Market brief 11/02/2022

VIETNAM STOCK MARKET

1,501.71

1D -0.34%

YTD 0.23%

1,545.92

1D -0.20%

YTD 0.66%

426.89

1D -0.32%

YTD -9.94%

112.54

1D -0.09%

YTD -0.12%

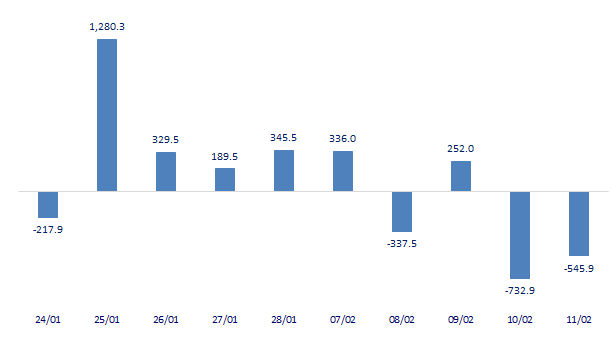

-545.91

1D 0.00%

YTD 0.00%

25,196.61

1D 0.05%

YTD -18.91%

Foreign investors continued to net sell 545 billion dong in 11/2 session. VIC was still the most net-sold by foreign investors on HoSE with a value of 268 billion dong. KBC and VND were net sold 52.8 billion dong and 42.4 billion dong respectively. On the other side, CTG was bought the most with 35.4 billion dong. GMD and VCB were net bought at VND 30.6 billion and VND 25.6 billion, respectively.

ETF & DERIVATIVES

26,080

1D -0.34%

YTD 0.97%

18,230

1D 0.33%

YTD 0.77%

19,230

1D 7.97%

YTD 1.21%

22,890

1D 1.28%

YTD -0.04%

23,900

1D 1.14%

YTD 6.32%

28,680

1D 0.99%

YTD 2.25%

20,210

1D 0.85%

YTD -5.91%

1,524

1D 0.11%

YTD 0.00%

1,527

1D 0.33%

YTD 0.00%

1,539

1D 0.15%

YTD 0.00%

1,543

1D 0.03%

YTD 0.00%

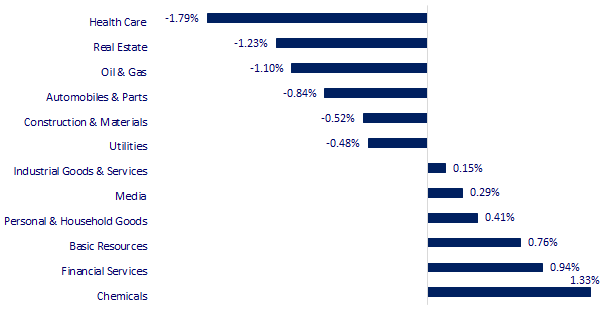

CHANGE IN PRICE BY SECTOR

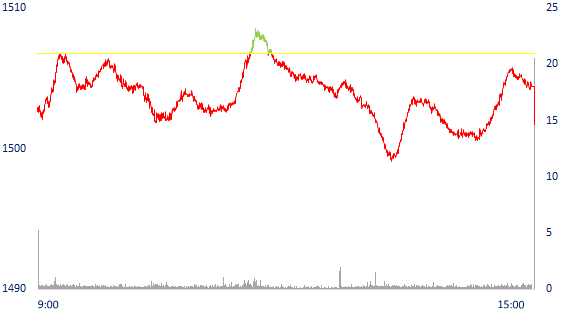

INTRADAY VNINDEX

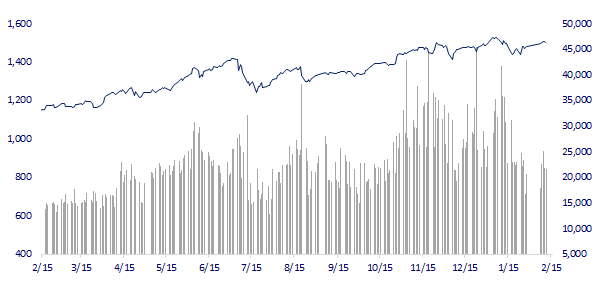

VNINDEX (12M)

GLOBAL MARKET

27,696.08

1D 0.00%

YTD -3.81%

3,462.95

1D -0.66%

YTD -4.86%

2,747.71

1D -0.87%

YTD -7.72%

24,906.66

1D 0.15%

YTD 6.45%

3,428.95

1D 0.03%

YTD 9.77%

1,699.20

1D -0.22%

YTD 2.51%

90.28

1D 0.82%

YTD 18.01%

1,827.85

1D 0.09%

YTD 0.39%

Asian stocks mostly followed Wall Street. Japanese market holiday. The Chinese market fell with Shanghai Composite down 0.66%, Shenzhen Component down 1.546%. Hong Kong's Hang Seng rose 0.15%. South Korea's Kospi index fell 0.87%.

