Market brief 19/01/2022

VIETNAM STOCK MARKET

1,442.79

1D 0.27%

YTD -3.70%

1,482.55

1D 0.37%

YTD -3.46%

409.31

1D -2.83%

YTD -13.65%

107.84

1D 0.34%

YTD -4.30%

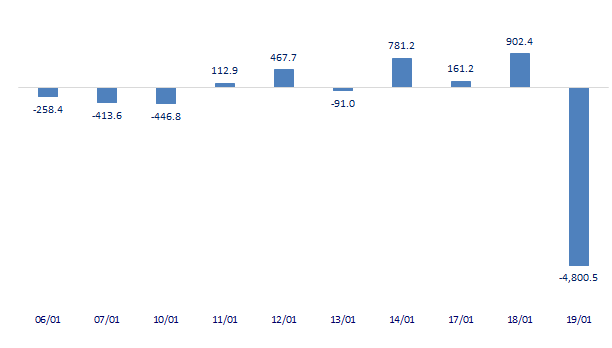

-4,800.51

1D 0.00%

YTD 0.00%

25,855.07

1D -4.87%

YTD -16.79%

Foreign investors suddenly net sold 4,800 billion dong in the session 19/1. The strong net selling of foreign investors on HoSE today was due to a sudden change in the put-through transaction of MSN, which saw a net selling of foreign capital of VND 4,747 billion through the put-through transaction. If calculated by both put-through and order-matching methods, MSN was net sold 4,728 billion dong.

ETF & DERIVATIVES

25,200

1D -0.36%

YTD -2.44%

17,440

1D -0.06%

YTD -3.59%

18,700

1D 5.00%

YTD -1.58%

22,000

1D 1.38%

YTD -3.93%

22,200

1D 2.78%

YTD -1.25%

27,100

1D 1.54%

YTD -3.39%

19,400

1D -6.28%

YTD -9.68%

1,484

1D -0.07%

YTD 0.00%

1,481

1D -0.16%

YTD 0.00%

1,481

1D 0.06%

YTD 0.00%

1,482

1D 0.07%

YTD 0.00%

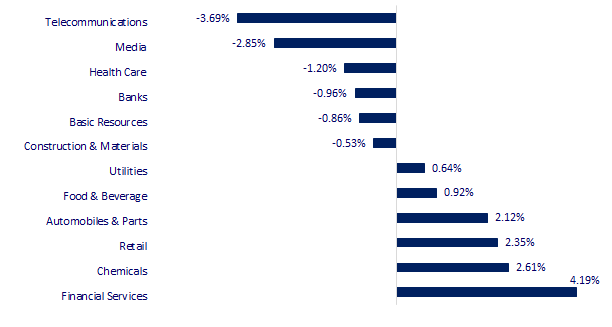

CHANGE IN PRICE BY SECTOR

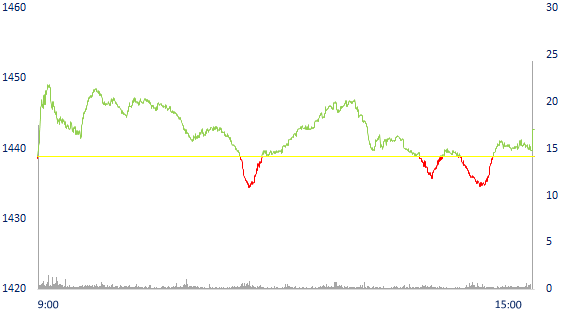

INTRADAY VNINDEX

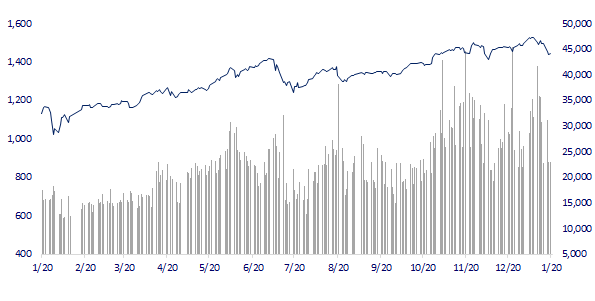

VNINDEX (12M)

GLOBAL MARKET

27,467.23

1D -1.30%

YTD -4.60%

3,558.18

1D -0.33%

YTD -2.24%

2,842.28

1D -0.77%

YTD -4.55%

24,127.85

1D -0.23%

YTD 3.12%

3,283.94

1D 0.12%

YTD 5.13%

1,658.24

1D -0.12%

YTD 0.04%

85.84

1D -0.58%

YTD 12.21%

1,818.95

1D 0.35%

YTD -0.10%

Asian stocks mostly fell after Wall Street's sell-off. In Japan, the Nikkei 225 fell 1.3%. The Chinese market fell with Shanghai Composite down 0.33%, Shenzhen Component down 1.28%. Hong Kong's Hang Seng fell 0.23%. South Korea's Kospi index fell 0.77%, the Kosdaq fell 0.77%.

