Market brief 21/02/2022

VIETNAM STOCK MARKET

1,510.84

1D 0.40%

YTD 0.84%

1,533.40

1D 0.13%

YTD -0.15%

440.99

1D 1.24%

YTD -6.96%

113.67

1D 0.84%

YTD 0.88%

158.64

1D 0.00%

YTD 0.00%

28,019.96

1D 7.97%

YTD -9.82%

Foreign investors continued to net buy VND158b on February 21, the focus of real estate. KBC was the strongest net buying by foreign investors with VND52b. Both DXG and VHM were net bought over VND44b. Besides, real estate codes like HDG or NLG were also gathered strongly by foreign investors. Meanwhile, fund certificates FUEVFVND were sold the most with VND139b, far ahead of MSN with VND25b.

ETF & DERIVATIVES

25,900

1D 0.58%

YTD 0.27%

18,000

1D -0.22%

YTD -0.50%

18,900

1D 6.12%

YTD -0.53%

22,500

1D 0.00%

YTD -1.75%

22,600

1D -0.88%

YTD 0.53%

28,500

1D 0.00%

YTD 1.60%

20,100

1D 0.85%

YTD -6.42%

1,515

1D 0.14%

YTD 0.00%

1,520

1D 0.73%

YTD 0.00%

1,530

1D 0.33%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

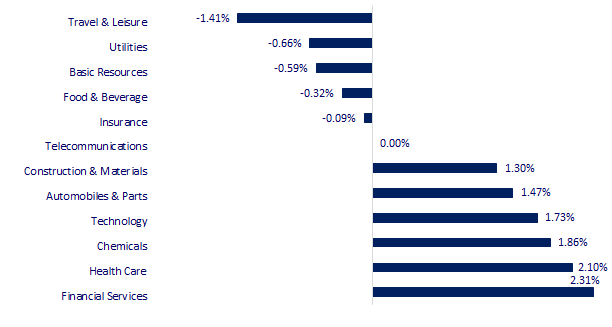

CHANGE IN PRICE BY SECTOR

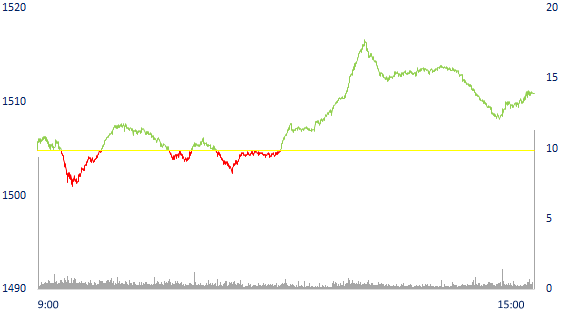

INTRADAY VNINDEX

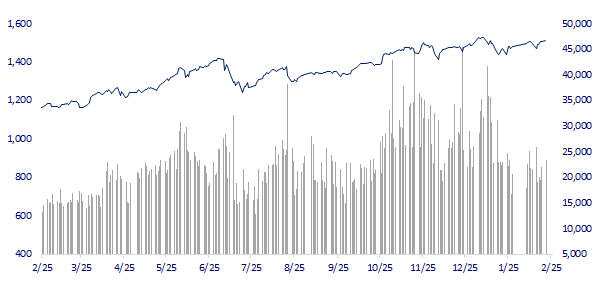

VNINDEX (12M)

GLOBAL MARKET

26,910.87

1D -0.21%

YTD -6.53%

3,490.61

1D 0.00%

YTD -4.10%

2,743.80

1D -0.03%

YTD -7.85%

24,170.07

1D 0.06%

YTD 3.30%

3,436.36

1D 0.22%

YTD 10.01%

1,694.32

1D -1.10%

YTD 2.21%

90.04

1D 0.32%

YTD 17.70%

1,899.80

1D 0.10%

YTD 4.34%

China kept lending rates unchanged, Asian stocks mixed. In Japan, Nikkei 225 fell 2% at times before reversing, down 0.21%. The Chinese market was mixed with the Shanghai Composite down 0.0042%. Hong Kong's Hang Seng rose 0.06%. China today left its one-year benchmark lending rate (LPR) unchanged at 3.7%, as forecast by Reuters poll respondents. The 5-year LPR held at 4.6%.

