Market brief 20/01/2022

VIETNAM STOCK MARKET

1,465.30

1D 1.56%

YTD -2.20%

1,492.81

1D 0.69%

YTD -2.79%

411.80

1D 0.61%

YTD -13.12%

109.67

1D 1.70%

YTD -2.67%

-129.32

1D 0.00%

YTD 0.00%

25,982.45

1D 0.49%

YTD -16.38%

Foreign investors reduced their net selling to 129 billion dong on January 20. NVL was sold the most by foreign investors with a value of 122 billion dong. NVL and STB were net sold at 113 billion dong and 46 billion dong, respectively. Meanwhile, HPG was the strongest net buying on this floor with 58 billion dong. CTG and GAS were net bought at 50 billion dong and 29 billion dong respectively.

ETF & DERIVATIVES

24,950

1D -0.99%

YTD -3.41%

17,640

1D 1.15%

YTD -2.49%

19,000

1D 6.68%

YTD 0.00%

22,000

1D 0.00%

YTD -3.93%

22,500

1D 1.35%

YTD 0.09%

27,100

1D 0.00%

YTD -3.39%

19,460

1D 0.31%

YTD -9.40%

1,495

1D 0.71%

YTD 0.00%

1,488

1D 0.49%

YTD 0.00%

1,496

1D 1.01%

YTD 0.00%

1,493

1D 0.72%

YTD 0.00%

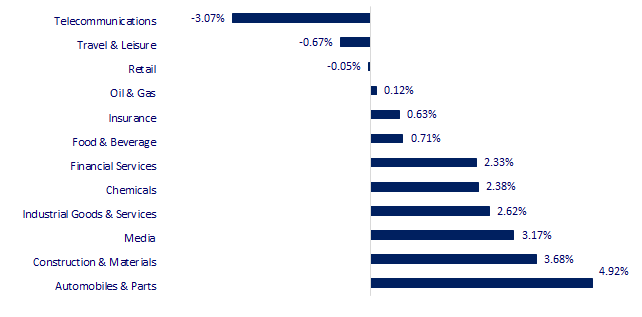

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,772.93

1D 1.03%

YTD -3.54%

3,555.06

1D -0.09%

YTD -2.33%

2,862.68

1D 0.72%

YTD -3.86%

24,952.35

1D 1.98%

YTD 6.64%

3,294.82

1D 0.33%

YTD 5.48%

1,656.96

1D -0.08%

YTD -0.04%

85.56

1D 0.55%

YTD 11.84%

1,837.65

1D -0.23%

YTD 0.93%

China cuts lending rates, Asian stocks mixed. In Japan, the Nikkei 225 gained 1.03%. The Chinese market fell with the Shanghai Composite down 0.09% and the Shenzhen Component down 0.06%. Hong Kong's Hang Seng rose 1.98%. South Korea's Kospi index rose 0.72%.

VIETNAM ECONOMY

0.98%

1D (bps) -2

YTD (bps) 17

5.60%

1.20%

YTD (bps) 19

1.88%

1D (bps) -2

YTD (bps) -12

22,870

1D (%) 0.09%

YTD (%) -0.31%

22,870

1D (%) -13.52%

YTD (%) -13.59%

3,640

1D (%) -0.25%

YTD (%) -0.49%

Entering January 2022, exports seem to show signs of "out of breath" when falling by 12% compared to the previous period, double the decrease of imports. This caused the trade balance to reverse to a large deficit. Regarding exports, the total value of export goods of Vietnam in the first period of January 1, 2022 reached USD 12.96 billion, down 17.9% compared to the period of December 2, 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Exports suddenly "out of breath", the trade balance reversed to a large deficit in the first half of January

- Reviewing more than VND 639,000 billion of the remaining capital of the medium-term public investment plan

- Vietnam-Japan trade in 2021 will reach 42.7 billion USD, with a trade deficit of 2.52 billion USD

