Market brief 26/01/2022

VIETNAM STOCK MARKET

1,481.58

1D 0.14%

YTD -1.11%

1,525.31

1D 0.60%

YTD -0.68%

411.82

1D 0.39%

YTD -13.12%

109.05

1D 0.94%

YTD -3.22%

332.16

1D 0.00%

YTD 0.00%

26,305.65

1D 2.95%

YTD -15.34%

Session 26/1: Foreign investors' trade was a bright spot when they were net buyers on all 3 exchanges, with a recorded value of 332 billion dong on the whole market. Foreign investors' buying power focused on big stocks like CTG, KBC, LPB, VHM while net selling MSN, PLX, NVL.

ETF & DERIVATIVES

25,500

1D 1.27%

YTD -1.28%

17,950

1D 0.96%

YTD -0.77%

18,950

1D 6.40%

YTD -0.26%

22,200

1D 0.91%

YTD -3.06%

23,200

1D 4.98%

YTD 3.20%

27,900

1D 1.82%

YTD -0.53%

19,780

1D 1.28%

YTD -7.91%

1,506

1D 0.63%

YTD 0.00%

1,516

1D 1.07%

YTD 0.00%

1,519

1D 1.00%

YTD 0.00%

1,493

1D 0.00%

YTD 0.00%

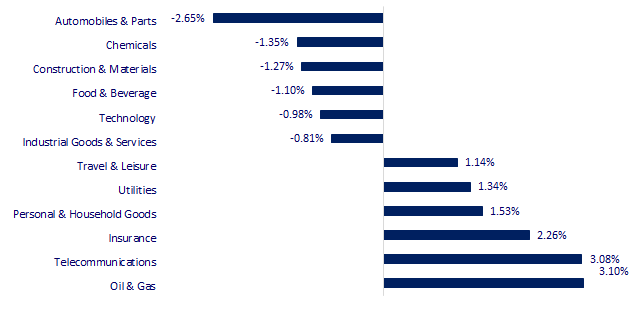

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,011.33

1D 0.42%

YTD -6.18%

3,455.67

1D 0.66%

YTD -5.06%

2,709.24

1D -0.41%

YTD -9.01%

24,289.90

1D -0.14%

YTD 3.81%

3,271.57

1D 0.73%

YTD 4.73%

1,643.44

1D 0.27%

YTD -0.86%

86.00

1D 0.81%

YTD 12.42%

1,846.65

1D -0.05%

YTD 1.42%

Asian stocks mixed, investors waited for the results of the Fed meeting. In Japan, the Nikkei 225 gained 0.42%. The Chinese market rallied with the Shanghai Composite up 0.66%. Hong Kong's Hang Seng fell 0.14%. China tech shares rebounded from a deep drop in the previous session with Tencent up 0.86%, JD up 1.43%. The Hang Seng Tech Index rose 0.79%. South Korea's Kospi index fell 0.41%.

VIETNAM ECONOMY

2.30%

1D (bps) 82

YTD (bps) 149

5.60%

1.21%

YTD (bps) 20

1.91%

1D (bps) -1

YTD (bps) -9

22,865

1D (%) 0.37%

YTD (%) -0.33%

25,991

1D (%) -1.25%

YTD (%) -1.80%

3,652

1D (%) 0.08%

YTD (%) -0.16%

On January 24, the Management Board of Hai Phong Economic Zone organized to award investment registration certificates for investment projects in industrial parks and economic zones in the city in January. In the first month of the year, Hai Phong has 5 newly granted and adjusted projects with a total newly and additionally invested capital of about 229m USD (including 3 foreign direct investment projects about 140m USD and 2 domestic investment projects about more than 2,000b dong).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hai Phong awarded investment certificates to projects with a total capital of 229 million USD

- 1,000 businesses in Ho Chi Minh City owe social insurance

- The largest oil refinery in Vietnam is expected to stop operating due to lack of money

- IMF cuts global growth forecast for 2022 as US and China recoveries weaken

- Experts: 'Fed rate hike will increase the global debt crisis'

