Market brief 09/02/2022

VIETNAM STOCK MARKET

1,505.38

1D 0.29%

YTD 0.47%

1,552.44

1D 0.13%

YTD 1.09%

424.19

1D 1.51%

YTD -10.51%

112.00

1D 0.43%

YTD -0.60%

252.02

1D 0.00%

YTD 0.00%

28,532.61

1D 11.32%

YTD -8.17%

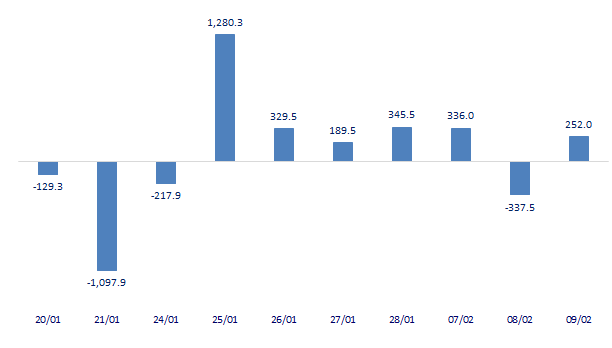

Session 9/2: Foreign investors returned to a net buying of 252 billion dong on the whole market. The buying force of foreign investors focused on disbursing FUEVFVND fund certificates and VND and GEX stocks while net selling VIC and NVL.

ETF & DERIVATIVES

26,300

1D 0.77%

YTD 1.82%

18,320

1D 0.38%

YTD 1.27%

18,770

1D 5.39%

YTD -1.21%

22,700

1D 0.89%

YTD -0.87%

23,600

1D 0.85%

YTD 4.98%

28,680

1D -0.62%

YTD 2.25%

20,480

1D 2.25%

YTD -4.66%

1,524

1D 0.12%

YTD 0.00%

1,531

1D 0.54%

YTD 0.00%

1,538

1D 0.33%

YTD 0.00%

1,541

1D 0.36%

YTD 0.00%

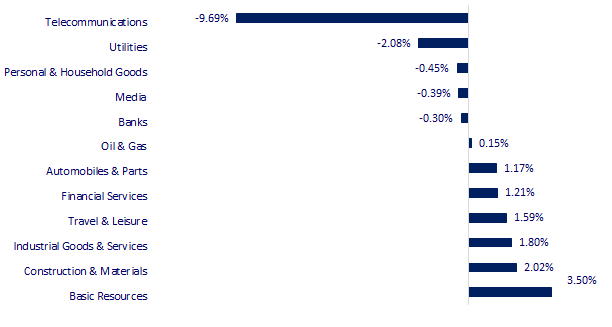

CHANGE IN PRICE BY SECTOR

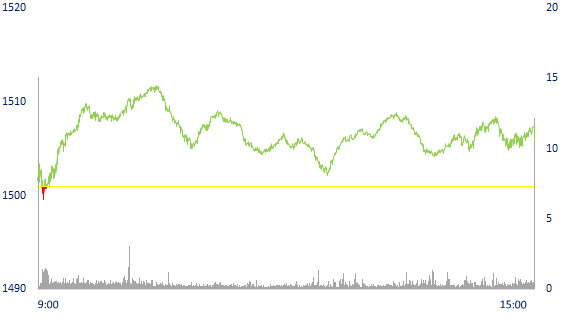

INTRADAY VNINDEX

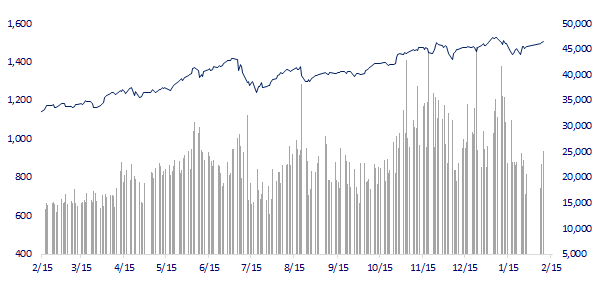

VNINDEX (12M)

GLOBAL MARKET

27,579.87

1D 0.27%

YTD -4.21%

3,479.95

1D 0.79%

YTD -4.39%

2,768.85

1D 0.81%

YTD -7.01%

24,829.99

1D 0.31%

YTD 6.12%

3,420.04

1D 0.54%

YTD 9.49%

1,703.16

1D 1.12%

YTD 2.75%

89.04

1D -0.66%

YTD 16.39%

1,828.95

1D 0.11%

YTD 0.45%

Asian stocks rose, South Korea led the region. In Japan, the Nikkei 225 gained 0.27%. Shares of Softbank Group rose 5.85% after the group announced plans to list Arm. The previous Arm sale to Nvidia failed. The Chinese market rose with the Shanghai Composite up 0.79%. Hong Kong's Hang Seng rose 0.31% with the tech sector flourishing. South Korea's Kospi index rose 0.81%.

