Market brief 11/01/2022

VIETNAM STOCK MARKET

1,492.31

1D -0.76%

YTD -0.40%

1,499.74

1D -0.99%

YTD -2.34%

481.61

1D -0.27%

YTD 1.61%

114.54

1D 0.21%

YTD 1.65%

112.92

1D 0.00%

YTD 0.00%

42,463.00

1D -15.37%

YTD 36.66%

Foreign investors traded actively when buying 42 million shares, worth 1,692 billion dong, while selling 43.5 million shares, worth 1,561 billion dong. Total net selling volume was at 1.5 million shares, but in terms of value, this capital inflow was a net purchase of 113 billion dong. On HoSE alone, foreign investors net bought back 100 billion dong, however, in terms of volume, this capital flow net sold 2.2 million shares.

ETF & DERIVATIVES

25,400

1D -0.70%

YTD -1.66%

17,670

1D -1.23%

YTD -2.32%

18,510

1D 3.93%

YTD -2.58%

22,750

1D -1.52%

YTD -0.66%

21,410

1D -1.15%

YTD -4.76%

27,400

1D -0.54%

YTD -2.32%

19,900

1D -1.68%

YTD -7.36%

1,503

1D -0.86%

YTD 0.00%

1,505

1D -0.82%

YTD 0.00%

1,504

1D -0.84%

YTD 0.00%

1,504

1D -0.63%

YTD 0.00%

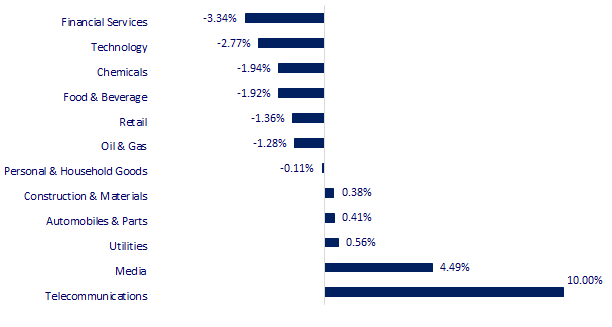

CHANGE IN PRICE BY SECTOR

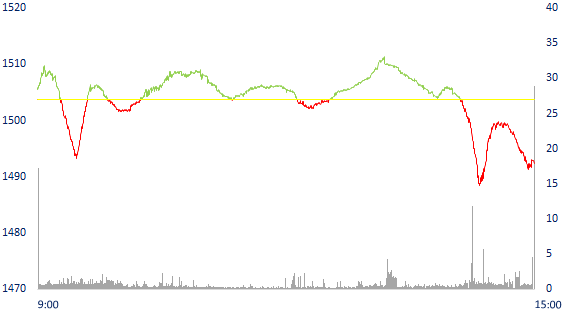

INTRADAY VNINDEX

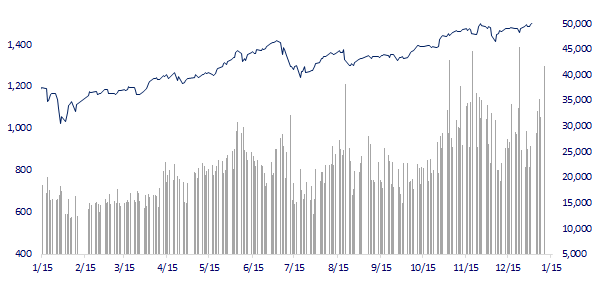

VNINDEX (12M)

GLOBAL MARKET

28,222.48

1D -0.09%

YTD -1.98%

3,567.44

1D -0.73%

YTD -1.99%

2,927.38

1D 0.02%

YTD -1.69%

23,739.06

1D 0.40%

YTD 1.46%

3,246.37

1D 0.60%

YTD 3.93%

1,667.12

1D 0.61%

YTD 0.57%

79.38

1D 0.86%

YTD 3.76%

1,804.70

1D -0.04%

YTD -0.88%

Investors were worried that central banks would tighten policies, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.09%. The Chinese market fell with Shanghai Composite down 0.73%, Shenzhen Component down 1.27%. Hong Kong's Hang Seng rose 0.4%. South Korea's Kospi index rose 0.02%, the Kosdaq increased 0.02%.

