Market brief 18/01/2022

VIETNAM STOCK MARKET

1,437.41

1D -1.06%

YTD -4.06%

1,476.59

1D -0.14%

YTD -3.85%

420.10

1D -5.67%

YTD -11.37%

107.35

1D -1.84%

YTD -4.73%

782.90

1D 0.00%

YTD 0.00%

27,179.65

1D -27.14%

YTD -12.53%

Foreign investors saw a sudden net buying of nearly 900 billion dong on HoSE while speculative groups continued to sell-off. In general, on the stock market, foreign investors bought 60.7 million shares, worth 2,429 billion VND, while selling 47.3 million shares, worth 1,832 billion VND. Total net buying volume was at 14.4 million shares, equivalent to a net buying value of VND 783 billion.

ETF & DERIVATIVES

25,290

1D 1.16%

YTD -2.09%

17,450

1D -0.17%

YTD -3.54%

18,590

1D 4.38%

YTD -2.16%

21,700

1D -1.36%

YTD -5.24%

21,600

1D -3.96%

YTD -3.91%

26,690

1D -0.04%

YTD -4.85%

20,700

1D 5.77%

YTD -3.63%

1,485

1D 0.07%

YTD 0.00%

1,483

1D -0.20%

YTD 0.00%

1,480

1D -0.13%

YTD 0.00%

1,481

1D 0.07%

YTD 0.00%

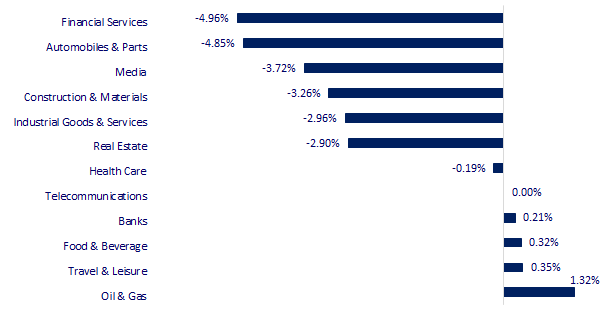

CHANGE IN PRICE BY SECTOR

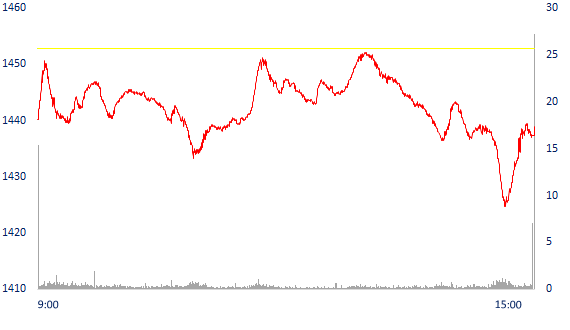

INTRADAY VNINDEX

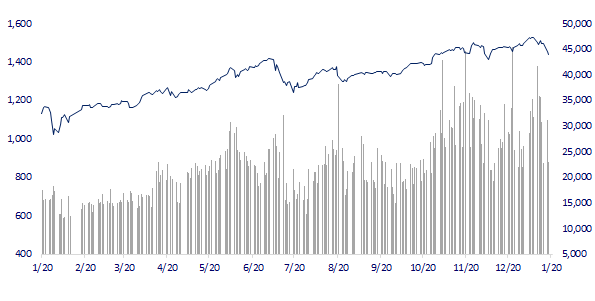

VNINDEX (12M)

GLOBAL MARKET

28,257.25

1D -0.90%

YTD -1.86%

3,569.91

1D 0.80%

YTD -1.92%

2,864.24

1D -0.89%

YTD -3.81%

24,112.78

1D -0.55%

YTD 3.06%

3,280.04

1D -0.24%

YTD 5.01%

1,660.27

1D -0.99%

YTD 0.16%

84.73

1D 1.10%

YTD 10.76%

1,809.80

1D -0.55%

YTD -0.60%

Asian stocks mostly fell, Wall Street on holiday. In Japan, the Nikkei 225 fell 0.09%. The Chinese market went against the general trend with Shanghai Composite up 0.8%, Shenzhen Component up 0.19%. Hong Kong's Hang Seng fell 0.55%. South Korea's Kospi index fell 0.89%, the Kosdaq fell 0.89%.