VIETNAM ECONOMY

2.59%

1D (bps) 32

YTD (bps) 178

5.60%

1.17%

1D (bps) 14

YTD (bps) 16

1.91%

1D (bps) -11

YTD (bps) -9

22,823

1D (%) -0.29%

YTD (%) -0.51%

26,648

1D (%) -0.22%

YTD (%) 0.68%

3,635

1D (%) -0.22%

YTD (%) -0.63%

According to the SBV, as of January 28, 2022, credit outstanding increased by about 2.74% compared to the end of 2021 (up 16.32% over the same period last year and much higher than the growth rate of 0.53% of January 2021. Before that, credit growth had a strong breakthrough in Q4.2021, bringing the total outstanding loan of the whole economy to nearly 10.44m billion at the end of the year. It is estimated that the amount of credit pumped out in January is about 286 trillion dong.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Nearly 286,000 billion was injected into the economy in January 2021

- The Prime Minister requested the State Bank to immediately implement the handling and restructuring of two weak banks

- Decisively speeding up public investment disbursement

- US House of Representatives passes temporary government spending bill

- Russia denies reaching an agreement with France on reducing tensions in Ukraine

- China eases real estate lending restrictions as housing market slumps

VN30

BANK

90,800

1D -1.30%

5D 2.02%

Buy Vol. 2,704,200

Sell Vol. 2,513,300

48,400

1D 2.22%

5D 0.94%

Buy Vol. 7,237,500

Sell Vol. 7,279,700

36,350

1D -0.41%

5D -1.49%

Buy Vol. 14,742,900

Sell Vol. 19,215,800

53,600

1D -0.37%

5D 1.52%

Buy Vol. 24,785,400

Sell Vol. 31,749,700

37,100

1D -0.54%

5D 1.23%

Buy Vol. 25,021,100

Sell Vol. 33,693,100

33,300

1D -1.48%

5D -1.19%

Buy Vol. 35,054,000

Sell Vol. 37,959,500

31,600

1D 0.64%

5D 2.27%

Buy Vol. 11,458,100

Sell Vol. 16,493,800

41,500

1D -1.19%

5D -1.07%

Buy Vol. 7,504,900

Sell Vol. 10,674,900

35,050

1D -2.23%

5D -1.41%

Buy Vol. 54,204,800

Sell Vol. 60,399,700

35,600

1D -0.42%

5D 3.04%

Buy Vol. 15,713,100

Sell Vol. 21,989,200

Last year was Vietnamese banking market witnessed the excitement of the digital transformation process, with some banks even expecting to transform themselves into digital creation to help customers transact 365+, unlimited space, transaction time. Techcombank focuses on developing customer experience on online banking (Ebanking), minimizing transaction time and costs for customers. MBBank has integrated all banking transactions and financial management completely free of charge on MBBank and Biz MBBank apps. Other emerging names such as VPBank NEO of VPBank, Ipay of VietinBank.

REAL ESTATE

79,000

1D -0.25%

5D -1.13%

Buy Vol. 3,552,300

Sell Vol. 3,661,600

53,100

1D 5.36%

5D 6.20%

Buy Vol. 3,325,500

Sell Vol. 2,583,100

90,800

1D 2.02%

5D 0.00%

Buy Vol. 4,961,300

Sell Vol. 4,547,100

NVL: has a high prepayment of more than 8,305 billion VND, double compared to the beginning of the year, this figure only accounts for about 4% of total assets of the company.

OIL & GAS

110,000

1D -3.51%

5D 0.92%

Buy Vol. 2,699,300

Sell Vol. 2,641,300

17,800

1D -0.56%

5D 5.95%

Buy Vol. 27,213,600

Sell Vol. 32,417,400

59,400

1D 1.02%

5D 5.88%

Buy Vol. 4,997,900

Sell Vol. 6,186,400

The US and Iran resumed indirect negotiations, oil prices plummeted. Brent oil futures fell $1.91, or 2.1%, to $90.78 a barrel.