VIETNAM ECONOMY

1.14%

1D (bps) -3

YTD (bps) 33

5.60%

1.24%

1D (bps) 7

YTD (bps) 23

1.96%

1D (bps) 9

YTD (bps) -4

22,920

1D (%) 0.35%

YTD (%) -0.09%

26,161

1D (%) -0.79%

YTD (%) -1.16%

3,631

1D (%) 0.03%

YTD (%) -0.74%

According to the Ministry of Industry and Trade, it is estimated that Vietnam's cashew exports in 2021 to the EU market will reach 135,000 tons, worth 816 million USD, up 16.5% in volume and 7.9% in value over the previous year. The above positive growth is due to the EU's demand for cashew nuts in the last month of the year reaching a high level according to the cyclical factor, in order to serve the Christmas and New Year holidays.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Cashew nut exports to the EU are estimated to increase by 15% in volume this year

- The Ministry of Construction proposed to review the situation of rising material prices

- Economic recovery in 2022: Focus on restoring aggregate demand

- Fed will prevent inflation so as not to affect the economy

- China plans to spend 200 billion USD to build an underwater train line, reaching the US in just 2 days

- Thai economy may 'decelerate' in the first half of 2022

VN30

BANK

79,400

1D -0.13%

5D 0.51%

Buy Vol. 1,416,800

Sell Vol. 2,285,500

39,400

1D 1.42%

5D 5.35%

Buy Vol. 7,124,300

Sell Vol. 7,219,300

33,000

1D -0.90%

5D -5.04%

Buy Vol. 10,937,000

Sell Vol. 11,251,200

48,450

1D -0.41%

5D -4.81%

Buy Vol. 10,481,400

Sell Vol. 11,257,800

34,300

1D -0.29%

5D -4.85%

Buy Vol. 14,755,100

Sell Vol. 14,546,000

27,900

1D -0.71%

5D -4.12%

Buy Vol. 12,147,800

Sell Vol. 12,580,000

29,300

1D -1.01%

5D -5.79%

Buy Vol. 7,709,000

Sell Vol. 8,181,300

40,200

1D -0.62%

5D -5.96%

Buy Vol. 7,090,800

Sell Vol. 10,028,100

32,450

1D 2.69%

5D 1.09%

Buy Vol. 53,702,100

Sell Vol. 56,485,900

32,750

1D -0.76%

5D -4.80%

Buy Vol. 9,831,000

Sell Vol. 13,537,700

VCB: Management has set a target of 12% increase in pre-tax profit. Total assets are expected to increase by 8%, capital mobilization in market 1 is 9% higher than at the end of 2021. Credit is planned to increase by 12% and bad debt will remain below 1.5%. The market share of international payment and trade finance is over 16%. The bank will strengthen credit quality control and speed up the recovery of bad debts and off-balance sheet debts. Targeted credit grows in line with the State Bank's (SBV) orientation, focuses on a safe and effective portfolio structure, and continues to promote retail credit.

REAL ESTATE

84,500

1D 0.72%

5D -5.06%

Buy Vol. 4,928,000

Sell Vol. 4,269,400

53,000

1D -2.03%

5D -2.57%

Buy Vol. 4,771,400

Sell Vol. 4,832,900

92,600

1D -0.96%

5D -2.32%

Buy Vol. 4,079,400

Sell Vol. 4,200,600

NVL: Offering VND1,300 billion of non-convertible, unwarranted and unsecured bonds to the public. Bond maturity is 18 months.

OIL & GAS

103,300

1D 1.27%

5D 1.37%

Buy Vol. 1,102,200

Sell Vol. 1,242,400

18,650

1D -0.53%

5D -0.27%

Buy Vol. 60,268,700

Sell Vol. 55,388,500

54,100

1D -1.64%

5D -3.22%

Buy Vol. 1,832,700

Sell Vol. 1,762,600

Ending Monday's session, the Brent oil contract dropped 88 cents (or 1.08%) to $80.87 per barrel. The WTI oil contract lost 67 cents (or 0.85%) to $78.23 a barre

VINGROUP

101,000

1D -1.27%

5D 0.00%

Buy Vol. 4,119,300

Sell Vol. 3,549,300

83,600

1D -2.11%

5D -1.76%

Buy Vol. 9,144,000

Sell Vol. 10,230,500

34,200

1D -2.29%

5D 9.79%

Buy Vol. 21,622,200

Sell Vol. 21,413,700

VinFast's pure-electric strategy is considered by the world press to be reasonable to penetrate the global market.

