Market brief 17/02/2022

VIETNAM STOCK MARKET

1,507.99

1D 1.06%

YTD 0.65%

1,540.51

1D 1.25%

YTD 0.31%

430.24

1D 0.26%

YTD -9.23%

112.42

1D 0.55%

YTD -0.23%

793.55

1D 0.00%

YTD 0.00%

22,763.89

1D -4.24%

YTD -26.74%

Foreign investors net bought again 793 billion dong in session 17/2. KDC was the strongest net bought on HoSE with 127 billion dong. KBC and DXG saw a net buying of 122 billion dong and 84 billion dong, respectively. On the other side, VIC was sold the most but the value was only 33.8 billion dong. VNM and DIG were net sold at VND 25.9 billion and VND 23.7 billion, respectively.

ETF & DERIVATIVES

25,950

1D 0.15%

YTD 0.46%

18,030

1D 0.50%

YTD -0.33%

19,050

1D 6.96%

YTD 0.26%

22,500

1D 0.45%

YTD -1.75%

22,800

1D 1.56%

YTD 1.42%

28,500

1D 0.00%

YTD 1.60%

20,050

1D 1.11%

YTD -6.66%

1,511

1D 0.06%

YTD 0.00%

1,517

1D 0.30%

YTD 0.00%

1,530

1D 0.60%

YTD 0.00%

1,540

1D 1.26%

YTD 0.00%

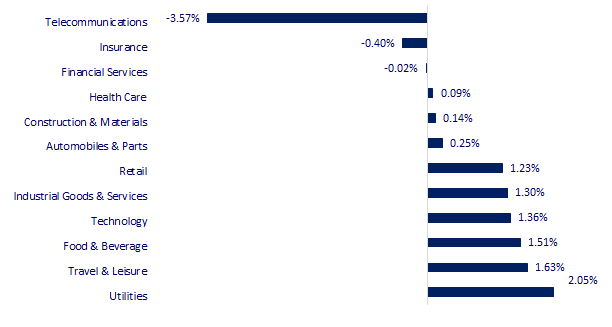

CHANGE IN PRICE BY SECTOR

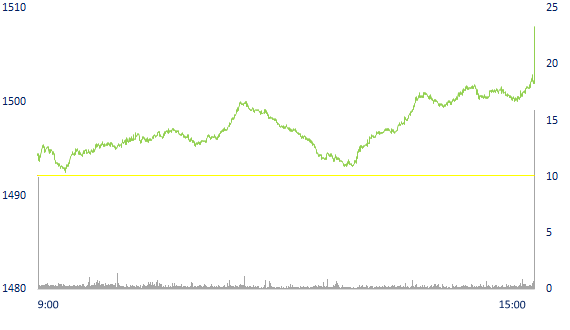

INTRADAY VNINDEX

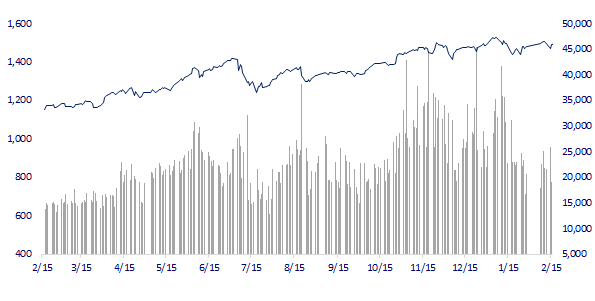

VNINDEX (12M)

GLOBAL MARKET

27,232.87

1D -0.45%

YTD -5.41%

3,468.04

1D 0.06%

YTD -4.72%

2,744.09

1D 0.53%

YTD -7.84%

24,792.77

1D 0.26%

YTD 5.96%

3,441.57

1D 0.07%

YTD 10.18%

1,711.58

1D 0.60%

YTD 3.26%

91.47

1D 0.07%

YTD 19.57%

1,888.35

1D 0.89%

YTD 3.71%

Asian stocks mixed, investors monitor the situation in Ukraine. In Japan, the Nikkei 225 fell 0.45%. Japan's exports in January were lower than expected, growing by only 9.6% yoy, lower than analysts' expectations for a 16.5% increase. The Chinese market rallied with the Shanghai Composite up 0.06%. Hong Kong's Hang Seng rose 0.26%. South Korea's Kospi index rose 0.53%.