VINGROUP

85,700

1D -1.83%

5D -11.65%

Buy Vol. 13,229,300

Sell Vol. 11,251,000

81,500

1D 0.37%

5D 1.49%

Buy Vol. 6,795,600

Sell Vol. 8,336,200

35,900

1D 1.13%

5D 2.72%

Buy Vol. 8,993,200

Sell Vol. 11,078,500

VHM: recorded the largest prepayment in the housing real estate industry with VND8,916b, equivalent to 4% of total capital, but a sharp decrease of 67% compared to the beginning of the year.

FOOD & BEVERAGE

82,800

1D 0.98%

5D -0.36%

Buy Vol. 3,138,000

Sell Vol. 3,702,400

146,600

1D 0.76%

5D 2.52%

Buy Vol. 1,172,300

Sell Vol. 977,400

153,800

1D -0.65%

5D 3.43%

Buy Vol. 222,100

Sell Vol. 213,700

VNM: In Q4.2021, gross profit margin decreased from 46.2% to 42.5%, continuing to decrease compared to Q3.2021 and to the lowest level in 5 years.

OTHERS

135,000

1D 2.66%

5D 10.75%

Buy Vol. 1,485,600

Sell Vol. 1,302,100

135,000

1D 2.66%

5D 10.75%

Buy Vol. 1,485,600

Sell Vol. 1,302,100

90,700

1D 0.11%

5D 1.34%

Buy Vol. 1,685,000

Sell Vol. 2,170,900

137,000

1D 0.51%

5D 3.40%

Buy Vol. 1,795,700

Sell Vol. 2,374,800

103,300

1D -1.62%

5D -0.67%

Buy Vol. 1,537,500

Sell Vol. 2,123,700

33,100

1D 0.30%

5D 6.09%

Buy Vol. 2,206,900

Sell Vol. 2,240,400

45,700

1D 0.11%

5D 1.44%

Buy Vol. 11,871,400

Sell Vol. 17,047,600

47,300

1D 3.84%

5D 12.09%

Buy Vol. 61,936,100

Sell Vol. 69,610,400

HPG: At the end of 2021, HPG made a provision of 235.5 billion dong to reduce the price of inventories, up from 86.5 billion at the beginning of the year and 65.8 billion in Q3.2021. The group's inventory value reached VND 42,370 billion, an increase of nearly VND 16,000 billion compared to the beginning of the year. In which, raw materials and materials reached 19,939 billion VND, set aside 121 billion VND; finished products 9,968 billion VND, set aside 50 billion VND.

Market by numbers

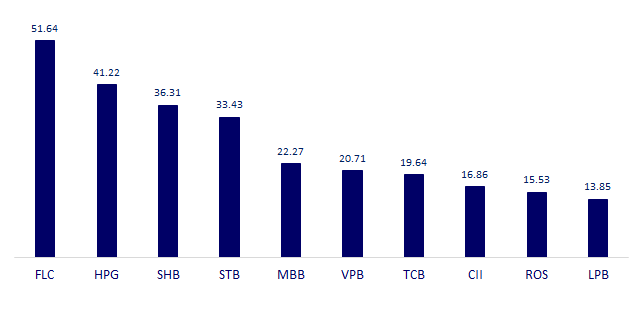

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

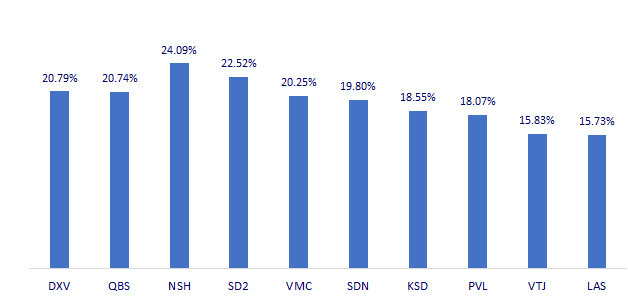

TOP INCREASES 3 CONSECUTIVE SESSIONS

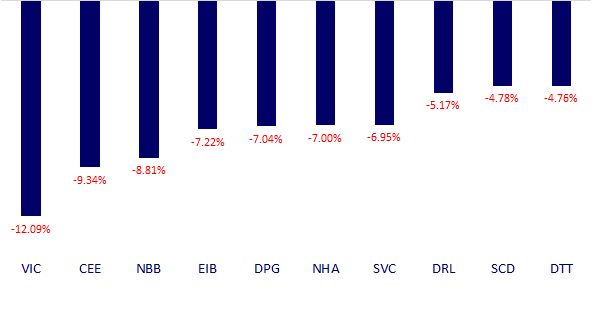

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.