Market brief 07/02/2022

VIETNAM STOCK MARKET

1,497.66

1D 1.26%

YTD -0.04%

1,541.25

1D 0.59%

YTD 0.36%

419.33

1D 0.62%

YTD -11.53%

110.75

1D 0.97%

YTD -1.71%

336.03

1D 0.00%

YTD 0.00%

20,754.25

1D -13.94%

YTD -33.21%

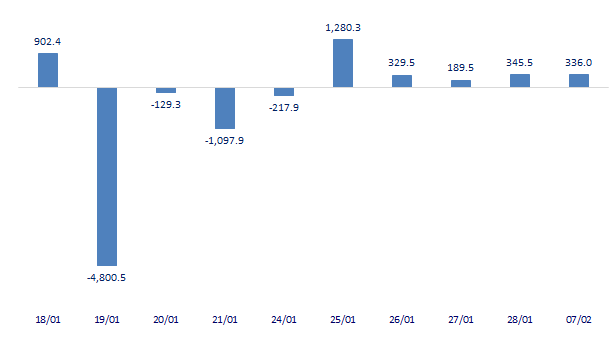

Foreign investors continued to net buy 336 billion dong in the first session of the year 2022. On HoSE only, foreign investors had the 5th net buying session in a row with a value down 9.3% compared to the session before the holiday and reached VND 306 billion, equivalent to a net buying volume of 7.2 million shares. Generally, in the past 5 sessions, foreign investors on HoSE had a total net buying of 2,400 billion dong.

ETF & DERIVATIVES

25,910

1D 0.66%

YTD 0.31%

18,170

1D 0.72%

YTD 0.44%

19,210

1D 7.86%

YTD 1.11%

22,700

1D 2.71%

YTD -0.87%

23,220

1D 6.96%

YTD 3.29%

28,380

1D 1.72%

YTD 1.18%

19,990

1D 0.30%

YTD -6.94%

1,521

1D 0.51%

YTD 0.00%

1,519

1D 0.26%

YTD 0.00%

1,532

1D 0.25%

YTD 0.00%

1,533

1D 0.31%

YTD 0.00%

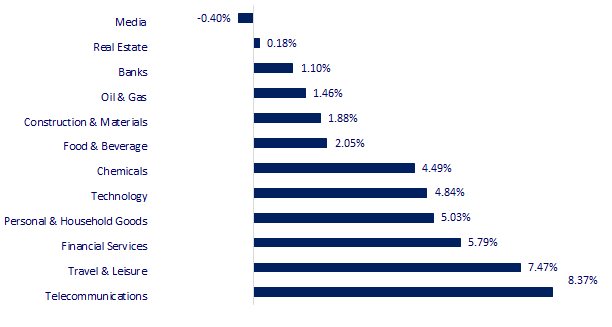

CHANGE IN PRICE BY SECTOR

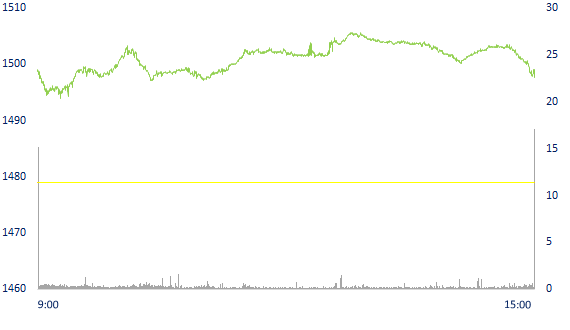

INTRADAY VNINDEX

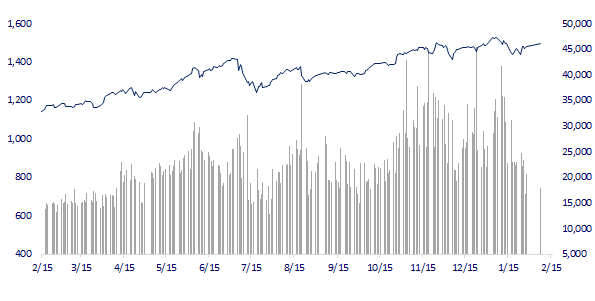

VNINDEX (12M)

GLOBAL MARKET

27,248.87

1D 0.23%

YTD -5.36%

3,429.58

1D 2.03%

YTD -5.78%

2,745.06

1D 3.07%

YTD -7.81%

24,579.55

1D 0.66%

YTD 5.05%

3,366.48

1D 3.70%

YTD 7.77%

1,677.24

1D 2.30%

YTD 1.18%

91.20

1D -1.41%

YTD 19.22%

1,812.35

1D 0.10%

YTD -0.46%

Asian stocks all rose, the Chinese market increased by more than 2% after the Tet holiday. In Japan, the Nikkei 225 gained 0.23%. The Chinese market went up with Shanghai Composite up 2.03%, Shenzhen Component up 0.965%. Hong Kong's Hang Seng rose 0.66%. South Korea's Kospi index rose 3.07%.

