Market brief 14/02/2022

VIETNAM STOCK MARKET

1,471.96

1D -1.98%

YTD -1.76%

1,505.07

1D -2.64%

YTD -2.00%

421.01

1D -1.38%

YTD -11.18%

110.85

1D -1.50%

YTD -1.62%

-285.16

1D 0.00%

YTD 0.00%

29,795.69

1D 18.25%

YTD -4.11%

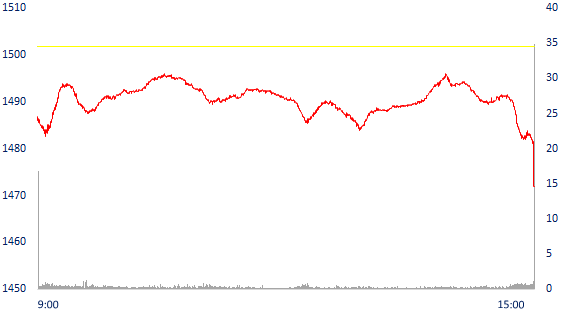

Only 30 minutes at the end of the session, VN-Index was blown away by nearly 30 points to 1,471 points, VN30 dropped strongly by 40.85 points to 1,505 points. A series of large stocks were sold strongly, the price dropped sharply, even at the floor in the ATC session like STB was sold up to 7.8 million shares, leading to a floor price of 32,850 VND/share.

ETF & DERIVATIVES

26,000

1D -0.31%

YTD 0.66%

17,900

1D -1.81%

YTD -1.05%

18,920

1D 6.23%

YTD -0.42%

22,450

1D -1.92%

YTD -1.97%

23,890

1D -0.04%

YTD 6.27%

28,450

1D -0.80%

YTD 1.43%

19,970

1D -1.19%

YTD -7.03%

1,502

1D -1.43%

YTD 0.00%

1,500

1D -1.77%

YTD 0.00%

1,513

1D -1.71%

YTD 0.00%

1,510

1D -2.13%

YTD 0.00%

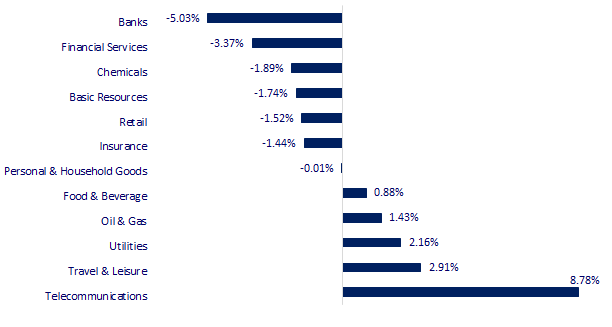

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

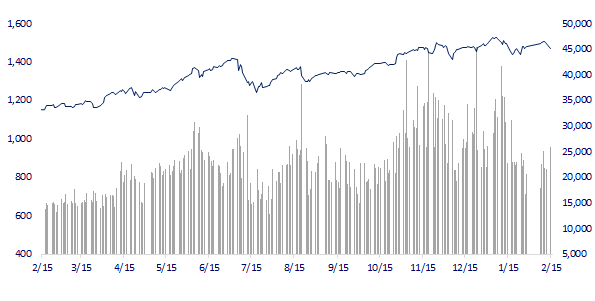

VNINDEX (12M)

GLOBAL MARKET

27,079.59

1D 0.27%

YTD -5.95%

3,428.88

1D -0.98%

YTD -5.79%

2,704.48

1D -1.57%

YTD -9.17%

24,556.57

1D -0.54%

YTD 4.95%

3,421.20

1D -0.23%

YTD 9.52%

1,684.69

1D -0.85%

YTD 1.63%

93.28

1D -1.11%

YTD 21.93%

1,857.05

1D -0.21%

YTD 1.99%

Asian stocks mostly fell, investors monitor the situation in Ukraine. Excluding the Japanese market, Nikkei 225 gained 0.27%. The Chinese market fell with the Shanghai Composite down 0.98%. Hong Kong's Hang Seng fell 0.54%. Hong Kong's health system is said to be overloaded because the number of Covid-19 infections has increased sharply recently. The Hong Kong government said mainland China would assist the city in issues such as testing and medical isolation.

