Market brief 08/02/2022

VIETNAM STOCK MARKET

1,500.99

1D 0.22%

YTD 0.18%

1,550.46

1D 0.60%

YTD 0.96%

417.89

1D -0.34%

YTD -11.84%

111.52

1D 0.70%

YTD -1.03%

-337.46

1D 0.00%

YTD 0.00%

25,630.64

1D 23.50%

YTD -17.51%

VIC was still being sold the most by foreign investors with a value of 290 billion dong, far behind VNM with more than 50 billion dong. HPG and NKG were net sold 48 billion dong and 42 billion dong respectively. Meanwhile, KBC was bought the most with 64 billion dong. DXG and CTG were net bought at 51 billion dong and 33 billion dong, respectively.

ETF & DERIVATIVES

26,100

1D 0.73%

YTD 1.05%

18,250

1D 0.44%

YTD 0.88%

18,930

1D 6.29%

YTD -0.37%

22,500

1D -0.88%

YTD -1.75%

23,400

1D 0.78%

YTD 4.09%

28,860

1D 1.69%

YTD 2.89%

20,030

1D 0.20%

YTD -6.75%

1,522

1D 0.06%

YTD 0.00%

1,523

1D 0.26%

YTD 0.00%

1,533

1D 0.10%

YTD 0.00%

1,536

1D 0.18%

YTD 0.00%

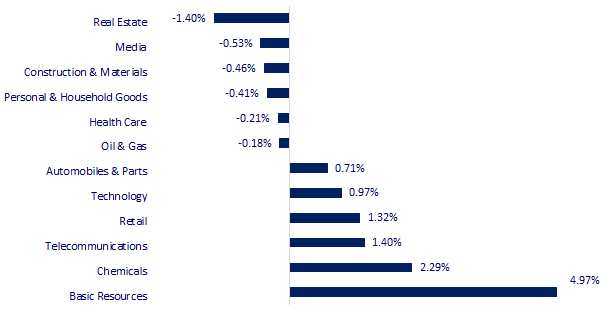

CHANGE IN PRICE BY SECTOR

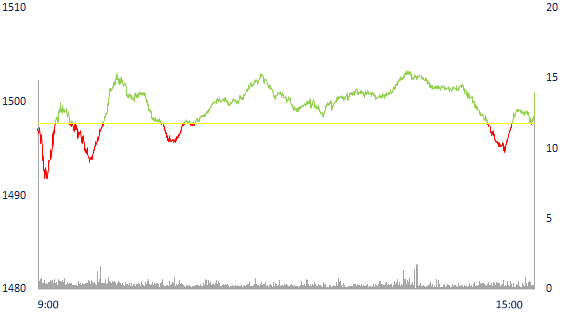

INTRADAY VNINDEX

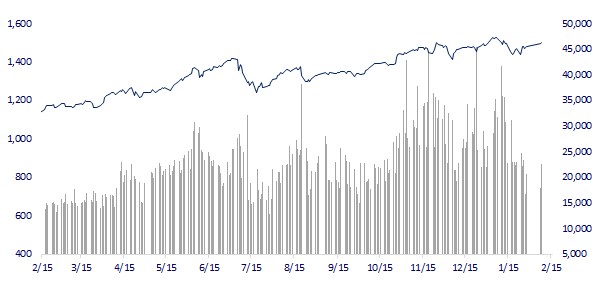

VNINDEX (12M)

GLOBAL MARKET

27,284.52

1D -0.31%

YTD -5.23%

3,452.63

1D 0.67%

YTD -5.14%

2,746.47

1D 0.05%

YTD -7.76%

24,329.49

1D -0.50%

YTD 3.98%

3,401.74

1D 1.05%

YTD 8.90%

1,684.23

1D 0.42%

YTD 1.61%

89.75

1D -1.47%

YTD 17.32%

1,819.75

1D -0.16%

YTD -0.06%

Investors assessed inflation and monetary policy outlook, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.31%. Shares of SoftBank Group fell 0.9% after the FT reported the sale of Arm chip business to Nvidia had failed. The Chinese market was mixed with Shanghai Composite up 0.67%, Shenzhen Component down 0.975%. Hong Kong's Hang Seng fell 0.5%. South Korea's Kospi index rose 0.05%.