VIETNAM ECONOMY

2.42%

YTD (bps) 161

5.60%

1.20%

1D (bps) 1

YTD (bps) 19

1.91%

1D (bps) 4

YTD (bps) -9

22,890

1D (%) 0.50%

YTD (%) -0.22%

26,350

1D (%) -1.05%

YTD (%) -0.45%

3,635

1D (%) 0.11%

YTD (%) -0.63%

The State Bank's data shows that the amount of deposits of residents and economic organizations at the end of November 2021 reached more than 10.68 million billion, up 6.6% compared to the end of 2020 - the growth rate. The lowest 11 months since this data was announced by the SBV. In which, deposits of residents only increased by 2.63% and deposits of economic organizations increased by 10.78%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many banks have a net withdrawal of deposits in 2021

- The Ministry of Transport has been assigned a record capital, pouring VND80,000b/each year into highways, seaports, and airports

- Prime Minister Pham Minh Chinh: In 2025, Long Thanh airport must be inaugurated

- Big risks from Fed policy overshadow concerns from Russia-Ukraine tension on stock market

- ECB will have the first rate hike in the fourth quarter

- Northern Ireland ruled to maintain customs controls on British agricultural products

VN30

BANK

92,400

1D 3.82%

5D 3.82%

Buy Vol. 2,761,000

Sell Vol. 2,055,700

47,400

1D -1.15%

5D -1.15%

Buy Vol. 4,714,200

Sell Vol. 5,988,800

36,300

1D -1.63%

5D -1.63%

Buy Vol. 22,125,200

Sell Vol. 25,373,000

52,800

1D 0.00%

5D 0.00%

Buy Vol. 13,419,800

Sell Vol. 19,732,800

36,300

1D -0.95%

5D -0.95%

Buy Vol. 16,788,400

Sell Vol. 22,239,100

33,800

1D 0.30%

5D 0.30%

Buy Vol. 23,313,000

Sell Vol. 30,224,600

31,100

1D 0.65%

5D 0.65%

Buy Vol. 8,797,900

Sell Vol. 11,329,800

41,700

1D -0.60%

5D -0.60%

Buy Vol. 7,884,100

Sell Vol. 13,718,200

35,600

1D 0.14%

5D 0.14%

Buy Vol. 36,376,700

Sell Vol. 35,549,100

34,700

1D 0.43%

5D 0.43%

Buy Vol. 7,384,200

Sell Vol. 9,300,900

TCB has just released a financial report showing that the balance of demand deposits and margin deposits at the end of 2021 has increased to VND 158,900 billion (up 24% compared to 2020). The CASA ratio as of December 31, 2021 reached 50.5%, a significant improvement from 46% in 2020 and a record high in the banking system. Meanwhile at MBB, total customer deposits in the past year increased by 23.7% to 384,692 billion dong. Demand deposits of the bank increased by 1.5 times to 171,396 billion dong, being one of the banks with the strongest growth. Besides, margin deposits also jumped 66% to 11,728 billion dong.

REAL ESTATE

80,000

1D 0.13%

5D 0.13%

Buy Vol. 2,996,500

Sell Vol. 3,195,200

50,600

1D 1.20%

5D 1.20%

Buy Vol. 1,066,300

Sell Vol. 928,500

91,000

1D 0.22%

5D 0.22%

Buy Vol. 3,144,300

Sell Vol. 3,428,200

KDH: Vietnam Market Access Stock Investment Fund, a unit related to an insider, bought and matched 400,000 KDH shares from January 5 to January 27.

OIL & GAS

114,700

1D 5.23%

5D 5.23%

Buy Vol. 1,769,200

Sell Vol. 1,687,300

17,850

1D 6.25%

5D 6.25%

Buy Vol. 74,784,700

Sell Vol. 37,092,800

58,700

1D 4.63%

5D 4.63%

Buy Vol. 6,450,800

Sell Vol. 6,199,500

GAS: received a "heavy" task assigned by the Vietnam Oil and Gas Group (PVN) with the target of gas and LNG supply increasing by 25% compared to the implementation in 2021.