VIETNAM ECONOMY

2.47%

1D (bps) -43

YTD (bps) 166

5.60%

1.31%

1D (bps) 4

YTD (bps) 30

2.11%

1D (bps) -7

YTD (bps) 11

23,015

1D (%) 0.22%

YTD (%) 0.33%

26,336

1D (%) -1.11%

YTD (%) -0.50%

3,669

1D (%) -0.27%

YTD (%) 0.30%

Regarding the bad debt situation at credit institutions, the average bad debt balance at 28 listed commercial banks and Agribank in 2021 increased by 17.3% compared to 2020, according to statistics from the banks' 2021 financial statements. Notably, bad debt balances in 2021 at some banks have increased rapidly compared to 2020, including VPBank by 60%, Vietinbank by 49%, VIB by 58%, and HDBank by 43%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Bad debt may increase rapidly in 2022 due to lack of legal corridor

- The huge scale of 5 highway projects of 263,000 billion in Vietnam is about to be invested

- 4 billion USD of FDI has 'flowed' into the technology sector in 2021

- The presidents of Russia and the United States agreed to meet "in principle" on the Ukraine issue

- The US considers approving the 4th injection of Covid-19 vaccine

- Hong Kong's economic growth forecast has been downgraded

VN30

BANK

87,400

1D 0.23%

5D 1.63%

Buy Vol. 1,969,600

Sell Vol. 1,682,600

45,250

1D 1.23%

5D 1.12%

Buy Vol. 6,325,800

Sell Vol. 4,977,900

34,400

1D -0.58%

5D -0.58%

Buy Vol. 21,120,000

Sell Vol. 20,700,100

51,500

1D -0.19%

5D 0.00%

Buy Vol. 15,230,800

Sell Vol. 15,751,700

35,900

1D 0.00%

5D 2.57%

Buy Vol. 16,241,100

Sell Vol. 18,802,300

32,650

1D 0.00%

5D 2.03%

Buy Vol. 32,891,500

Sell Vol. 30,449,700

29,600

1D 0.34%

5D 1.37%

Buy Vol. 10,768,000

Sell Vol. 10,748,900

40,900

1D 0.25%

5D 2.25%

Buy Vol. 6,361,900

Sell Vol. 6,136,900

33,200

1D -0.45%

5D 1.07%

Buy Vol. 37,841,600

Sell Vol. 37,584,400

34,400

1D 1.62%

5D 1.18%

Buy Vol. 13,120,800

Sell Vol. 10,808,100

BID: BIDV has announced that it will continue to sell for the third time about a debt of nearly 500 billion VND of Archplus Architecture and Construction JSC. It is known that the auctioned asset is a debt arising from Archplus's bond investment at BIDV. This is the 10th time the bank has announced the auction of the above property after 9 unsuccessful attempts to sell it. Total outstanding balance as of April 15, 2021 is 498 billion VND, of which principal balance is 257 billion VND, interest debt is 173.8 billion VND and overdue penalty fee is 67.2 billion VND.

REAL ESTATE

78,500

1D 0.00%

5D 0.64%

Buy Vol. 3,701,100

Sell Vol. 3,516,700

54,200

1D 0.37%

5D 2.85%

Buy Vol. 1,323,000

Sell Vol. 1,561,200

91,200

1D 0.00%

5D 1.90%

Buy Vol. 3,836,800

Sell Vol. 3,812,400

KDH: Collecting shareholders' written opinions on the listing of bonds for the company's 2022 public offering

OIL & GAS

115,800

1D -1.03%

5D -0.17%

Buy Vol. 711,500

Sell Vol. 856,600

18,400

1D -0.81%

5D 3.95%

Buy Vol. 37,145,400

Sell Vol. 46,745,400

59,900

1D 0.17%

5D -0.50%

Buy Vol. 3,987,600

Sell Vol. 5,335,400

GAS: reported production and business plan in 2022 with a flat revenue of VND 80,000 billion, whereas profit after tax decreased by 20% to VND 7,039 billion

VINGROUP

83,600

1D 1.70%

5D 2.20%

Buy Vol. 5,025,400

Sell Vol. 5,124,300

80,000

1D 0.38%

5D 2.43%

Buy Vol. 4,524,800

Sell Vol. 6,668,100

34,100

1D 1.49%

5D 3.33%

Buy Vol. 11,947,500

Sell Vol. 8,976,700

VIC: Additional listing of 8,720,770 shares to convert preferred shares into common shares. Trading date of listed securities: February 25, 2022

FOOD & BEVERAGE

81,000

1D 0.50%

5D -0.12%

Buy Vol. 3,017,100

Sell Vol. 3,000,900

160,300

1D -1.84%

5D 5.74%

Buy Vol. 1,190,000

Sell Vol. 1,425,200

169,600

1D 0.12%

5D 1.01%

Buy Vol. 168,800

Sell Vol. 220,500

VNM: If the stock doesn't soon get out of a prolonged downtrend, Vinamilk is likely to fall out of the top 10 most valuable companies on the stock exchange for the first time in many years.