- China is about to start a 3-year anti-money laundering campaign

VN30

BANK

94,500

1D -1.36%

5D 8.87%

Buy Vol. 3,805,100

Sell Vol. 3,544,900

48,100

1D -1.84%

5D 10.19%

Buy Vol. 6,945,700

Sell Vol. 8,393,600

37,650

1D 1.76%

5D 11.39%

Buy Vol. 35,000,800

Sell Vol. 42,178,500

52,400

1D 0.96%

5D 7.27%

Buy Vol. 23,893,800

Sell Vol. 29,174,300

35,900

1D 2.87%

5D 7.16%

Buy Vol. 30,389,400

Sell Vol. 32,716,000

33,300

1D 2.15%

5D 12.50%

Buy Vol. 44,352,700

Sell Vol. 48,867,000

30,700

1D 2.16%

5D 6.04%

Buy Vol. 13,279,900

Sell Vol. 17,092,000

39,200

1D -1.38%

5D -0.25%

Buy Vol. 15,422,900

Sell Vol. 19,815,600

35,550

1D 2.45%

5D 8.05%

Buy Vol. 81,221,200

Sell Vol. 87,819,800

35,450

1D 1.72%

5D 7.42%

Buy Vol. 14,677,500

Sell Vol. 18,845,000

CTG: On January 24, 2022, CTG and Manulife Vietnam have officially launched and launched their business under an exclusive cooperation agreement lasting 16 years. Accordingly, the agreement has been signed and effective from December 29, 2021, Manulife Vietnam is officially the exclusive distributor of life insurance solutions for VietinBank's customers.

REAL ESTATE

79,400

1D 0.51%

5D -0.75%

Buy Vol. 2,134,800

Sell Vol. 2,645,200

50,400

1D 1.00%

5D -2.89%

Buy Vol. 1,896,700

Sell Vol. 2,056,200

86,800

1D -3.56%

5D -2.47%

Buy Vol. 3,231,000

Sell Vol. 4,804,100

PDR: announced the decision of the Board of Directors on approving the transfer of a part of the project in Division 4, in Nhon Hoi eco-tourism urban area with the category of hotels.

OIL & GAS

112,200

1D 2.47%

5D 4.86%

Buy Vol. 2,281,800

Sell Vol. 2,443,500

16,300

1D -1.51%

5D 1.56%

Buy Vol. 31,598,600

Sell Vol. 29,851,100

57,000

1D 4.78%

5D 5.36%

Buy Vol. 7,924,000

Sell Vol. 6,559,400

The $9 billion Nghi Son refinery and petrochemical plant, which supplies about 35% of domestic petroleum consumption, may stop operating due to severe financial difficulties.

VINGROUP

96,400

1D 0.42%

5D 0.63%

Buy Vol. 3,092,200

Sell Vol. 3,637,600

81,200

1D 0.25%

5D 4.64%

Buy Vol. 6,064,900

Sell Vol. 8,077,900

33,900

1D 2.26%

5D 1.95%

Buy Vol. 14,093,100

Sell Vol. 17,472,000

VIC: Kia EV6 rival of VinFast VF 8 announced the official price in the US - from 42,000 to 57,000 USD will be available at dealers in the US in the next few weeks.

FOOD & BEVERAGE

79,700

1D 0.63%

5D -4.44%

Buy Vol. 2,541,300

Sell Vol. 2,517,100

147,000

1D -3.92%

5D -0.34%

Buy Vol. 1,288,200

Sell Vol. 1,987,900

143,700

1D -0.90%

5D -4.20%

Buy Vol. 271,400

Sell Vol. 213,500

VNM: VNM has decreased continuously for the last 5 sessions from 83,400 VND/share to 79,200 VND/share. Although the decrease was not much, it was the continuation of the persistent decline over the past 1 year.

OTHERS

121,100

1D -0.16%

5D -4.12%

Buy Vol. 749,700

Sell Vol. 781,500

121,100

1D -0.16%

5D -4.12%

Buy Vol. 749,700

Sell Vol. 781,500

86,000

1D -0.58%

5D -2.60%

Buy Vol. 1,591,900

Sell Vol. 1,505,100

131,900

1D 0.69%

5D -1.20%

Buy Vol. 1,517,300

Sell Vol. 1,409,200

101,000

1D 4.12%

5D 7.91%

Buy Vol. 2,677,500

Sell Vol. 2,812,800

31,000

1D -0.80%

5D -2.52%

Buy Vol. 1,507,900

Sell Vol. 2,135,800

42,450

1D -0.82%

5D -6.08%

Buy Vol. 12,742,900

Sell Vol. 14,776,200

43,450

1D 0.46%

5D -0.11%

Buy Vol. 24,198,500

Sell Vol. 26,952,100

FPT: Over the past ten years, FPT's cash and bank deposits have been on an uptrend and have increased sharply since the beginning of 2020. By the end of 2021, FPT's cash and bank deposits have increased. increased to 26,149 billion VND. 2021 is also the first year that FPT's revenue from deposit interest exceeds VND 1,000 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.