VIETNAM ECONOMY

1.02%

1D (bps) 4

YTD (bps) 21

5.60%

1.15%

1D (bps) -5

YTD (bps) 14

1.92%

1D (bps) 2

YTD (bps) -8

22,985

1D (%) 0.50%

YTD (%) 0.20%

26,370

1D (%) -0.83%

YTD (%) -0.37%

3,654

1D (%) 0.11%

YTD (%) -0.11%

Decree on reduction of 2% VAT, applicable to groups of goods and services currently applying the tax rate of 10% (to 8%) from the effective date of this Decree to the end of 31/12/2022. It is expected that these policies will reduce state budget revenue in 2022 by about VND 51,400 billion; including 49,400 billion VND from the value-added tax reduction policy and 2,000 billion VND from the policy of deducting expenses for sponsoring and supporting Covid-19 prevention and control.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The budget "lost" about 49,400 billion VND when reducing value-added tax to 8% from the 1st of Tet

- Proposal to invest 8,168 billion VND for "super" Hoa Lac - Hoa Binh expressway PPP project

- Construction steel simultaneously increased in price in the first month of 2022

- China approves "deposit" of national crude oil reserves

- Many major US banks recorded a sharp increase in profits in 2021

- Middle East tensions push oil prices to over 7 years high

VN30

BANK

87,600

1D 1.62%

5D 10.33%

Buy Vol. 2,797,700

Sell Vol. 2,866,300

44,900

1D 2.86%

5D 13.96%

Buy Vol. 9,080,800

Sell Vol. 8,240,200

34,550

1D -1.29%

5D 4.70%

Buy Vol. 24,614,800

Sell Vol. 29,668,600

48,750

1D 0.31%

5D 0.62%

Buy Vol. 14,075,800

Sell Vol. 13,377,800

33,250

1D 0.61%

5D -3.06%

Buy Vol. 12,573,500

Sell Vol. 10,687,600

29,900

1D 1.36%

5D 7.17%

Buy Vol. 25,839,700

Sell Vol. 30,991,300

29,550

1D 1.90%

5D 0.85%

Buy Vol. 8,992,900

Sell Vol. 8,323,600

38,900

1D -3.23%

5D -3.23%

Buy Vol. 14,554,400

Sell Vol. 14,782,100

33,900

1D 3.99%

5D 4.47%

Buy Vol. 78,951,800

Sell Vol. 62,820,300

32,800

1D 0.15%

5D 0.15%

Buy Vol. 7,133,100

Sell Vol. 6,578,800

TCB: The Ministry of Finance honored Techcombank as the leader in the list of "Market Makers" in the construction and issuance of Government bonds. This is the second consecutive year that Techcombank is the most active "market maker" in the construction and issuance of government bonds, boosting liquidity in the Vietnamese market.

REAL ESTATE

80,100

1D 0.13%

5D -5.21%

Buy Vol. 3,619,400

Sell Vol. 3,420,800

50,500

1D 1.41%

5D -4.72%

Buy Vol. 3,462,900

Sell Vol. 2,914,500

88,000

1D 1.73%

5D -4.97%

Buy Vol. 4,949,200

Sell Vol. 4,936,000

Ha Tinh plans to develop an eco-tourism urban area of 185 hectares, expand the planning of Nghen town to 2,577 hectares

OIL & GAS

107,000

1D 2.29%

5D 3.58%

Buy Vol. 1,879,900

Sell Vol. 1,932,800

15,400

1D -6.67%

5D -17.43%

Buy Vol. 42,814,900

Sell Vol. 48,772,900

54,000

1D 0.75%

5D -0.18%

Buy Vol. 2,206,800

Sell Vol. 1,937,600

POW: in 2021, POW will record a total electricity output of 14,701m kWh, ~79% of the year plan. Power output has not met the plan, the demand for power on the system continues decrease sharply.

VINGROUP

95,900

1D -1.13%

5D -5.05%

Buy Vol. 3,083,400

Sell Vol. 3,628,200

77,000

1D -2.65%

5D -7.89%

Buy Vol. 12,071,500

Sell Vol. 12,524,900

32,400

1D 1.25%

5D -5.26%

Buy Vol. 17,757,100

Sell Vol. 15,066,500

VIC: Vietnam's tax incentives and registration fee exemptions for electric cars will create a driving force for VinFast to develop stronger electric vehicle orientation.

FOOD & BEVERAGE

83,400

1D 0.60%

5D -0.36%

Buy Vol. 3,299,700

Sell Vol. 3,982,700

142,100

1D 0.07%

5D -1.93%

Buy Vol. 1,755,000

Sell Vol. 1,629,800

151,000

1D 0.67%

5D -1.24%

Buy Vol. 375,500

Sell Vol. 362,700

VNM: During the trading week of January 10-14, VNM was among the top stocks that were strongly bought by domestic individuals with a value of 487 billion dong respectively.