VIETNAM ECONOMY

2.90%

1D (bps) 1

YTD (bps) 209

5.60%

1.34%

1D (bps) 10

YTD (bps) 33

2.12%

1D (bps) 14

YTD (bps) 12

23,005

1D (%) 0.48%

YTD (%) 0.28%

26,336

1D (%) -1.06%

YTD (%) -0.50%

3,665

1D (%) 0.11%

YTD (%) 0.19%

Calculated by the growth of outstanding loans near the end of January, the amount of credit pumped out in January reached nearly VND 286,000 billion, the strongest MoM increase in recent years. Previously, credit growth accelerated in Q4.2021. Mr.Dao Minh Tu, Deputy Governor of the State Bank of Vietnam, said that in 2022, the SBV plans to expand the credit growth target to about 14% and can be flexible in the direction of management.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit increased at the beginning of the year

- WB: Vietnam's inflation is still under control

- China had a trade surplus of nearly 7 billion USD to Vietnam in the first month of the year

- Fed ready to raise interest rates faster than expected if high inflation persists

- China wants to work with Asian countries to promote the use of local currencies to replace USD

- Oil recovers as the situation between Russia and Ukraine remains tense

VN30

BANK

87,500

1D 0.57%

5D -4.16%

Buy Vol. 2,581,100

Sell Vol. 2,831,300

46,000

1D 1.88%

5D -4.96%

Buy Vol. 3,572,200

Sell Vol. 3,581,600

34,900

1D 0.72%

5D -5.03%

Buy Vol. 10,344,300

Sell Vol. 12,235,400

52,200

1D 1.16%

5D -2.61%

Buy Vol. 12,250,500

Sell Vol. 14,383,000

36,300

1D 1.82%

5D -1.09%

Buy Vol. 17,392,600

Sell Vol. 18,727,400

33,200

1D 1.68%

5D -1.63%

Buy Vol. 16,515,500

Sell Vol. 17,163,400

29,750

1D 1.71%

5D -5.56%

Buy Vol. 7,351,400

Sell Vol. 7,908,200

41,150

1D 1.86%

5D -0.12%

Buy Vol. 5,621,200

Sell Vol. 5,165,900

33,900

1D 0.89%

5D -2.45%

Buy Vol. 32,181,100

Sell Vol. 32,846,100

34,300

1D 0.29%

5D -3.52%

Buy Vol. 9,105,900

Sell Vol. 9,173,800

ACB: is the 5th largest bank in terms of CASA ratio. Deposit at this bank at the end of 2021 is VND 96,747 billion, accounting for 25.47% of total customer deposits. This rate has improved significantly compared to 21.62% in 2020.

REAL ESTATE

79,000

1D 1.15%

5D 0.64%

Buy Vol. 5,292,100

Sell Vol. 5,225,200

54,900

1D 2.04%

5D 3.98%

Buy Vol. 2,634,500

Sell Vol. 2,672,000

92,000

1D 2.00%

5D 2.22%

Buy Vol. 4,707,100

Sell Vol. 4,544,400

NVL: The scale of NVL's total assets has expanded rapidly in the past 3 years from VND89,979b to VND201,520b, an increase of 124%. Enterprises have financial debt from 34,591b VND to 60,519b VND.

OIL & GAS

118,700

1D 3.67%

5D 5.98%

Buy Vol. 1,996,600

Sell Vol. 1,921,900

18,600

1D 2.20%

5D 0.27%

Buy Vol. 87,723,900

Sell Vol. 82,289,100

60,000

1D 1.69%

5D -0.83%

Buy Vol. 4,973,000

Sell Vol. 5,339,900

Closing the session yesterday, the Brent oil contract advanced 1.6% to $94.81 a barrel, after falling 3.3% after Russia announced the withdrawal of part of its troops near Ukraine.

VINGROUP

83,100

1D 0.24%

5D -1.07%

Buy Vol. 6,533,200

Sell Vol. 7,147,000

80,800

1D 1.00%

5D 0.87%

Buy Vol. 4,537,800

Sell Vol. 7,063,000

34,450

1D 0.44%

5D -4.31%

Buy Vol. 7,642,300

Sell Vol. 8,448,800

VIC: On February 16, VinFast announced a new smart electric motorcycle model called VinFast Vento. Vento operates with a maximum capacity of 4,000W and the highest speed of 80km/h.