VINGROUP

91,200

1D -5.98%

5D -5.98%

Buy Vol. 9,665,700

Sell Vol. 12,171,700

82,200

1D 2.37%

5D 2.37%

Buy Vol. 7,476,900

Sell Vol. 8,745,700

35,500

1D 1.57%

5D 1.57%

Buy Vol. 17,650,100

Sell Vol. 21,698,000

VIC: Additional issue of 8,720,770 ordinary shares to convert preference shares, bringing the total number of outstanding shares to 3,813,925,561 shares.

FOOD & BEVERAGE

83,500

1D 0.48%

5D 0.48%

Buy Vol. 2,765,200

Sell Vol. 2,907,200

147,900

1D 3.43%

5D 3.43%

Buy Vol. 990,600

Sell Vol. 933,200

152,100

1D 2.29%

5D 2.29%

Buy Vol. 197,600

Sell Vol. 155,900

VNM: From February 9 to March 10, F&N Diary Investments PTE.LTD, a unit related to a member of the BOD, registered to buy 20.9 million shares. raising holdings to 390.65 million units (18.69%)

OTHERS

130,400

1D 6.97%

5D 6.97%

Buy Vol. 1,753,400

Sell Vol. 1,162,100

130,400

1D 6.97%

5D 6.97%

Buy Vol. 1,753,400

Sell Vol. 1,162,100

89,500

1D 0.00%

5D 0.00%

Buy Vol. 908,700

Sell Vol. 1,102,400

133,900

1D 1.06%

5D 1.06%

Buy Vol. 1,359,100

Sell Vol. 1,792,700

107,300

1D 3.17%

5D 3.17%

Buy Vol. 2,033,300

Sell Vol. 1,983,600

32,200

1D 3.21%

5D 3.21%

Buy Vol. 1,954,500

Sell Vol. 1,308,200

45,850

1D 1.78%

5D 1.78%

Buy Vol. 16,181,900

Sell Vol. 17,375,900

43,050

1D 2.01%

5D 2.01%

Buy Vol. 30,054,700

Sell Vol. 23,644,500

HPG: In early February 2022, Hoa Phat Dung Quat Steel Joint Stock Company signed a contract to export the first batch of hot rolled coil (HRC) to Italy with a volume of 35,000 tons. The first order of the year going to Europe opens up a large consumption market for Hoa Phat Group's products.

Market by numbers

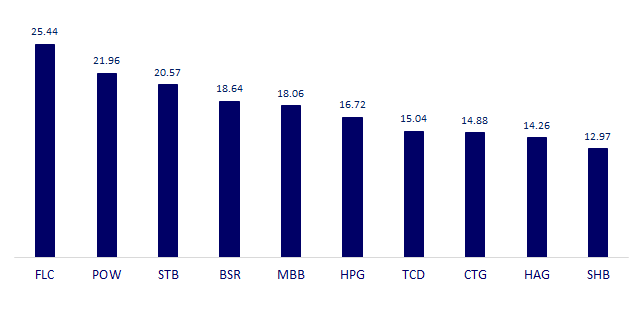

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

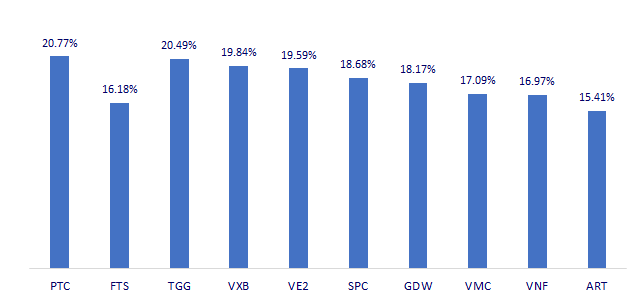

TOP INCREASES 3 CONSECUTIVE SESSIONS

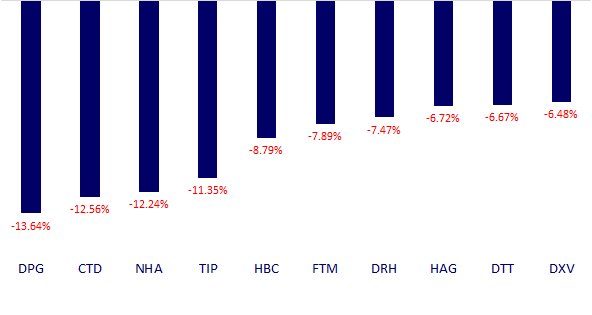

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.