VIETNAM ECONOMY

3.08%

1D (bps) -24

YTD (bps) 227

5.60%

1.23%

1D (bps) 18

YTD (bps) 22

1.98%

1D (bps) -5

YTD (bps) -2

22,945

1D (%) 0.53%

YTD (%) 0.02%

26,151

1D (%) -1.32%

YTD (%) -1.20%

3,644

1D (%) 0.11%

YTD (%) -0.38%

Proposing to stop granting investment policy for wind power and solar power projects that have not been implemented. The project is included in the Power Plan, but until January 26, 2022, it has not been implemented to wait for the review and development of the Power Plan VIII. Out of 146 projects that have signed power purchase and sale contracts with EVN, 62 projects failed to come into commercial operation (COD) before the incentive policy expired.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- HSBC raises Vietnam's 2022 inflation forecast to 3%

- It is estimated to spend nearly 22,000 billion VND to build Khanh Hoa - Buon Ma Thuot highway

- Proposing to stop granting investment policy for wind power and solar power projects that have not been implemented yet

- BoE may raise interest rates again in March

- Kremlin: Russia-US relations at the lowest level

- Stockpiles are dwindling, threatening to fuel a spreading global commodity crisis

VN30

BANK

86,000

1D -4.44%

5D -6.93%

Buy Vol. 5,119,600

Sell Vol. 5,967,600

44,750

1D -6.58%

5D -5.59%

Buy Vol. 9,869,800

Sell Vol. 10,792,100

34,600

1D -5.98%

5D -4.68%

Buy Vol. 20,672,300

Sell Vol. 25,034,800

51,500

1D -4.10%

5D -2.46%

Buy Vol. 26,003,100

Sell Vol. 28,748,400

35,000

1D -4.37%

5D -3.58%

Buy Vol. 25,516,200

Sell Vol. 29,845,500

32,000

1D -5.74%

5D -5.33%

Buy Vol. 36,196,200

Sell Vol. 39,781,000

29,200

1D -6.41%

5D -6.11%

Buy Vol. 24,032,800

Sell Vol. 24,750,000

40,000

1D -6.65%

5D -4.08%

Buy Vol. 9,988,900

Sell Vol. 14,785,700

32,850

1D -6.94%

5D -7.72%

Buy Vol. 51,068,400

Sell Vol. 58,590,500

34,000

1D -4.76%

5D -2.02%

Buy Vol. 18,038,100

Sell Vol. 19,672,800

VPB: VPBank announced to collect shareholders' opinions on adjusting the maximum foreign ownership ratio from 15% to 17.5% of charter capital. Although the General Director of VPBan did not disclose the specific time to complete the plan to sell 15% of capital to foreign partners, he affirmed: "All that the management commits to will be done. The offering of shares to strategic investors will be implemented in the coming months."

REAL ESTATE

78,000

1D -0.13%

5D -2.50%

Buy Vol. 3,765,800

Sell Vol. 3,948,200

52,700

1D -0.19%

5D 4.15%

Buy Vol. 2,049,800

Sell Vol. 1,680,500

89,500

1D -0.67%

5D -1.65%

Buy Vol. 3,131,300

Sell Vol. 3,199,300

Lam Dong approved 142 projects calling for investment in the period 2021 - 2025. Some prominent projects such as Prenn Lake (1,000ha), Dan Kia - Suoi Vang are nearly 4,000 ha.

OIL & GAS

116,000

1D 4.50%

5D 1.13%

Buy Vol. 2,958,900

Sell Vol. 2,902,600

17,700

1D -3.28%

5D -0.84%

Buy Vol. 42,789,600

Sell Vol. 40,207,200

60,200

1D 1.35%

5D 2.56%

Buy Vol. 4,707,000

Sell Vol. 6,529,400

POW: set a plan to go backwards, the expected profit is at VND 1,012 billion in 2022. Compared with the implementation in 2021 of VND 2,319 billion, this plan of POW is more than 56% backward.

VINGROUP

81,800

1D 0.12%

5D -10.31%

Buy Vol. 8,803,500

Sell Vol. 8,271,600

78,100

1D -2.01%

5D -4.99%

Buy Vol. 7,613,700

Sell Vol. 8,035,200

33,000

1D -4.62%

5D -7.04%

Buy Vol. 15,375,500

Sell Vol. 14,626,800

In the trading week from February 7-11, VIC dropped the most in the VN30 group, down 15.8% and was a key factor that adversely affected the VN-Index's volatility.