VIETNAM ECONOMY

3.32%

YTD (bps) 251

5.60%

1.05%

1D (bps) 3

YTD (bps) 4

2.03%

1D (bps) 1

YTD (bps) 3

22,905

1D (%) 0.42%

YTD (%) -0.15%

26,268

1D (%) -1.86%

YTD (%) -0.76%

3,638

1D (%) 0.00%

YTD (%) -0.55%

The Department of Labor, Invalids and Social Affairs of Ho Chi Minh City has just informed that for the first time in recent years, workers returning to the city to work have achieved a very high rate, up to more than 96%, timely supplementing employees. As of the morning of February 10, more than 1.9 million workers returned to Ho Chi Minh City to work.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- VAT reduced to 8%: "Leverage" to stimulate consumption demand

- Foreign investment inflows extend the recovery momentum

- Many businesses in Ho Chi Minh City have orders until July

- US inflation hit 7.5% in January, the highest in nearly 40 years

- EC raises regional inflation forecast due to supply disruptions and energy crisis

- Developing countries draw up scenarios to deal with the Fed's interest rate hikes

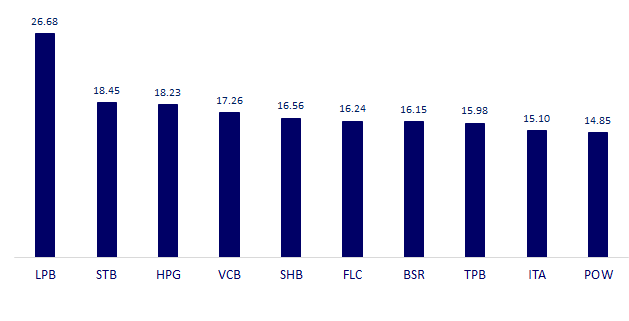

VN30

BANK

90,000

1D -1.42%

5D 1.12%

Buy Vol. 1,685,600

Sell Vol. 2,250,800

47,900

1D -1.03%

5D -0.10%

Buy Vol. 2,844,600

Sell Vol. 3,642,600

36,800

1D 0.14%

5D -0.27%

Buy Vol. 15,051,600

Sell Vol. 22,708,300

53,700

1D 0.19%

5D 1.70%

Buy Vol. 15,430,800

Sell Vol. 16,152,500

36,600

1D -0.27%

5D -0.14%

Buy Vol. 21,449,400

Sell Vol. 21,945,600

33,950

1D 0.59%

5D 0.74%

Buy Vol. 24,391,800

Sell Vol. 29,659,200

31,200

1D -0.95%

5D 0.97%

Buy Vol. 7,885,300

Sell Vol. 8,251,900

42,850

1D 4.00%

5D 2.15%

Buy Vol. 24,317,600

Sell Vol. 24,642,600

35,300

1D 1.58%

5D -0.70%

Buy Vol. 47,647,600

Sell Vol. 32,726,500

35,700

1D 0.42%

5D 3.33%

Buy Vol. 18,902,700

Sell Vol. 18,921,300

Among 27 banks on the stock exchange, BIDV was the bank that reduced the most debt in group 5 in the fourth quarter when it handled VND 6,901 billion, equivalent to a decrease of nearly 50%. Compared to the end of 2020, BIDV's potentially loss-of-capital debt has more than halved to 6,979 billion. BIDV's Group 5 debt dropped sharply thanks to the promotion of bad debt handling in 2021. Besides the continuous For sale of bad debts, this bank also used nearly 19,345 billion dong of the reserve fund to deal with bad debts, in the fourth quarter alone, it used more than 7,200 billion dong.

REAL ESTATE

78,100

1D -0.51%

5D -2.25%

Buy Vol. 2,434,400

Sell Vol. 2,808,000

52,800

1D 0.00%

5D 5.60%

Buy Vol. 1,300,500

Sell Vol. 1,097,900

90,100

1D 0.11%

5D -0.77%

Buy Vol. 3,604,300

Sell Vol. 3,490,500

NVL: In 2021, revenue from the handover of projects such as NovaHills, Saigon Royal, Aqua City, NovaWorld Phan Thiet, NovaWorld Ho Tram, Victoria Village recorded VND 13,511 billion.

