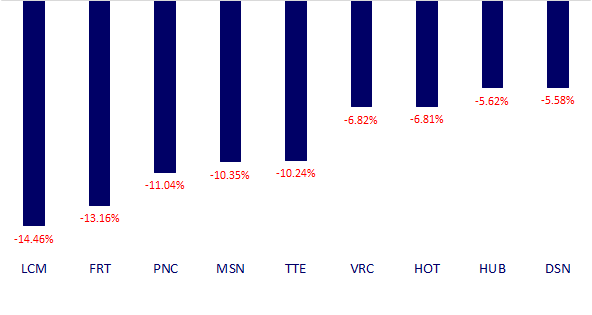

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.