VIETNAM ECONOMY

2.27%

1D (bps) -15

YTD (bps) 146

5.60%

1.03%

1D (bps) -17

YTD (bps) 2

2.02%

1D (bps) 11

YTD (bps) 2

22,970

1D (%) 0.70%

YTD (%) 0.13%

26,406

1D (%) -1.01%

YTD (%) -0.23%

3,644

1D (%) 0.22%

YTD (%) -0.38%

In terms of the structure of the issuer industry, real estate is still the industry that issues the most corporate bonds, accounting for nearly 40% of the amount of corporate bonds issued last year. This is also the industry with the highest average primary interest rate with an interest rate of nearly 9.8%. Banking is the second ranked industry in terms of issuance ratio, accounting for 33% of corporate bonds issued, an increase of 3.9 percentage points compared to 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- More than 700tr dong of corporate bonds are issued in 2021, real estate attracts the most money with an average interest rate of up to 9.8%

- The State Bank injects money after Tet, the agency is in charge of inflation

- The Prime Minister requested to soon submit a plan to extend the payment of taxes and land rent this year

- NDRC: China's inflation expected to rise moderately in 2022

- US jobs soar despite Omicron, adding pressure on Fed

- ECB President: ECB does not need to rush to raise interest rates

VN30

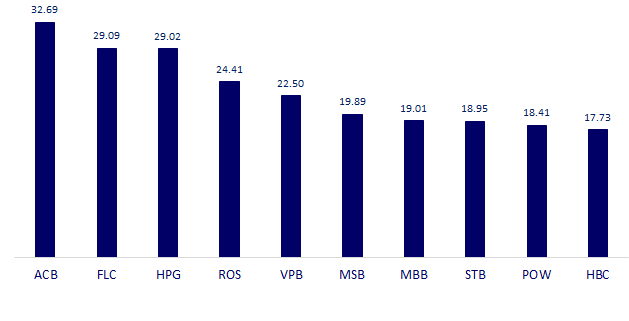

BANK

92,000

1D -0.43%

5D 3.37%

Buy Vol. 2,115,800

Sell Vol. 1,971,400

47,350

1D -0.11%

5D -1.25%

Buy Vol. 4,481,400

Sell Vol. 4,912,900

36,500

1D 0.55%

5D -1.08%

Buy Vol. 17,478,800

Sell Vol. 16,702,900

53,800

1D 1.89%

5D 1.89%

Buy Vol. 25,953,400

Sell Vol. 28,752,200

37,300

1D 2.75%

5D 1.77%

Buy Vol. 35,548,800

Sell Vol. 37,487,800

33,800

1D 0.00%

5D 0.30%

Buy Vol. 31,663,600

Sell Vol. 33,147,200

31,400

1D 0.96%

5D 1.62%

Buy Vol. 9,889,300

Sell Vol. 11,099,900

42,000

1D 0.72%

5D 0.12%

Buy Vol. 8,560,400

Sell Vol. 10,383,200

35,850

1D 0.70%

5D 0.84%

Buy Vol. 34,218,400

Sell Vol. 37,719,200

35,750

1D 3.03%

5D 3.47%

Buy Vol. 47,699,500

Sell Vol. 44,104,600

The top 10 banks with the largest bad debt in 2021 have had many notable changes. Eximbank and LienVietPostBank are two banks that have been removed from this list this year, replaced by two new names including HDBank and ACB, with bad debts of 3,360 billion and 2,799 billion respectively. However, in terms of the ratio of total outstanding loans, these two names are still among the top banks with low bad debt ratios in the whole industry. BIDV, VPBank, and VietinBank are still the top 3 banks in the list of largest bad debts among listed banks. However, this group had a drastic change in rankings.

REAL ESTATE

79,200

1D -1.00%

5D -0.88%

Buy Vol. 2,793,900

Sell Vol. 3,218,600

50,400

1D -0.40%

5D 0.80%

Buy Vol. 1,161,200

Sell Vol. 1,066,900

89,000

1D -2.20%

5D -1.98%

Buy Vol. 3,224,600

Sell Vol. 3,889,900

NVL: At the end of fiscal year 2021, Novaland Group recorded more than VND 14,967 billion total consolidated revenue and more than VND 3,460 billion consolidated profit after tax.

OIL & GAS

114,000

1D -0.61%

5D 4.59%

Buy Vol. 1,529,800

Sell Vol. 1,196,100

17,900

1D 0.28%

5D 6.55%

Buy Vol. 60,685,600

Sell Vol. 47,581,300

58,800

1D 0.17%

5D 4.81%

Buy Vol. 3,232,100

Sell Vol. 4,056,900

The oil and gas industry will continue to accelerate the approval of investment and exploitation projects such as Block B, Nam Du - U Minh to make investments on schedule in the period 2022-2025.