FOOD & BEVERAGE

81,100

1D -1.10%

5D -2.87%

Buy Vol. 4,504,400

Sell Vol. 4,541,100

151,600

1D 1.20%

5D 2.50%

Buy Vol. 1,360,600

Sell Vol. 1,628,500

167,900

1D 5.20%

5D 10.39%

Buy Vol. 657,700

Sell Vol. 506,500

SAB: At the end of 2021, Liabilities were recorded at nearly VND7.9tr, up 28% yoy. Notably, other short-term payables skyrocketed nearly VND 2.3 trillion.

OTHERS

140,000

1D 5.42%

5D 7.36%

Buy Vol. 1,688,200

Sell Vol. 1,479,300

140,000

1D 5.42%

5D 7.36%

Buy Vol. 1,688,200

Sell Vol. 1,479,300

91,000

1D -0.66%

5D 1.68%

Buy Vol. 1,519,200

Sell Vol. 1,398,600

132,000

1D -2.44%

5D -1.42%

Buy Vol. 1,236,100

Sell Vol. 1,610,100

104,600

1D -0.19%

5D -2.52%

Buy Vol. 790,900

Sell Vol. 1,393,000

33,300

1D -1.91%

5D 3.42%

Buy Vol. 2,259,200

Sell Vol. 2,956,300

43,600

1D -3.33%

5D -4.91%

Buy Vol. 14,777,400

Sell Vol. 17,128,000

46,200

1D -2.01%

5D 7.32%

Buy Vol. 30,219,400

Sell Vol. 35,064,000

SSI: Successfully signed a loan agreement of VND 10,000 billion - equivalent to more than USD 440 million - with VietinBank, Hanoi branch. This is the largest credit line contract of SSI to date with a joint stock commercial bank in Vietnam, promising to open up a more comprehensive cooperation direction in the future between the two financial institutions. leading in the country.

Market by numbers

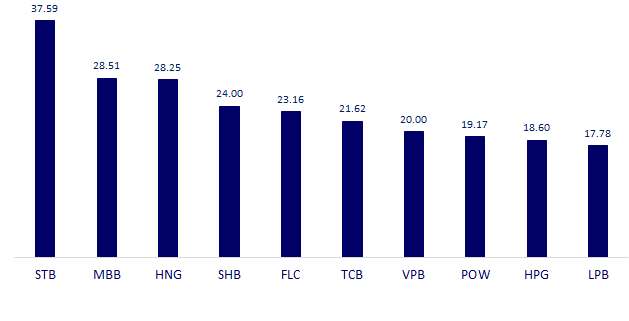

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

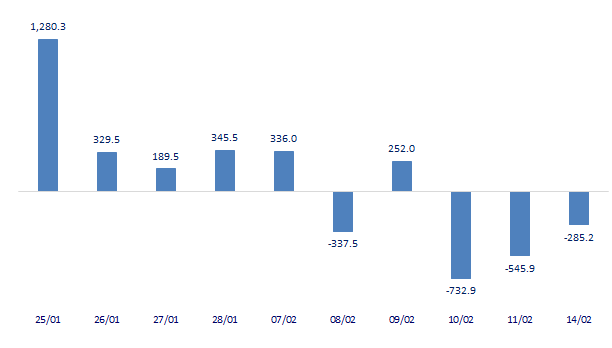

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

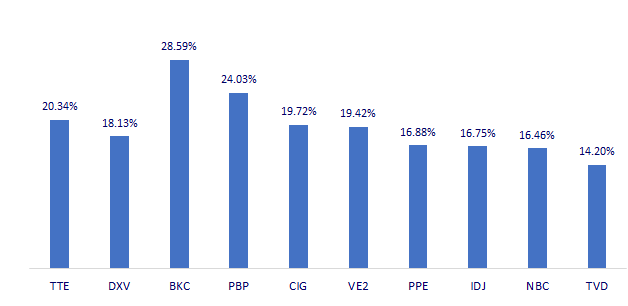

TOP INCREASES 3 CONSECUTIVE SESSIONS

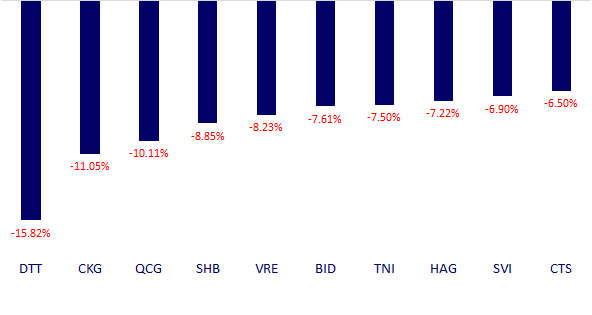

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.