OTHERS

124,500

1D 3.32%

5D 0.57%

Buy Vol. 1,100,200

Sell Vol. 1,005,000

124,500

1D 3.32%

5D 0.57%

Buy Vol. 1,100,200

Sell Vol. 1,005,000

88,100

1D -1.01%

5D -1.56%

Buy Vol. 1,907,800

Sell Vol. 2,271,600

130,100

1D 0.08%

5D -1.29%

Buy Vol. 1,473,700

Sell Vol. 1,582,800

93,300

1D -0.21%

5D -0.85%

Buy Vol. 624,600

Sell Vol. 685,900

31,100

1D -6.47%

5D -15.49%

Buy Vol. 4,949,900

Sell Vol. 4,598,300

42,300

1D -6.62%

5D -12.06%

Buy Vol. 28,724,500

Sell Vol. 27,708,900

44,000

1D -1.57%

5D -2.44%

Buy Vol. 35,157,400

Sell Vol. 34,538,600

MWG: Mr. Nguyen Duc Tai: The mobile world still has a dream of 10 billion USD, if there is no Covid, maybe 1-2 years from now it will be achieved. Looking back at the figure of 10 billion USD, this is actually the big ambition set forth by the management in the years 2015-2016: the time when the Company was full of confidence after its great success with the Dien May Xanh chain. In fact, this number was interpreted as a distant expectation at that time.

Market by numbers

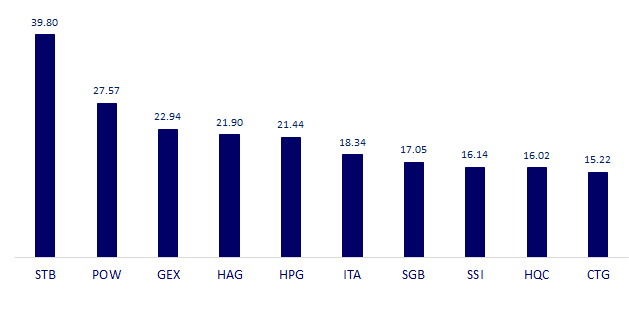

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

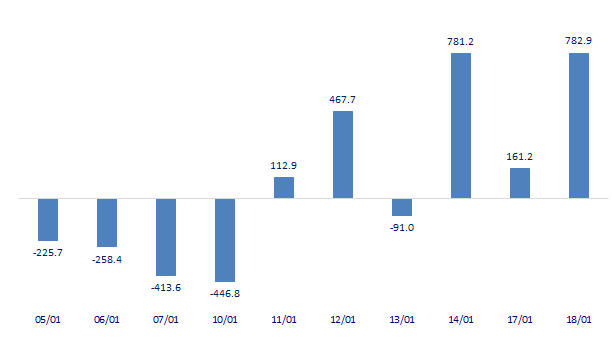

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

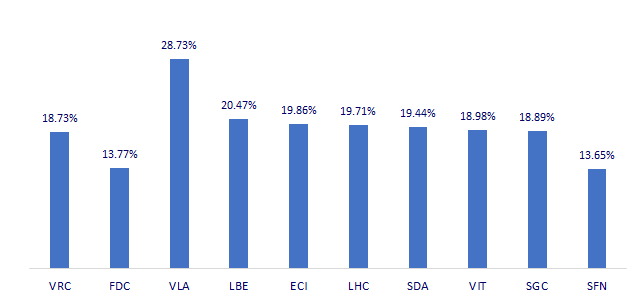

TOP INCREASES 3 CONSECUTIVE SESSIONS

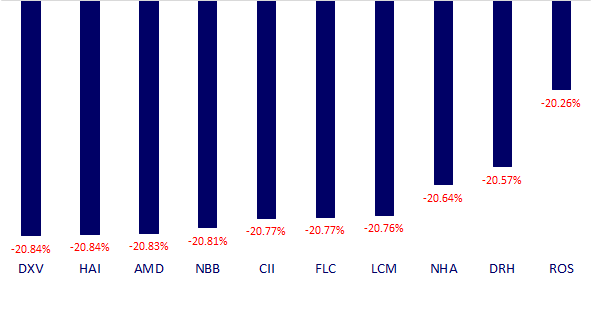

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.