VIETNAM ECONOMY

1.00%

1D (bps) -2

YTD (bps) 19

5.60%

1.20%

1D (bps) 5

YTD (bps) 19

1.90%

1D (bps) -2

YTD (bps) -10

22,925

1D (%) 0.09%

YTD (%) -0.07%

26,203

1D (%) -0.83%

YTD (%) -1.00%

3,647

1D (%) -0.16%

YTD (%) -0.30%

The Governor of the State Bank (SBV) recently issued Directive No. 01/CT-NHNN requesting credit institutions to continue implementing drastic, practical and effective solutions to support people and businesses . Credit institutions cut operating costs, reduce profit targets, and do not pay cash dividends in 2022 to continue to reduce lending interest rates.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank of Vietnam asked the bank to continue to reduce lending interest rates, not to pay cash dividends

- Governor of the State Bank: Strictly handle the case that requires customers to buy insurance when granting credit

- Proposal to announce the opening of borders to the world from May 1

- The Yuan of China is under pressure to lower interest rates

- The poorest countries are facing an increased debt obligation of 11 billion USD

- World gold fell when the USD, the yield increased sharply

VN30

BANK

86,800

1D -0.91%

5D 8.50%

Buy Vol. 1,369,400

Sell Vol. 1,970,600

43,650

1D -2.78%

5D 3.56%

Buy Vol. 4,951,800

Sell Vol. 6,089,800

33,800

1D -2.17%

5D -1.02%

Buy Vol. 14,843,100

Sell Vol. 18,774,200

48,850

1D 0.21%

5D -3.08%

Buy Vol. 6,298,300

Sell Vol. 8,240,800

33,500

1D 0.75%

5D -5.37%

Buy Vol. 10,182,700

Sell Vol. 10,148,500

29,600

1D -1.00%

5D 1.37%

Buy Vol. 20,717,100

Sell Vol. 31,724,600

28,950

1D -2.03%

5D -6.46%

Buy Vol. 5,005,500

Sell Vol. 5,995,200

39,300

1D 1.03%

5D -8.60%

Buy Vol. 9,328,800

Sell Vol. 11,595,500

32,900

1D -2.95%

5D -5.19%

Buy Vol. 34,689,200

Sell Vol. 43,153,700

33,000

1D 0.61%

5D -0.30%

Buy Vol. 3,678,800

Sell Vol. 4,388,500

BID: The Board of Directors approved the draft appendix to the contract to amend the syndicated loan with Keb Hanabank for medium-term financing for Vietnam Coal and Mineral Industries Group.

REAL ESTATE

80,000

1D -0.12%

5D -4.53%

Buy Vol. 2,799,900

Sell Vol. 3,447,000

51,900

1D 2.77%

5D -3.35%

Buy Vol. 2,302,800

Sell Vol. 1,576,700

89,000

1D 1.14%

5D -1.11%

Buy Vol. 6,150,200

Sell Vol. 5,913,400

NVL: Novaland related enterprise, Summer Beach Investment JSC has raised VND 1,500 billion of bonds for NovaWorld Phan Thiet

OIL & GAS

107,000

1D 0.00%

5D -0.93%

Buy Vol. 1,079,000

Sell Vol. 1,861,800

16,050

1D 4.22%

5D -11.57%

Buy Vol. 37,453,400

Sell Vol. 26,985,400

54,100

1D 0.19%

5D -1.28%

Buy Vol. 1,282,600

Sell Vol. 2,560,100

Ending the session 18/01, Brent oil contract advanced 1.19% to 87.51 USD/barrel. The WTI oil contract added 2.43% to $85.43 a barrel, both recording their highest levels since October 2014.