FOOD & BEVERAGE

80,800

1D 0.50%

5D -2.30%

Buy Vol. 3,204,600

Sell Vol. 3,002,900

163,000

1D 3.10%

5D 8.96%

Buy Vol. 2,340,900

Sell Vol. 2,029,900

170,500

1D 1.25%

5D 8.60%

Buy Vol. 475,400

Sell Vol. 622,300

MSN: Masan said it will replicate the mini-mall model and set a target of 2,000 stores following this model in 2022.

OTHERS

141,600

1D 1.72%

5D 6.47%

Buy Vol. 1,538,500

Sell Vol. 1,411,200

141,600

1D 1.72%

5D 6.47%

Buy Vol. 1,538,500

Sell Vol. 1,411,200

92,800

1D 1.64%

5D 0.87%

Buy Vol. 1,360,600

Sell Vol. 1,770,200

134,500

1D 1.20%

5D -1.32%

Buy Vol. 1,514,600

Sell Vol. 1,944,800

107,900

1D 1.51%

5D 4.45%

Buy Vol. 1,289,500

Sell Vol. 1,799,500

34,000

1D 0.74%

5D 1.19%

Buy Vol. 2,168,100

Sell Vol. 3,451,000

45,000

1D 0.22%

5D -0.22%

Buy Vol. 12,664,000

Sell Vol. 12,552,400

46,500

1D 1.09%

5D -1.06%

Buy Vol. 19,937,700

Sell Vol. 27,308,800

VJC: announced the result of offering 3,000 billion VND of bonds to a domestic organization with a term of 36 months, the maturity date is December 30, 2024. This is a non-convertible bond, without warrants, without collateral, paying interest every 6 months. The actual interest rate is calculated at 9.5%/year for the first two interest periods.

Market by numbers

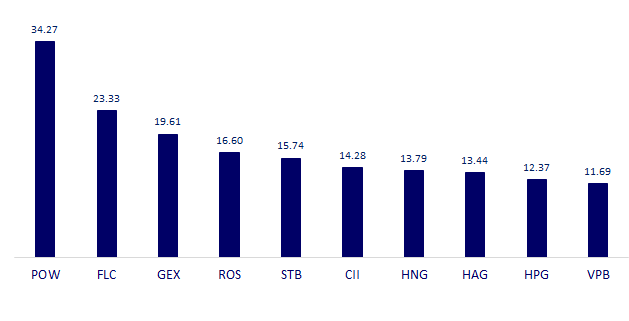

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

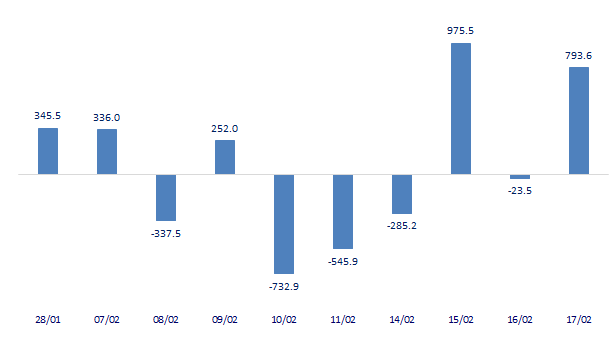

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

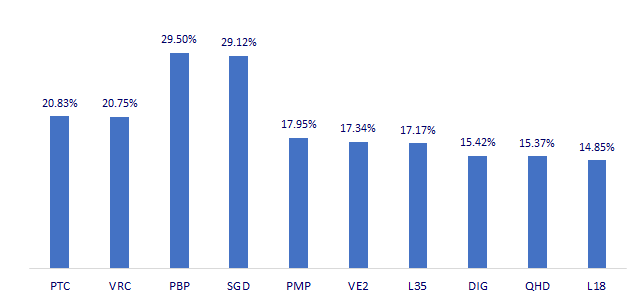

TOP INCREASES 3 CONSECUTIVE SESSIONS

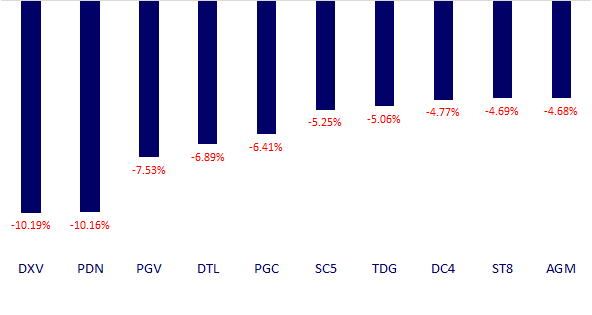

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.