OIL & GAS

111,000

1D -0.89%

5D 1.83%

Buy Vol. 833,700

Sell Vol. 1,120,600

18,300

1D -1.35%

5D 8.93%

Buy Vol. 42,623,000

Sell Vol. 47,475,200

59,400

1D -1.82%

5D 5.88%

Buy Vol. 4,568,300

Sell Vol. 5,624,800

PLX: Petrolimex holds an inventory of more than VND 13,384 billion, up 40% compared to the beginning of 2021. In which, goods (mainly gasoline and oil) are more than VND 9,623 billion.

VINGROUP

81,700

1D -2.74%

5D -15.77%

Buy Vol. 14,064,200

Sell Vol. 11,574,400

79,700

1D -0.50%

5D -0.75%

Buy Vol. 6,330,300

Sell Vol. 6,759,600

34,600

1D -3.89%

5D -1.00%

Buy Vol. 11,619,500

Sell Vol. 15,053,700

VIC: Business results in January 2021 show that VinFast's gasoline car sales decreased by more than 1,000 units after the news of production cessation.

FOOD & BEVERAGE

82,000

1D -0.85%

5D -1.32%

Buy Vol. 2,690,800

Sell Vol. 2,913,800

149,800

1D 0.13%

5D 4.76%

Buy Vol. 820,300

Sell Vol. 1,039,200

159,600

1D 1.66%

5D 7.33%

Buy Vol. 413,600

Sell Vol. 347,700

MSN: The CrownX forecasts 2022 revenue of up to VND 76,000 billion, which is Masan's main growth driver

OTHERS

132,800

1D -0.15%

5D 8.94%

Buy Vol. 1,087,200

Sell Vol. 1,182,300

132,800

1D -0.15%

5D 8.94%

Buy Vol. 1,087,200

Sell Vol. 1,182,300

91,600

1D -0.43%

5D 2.35%

Buy Vol. 1,456,600

Sell Vol. 1,839,600

135,300

1D -0.73%

5D 2.11%

Buy Vol. 1,159,600

Sell Vol. 1,376,100

104,800

1D 1.45%

5D 0.77%

Buy Vol. 1,749,800

Sell Vol. 997,100

33,950

1D 1.04%

5D 8.81%

Buy Vol. 3,435,000

Sell Vol. 4,492,600

45,100

1D 0.00%

5D 0.11%

Buy Vol. 9,656,700

Sell Vol. 12,282,200

47,150

1D 0.32%

5D 11.73%

Buy Vol. 34,970,300

Sell Vol. 33,367,300

HPG: crude steel production in January reached 707,000 tons, up 5% over the same period. Sales volume reached 631,000 tons, including construction steel, billet, hot rolled coil; down nearly 6% over the same period and down 21% compared to the last month of 2021. In which, construction steel accounted for 382,000 tons, 2 times higher than the same period last year and up 8.2% compared to December 2021.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

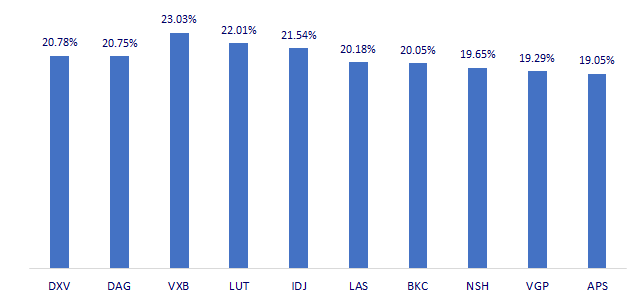

TOP INCREASES 3 CONSECUTIVE SESSIONS

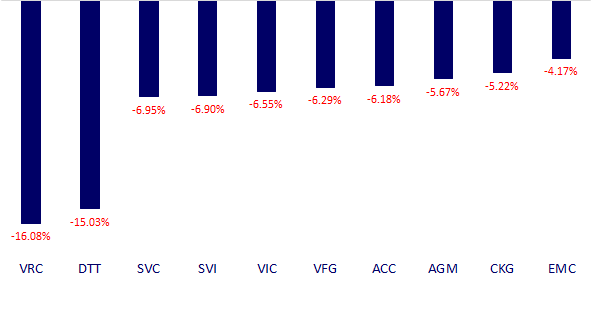

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.