FOOD & BEVERAGE

83,700

1D 0.00%

5D -1.85%

Buy Vol. 3,305,800

Sell Vol. 3,366,500

144,900

1D -5.29%

5D -14.76%

Buy Vol. 1,940,200

Sell Vol. 2,425,300

152,900

1D 0.59%

5D -1.35%

Buy Vol. 270,100

Sell Vol. 186,900

MSN: Masan Group is about to issue 236 million shares for bonus, rate 20%. The company's charter capital after the issuance is expected to increase to 14,166 billion dong.

OTHERS

123,800

1D 0.00%

5D -1.75%

Buy Vol. 767,200

Sell Vol. 905,600

123,800

1D 0.00%

5D -1.75%

Buy Vol. 767,200

Sell Vol. 905,600

89,500

1D -2.72%

5D -4.28%

Buy Vol. 3,515,600

Sell Vol. 4,164,300

131,800

1D -0.90%

5D -4.35%

Buy Vol. 999,000

Sell Vol. 1,367,300

94,100

1D 0.97%

5D -2.49%

Buy Vol. 763,000

Sell Vol. 791,900

36,800

1D -2.39%

5D -2.13%

Buy Vol. 4,842,100

Sell Vol. 5,722,700

48,100

1D -2.93%

5D -9.25%

Buy Vol. 24,382,800

Sell Vol. 25,200,800

45,100

1D -1.20%

5D -3.53%

Buy Vol. 19,757,800

Sell Vol. 23,365,300

HPG: For the whole year of 2021, HPG has supplied to the market a total of 8.8 million tons of steel including billet, construction steel, HRC, steel pipe and corrugated iron, up 35% over the same period. 2021 is also the first time the Company has reached sales volume of over 1 million tons of steel in a month. In terms of proportion of products, construction steel and HRC contributed mainly to sales volume.

Market by numbers

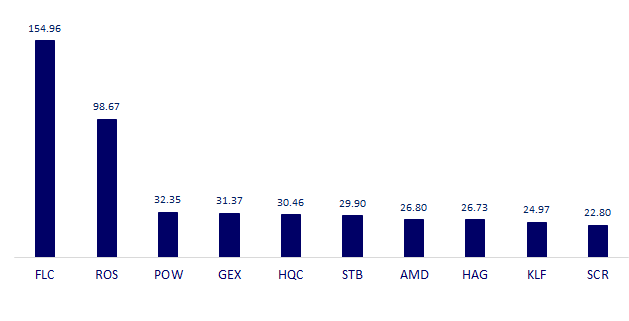

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

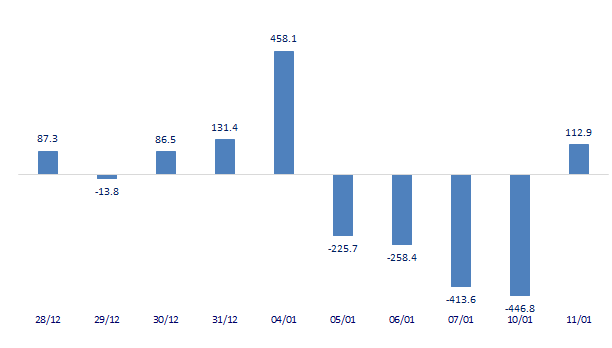

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

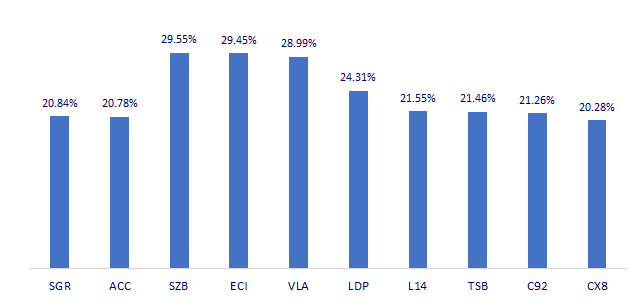

TOP INCREASES 3 CONSECUTIVE SESSIONS

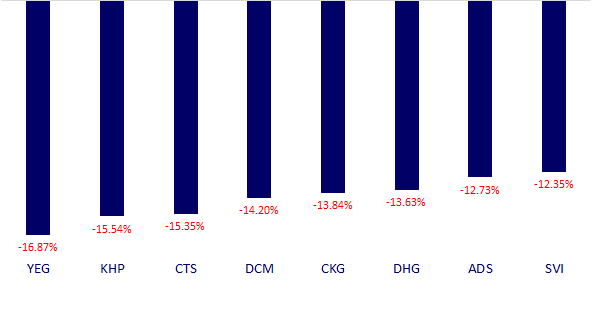

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.