VINGROUP

95,800

1D -0.10%

5D -4.96%

Buy Vol. 3,872,100

Sell Vol. 3,995,100

77,600

1D 0.78%

5D -7.18%

Buy Vol. 5,630,100

Sell Vol. 5,750,800

33,250

1D 2.62%

5D -7.64%

Buy Vol. 8,959,800

Sell Vol. 8,556,300

Vingroup and VinFuture have created a special and unique opportunity to bring Vietnamese science to the world

FOOD & BEVERAGE

83,400

1D 0.00%

5D 0.36%

Buy Vol. 2,705,500

Sell Vol. 3,347,700

147,500

1D 3.80%

5D 1.79%

Buy Vol. 2,242,800

Sell Vol. 2,339,800

150,000

1D -0.66%

5D -1.83%

Buy Vol. 156,000

Sell Vol. 263,400

MSN: In 2021, MSN's consolidated net revenue reached VND88,629 billion, up 14.8% yoy thanks to strong growth in revenue from most business segments.

OTHERS

126,300

1D 1.45%

5D 2.52%

Buy Vol. 1,169,500

Sell Vol. 1,166,400

126,300

1D 1.45%

5D 2.52%

Buy Vol. 1,169,500

Sell Vol. 1,166,400

88,300

1D 0.23%

5D -1.45%

Buy Vol. 1,212,200

Sell Vol. 1,441,300

133,500

1D 2.61%

5D -1.84%

Buy Vol. 1,448,000

Sell Vol. 1,676,400

93,600

1D 0.32%

5D 0.97%

Buy Vol. 526,600

Sell Vol. 666,800

31,800

1D 2.25%

5D -14.05%

Buy Vol. 3,390,300

Sell Vol. 3,058,900

45,200

1D 6.86%

5D -10.50%

Buy Vol. 21,735,500

Sell Vol. 17,913,000

43,500

1D -1.14%

5D -5.84%

Buy Vol. 27,256,600

Sell Vol. 26,376,300

PNJ: In 2021, PNJ recorded net revenue of VND 19,593 billion, up 11.9% and completing 93.3% of the year plan. Profit after tax reached VND 1,030 billion, down 3.7% compared to the previous year and just reached 84% of the 2021 target. In December 2021 alone, PNJ's net revenue reached VND 2,834 billion, up 29% and profit after tax reached 192 billion dong, up 43.4%.

Market by numbers

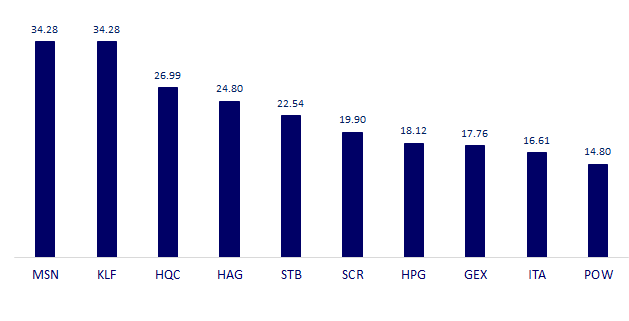

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

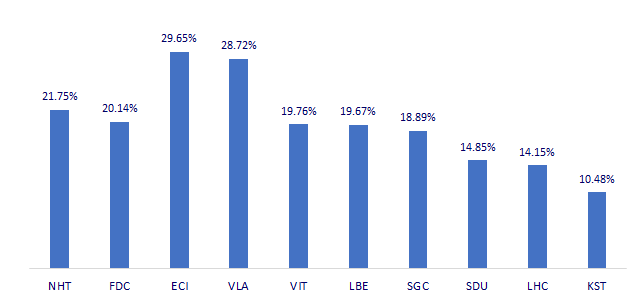

TOP INCREASES 3 CONSECUTIVE SESSIONS

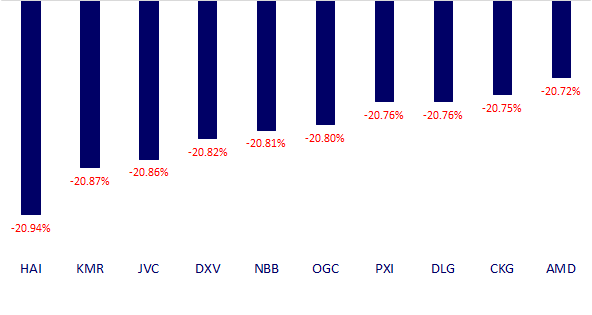

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.