- The US has no intention of easing tariffs on Chinese goods

- China continues to lower the basic lending rate

- OPEC: Omicron and monetary policy do not make crude oil demand difficult

VN30

BANK

87,100

1D 0.35%

5D 6.35%

Buy Vol. 4,158,200

Sell Vol. 4,536,300

46,700

1D 6.99%

5D 6.14%

Buy Vol. 10,301,100

Sell Vol. 7,868,300

35,100

1D 3.85%

5D -0.14%

Buy Vol. 23,123,600

Sell Vol. 22,880,400

48,850

1D 0.00%

5D -3.27%

Buy Vol. 10,917,500

Sell Vol. 11,303,100

33,950

1D 1.34%

5D -3.69%

Buy Vol. 12,284,900

Sell Vol. 11,306,000

30,200

1D 2.03%

5D 1.68%

Buy Vol. 29,410,600

Sell Vol. 29,798,000

28,900

1D -0.17%

5D -6.17%

Buy Vol. 7,587,800

Sell Vol. 6,609,600

39,600

1D 0.76%

5D -6.05%

Buy Vol. 9,743,900

Sell Vol. 9,990,900

33,800

1D 2.74%

5D -1.46%

Buy Vol. 67,321,800

Sell Vol. 49,751,900

32,950

1D -0.15%

5D -1.20%

Buy Vol. 8,432,400

Sell Vol. 5,770,000

VCB: Regarding the ability to defend against bad debt, Vietcombank caught the attention of the market when it announced the bad debt coverage ratio of this bank at 424%, a record high in the banking industry. This means that each VND of bad debt on the balance sheet of Vietcombank is secured by more than 4 VND of provision. According to this bank's report, by the end of 2021, the bad debt ratio is 963,670 billion dong and 0.63%, the scale of bad debt on the balance sheet and the reserve fund of Vietcombank is accordingly at 6,070 billion dong and 25,740 billion dong.

REAL ESTATE

80,200

1D 0.25%

5D -3.95%

Buy Vol. 4,186,200

Sell Vol. 4,303,600

51,700

1D -0.39%

5D -3.36%

Buy Vol. 2,042,700

Sell Vol. 1,629,100

90,000

1D 1.12%

5D -0.55%

Buy Vol. 4,818,000

Sell Vol. 4,943,100

PDR: Recorded from Nhon Hoi project, PDR's profit is more than 750b dong in Q4.2021. In the whole year of2021, revenue decreased by 7%, profit after tax increased by 52% to more than VND 1,860b thanks to cost savings.

OIL & GAS

108,600

1D 1.50%

5D 3.43%

Buy Vol. 1,220,500

Sell Vol. 1,467,300

17,000

1D 5.92%

5D 0.59%

Buy Vol. 32,781,700

Sell Vol. 26,089,600

54,100

1D 0.00%

5D -0.18%

Buy Vol. 1,376,200

Sell Vol. 1,650,100

Iraq - Turkey pipeline has problems, oil prices increase. Brent oil futures rose 93 cents, or 1.1%, to $88.44 a barrel, in a session touching $89.13 a barrel, the highest since October 13, 2014.

VINGROUP

95,000

1D -0.84%

5D -3.85%

Buy Vol. 3,543,600

Sell Vol. 3,550,700

78,600

1D 1.29%

5D -4.38%

Buy Vol. 6,471,300

Sell Vol. 6,318,700

33,600

1D 1.05%

5D -0.59%

Buy Vol. 9,963,500

Sell Vol. 11,752,900

VHM: In contrast to the net selling session of foreign investors today, VHM was in the top of this group with a net buying value of 16.7 billion dong.

FOOD & BEVERAGE

83,000

1D -0.48%

5D -0.12%

Buy Vol. 2,683,100

Sell Vol. 2,950,200

149,200

1D 1.15%

5D 3.04%

Buy Vol. 1,495,600

Sell Vol. 1,549,200

150,000

1D 0.00%

5D -0.66%

Buy Vol. 567,600

Sell Vol. 416,000

MSN: Q4.2021, Masan net sales of VND 23,828 billion, up 10% QoQ. Excluding the revenue from the animal feed segment in December 2020, net revenue in the fourth quarter of 2021 increased by 17% QoQ.

OTHERS

123,600

1D -2.14%

5D 1.31%

Buy Vol. 973,400

Sell Vol. 1,082,100

123,600

1D -2.14%

5D 1.31%

Buy Vol. 973,400

Sell Vol. 1,082,100

88,800

1D 0.57%

5D -3.58%

Buy Vol. 2,862,200

Sell Vol. 2,134,200

134,000

1D 0.37%

5D -1.11%

Buy Vol. 1,734,100

Sell Vol. 1,693,000

94,400

1D 0.85%

5D 0.32%

Buy Vol. 715,200

Sell Vol. 794,400

32,500

1D 2.20%

5D -8.45%

Buy Vol. 3,008,000

Sell Vol. 2,347,700

45,700

1D 1.11%

5D -6.45%

Buy Vol. 17,023,300

Sell Vol. 18,386,600

44,000

1D 1.15%

5D -5.78%

Buy Vol. 26,341,200

Sell Vol. 23,025,800

SSI: has just announced business results of its own financial statements for the fourth quarter of 2021 and for the whole year of 2021. Revenue and pre-tax profit in the fourth quarter of 2021 reached VND 2,681 billion and VND 1,264 billion, respectively. The parent company's profit after tax was VND 1,012 billion, 2.6 times higher than the same period last year. For the whole year, the Company recorded total revenue of VND 7,773 billion, profit before tax of VND 3,327 billion, up 72% and 113% respectively over the same period in 2020.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.