Market brief 10/02/2022

VIETNAM STOCK MARKET

1,506.79

1D 0.09%

YTD 0.57%

1,548.95

1D -0.22%

YTD 0.86%

428.24

1D 0.95%

YTD -9.65%

112.64

1D 0.57%

YTD -0.04%

-732.89

1D 0.00%

YTD 0.00%

25,184.74

1D -11.73%

YTD -18.95%

According to data from the Securities Depository Center (VSD), the number of new domestic individual investor accounts opened in January reached 194,310 units, down 14.2% compared to the number of new openings in December 2021. Although down from two months ago, this is the month with the third highest number of new domestic individual accounts opening in history.

ETF & DERIVATIVES

26,170

1D -0.49%

YTD 1.32%

18,170

1D -0.82%

YTD 0.44%

19,150

1D 7.52%

YTD 0.79%

22,600

1D -0.44%

YTD -1.31%

23,630

1D 0.13%

YTD 5.12%

28,400

1D -0.98%

YTD 1.25%

20,040

1D -2.15%

YTD -6.70%

1,522

1D -0.11%

YTD 0.00%

1,522

1D -0.60%

YTD 0.00%

1,537

1D -0.11%

YTD 0.00%

1,543

1D 0.10%

YTD 0.00%

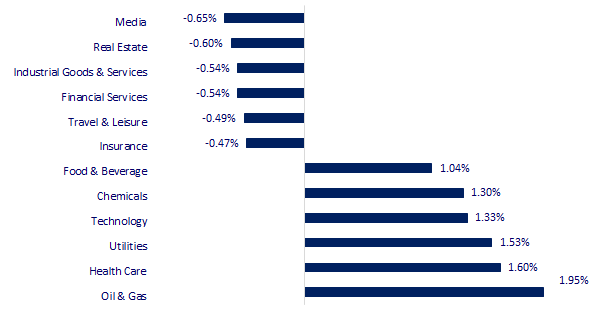

CHANGE IN PRICE BY SECTOR

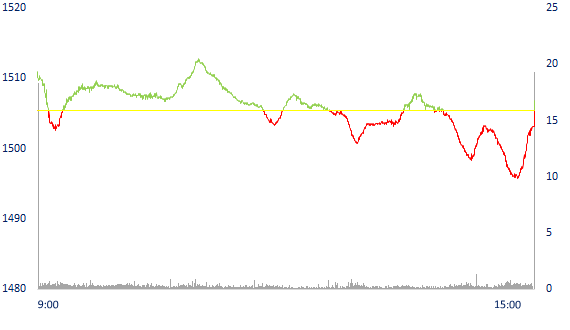

INTRADAY VNINDEX

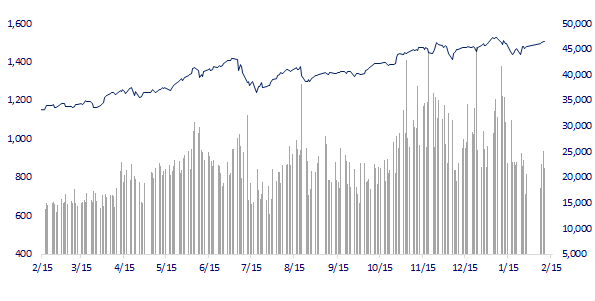

VNINDEX (12M)

GLOBAL MARKET

27,696.08

1D 0.14%

YTD -3.81%

3,485.91

1D 0.17%

YTD -4.23%

2,771.93

1D 0.11%

YTD -6.91%

24,924.35

1D 0.39%

YTD 6.52%

3,428.00

1D 0.23%

YTD 9.74%

1,703.00

1D -0.01%

YTD 2.74%

89.74

1D 0.06%

YTD 17.31%

1,833.45

1D -0.07%

YTD 0.69%

Asian stocks rose, investors awaited US inflation data. In Japan, the Nikkei 225 gained 0.14%. The Chinese market was mixed with the Shanghai Composite up 0.17%. Hong Kong's Hang Seng rose 0.39%. South Korea's Kospi index rose 0.11%.