VINGROUP

87,300

1D -4.28%

5D -10.00%

Buy Vol. 13,338,400

Sell Vol. 10,963,300

81,200

1D -1.22%

5D 1.12%

Buy Vol. 4,543,500

Sell Vol. 6,207,200

35,500

1D 0.00%

5D 1.57%

Buy Vol. 10,488,500

Sell Vol. 11,808,000

VIC: For the whole year of 2021, VIC achieved VND 125,306b in net revenue, up 13% over the same period last year. Profit before tax reached VND 3,346b, loss after tax was VND7,523b.

FOOD & BEVERAGE

82,000

1D -1.80%

5D -1.32%

Buy Vol. 3,713,200

Sell Vol. 4,837,800

145,500

1D -1.62%

5D 1.75%

Buy Vol. 1,020,600

Sell Vol. 858,600

154,800

1D 1.78%

5D 4.10%

Buy Vol. 250,700

Sell Vol. 252,500

VNM: VNM's market capitalization is more than 7.5b USD. With its large scale, VNM has more or less faced growth pressure. VNM profit has been in a sideways trend for the past 5 years.

OTHERS

131,500

1D 0.84%

5D 7.88%

Buy Vol. 1,090,900

Sell Vol. 1,109,600

131,500

1D 0.84%

5D 7.88%

Buy Vol. 1,090,900

Sell Vol. 1,109,600

90,600

1D 1.23%

5D 1.23%

Buy Vol. 1,503,900

Sell Vol. 2,150,600

136,300

1D 1.79%

5D 2.87%

Buy Vol. 2,221,700

Sell Vol. 2,404,800

105,000

1D -2.14%

5D 0.96%

Buy Vol. 1,029,800

Sell Vol. 1,931,700

33,000

1D 2.48%

5D 5.77%

Buy Vol. 2,870,400

Sell Vol. 2,236,400

45,650

1D -0.44%

5D 1.33%

Buy Vol. 12,528,600

Sell Vol. 13,134,800

45,550

1D 5.81%

5D 7.94%

Buy Vol. 44,110,600

Sell Vol. 36,704,400

MWG: on November 3, 2021, MWG bought 1.29 million shares of An Khang Retail Company at a business consolidation fee of VND 52.2 billion. After the transaction, MWG owns 100% of shares in An Khang. MWG will invest both financial resources and a dedicated leadership team to promote the An Khang pharmacy chain in 2022. The chain has 178 stores by the end of 2021, a sharp increase from 68 at the end of 2020. .

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

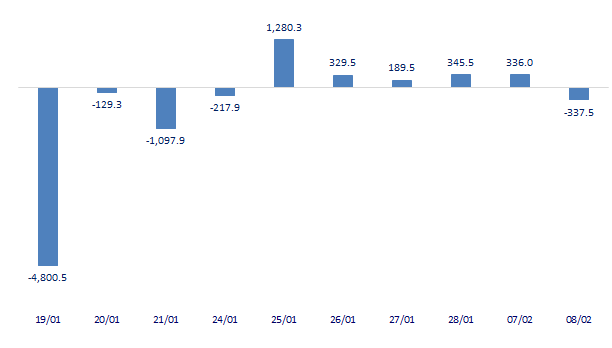

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

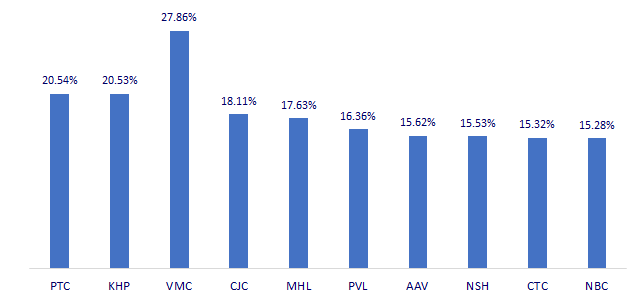

TOP INCREASES 3 CONSECUTIVE SESSIONS

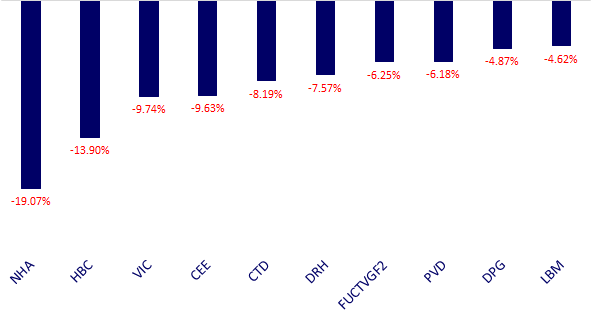

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.