OTHERS

146,000

1D -2.01%

5D 4.29%

Buy Vol. 1,231,100

Sell Vol. 1,260,600

146,000

1D -2.01%

5D 4.29%

Buy Vol. 1,231,100

Sell Vol. 1,260,600

93,500

1D 1.41%

5D 2.75%

Buy Vol. 2,396,200

Sell Vol. 2,821,400

133,900

1D -0.07%

5D 1.44%

Buy Vol. 1,289,400

Sell Vol. 1,719,600

106,500

1D -0.47%

5D 1.82%

Buy Vol. 1,184,000

Sell Vol. 1,245,500

34,600

1D 2.98%

5D 3.90%

Buy Vol. 3,723,000

Sell Vol. 4,575,900

46,000

1D 1.77%

5D 5.50%

Buy Vol. 18,454,500

Sell Vol. 22,139,500

46,650

1D -0.85%

5D 0.97%

Buy Vol. 20,414,000

Sell Vol. 30,019,200

MWG: set a new revenue record in January 2022 with VND16,000b, about to open a store in Indonesia. On January 10, 2022, MWG tested 12 independent retail stores: Mother & Baby products (AVAKids); sportswear (AVASport); fashion (AVAFashion); at the same time, deploying shop-in-shop business: jewelry (AVAJi) at TGDD store and bicycle (AVACycle) at DMX store. Due to the opening on the occasion of Tet, the AVA chain's points of sale had a good start and contributed more than VND50b in revenue.

Market by numbers

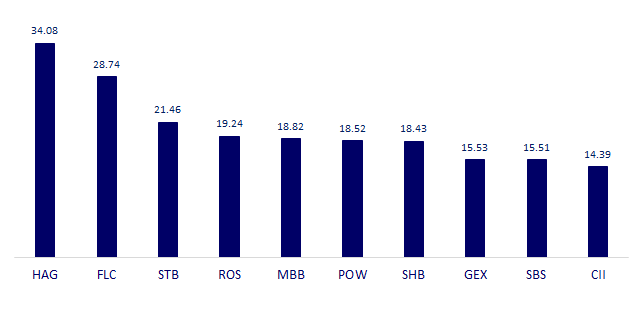

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

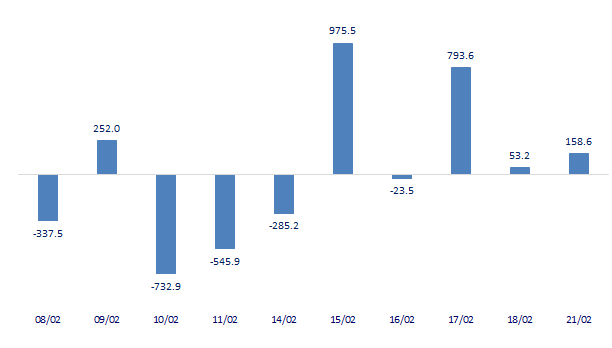

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

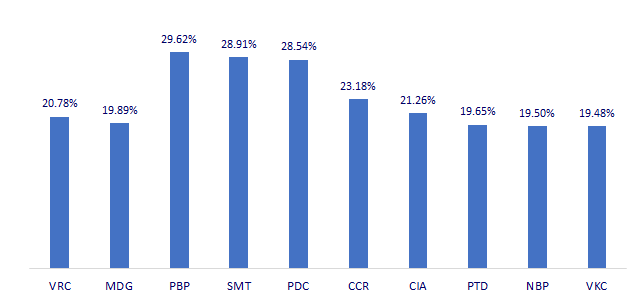

TOP INCREASES 3 CONSECUTIVE SESSIONS

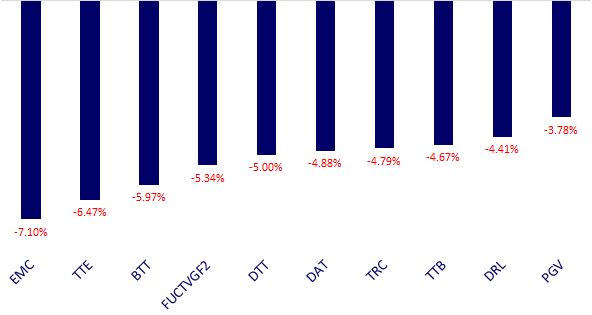

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.