VIETNAM ECONOMY

3.32%

1D (bps) 73

YTD (bps) 251

5.60%

1.02%

1D (bps) -15

YTD (bps) 1

2.02%

1D (bps) 11

YTD (bps) 2

22,810

1D (%) -0.04%

YTD (%) -0.57%

26,674

1D (%) 0.18%

YTD (%) 0.78%

3,636

1D (%) 0.03%

YTD (%) -0.60%

According to the General Department of Customs, during the 2022 Lunar New Year holiday (from January 29 to February 6, 2022), the whole country has 2,462 enterprises engaged in import and export of goods, 2.56 times more than the number during the Tet holiday in 2021. The total import-export value of the country reached 3.05 billion USD, a sharp increase of 83% compared to the Tet holiday in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Minister of Finance: Closely coordinate fiscal and monetary policies to realize dual goals

- Vietnam is on track to become a new global manufacturing hub

- Import and export of the whole country reached 3.05 billion USD during the Lunar New Year

- EIA: US oil production could hit a record in 2023

- Iceland makes biggest interest rate hike since 2008 due to housing boom

- 'The US is considering imposing more tariffs if China does not fulfill its commitments in the phase 1 agreement'

VN30

BANK

91,300

1D 0.55%

5D 2.58%

Buy Vol. 2,425,000

Sell Vol. 2,724,800

48,400

1D 0.00%

5D 0.94%

Buy Vol. 3,856,100

Sell Vol. 5,555,600

36,750

1D 1.10%

5D -0.41%

Buy Vol. 16,530,100

Sell Vol. 18,124,600

53,600

1D 0.00%

5D 1.52%

Buy Vol. 16,922,500

Sell Vol. 21,035,000

36,700

1D -1.08%

5D 0.14%

Buy Vol. 25,175,200

Sell Vol. 27,849,300

33,750

1D 1.35%

5D 0.15%

Buy Vol. 45,430,600

Sell Vol. 42,239,900

31,500

1D -0.32%

5D 1.94%

Buy Vol. 9,221,000

Sell Vol. 10,870,700

41,200

1D -0.72%

5D -1.79%

Buy Vol. 5,913,300

Sell Vol. 6,894,400

34,750

1D -0.86%

5D -2.25%

Buy Vol. 62,625,300

Sell Vol. 61,089,400

35,550

1D -0.14%

5D 2.89%

Buy Vol. 13,512,400

Sell Vol. 13,629,400

TCB: According to Brand Finance's announcement, Techcombank is one of the banking brands with the fastest growth in value globally, surpassing 74 places and reaching the Top 200 Most Valuable Global Banking Brands in 2022 by the organization. In the list, Techcombank was valued at 945 million USD by Brand Finance, promoted to 74 places, from 270 to 196. With this result, Techcombank is one of only two Vietnamese banks mentioned by Brand Finance in value growth.

REAL ESTATE

78,500

1D -0.63%

5D -1.75%

Buy Vol. 3,454,400

Sell Vol. 4,335,100

52,800

1D -0.56%

5D 5.60%

Buy Vol. 2,072,200

Sell Vol. 1,939,000

90,000

1D -0.88%

5D -0.88%

Buy Vol. 3,457,100

Sell Vol. 3,747,700

NVL: NovaGroup wants to research and invest in 3 projects of nearly 500 hectares in Dong Thap, including Green Dragon Smart Urban, Bui Thanh Thuy craft village and Las Vegas Island project.

OIL & GAS

112,000

1D 1.82%

5D 2.75%

Buy Vol. 1,737,200

Sell Vol. 1,324,800

18,550

1D 4.21%

5D 10.42%

Buy Vol. 75,281,300

Sell Vol. 70,411,100

60,500

1D 1.85%

5D 7.84%

Buy Vol. 4,936,800

Sell Vol. 6,240,600

Oil prices were steady around $90 a barrel on Wednesday, but the prospect of increased supply from Iran and the United States weighed on the market.

VINGROUP

84,000

1D -1.98%

5D -13.40%

Buy Vol. 17,309,600

Sell Vol. 14,990,200

80,100

1D -1.72%

5D -0.25%

Buy Vol. 9,032,200

Sell Vol. 10,300,800

36,000

1D 0.28%

5D 3.00%

Buy Vol. 16,564,800

Sell Vol. 21,258,700

VIC: The Van Village project in Da Nang has a scale of nearly 1,000ha, including 60% of land, 40% of water surface, an investment of about VND 35,000 billion, invested by Vinpearl

FOOD & BEVERAGE

82,700

1D -0.12%

5D -0.48%

Buy Vol. 2,869,200

Sell Vol. 3,310,300

149,600

1D 2.05%

5D 4.62%

Buy Vol. 2,373,100

Sell Vol. 2,184,000

157,000

1D 2.08%

5D 5.58%

Buy Vol. 326,200

Sell Vol. 330,200

MSN: in January MSN bought an additional 31% of Phuc Long's capital, bringing its ownership rate to 51%. At $110 million for a 31% stake, Phuc Long is valued at $355 million.

OTHERS

133,000

1D -1.48%

5D 9.11%

Buy Vol. 1,286,200

Sell Vol. 1,373,800

133,000

1D -1.48%

5D 9.11%

Buy Vol. 1,286,200

Sell Vol. 1,373,800

92,000

1D 1.43%

5D 2.79%

Buy Vol. 1,810,900

Sell Vol. 1,690,500

136,300

1D -0.51%

5D 2.87%

Buy Vol. 1,560,700

Sell Vol. 1,956,000

103,300

1D 0.00%

5D -0.67%

Buy Vol. 1,742,500

Sell Vol. 1,737,500

33,600

1D 1.51%

5D 7.69%

Buy Vol. 3,083,500

Sell Vol. 2,975,000

45,100

1D -1.31%

5D 0.11%

Buy Vol. 11,332,600

Sell Vol. 14,235,800

47,000

1D -0.63%

5D 11.37%

Buy Vol. 36,040,500

Sell Vol. 48,130,600

SSI: is expected to issue 10m ESOP, accounting for 1.018% of the total number of outstanding shares. The shares on offer are only transferable 50% after 2 years and the remaining 50% after 3 years from the issuance date. The asking price is 10,000 VND/share, 78% lower than SSI's current market price of 45,700 VND/share. According to SSI, the proceeds from the issuance will be used to supplement working capital for the company.

Market by numbers

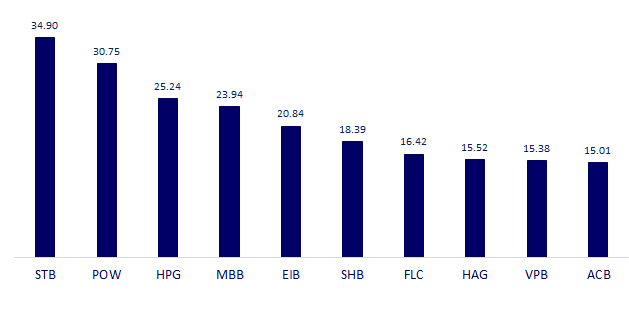

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

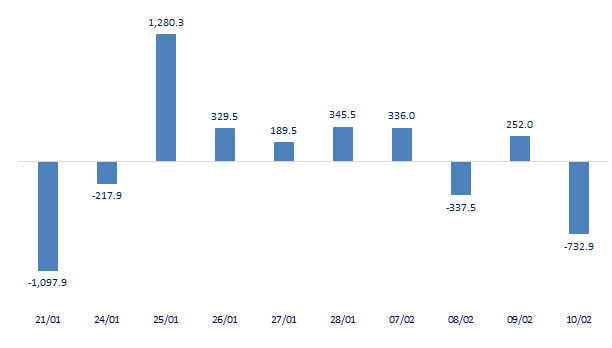

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

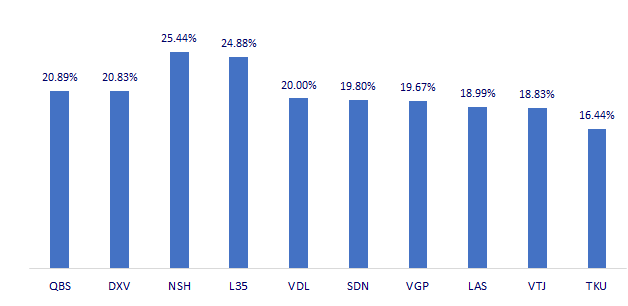

TOP INCREASES 3 CONSECUTIVE SESSIONS

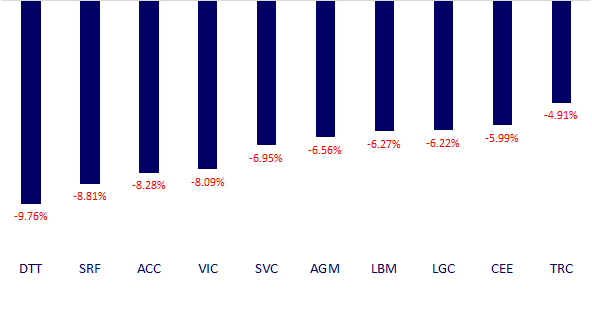

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.